Guided City Tours Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Guided City Tours Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Guided City Tours Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

GUIDED CITY TOURS FINANCIAL MODEL FOR STARTUP INFO

Highlights

This sophisticated 5-year guided city tours financial projection model is designed for businesses at any size or development stage, providing a comprehensive financial plan for city tour operators with minimal prior financial planning experience and basic Excel skills. The fully editable guided city tours cash flow model and expense projection tools enable users to accurately estimate startup costs, implement an effective guided tour pricing strategy financial model, and conduct detailed financial feasibility guided city tours analysis. With this template, operators can perform a thorough guided tours break-even analysis, forecast revenue streams guided tours financial model, and build a robust profitability model guided city tours to ensure sound tourism business financial performance and investment analysis.

This comprehensive guided city tours financial projection model addresses common pain points by offering a ready-made, easy-to-use Excel template that integrates detailed city tour business revenue forecast, expense projections, and cash flow modeling on both monthly and annual bases, eliminating the complexity of manual financial budgeting guided city tours processes. It enables operators to perform in-depth financial analysis guided tour services, including profitability model guided city tours, break-even analysis, and sensitivity analysis guided city tours finance, thereby providing clarity on operational cost models and revenue streams guided tours financial model. The template’s built-in guided tour pricing strategy financial model and earnings forecast model streamline decision-making to optimize pricing and profitability, while its financial feasibility guided city tours and investment analysis features reduce uncertainty for startup and existing tour companies, improving valuation and financing discussions.

Description

This guided city tours financial model offers a comprehensive financial planning framework tailored for tour companies, incorporating detailed financial analysis of guided tour services with robust city tour business revenue forecasts and expense projections. It includes integrated three-statement financial reporting, a guided city tours cash flow model, and profitability models that evaluate operational costs and break-even points, accompanied by sensitivity analysis to assess varying market conditions. The model supports strategic decisions through guided tour pricing strategy financial models, investment analysis, and financial budgeting for city tour operators, enabling precise forecasting of revenue streams, earnings, and overall financial feasibility. Users can easily adjust key assumptions affecting guided tours’ financial performance, facilitating scenario analysis and optimizing capital structure through debt and equity funding options to maximize business valuation and ensure sustainable growth.

