Floating Hotel Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Floating Hotel Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Floating Hotel Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

FLOATING HOTEL FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive floating hotel financial model offers a detailed five-year floating hotel revenue projections and cash flow forecast, designed to support fundraising and strategic financial planning for startups and entrepreneurs. Equipped with an all-inclusive floating hotel budgeting template, break-even analysis, and expense tracking tools, it facilitates precise floating hotel cost analysis and capital expenditure planning. Users can leverage built-in floating hotel investment return calculations and financial feasibility assessments to gauge project valuation and funding requirements effectively. The model also includes floating hotel income statement and balance sheet modeling, enabling thorough floating hotel financial performance reviews and investment analysis, ensuring robust floating hotel profit margins and optimized operating expenses management.

This ready-made floating hotel financial model Excel template effectively alleviates the challenges of conducting comprehensive floating hotel cost analysis, budgeting, and revenue projections by providing an integrated platform for real-time floating hotel cash flow forecast and expense tracking. It streamlines financial planning for floating hotels by including key features such as floating hotel income statement and balance sheet modeling, allowing users to perform in-depth floating hotel investment analysis, project valuation, and break-even analysis with ease. The model also facilitates clear visibility into floating hotel operating expenses, capital expenditure, and funding requirements, empowering investors and operators to accurately assess floating hotel profit margins and financing options while ensuring sustainable floating hotel financial performance across a 5-year horizon.

Description

This comprehensive floating hotel financial model offers a detailed 5-year financial projection template, integrating floating hotel revenue projections, cost analysis, and operating expenses to provide a thorough expense tracking and budgeting framework. It features a floating hotel income statement, balance sheet modeling, and cash flow forecast to support robust financial planning for floating hotels, enabling precise floating hotel break-even analysis and capital expenditure management. The model’s dynamic structure facilitates floating hotel investment return evaluation and project valuation through discounted cash flow methods, while embedded financial performance metrics and KPIs assist in assessing floating hotel profit margins and financial feasibility. Additionally, this model supports floating hotel funding requirements and financing options by delivering insightful floating hotel investment analysis and sales forecasts, ensuring strategic decision-making is both data-driven and aligned with market demands.

FLOATING HOTEL FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Master financial planning for your floating hotel with our comprehensive budgeting template. From detailed floating hotel cost analysis and expense tracking to precise revenue projections and cash flow forecasts, our model delivers clear insights into investment return and profit margins. Streamline your floating hotel break-even analysis, capital expenditure planning, and project valuation with presentation-ready figures. Ideal for crafting persuasive income statements, balance sheet modeling, and sales forecasts, this template empowers you to confidently address funding requirements and financing options, impressing discerning investors with robust 5-year financial performance projections. Elevate your floating hotel investment analysis today!

