Industrial Park Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Industrial Park Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Industrial Park Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

INDUSTRIAL PARK FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive 5-year industrial park financial projection model is designed for businesses of any size and development stage, providing a robust framework for industrial real estate financial forecasting and investment analysis. With minimal prior financial planning experience or advanced Excel skills required, this industrial park profit and loss model delivers quick, reliable results for effective financial planning, including cash flow management, capital expenditure tracking, and operational cost analysis. Fully unlocked and customizable, it serves as an essential industrial park feasibility financial model and revenue forecasting tool, enabling users to confidently conduct industrial park funding and financial modeling before purchasing or expanding industrial park projects.

This industrial park financial projection model offers a robust solution to common pain points faced by buyers, providing a ready-made, investor-ready Excel template that streamlines complex financial planning for industrial parks. By integrating an industrial park profit and loss model, cash flow forecast, and a capital expenditure model, it eliminates guesswork and accelerates accurate industrial real estate financial forecasting. The template includes a comprehensive industrial park funding and financial model alongside cost analysis and revenue forecasting modules, ensuring thorough industrial park investment analysis and feasibility assessment. Additionally, the financial model supports detailed industrial park budget modeling and operational cost tracking, empowering users to anticipate financial outcomes, optimize industrial park valuation, and confidently present a professional industrial park business financial plan without the hassle of building formulas from scratch.

Description

This comprehensive industrial park financial projection model serves as an essential tool for financial planning for industrial parks, providing detailed industrial real estate financial forecasting and investment analysis. Featuring a 5-year industrial park startup financial model with monthly and yearly financial statements, KPIs, cash flow models, and diagnostic tools, it supports effective industrial park budget modeling, cost analysis, and profit and loss tracking. The model integrates industrial park capital expenditure and operational cost modules alongside funding and financial scenarios, including business bank loans and equity investments, enabling precise industrial park valuation financial model and feasibility assessments. Designed for small and medium-sized enterprises, this industrial park financial statement model facilitates informed decision-making, supports industrial project financial modeling, and enhances liquidity management, thereby fostering sustainable growth and maximizing returns on industrial park development and expansion initiatives.

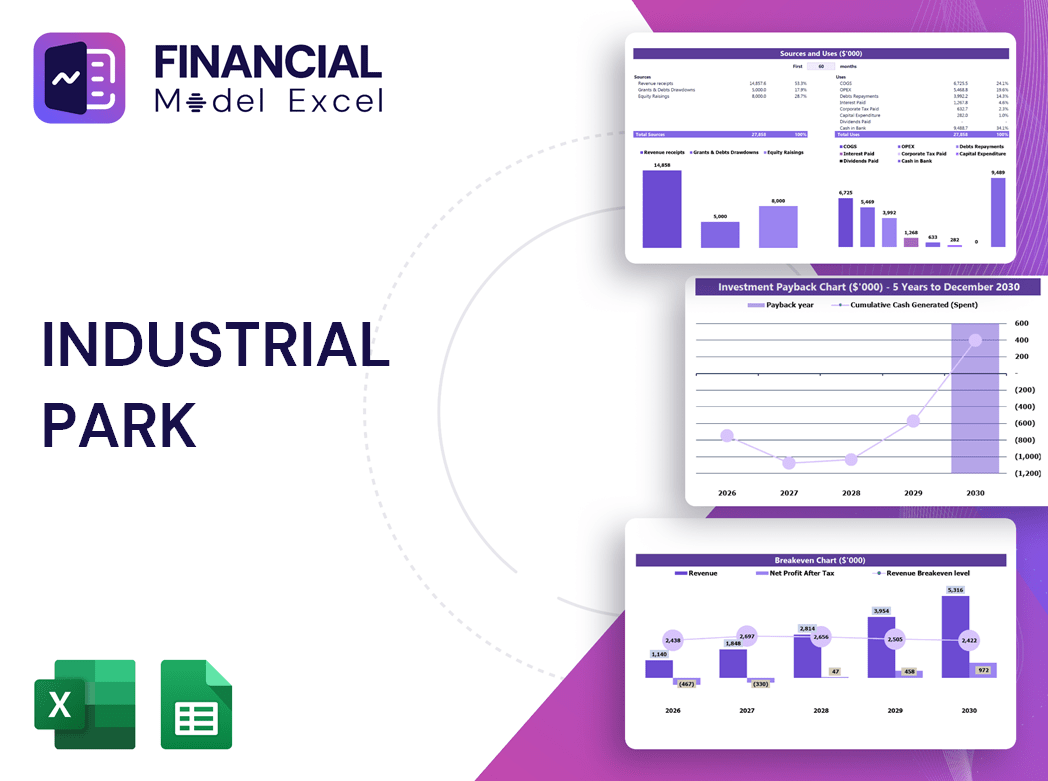

INDUSTRIAL PARK FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our comprehensive industrial park financial projection model in Excel is designed for seamless investor presentations. Featuring detailed business financial plans, cash flow models, and standardized reports, this financial model for industrial development ensures clarity and precision. Built with an investor-first mindset, it offers a robust 5-year forecast, integrating industrial park revenue forecasting, cost analysis, and profit and loss modeling. Whether for funding discussions or feasibility studies, this template streamlines financial planning and enhances your industrial park investment analysis.