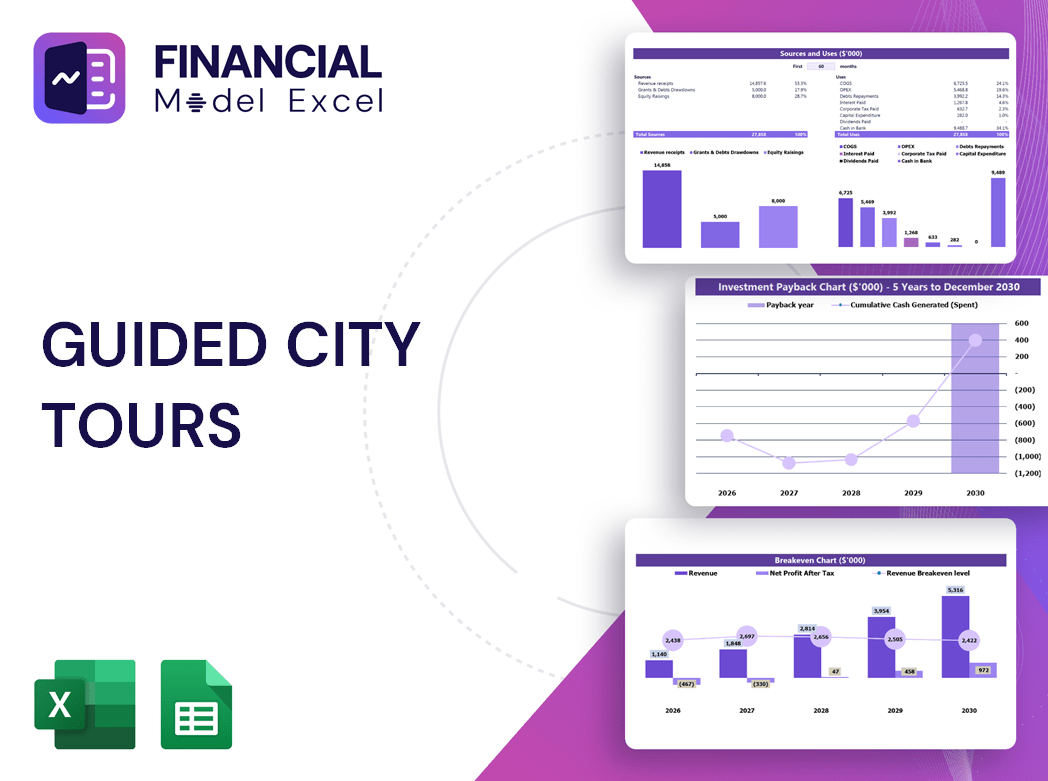

GUIDED CITY TOURS FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

A robust financial model for guided tours business seamlessly integrates profit & loss, balance sheet, and guided city tours cash flow model into a dynamic, scenario-driven forecast. Unlike standard five-year projections focusing solely on income statements, this comprehensive approach offers a precise financial analysis guided tour services need. It captures revenue streams guided tours financial model, expense projections, and sensitivity analysis guided city tours finance, empowering operators with actionable insights. This enables optimized guided tour pricing strategy financial model, accurate break-even analysis, and strategic planning, ensuring sustainable profitability and informed investment decisions in the competitive city tour business.

Dashboard

The guided city tours financial projection model offers a comprehensive dashboard to monitor key metrics like revenue streams, operational costs, and profitability. This financial model for guided tours business consolidates cash flow, expense projections, and earnings forecasts into an intuitive report, enabling precise financial budgeting and break-even analysis. Tour operators gain valuable insights into their financial feasibility and investment potential, ensuring strategic decision-making. Shareable and detailed, this tool streamlines financial analysis for guided tour services, empowering you to optimize pricing strategies and enhance overall tourism business financial performance.

Business Financial Statements

Our financial model for guided tours business automatically generates comprehensive annual Excel reports, integrating core financial statements tied directly to your key assumptions. By updating inputs like pricing strategy or operational costs, the model instantly recalculates your guided city tours cash flow model, revenue forecast, and profitability projections. This dynamic financial plan for city tour operators ensures accurate forecasting and facilitates detailed financial analysis of guided tour services, empowering you with precise insights into your business valuation and investment feasibility. Experience streamlined financial budgeting and sensitivity analysis tailored specifically for guided tour companies.

Sources And Uses Statement

A comprehensive guided city tours cash flow model is essential to accurately track all revenue streams and pinpoint where funds are allocated. This financial analysis of guided tour services supports effective financial budgeting and enhances the tourism business financial performance model. By clearly outlining sources and uses of cash, city tour operators can optimize their guided tour pricing strategy financial model, improve operational cost management, and ensure profitability. This approach strengthens the financial plan for city tour operators, enabling precise revenue forecasts and robust financial feasibility assessments.

Break Even Point In Sales Dollars

The break-even analysis within our comprehensive financial model for guided city tours is crucial for start-ups evaluating business viability. This key metric determines the exact revenue needed to cover all operational costs, including taxes. Achieving this revenue threshold signals the shift from covering expenses to generating profit, marking the point where initial investments begin to yield returns. Essential for informed decision-making, this profitability model empowers city tour operators to assess financial feasibility and optimize their guided tour pricing strategy for sustainable growth.

