Hang Gliding School Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Hang Gliding School Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Hang Gliding School Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

HANG GLIDING SCHOOL FINANCIAL MODEL FOR STARTUP INFO

Highlights

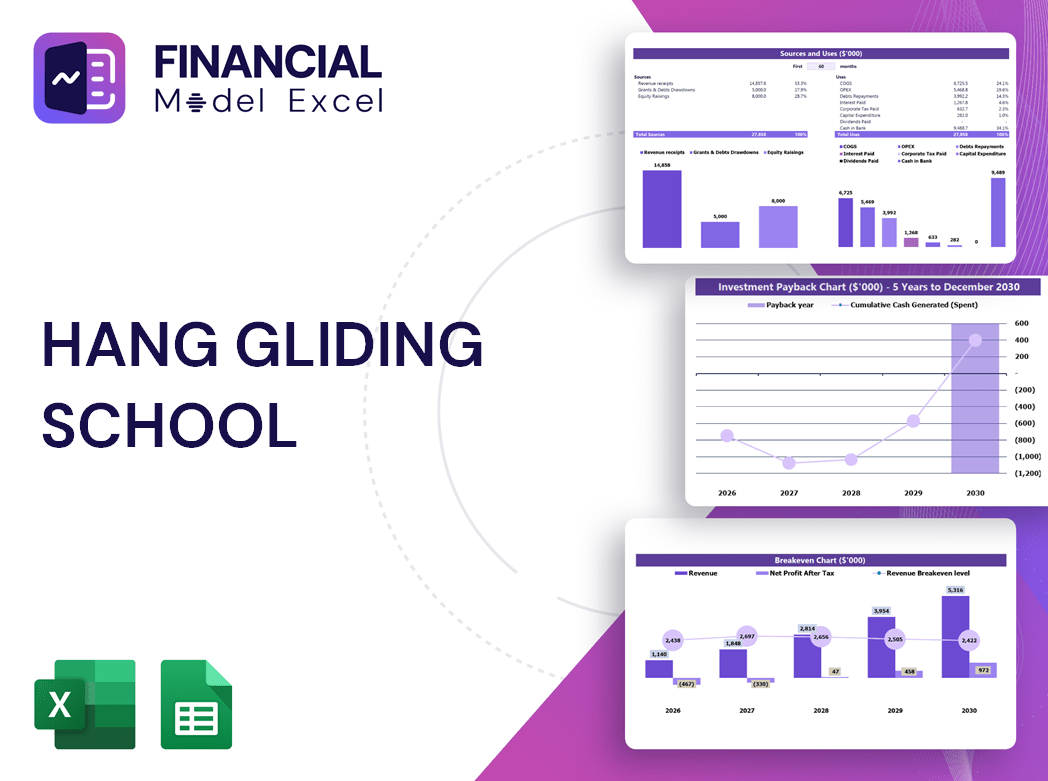

This comprehensive 5-year hang gliding school financial model serves as an essential tool for conducting a detailed profitability analysis for hang gliding schools, including revenue streams for hang gliding schools, hang gliding instruction cost analysis, and startup costs for hang gliding academy. It features a robust financial plan with profit and loss projections, cash flow management for hang gliding school operations, and investment analysis, all formatted in GAAP or IFRS standards. Designed to support aviation training center financial projections and air sports academy budgeting templates, this startup financial model template in Excel enables entrepreneurs to evaluate startup ideas, optimize hang gliding course pricing strategy, forecast school enrollment, and manage customer acquisition costs effectively to secure funding from banks, angels, grants, and venture capital.

The ready-made hang gliding school business plan financial model excel template effectively addresses common pain points such as complex cash flow management hang gliding school, uncertainty in hang gliding instruction cost analysis, and unclear revenue streams for hang gliding schools, providing a comprehensive aeronautical training center financial plan framework. By incorporating detailed budgeting templates and cash flow projections, it simplifies profitability analysis for hang gliding schools and startup costs for hang gliding academy, while the enrollment forecast and customer acquisition costs hang gliding school sections enable strategic pricing and marketing decisions. This financial statement template for hang gliding business offers clarity on expense breakdowns and rental income models, facilitating precise investment analysis and enhancing the financial viability of hang gliding training, ultimately empowering users to customize and scale their aviation training center financial projections with confidence.

Description

The hang gliding school business plan financial model offers a robust 5-year projection encompassing income statements, balance sheets, and cash flow forecasts, tailored specifically for aviation training centers and extreme sports schools. It integrates detailed revenue streams for hang gliding schools, a comprehensive hang gliding instruction cost analysis, and a hang gliding rental income model to ensure accurate profitability analysis. This financial plan includes startup costs for hang gliding academies, customer acquisition costs, and budgeting templates for air sports academies, allowing for precise cash flow management and enrollment forecasting. Designed for both startups and established aeronautical training centers, the model provides a clear financial viability assessment, course pricing strategies, and a detailed business expense breakdown, equipping stakeholders with valuable insights for investment analysis and sustainable growth.