Dashboard

The Dashboard tab offers a comprehensive industrial park financial projection model, featuring dynamic graphs, key ratios, detailed charts, and an integrated financial statement model. This streamlined interface enables seamless industrial park investment analysis, financial planning, and revenue forecasting, empowering stakeholders with actionable insights for informed decision-making and strategic growth.

Business Financial Statements

When developing an industrial park startup financial model, it’s essential to include all vital components within a clear, intuitive template. Whether using an industrial park financial projection model or a comprehensive industrial park feasibility financial model, simplicity and transparency are key. A well-structured financial model for industrial development ensures easy evaluation by investors and stakeholders, streamlining decision-making. Prioritize clarity in your industrial park cash flow model and budget modeling to effectively communicate your industrial park investment analysis and financial planning efforts.

Sources And Uses Statement

This industrial park startup financial model features a comprehensive sources and uses of funds section, providing clear insight into the project's funding structure. Users can easily track capital inflows and outflows, enhancing financial planning and investment analysis. This detailed financial planning tool supports industrial park feasibility, budget modeling, and cash flow forecasting to optimize operational and capital expenditure management. Ideal for industrial park investment analysis, the model ensures transparent and accurate financial forecasting to drive informed decision-making.

Break Even Point In Sales Dollars

Utilizing an industrial park financial projection model, the break-even point calculation offers clear insights into profitability across varying sales volumes. In a 5-year industrial park feasibility financial model, the break-even marks when total sales contributions precisely cover fixed costs, resulting in zero profit or loss. This essential analysis, grounded in marginal costing principles, adapts to fluctuating operational levels, empowering precise industrial park investment analysis and informed financial planning for long-term success.

Top Revenue

This industrial park financial projection model offers a dedicated section for in-depth analysis of revenue streams. Users can evaluate income sources for each service or product line separately, enhancing accuracy in industrial real estate financial forecasting. Ideal for industrial park investment analysis, this financial model supports detailed financial planning, budget modeling, and revenue forecasting to drive informed decision-making and maximize profitability.

Business Top Expenses Spreadsheet

The Top Expenses tab offers a detailed cost analysis, essential for accurate industrial park financial planning and tax compliance. This internal report breaks down expenses by period—monthly, quarterly, or annually—enabling comparison between actual and projected costs. Leveraging this data supports your industrial park startup financial model and aids in strategic forecasting, investment analysis, and operational budgeting. Maintaining organized expense records not only ensures transparency but also empowers effective financial modeling for industrial development and future expansion scenarios.

INDUSTRIAL PARK FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Every industrial park financial projection model must accurately capture startup costs, vital for early-stage planning to prevent underfunding or overspending. Our comprehensive industrial park feasibility financial model includes a detailed Pro-forma, outlining essential funding, capital expenditure, and operational cost data. This financial forecasting tool empowers developers to effectively manage expenses, optimize budget modeling, and confidently plan revenue streams. Utilize this industrial park investment analysis model to ensure precise financial planning and secure sustainable growth from project inception through expansion.

CAPEX Spending

CAPEX is a critical component in any industrial park financial projection model, representing one of the largest capital-intensive expenditures. It serves as a key indicator of the future operational quality and growth potential within industrial real estate financial forecasting. Analyzing historical CAPEX figures through the industrial park cash flow model and projected balance sheets over five years is essential for accurate industrial park budget modeling. This careful evaluation enables precise financial planning for industrial parks, ensuring responsible budgeting and robust industrial park investment analysis for sustainable success.

Loan Financing Calculator

Our comprehensive industrial park financial projection model features an integrated loan amortization schedule, detailing both principal and interest calculations. This financial planning tool accurately forecasts payment amounts by incorporating loan principal, interest rate, term duration, and payment frequency. Ideal for industrial park investment analysis, operational cost modeling, and capital expenditure planning, it ensures precise cash flow management and enhances budget modeling efficiency—empowering informed decision-making for industrial real estate financial forecasting and project profitability.

INDUSTRIAL PARK FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The net profit margin is a crucial metric in industrial park financial projection models, revealing how efficiently a business converts sales into profit. This measure highlights the percentage of revenue retained after all expenses, essential for industrial real estate financial forecasting and investment analysis models. Accurately assessing net profit margins supports sound financial planning for industrial parks, guiding operational cost models and capital expenditure decisions. By leveraging the net income percentage within an industrial park profit and loss model, stakeholders can effectively evaluate profitability and drive sustainable long-term growth in industrial development projects.