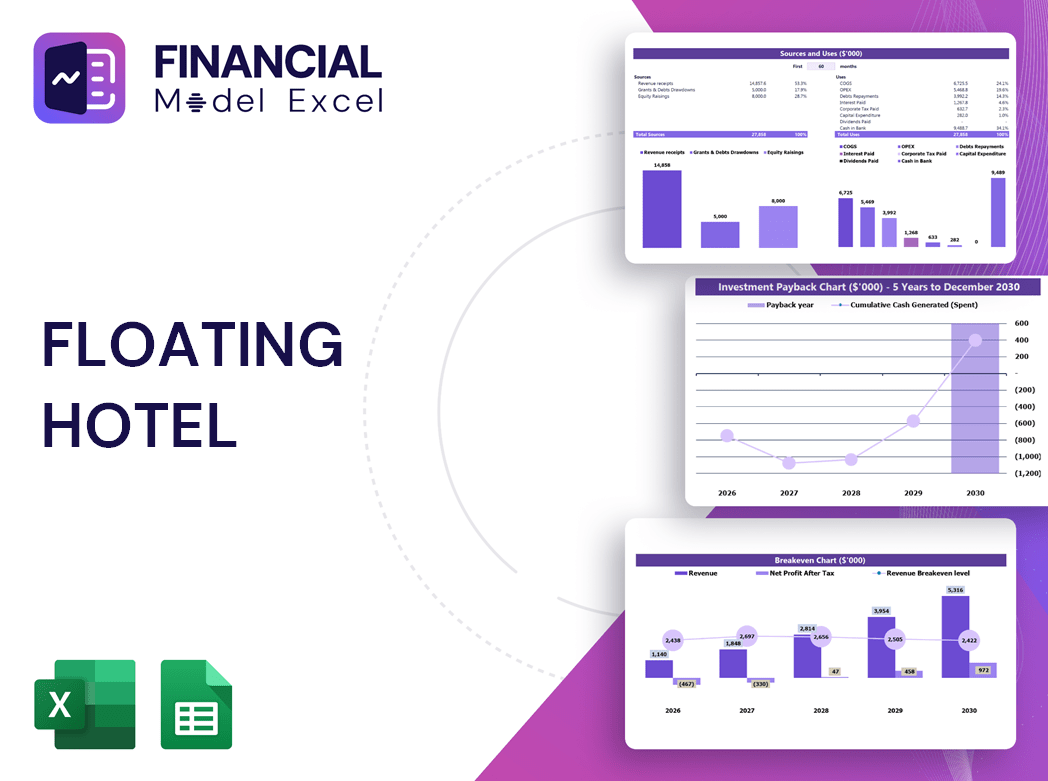

Dashboard

Our floating hotel financial planning dashboard seamlessly consolidates key data from income statements, cash flow forecasts, and expense tracking. Customize your KPIs to monitor floating hotel revenue projections, operating expenses, and profit margins with ease. This dynamic tool automates calculations across selected periods, supporting detailed budgeting templates, break-even analysis, and investment return insights. Tailor your dashboard monthly or yearly to enhance floating hotel financial feasibility and project valuation, empowering strategic decisions with real-time financial performance metrics at your fingertips.

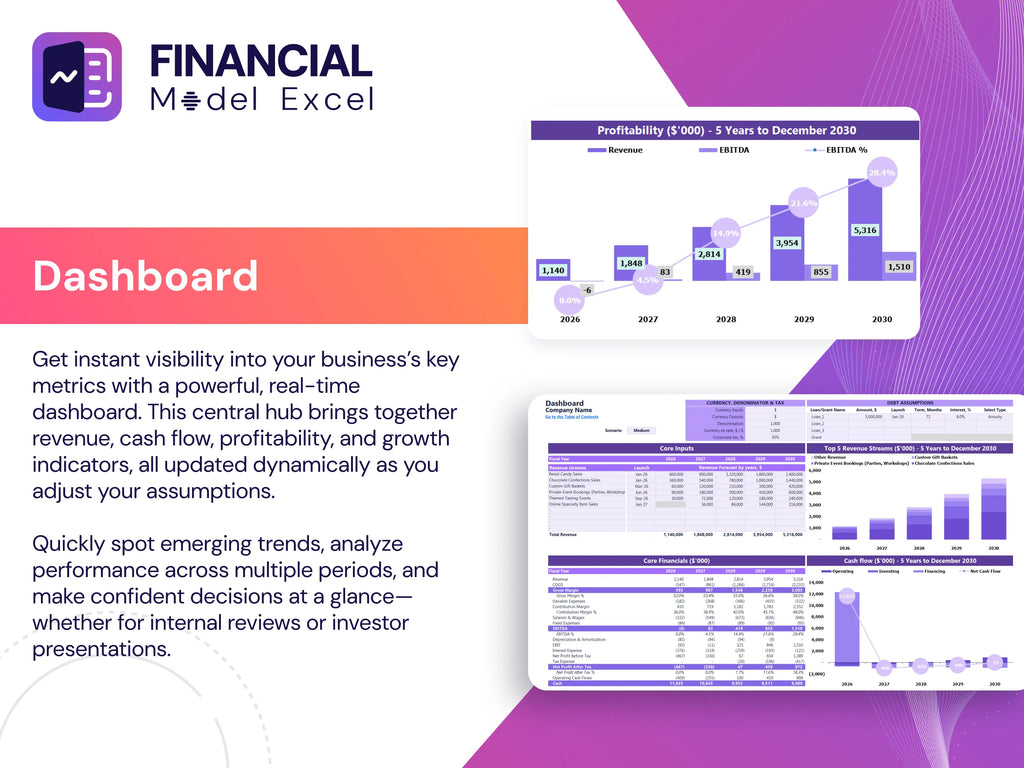

Business Financial Statements

Each floating hotel financial statement plays a crucial role in comprehensive financial planning. The floating hotel income statement reveals profit margins by detailing operating expenses and revenue projections. The floating hotel balance sheet modeling captures the asset, liability, and capital expenditure structure at a specific time. Meanwhile, the floating hotel cash flow forecast tracks liquidity from core operations, investments, and financing activities. Together, these statements provide an integrated view of a floating hotel’s financial performance, enabling accurate investment analysis, break-even analysis, and project valuation for informed decision-making and maximizing return on investment.