Top Revenue

In the guided city tours industry, the financial projection model highlights two critical metrics: the top line—representing revenue streams from tour sales—and the bottom line, indicating net earnings. Investors and operators closely monitor these in the financial plan for city tour operators, as fluctuations impact profitability models and overall financial performance. Achieving top-line growth in a guided tours business revenue forecast signifies increased gross sales, positively influencing cash flow models and the financial feasibility of expanding tour services. Accurate financial analysis and budgeting ensure sustainable success and strong investment appeal.

Business Top Expenses Spreadsheet

The guided city tours expense projection captures all annual costs across four key categories, crucial for accurate financial analysis of guided tour services. Our 5-year cash flow model details specific expenses, from customer acquisition and operational costs to employee salaries and unforeseen charges. Integrating this into a comprehensive financial model for guided tours business enables precise revenue forecasting, profitability analysis, and informed financial planning for city tour operators. This financial budgeting approach ensures a robust financial feasibility assessment, supporting strategic decisions to optimize guided tour pricing strategy and maximize overall tourism business financial performance.

GUIDED CITY TOURS FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our financial model for guided city tours offers a comprehensive expense projection and budgeting tool, enabling operators to accurately forecast operational costs and other expenses up to 60 months. With built-in expense forecasting curves—including revenue-based percentages, growth rates, and periodic costs—this guided tours cash flow model ensures precise financial analysis. Expenses can be classified by COGS, variable or fixed costs, wages, or CAPEX, supporting detailed financial planning and break-even analysis. Optimize your guided tour business revenue forecast and investment decisions with this robust financial modeling solution tailored for city tour operators.

CAPEX Spending

A comprehensive financial model for guided city tours includes a detailed startup expenses (CAPEX) table, capturing capitalized investments in assets essential for growth. These expenditures, reflected on the projected balance sheet rather than the pro forma income statement, represent strategic investments driving long-term expansion. Incorporating this into your guided tours financial plan enhances cash flow modeling, expense projection, and profitability forecasts, providing city tour operators with a clear view of financial feasibility and optimized pricing strategies for sustained revenue growth.

Loan Financing Calculator

Our financial model for guided tours business includes a comprehensive loan amortization schedule designed to streamline your financial planning. This schedule details repayment dates, installment amounts with clear principal and interest breakdowns, and loan terms such as interest rate, repayment frequency, and duration. Integrated formulas ensure ease of use, enhancing your guided city tours cash flow model and supporting accurate financial budgeting. By incorporating this tool, city tour operators gain valuable insights for financial analysis guided tour services and can confidently manage debt within their tourism business financial performance model.

GUIDED CITY TOURS FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Return on Equity (ROE) is a key profitability metric that evaluates a guided city tours business’s ability to generate profits from shareholders' investments. In the context of financial modeling for tour companies, ROE reveals how effectively each dollar of equity drives earnings, essential for investment analysis and financial feasibility assessments. Utilizing a comprehensive financial projection model—integrating balance sheet forecasts and profit and loss templates—enables city tour operators to optimize their guided tour pricing strategy, expense projections, and overall revenue streams for sustained profitability and growth.

Cash Flow Forecast Excel

A robust guided city tours cash flow model is essential for accurate financial planning and growth. This financial projection model tracks critical factors like receivables, payables, working capital, and net cash flow, providing a clear cash flow forecast. Incorporating detailed revenue streams and operational cost models, it supports effective guided tour pricing strategy and profitability analysis. Ideal for city tour operators, this financial plan enables precise budgeting, break-even analysis, and investment evaluation, ensuring sustainable business performance and informed decision-making in the competitive tourism sector.

KPI Benchmarks

Benchmarking is a vital tool in financial analysis for guided tour services, enabling city tour operators to compare key financial indicators such as profit margins, expense projections, and operational costs against industry peers. Utilizing a financial model for guided tours business, benchmarking informs revenue forecasts, break-even analysis, and profitability models. This strategic approach helps startups and established operators optimize their guided city tours cash flow model and pricing strategies, enhancing competitiveness. By evaluating financial performance through standardized criteria, companies identify improvement areas, drive financial feasibility, and ensure sustained growth in the dynamic tourism business landscape.