Cash Flow Forecast Excel

An industrial park cash flow model provides a detailed forecast of all cash inflows and outflows over a specified period, offering comprehensive insight into your business’s financial health. This essential tool supports industrial park financial planning by accurately projecting operational costs and revenues, enabling thorough industrial park investment analysis. By leveraging an industrial park financial projection model, stakeholders can confidently manage budgeting, funding, and expansion strategies, ensuring optimal cash management and sustainable growth for industrial development projects.

KPI Benchmarks

The industrial park financial projection model includes a dedicated tab for financial benchmarking, enabling comprehensive analysis of performance metrics. This financial model for industrial development compares key indicators against similar industrial real estate projects, providing insights into competitiveness, efficiency, and productivity. Leveraging this industrial park investment analysis model empowers stakeholders with accurate financial forecasting, enhancing strategic financial planning for industrial parks and supporting informed decision-making.

P&L Statement Excel

To make informed decisions, rely on an industrial park profit and loss model—an essential financial projection tool built on cutting-edge forecasting techniques. This model enables precise industrial real estate financial forecasting, empowering you to analyze operational costs, capital expenditures, and cash flows comprehensively. Utilizing a robust industrial park financial projection model allows for a clear diagnosis of your business’s financial health, revealing strengths and areas for improvement. With expert financial planning for industrial parks, you gain the insights needed to optimize investment strategies and drive sustainable growth.

Pro Forma Balance Sheet Template Excel

The industrial park financial projection model provides a comprehensive snapshot of assets and liabilities, revealing your project's financial position at a specific point in time. Complementing this, the industrial park profit and loss model tracks operational performance across periods, while the industrial park balance sheet template highlights net worth and equity-debt structures. Together, these core financial models enable precise industrial real estate financial forecasting, including liquidity and turnover ratio analysis—essential for strategic financial planning and investment decision-making in industrial park development and expansion.

INDUSTRIAL PARK FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Discover our comprehensive industrial park financial projection model—your ultimate tool for in-depth valuation and investment analysis. This dynamic Excel template empowers users to perform Discounted Cash Flow (DCF) valuation with ease, while incorporating residual value, replacement cost, market comparables, and relative valuation metrics. Ideal for industrial real estate financial forecasting, this model supports thorough industrial park feasibility financial analysis, capital expenditure planning, and cash flow management. Whether you’re developing a financial plan, conducting investment analysis, or preparing financial statements, our industrial park financial model ensures precise, data-driven decision-making for successful project outcomes.

Cap Table

In industrial park investment analysis models, maintaining a detailed cap table is essential. This financial planning tool outlines ownership of securities—common stock, preferred shares, options, and warrants—ensuring clarity in industrial park funding and financial modeling. Accurate, up-to-date records empower stakeholders to make informed decisions on fundraising, employee compensation, and potential acquisitions. Integrating cap table data into your industrial real estate financial forecasting enhances the precision of your industrial park feasibility financial model and drives confident, strategic growth.

INDUSTRIAL PARK FINANCIAL PLAN TEMPLATE ADVANTAGES

Demonstrate investor confidence with an industrial park financial projection model that ensures transparent, accurate, and strategic planning.

The industrial park financial model optimizes cash inflows and outflows, ensuring accurate, strategic financial planning and increased profitability.

Optimize investment decisions confidently with the industrial park financial projection model’s accurate, dynamic financial forecasting capabilities.

Industrial park financial projection models empower strategic investment decisions, maximizing profitability and attracting top-tier stakeholders.

Accelerate growth with our industrial park financial projection model for precise forecasting and strategic investment decisions.

INDUSTRIAL PARK FINANCIAL FORECAST TEMPLATE ADVANTAGES

The industrial park financial projection model enables dynamic updates for precise, real-time investment and operational decision-making.

The industrial park financial projection model enables dynamic input adjustments, refining forecasts for accurate, strategic decision-making.

Our industrial park financial projection model ensures accurate forecasts, supporting stakeholder confidence and streamlined funding approvals.

An industrial park financial model ensures precise forecasting, enhancing investment confidence and securing bank loan approvals efficiently.

The industrial park cash flow model identifies potential cash shortfalls early, ensuring proactive financial management and stability.

The industrial park profit and loss model provides early financial insights, safeguarding cash flow and optimizing investment decisions.

The industrial park financial projection model ensures accurate forecasting for optimized investment and sustainable growth.

The industrial park cash flow model ensures timely cash insights, enabling proactive financial decisions and sustainable business growth.

Optimize industrial park investments with our precise financial model for compelling, data-driven investor presentations and confident decision-making.

The industrial park financial model accelerates funding by clearly demonstrating startup costs and profitability to investors.