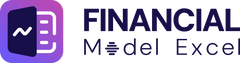

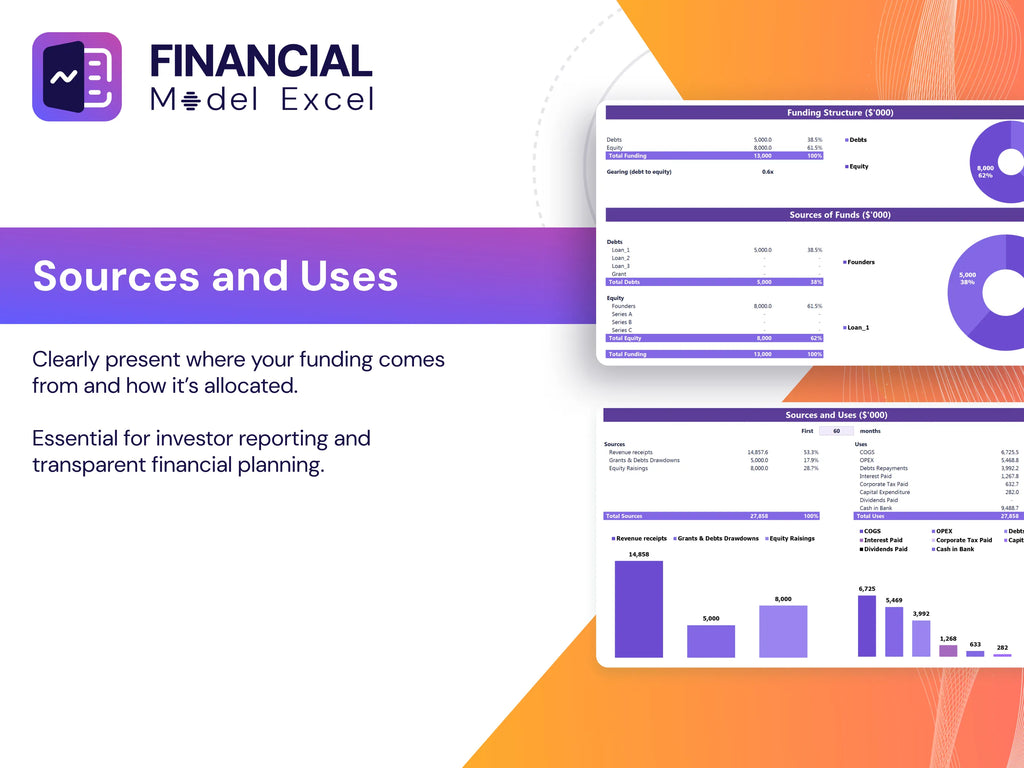

Sources And Uses Statement

This comprehensive five-year floating hotel financial projection template includes a detailed sources and uses tab, clearly outlining the company’s funding structure. It empowers investors and managers to analyze floating hotel investment return, capital expenditure, and funding requirements with precision. By integrating floating hotel cost analysis and revenue projections, users gain valuable insights into cash flow forecasts and break-even analysis. This tool is essential for effective financial planning for floating hotels, enabling accurate expense tracking, profit margin evaluation, and overall project valuation to optimize financial performance and support strategic decision-making.

Break Even Point In Sales Dollars

A floating hotel break-even analysis is essential to pinpoint when your venture covers all floating hotel operating expenses and starts generating profit. By distinguishing between fixed costs—like administrative salaries and overhead—and variable costs tied directly to occupancy and services, you can accurately model your floating hotel cash flow forecast. Utilizing a floating hotel budgeting template ensures precise expense tracking and enhances financial planning for floating hotels, helping optimize floating hotel profit margins and improve overall floating hotel financial performance. This analysis is vital for informed floating hotel investment return projections and robust floating hotel project valuation.

Top Revenue

Topline revenue and bottom-line profit are pivotal metrics in floating hotel income statements and financial performance reviews. Investors closely examine floating hotel revenue projections and profit margins to assess viability. Tracking topline growth through detailed floating hotel sales forecasts boosts confidence in return on investment and supports robust floating hotel cash flow forecasts. Accurate floating hotel cost analysis and expense tracking underpin effective budgeting templates, while break-even and investment analyses ensure sound financial planning for floating hotels. Monitoring these key indicators quarterly and annually drives informed decisions and maximizes floating hotel project valuation.

Business Top Expenses Spreadsheet

Utilizing a floating hotel expense tracking report provides clear insights into top operating expenses, aiding in precise floating hotel cost analysis and budgeting. This internal breakdown highlights spending patterns by category, facilitating accurate floating hotel cash flow forecasts and financial planning. By comparing actual expenses against projections, stakeholders can assess floating hotel profit margins, identify variances, and adjust strategies to optimize floating hotel financial performance. Such detailed expense reporting supports informed decisions on floating hotel investment return and ensures robust floating hotel break-even analysis for sustainable growth.