P&L Statement Excel

A comprehensive financial model for guided tours businesses goes beyond the income statement, which tracks profitability and key revenue streams. While the income statement reveals past performance and forecasted earnings, it doesn’t capture assets, liabilities, or cash flow dynamics vital for financial feasibility and investment analysis. Integrating a guided city tours cash flow model, expense projection, and break-even analysis offers a holistic view of operational costs and profitability. This multifaceted approach enhances financial planning, budgeting, and sensitivity analysis—empowering city tour operators to optimize pricing strategies and accurately forecast long-term revenue and earnings.

Pro Forma Balance Sheet Template Excel

A comprehensive financial model for guided city tours integrates the pro forma balance sheet, profit and loss forecast, and cash flow projections to deliver a holistic view of business performance. While profit and loss statements capture investor attention, the balance sheet is vital for accurate cash flow modeling and assessing operational efficiency. Coupled with key financial metrics—such as profitability ratios and return on invested capital—this financial analysis enables city tour operators to create reliable earnings forecasts, validate investment assumptions, and develop effective pricing strategies, ensuring sustainable growth and investor confidence in the guided tours business.

GUIDED CITY TOURS FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Leverage our financial projection model tailored for guided city tours to create comprehensive startup valuation analyses. This professional template enables you to conduct Discounted Cash Flow (DCF) valuations and apply advanced financial modeling for tour companies. Gain clear insights into revenue streams, operational cost models, and profitability forecasts. Optimize your guided tour pricing strategy financial model and perform sensitivity analysis to ensure robust financial planning. Perfect for developing financial plans, break-even analysis, and investment evaluations, empowering guided city tour operators to make data-driven decisions that drive sustainable growth and profitability.

Cap Table

The financial projection model for guided city tours integrates a detailed cap table, essential for startups to visualize ownership structure clearly. It outlines equity shares, preferred shares, options, and stakeholders’ valuations, providing transparency in company ownership. This equity cap table supports accurate financial analysis and investment decisions, ensuring city tour operators have a comprehensive financial plan. Incorporating this tool into your guided tours business enhances revenue forecasting, expense projection, and profitability modeling, driving informed strategies and optimizing financial performance.

GUIDED CITY TOURS BUSINESS PROJECTION TEMPLATE ADVANTAGES

Accurately compute startup costs and maximize profits with our comprehensive guided city tours financial forecasting model.

Our financial model guides city tours operators to forecast cash flow, ensuring proactive cash shortage and surplus management.

Take control of your guided city tours’ cash flow with our precise, comprehensive financial modeling and forecasting tools.

Optimize repayments effortlessly using the guided city tours financial model’s comprehensive 3-statement template for startup success.

A robust financial model for guided city tours boosts credibility and attracts serious investors effortlessly.

GUIDED CITY TOURS BUSINESS PROJECTION TEMPLATE ADVANTAGES

Optimize profitability and secure funding with our comprehensive financial model for guided city tours businesses.

Impress investors confidently with a reliable guided city tours financial model ensuring accurate revenue and profitability forecasts.

Optimize profitability with our financial model, accurately forecasting revenue and expenses for guided city tour operators.

The guided city tours financial model empowers strategic decisions by accurately forecasting cash flow and evaluating investment impacts.

Our financial model for guided tours ensures better decision making through accurate revenue and expense projections.

Optimize guided city tours’ profitability by using financial models for confident cash flow and investment decision-making.

Get a robust, fully expandable financial model delivering precise revenue forecasts and profitability insights for guided city tours.

This robust guided city tours financial model empowers precise 5-year revenue forecasting and customizable business planning.

Save time and money with our guided city tours financial model for accurate revenue forecasting and cost management.

Our guided city tours financial model delivers effortless, expert calculations—freeing you to focus on strategy and growth.