HANG GLIDING SCHOOL FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

This comprehensive hang gliding school business plan financial model empowers entrepreneurs to input key assumptions—ranging from startup costs and course pricing strategy to rental income and customer acquisition expenses. By integrating these elements, it delivers a clear financial forecast and cash flow projection, demonstrating the financial viability and profitability of the aviation training center. Ideal for air sports academies, this tool offers detailed budgeting templates and expense breakdowns that attract investors with a complete view of revenue streams and enrollment forecasts, ensuring confident, data-driven decisions for successful hang gliding school startups.

Dashboard

Our comprehensive financial model Excel template is designed to streamline your hang gliding school business plan. It effortlessly prepares detailed cash flow projections and budgeting templates, while generating monthly or annual reports of all three core financial statements. The intuitive dashboard consolidates vital data from your aeronautical training center financial plan into clear, visual charts, enhancing decision-making. Perfect for analyzing startup costs, course pricing strategies, and revenue streams, this tool ensures effective cash flow management and financial viability for your air sports academy. Elevate your hang gliding instruction cost analysis with this all-in-one financial forecasting solution.

Business Financial Statements

Our comprehensive hang gliding school business plan financial model empowers owners to efficiently prepare detailed financial statements, expense breakdowns, and enrollment forecasts. This robust aviation training center financial plan streamlines cash flow management and profitability analysis, enabling clear communication of operational results to stakeholders. Featuring automated projections, course pricing strategies, and revenue stream insights, it presents data through dynamic graphs and charts—ideal for captivating potential investors. Whether for startup costs, customer acquisition expenses, or hang gliding rental income models, this template ensures your air sports academy's financial viability and growth are confidently showcased.

Sources And Uses Statement

The Sources and Uses of Funds tab details the company’s funding origins alongside planned expenditures within a comprehensive 5-year financial forecast. This section provides clear descriptions, supporting effective cash flow management and ensuring alignment with the hang gliding school’s business plan financial model. It’s an essential component for investment analysis, budgeting, and profitability tracking, enabling an accurate projection of startup costs, operational expenses, and targeted revenue streams for sustained growth.

Break Even Point In Sales Dollars

The 5-year breakeven tab in this hang gliding school financial model clearly illustrates when your aviation training center is projected to turn profitable. Utilizing an accurate break-even formula, the cash flow projection pinpoints the moment your total revenues surpass expenses, providing essential insights for effective cash flow management and investment analysis. This tool is vital for assessing the financial viability of your hang gliding academy and strategizing sustainable growth.

Top Revenue

The Top Revenue tab empowers you to generate detailed demand reports for your café offerings, while delivering clear profitability and financial metrics based on your assumptions. Quickly explore revenue depths and bridges within the P&L template, gaining insight into performance across different periods, such as weekdays versus weekends. These revenue projections enable informed decisions on resource allocation, ensuring optimal staffing and inventory management to maximize profitability and operational efficiency.

Business Top Expenses Spreadsheet

For any hang gliding school or extreme sports academy, meticulous expense planning is crucial to ensure financial viability. Our aviation training center financial model categorizes costs into four key groups for clarity and precision, with an adaptable ‘other’ category for additional expenses. This structure supports effective cash flow management and profitability analysis, helping startups control startup costs and optimize revenue streams. Utilizing our hang gliding school budgeting template enables you to justify large expenses, minimize customer acquisition costs, and drive sustainable growth through informed financial planning. Accurate cost tracking is your foundation for long-term success.

HANG GLIDING SCHOOL FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our comprehensive cost report caters to both individual and group budgets while enabling precise tracking of FTE and PTE salary expenses. Integrated seamlessly within our startup pro forma template, your customized financial inputs automatically update the entire hang gliding school business plan financial model. This ensures accurate cash flow projections, enrollment forecasts, and expense breakdowns—empowering your aeronautical training center financial plan with real-time insights for effective budgeting and profitability analysis.

CAPEX Spending

Capital expenditures (CAPEX) encompass the startup costs essential for acquiring key assets in a hang gliding school business plan. These significant investments, spread over varying timeframes, are crucial for enhancing equipment and operational efficiency. Accurately integrating CAPEX into the balance sheet forecast and cash flow projections ensures a realistic financial model. Reflecting these expenses in the profit and loss statement template supports comprehensive budgeting and effective cash flow management. Properly accounting for CAPEX drives the financial viability and long-term profitability of aviation training centers and extreme sports school revenue models.

Loan Financing Calculator

The company’s repayment plan is clearly outlined using a detailed loan amortization schedule template. Our 5-year financial projection model integrates this schedule with advanced algorithms, accurately breaking down each installment into principal and interest components. This streamlined approach supports precise cash flow management for hang gliding schools or aviation training centers, ensuring clarity in financial planning and enhancing the overall financial viability of your air sports academy.