FLOATING HOTEL FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

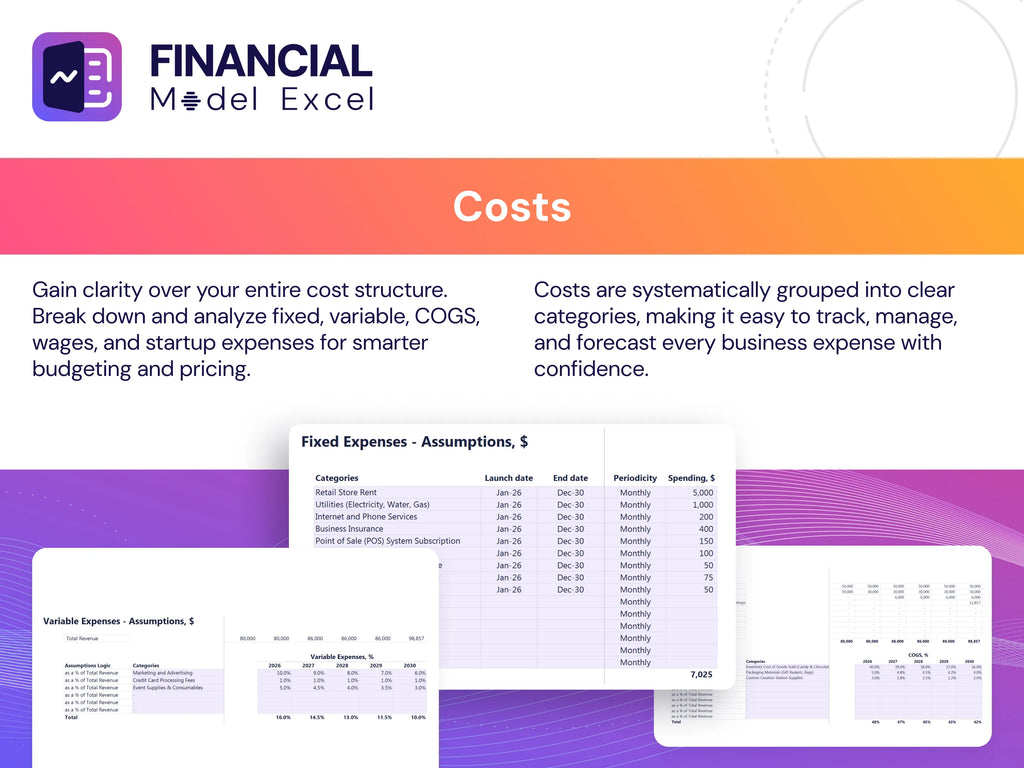

Costs

Our floating hotel budgeting template offers a comprehensive cost analysis and expense tracking system, allowing detailed forecasting of operating expenses and capital expenditures for up to 60 months. Integrated expense curves enable precise floating hotel cash flow forecasts and break-even analysis by modeling costs as fixed, variable, or COGS. This structured methodology supports accurate floating hotel financial planning, investment return projections, and profit margin optimization, streamlining floating hotel income statement and balance sheet modeling. Ideal for robust floating hotel project valuation and investment analysis, it empowers stakeholders to confidently assess funding requirements and financial feasibility with ease.

CAPEX Spending

Capital expenditures (CAPEX) are essential for driving rapid growth and innovation in floating hotels. Allocating CAPEX strategically enables the introduction of cutting-edge technologies and the development of optimized services, directly impacting floating hotel financial feasibility and profit margins. Given that CAPEX represents a significant portion of operating expenses, precise floating hotel cost analysis and budgeting templates are vital. Effective financial planning for floating hotels—incorporating cash flow forecasts, break-even analysis, and investment return projections—ensures transparent expense tracking and robust project valuation, empowering stakeholders to maintain control and maximize investment performance.

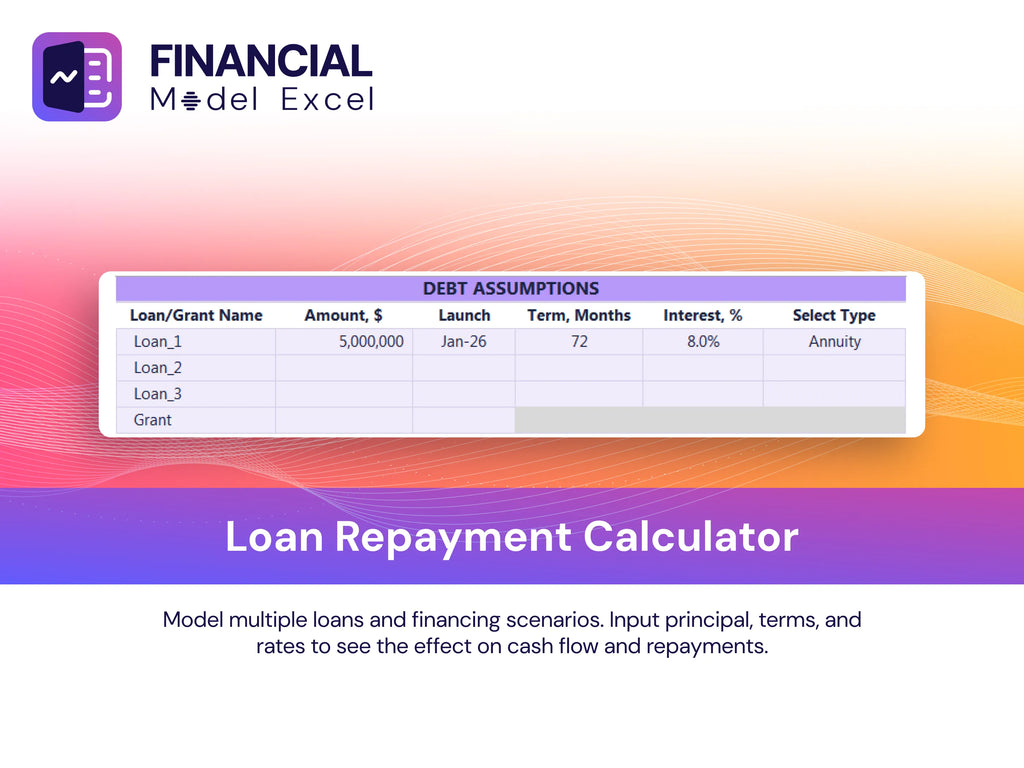

Loan Financing Calculator

Start-ups and developing floating hotel ventures must meticulously manage loan repayment schedules, detailing amounts, maturities, and terms. Integrating these into floating hotel cash flow forecasts ensures accurate financial planning. Interest expenses impact budgeting, while principal repayments influence the floating hotel income statement and cash flow statements. Closing debt balances are reflected in the floating hotel balance sheet modeling. Comprehensive floating hotel cost analysis and break-even analysis rely on precise loan tracking, essential for maximizing floating hotel investment returns and financial feasibility. Effective floating hotel expense tracking and financing options planning drive sustained profit margins and project valuation.

FLOATING HOTEL FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

When developing your floating hotel income statement template, accurately projecting return on investment (ROI) is essential for assessing profitability. ROI measures the effectiveness of your floating hotel investment by comparing net gains against total investment costs, including operating expenses and capital expenditure. A thorough floating hotel investment analysis, combined with cash flow forecasts and cost analysis, ensures informed financial planning. Leveraging detailed floating hotel revenue projections and expense tracking enhances your ability to maximize profit margins and achieve a robust investment return, laying the foundation for sustainable success in the floating hotel industry.

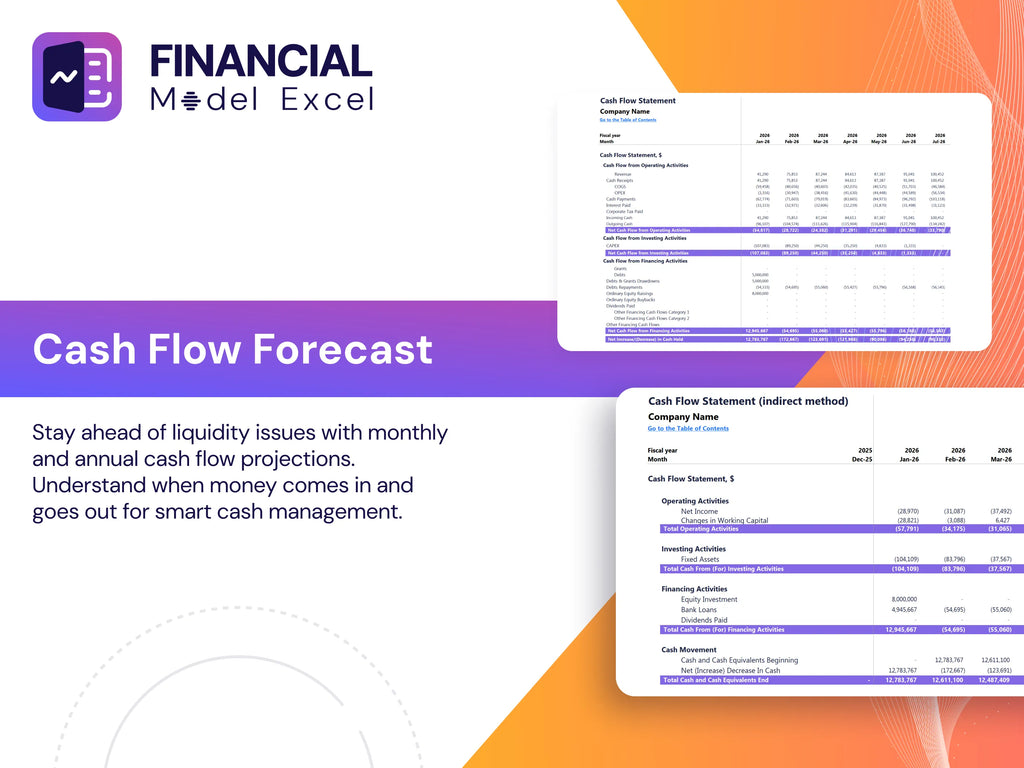

Cash Flow Forecast Excel

Our floating hotel cash flow forecast template in Excel efficiently manages inflows and outflows, ensuring sufficient liquidity to meet liabilities. This clear projection is vital for banks and investors assessing your floating hotel financial feasibility and funding requirements. By integrating detailed expense tracking, operating expenses, and capital expenditure insights, it strengthens your floating hotel investment return analysis. Confidently present your floating hotel income statement and balance sheet modeling to demonstrate robust cash flow performance and secure financing options with transparency and professionalism.