HANG GLIDING SCHOOL FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Net Present Value (NPV) is a critical metric in your hang gliding school business plan financial model, quantifying the current worth of future cash flows discounted to present value. It answers key questions like, “What is today’s value of $1 received years down the line?” By summing these discounted cash inflows over multiple periods, NPV provides a clear measure of your aviation training center’s long-term profitability and financial viability. Incorporating NPV into your paragliding and hang gliding financial forecast ensures informed decisions for budgeting, investment analysis, and cash flow management in your air sports academy.

Cash Flow Forecast Excel

A solid hang gliding school business plan requires precise cash flow management to ensure financial viability. Our aviation training center financial projections template features an updated cash flow statement, incorporating key metrics like Days Payable, Days Receivable, working capital, and debt. Presented in a clear waterfall format, it calculates net cash flow and aligns with your balance sheet for accurate budgeting. Whether for startup costs or long-term financial planning, this model supports effective cash flow management, enabling extreme sports schools to optimize revenue streams, pricing strategy, and profitability analysis with confidence.

KPI Benchmarks

The financial benchmarking feature in our startup costs template empowers hang gliding schools and aviation training centers to conduct in-depth comparative analysis. By evaluating key financial metrics such as losses, cash flow, and revenue streams against industry peers, businesses gain critical insights into their financial viability and profitability. This data-driven approach enables precise adjustments in budgeting, cost management, and enrollment forecasts, ensuring strategic growth. Understanding these financial benchmarks is essential for flight schools and extreme sports academies aiming to optimize performance and elevate their business to the highest level of success.

P&L Statement Excel

The projected income statement template is crucial in any hang gliding school business plan financial model, revealing profitability and operational performance. Precision in these projections ensures reliable insights into revenue streams and expenses. However, it excludes assets, liabilities, and cash flow details—key components for a comprehensive aviation training center financial plan. Without integrating cash flow projections, the profit and loss statement offers an incomplete picture. To accurately assess financial viability and manage cash flow, combine the P&L statement with detailed budgeting templates and cash flow management tools tailored for hang gliding academies.

Pro Forma Balance Sheet Template Excel

The hang gliding school financial model relies on a projected balance sheet, capturing assets, liabilities, and net worth at a specific point. Complementing this, the P&L forecast details operational performance over time, essential for profitability analysis. Together, these financial statements provide critical insights into cash flow management, liquidity, and turnover ratios. Utilizing a comprehensive aeronautical training center financial plan—including course pricing strategy, startup costs, and revenue streams—ensures accurate financial projections and investment analysis for sustainable growth in the hang gliding and air sports industry.

HANG GLIDING SCHOOL FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

The hang gliding school financial model template integrates essential tools like Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF) to support robust investment analysis. WACC offers a clear view of capital costs based on equity and debt proportions, crucial for lenders evaluating risk. Meanwhile, DCF enables investors to accurately value future revenue streams, ensuring informed decisions. This comprehensive financial plan empowers hang gliding school owners, creditors, and investors to confidently assess profitability, manage cash flow, and optimize their aviation training center’s growth strategies.

Cap Table

A capitalization table is a vital financial tool in our hang gliding school business plan financial model, detailing four funding rounds to project shareholder ownership and dilution. This comprehensive cap table includes equity shares, preferred shares, employee stock options, convertible bonds, and more. By integrating this within your aviation training center financial projections, you gain clear insights into investment impacts, ensuring accurate revenue forecasting and strategic cash flow management for your air sports academy. Understanding ownership dynamics empowers informed decision-making and strengthens your hang gliding school's financial viability and growth potential.

HANG GLIDING SCHOOL PRO FORMA TEMPLATE EXCEL ADVANTAGES

Our financial model ensures precise cash flow management, boosting profitability and sustainable growth for your hang gliding school.

Maximize profits effortlessly with our comprehensive hang gliding school financial model and startup projection toolkit.

The hang gliding school financial model ensures confident loan approval through precise forecasting and strategic financial planning.

Optimize growth and profitability by reassessing assumptions with a detailed hang gliding school financial model projection.

Take control of cash flow and maximize profits with our comprehensive hang gliding school financial model.

HANG GLIDING SCHOOL PROJECTED CASH FLOW STATEMENT TEMPLATE EXCEL ADVANTAGES

Optimize cash flow with our hang gliding school financial model to effectively manage accounts receivable and boost profitability.

A detailed cash flow model pinpoints late payers, optimizing payment strategies and enhancing your hang gliding school's financial stability.

Optimize funding success with a detailed hang gliding school business plan financial model showcasing profitability and growth.

Impress investors with a robust hang gliding school financial model that ensures clear profitability and strategic growth.

Our hang gliding school financial model ensures precise cash flow management, maximizing profitability and attracting savvy investors.

Our hang gliding school financial model ensures precise cash flow and profitability forecasting for confident business growth decisions.

Our financial model ensures accurate revenue forecasting and cost control for profitable hang gliding school management.

The hang gliding school financial model ensures precise planning, boosting investor confidence and maximizing funding success.

Our financial model identifies cash gaps and surpluses early, ensuring proactive, precise hang gliding school cash flow management.

The financial model enables proactive cash flow management, helping avoid deficits and optimize reinvestment opportunities for growth.