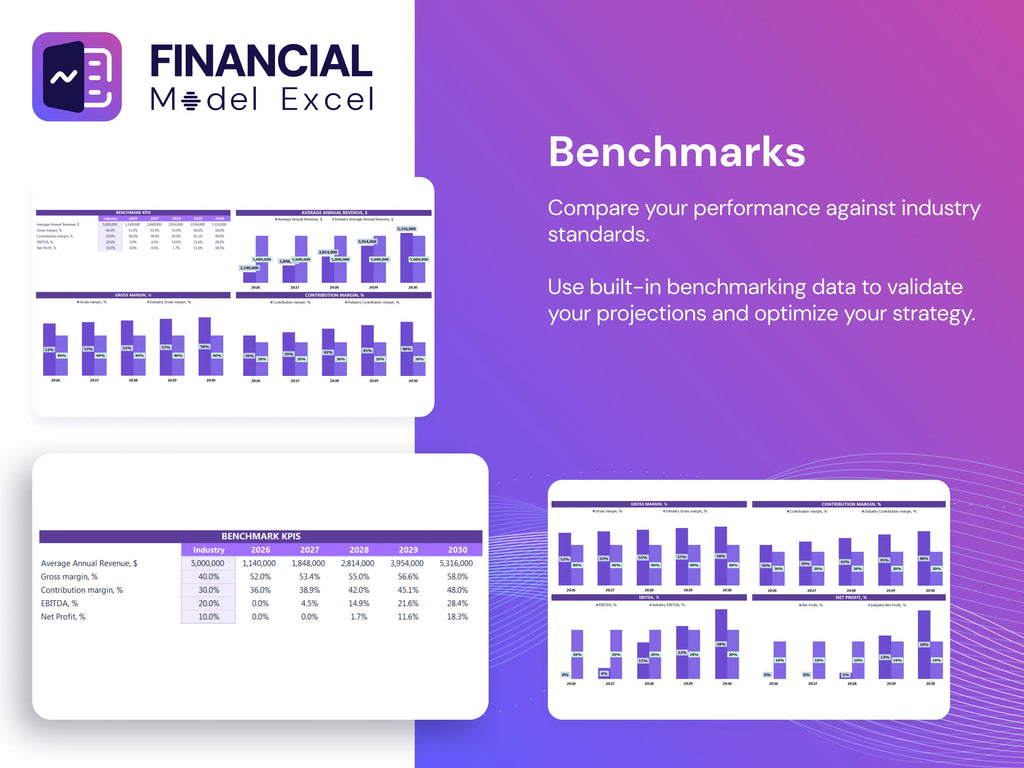

KPI Benchmarks

Unlock powerful insights with our floating hotel financial benchmarking tool, integrated into an easy-to-use projections template. Effortlessly conduct floating hotel revenue projections, cost analysis, and break-even analysis to compare your financial performance against industry peers. This peer-to-peer benchmarking highlights your floating hotel’s profit margins, operating expenses, and investment returns, revealing gaps and growth opportunities. Perfect for startups and established businesses, it supports robust financial planning for floating hotels by tracking expense, forecasting cash flow, and assessing funding requirements—empowering you to optimize capital use and maximize your floating hotel’s financial feasibility and long-term success.

P&L Statement Excel

Leverage our comprehensive floating hotel financial planning tools, including detailed revenue projections, cost analysis, and break-even analysis. This Excel-based budgeting template delivers accurate monthly and 5-year cash flow forecasts, enabling effective expense tracking and investment return analysis. Seamlessly model your income statement and balance sheet to evaluate operating expenses, capital expenditure, and profit margins. Ideal for financial feasibility studies and project valuation, it supports informed decision-making with precise floating hotel sales forecasts and funding requirement assessments. Elevate your floating hotel investment analysis and optimize financial performance with this robust financial model.

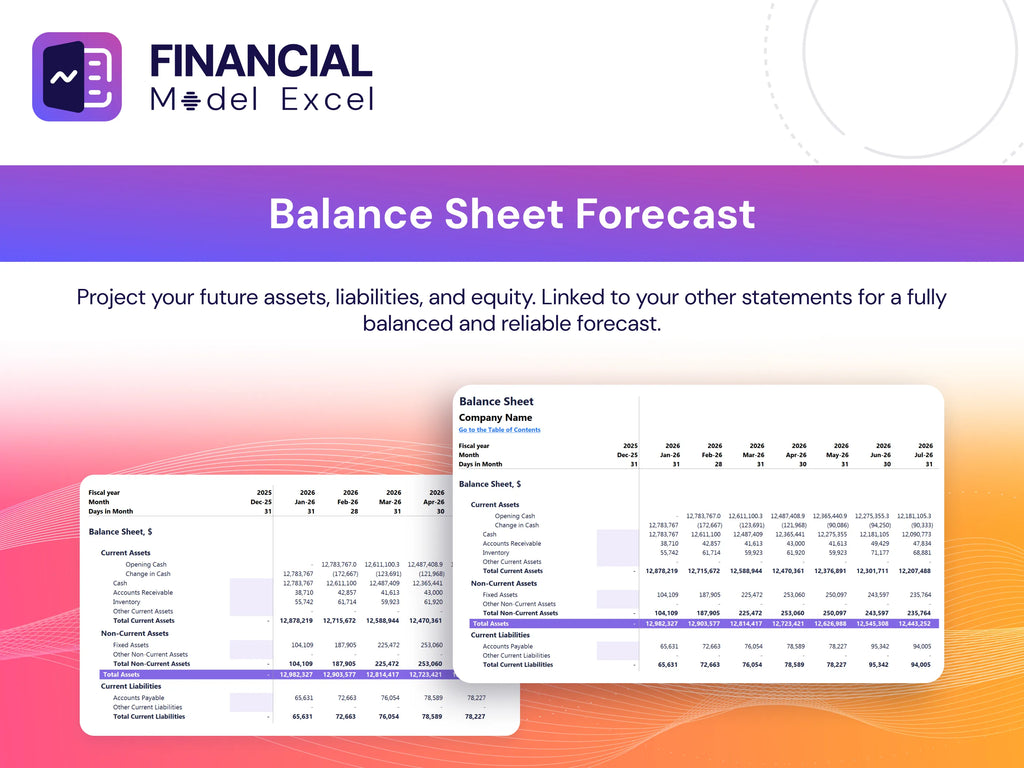

Pro Forma Balance Sheet Template Excel

In floating hotel financial planning, integrating the projected balance sheet, income statement, and cash flow forecast is vital for a comprehensive view. While the profit and loss statement often captures investor attention, the balance sheet is crucial for accurate floating hotel cash flow forecasting. It reveals how capital and operating expenses are managed, supporting reliable investment return and profit margin analysis. Combining these forecasts with key financial metrics enables a thorough floating hotel investment analysis, ensuring realistic revenue projections and efficient use of funds—empowering informed decision-making for sustainable growth and enhanced financial performance.

FLOATING HOTEL FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

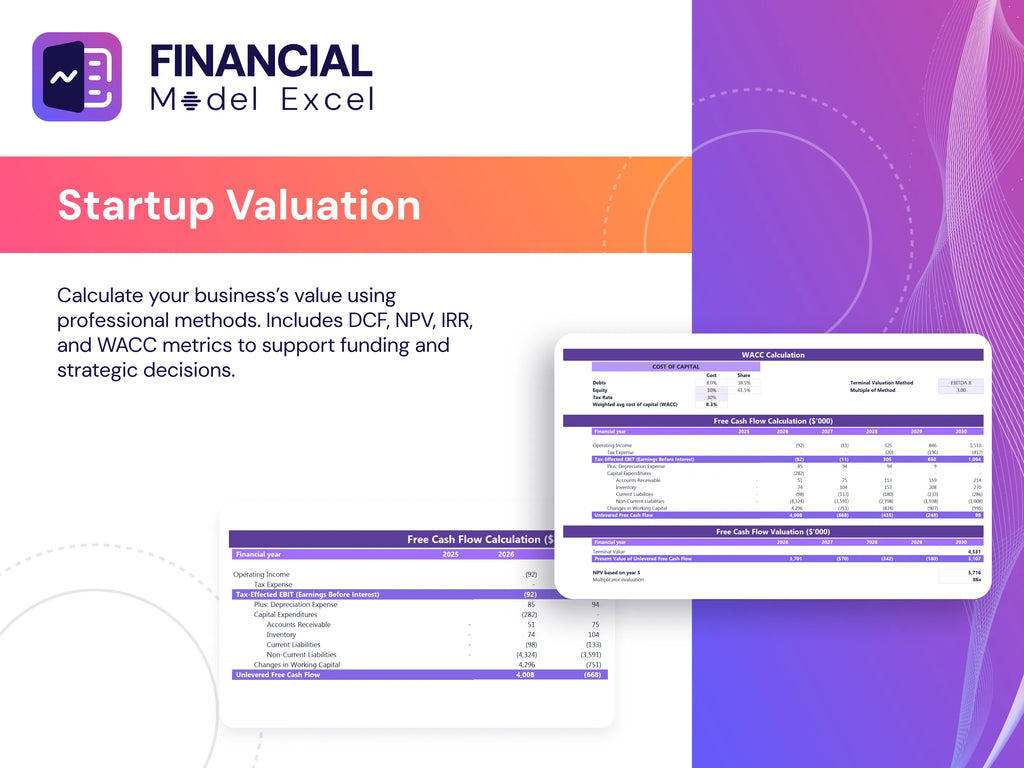

Startup Valuation Model

This comprehensive financial Excel template includes a detailed floating hotel project valuation report, enabling users to conduct Discounted Cash Flow (DCF) analysis seamlessly. By inputting key rates such as Cost of Capital, investors can accurately assess floating hotel investment return and forecast cash flow. Ideal for floating hotel financial feasibility studies, this tool supports precise financial planning, budget management, and break-even analysis to optimize floating hotel profit margins and operating expenses.

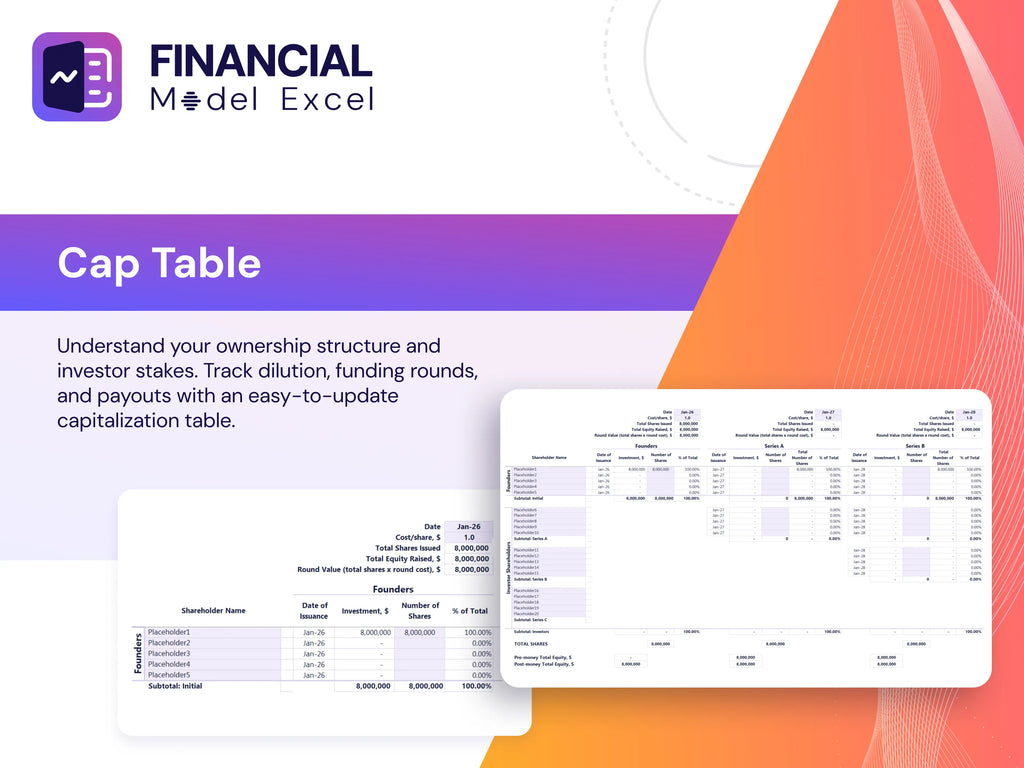

Cap Table

The pro forma cap table is vital for evaluating share capital, market value, and making informed financial decisions. It empowers investors to accurately assess the floating hotel investment return and project valuation. Our comprehensive floating hotel financial model includes detailed proformas—covering income statements, cash flow forecasts, cost analysis, and break-even analysis—ensuring thorough financial planning for floating hotels. This robust tool supports expense tracking, budgeting, and performance analysis, providing critical insights for maximizing profit margins and optimizing operating expenses. Access the full version now to confidently navigate your floating hotel’s funding requirements and investment analysis with precision.

FLOATING HOTEL PRO FORMA PROJECTION ADVANTAGES

The floating hotel financial model ensures precise expense tracking and maximizes profit margins for confident investment decisions.

The 5-year floating hotel financial model streamlines assumptions, enhancing accuracy in revenue projections and investment analysis.

Set new goals confidently with the floating hotel financial model, optimizing investment returns and cash flow forecasting.

Optimize floating hotel investment returns with our accurate financial model and comprehensive business plan forecast template.

Easily forecast cash flow and maximize profits with the comprehensive floating hotel financial model startup template.

FLOATING HOTEL STARTUP FINANCIAL MODEL TEMPLATE EXCEL FREE ADVANTAGES

Optimize your investment with our floating hotel financial model—streamline projections, cash flow, and funding for confident pitching.

Impress investors confidently using our proven floating hotel financial model for accurate revenue projections and investment analysis.

The floating hotel financial model identifies potential cash shortfalls early, ensuring proactive financial planning and stability.

The floating hotel cash flow forecast serves as a vital early warning system, ensuring proactive financial planning and risk management.

Integrated floating hotel financial model optimizes revenue projections and investment return to secure confident investor commitment.

Our floating hotel financial model integrates all forecasts and analyses, delivering investor-ready, deal-proven clarity and confidence.

Our floating hotel financial model saves you time by streamlining detailed revenue projections and cost analysis effortlessly.

Our floating hotel financial model streamlines cash flow forecasting, enabling focus on growth, customers, and business success.

Our floating hotel financial model delivers precise revenue projections and comprehensive cost analysis, maximizing investment returns efficiently.

Unlock accurate floating hotel financial performance with our all-in-one 3 Way Financial Model—no formulas or consultants needed!