Insurance Broker Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Insurance Broker Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Insurance Broker Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

INSURANCE BROKER FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year insurance brokerage financial projections model serves as an essential financial model template for insurance brokers, integrating key components such as a profit and loss model, cash flow model for insurance brokerages, and an expense budgeting model. Designed specifically for startups and entrepreneurs, it includes insurance broker sales forecasting models, underwriting financial models, and KPI financial models to support detailed business planning and fundraising efforts. With built-in insurance brokerage revenue forecast models and financial scenario analysis capabilities, this versatile insurance broker business valuation model enables users to evaluate startup ideas, plan pre-launch expenses, and attract funding from banks, angels, grants, and VC funds, all while offering full editing flexibility.

The insurance brokerage financial model template is designed to alleviate common pain points by offering a comprehensive yet user-friendly solution that eliminates the need for complex formulas, extensive formatting, or costly external consulting. This ready-made insurance broker financial projections model integrates key elements such as revenue forecasting, commission calculations, expense budgeting, and profit and loss analysis, empowering business owners to effortlessly manage cash flow, operational costs, and capital requirements. It facilitates robust financial scenario analysis and KPI tracking, enabling accurate sales forecasting and investment return assessments, which are crucial for strategic decision-making and presenting clear business valuations to investors or lenders. By simplifying the financial planning process, this model allows brokers to focus on growing their business with confidence, reducing dependency on expensive software or financial experts.

Description

Our insurance broker financial projections model serves as a comprehensive financial planning model for insurance brokers, enabling precise forecasting of revenue, expenses, and commissions through the insurance broker commission calculation model. This robust financial model template for insurance brokers supports detailed insurance brokerage profit and loss modeling, cash flow forecasting, and insurance broker expense budgeting, providing a clear view of financial performance and operational costs. With integrated insurance brokerage KPI financial models and insurance broker sales forecasting capabilities, the tool helps evaluate business valuation and perform insurance brokerage financial scenario analysis, ensuring strategic insight into capital requirements and investment returns to drive sustained growth and profitability.

INSURANCE BROKER FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Streamline your investor meetings with our comprehensive 5-year insurance broker financial projections model. Featuring dedicated setup sheets for financial assumptions, commission calculations, cash flow modeling, and a pre-built profit and loss statement, this professional financial model template for insurance brokers delivers key business insights effortlessly. Designed to support accurate revenue forecasts, expense budgeting, and KPI analysis, it presents your insurance brokerage’s financial performance in a clear, investor-friendly format—empowering confident decision-making and strategic growth planning.

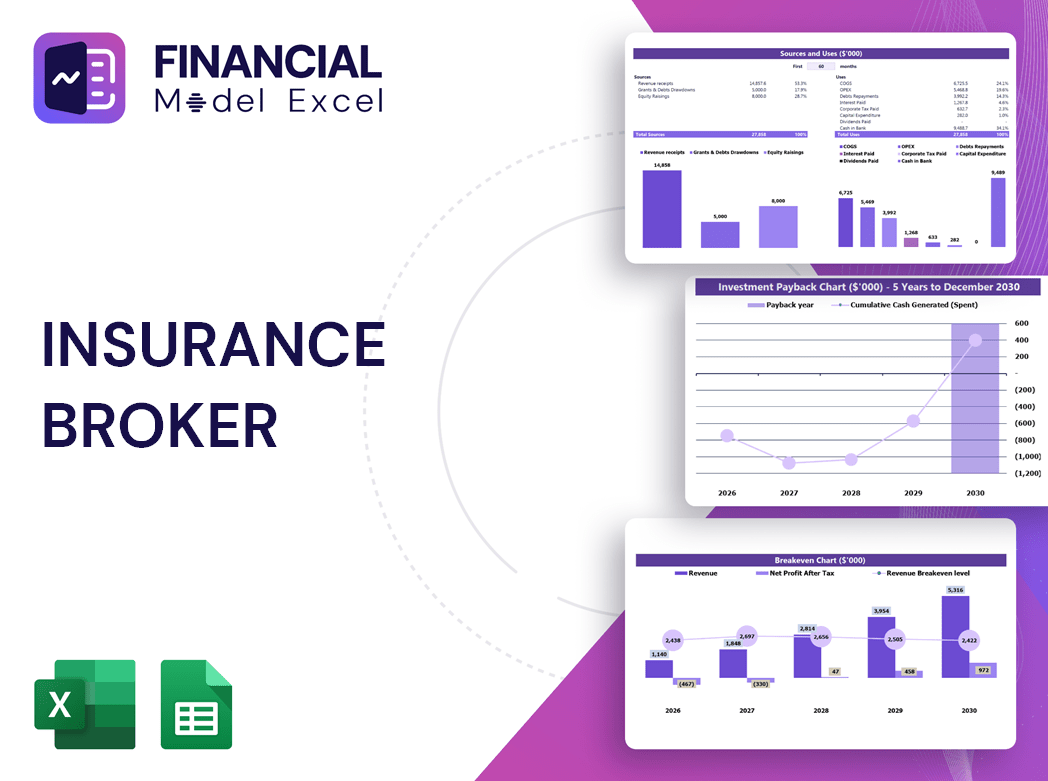

Dashboard

The integrated dashboard within this insurance brokerage financial model delivers comprehensive insights by consolidating key metrics from cash flow models for insurance brokerages, profit and loss statements, and detailed revenue forecasts. It visually presents crucial data—such as monthly and annual revenue breakdowns—through intuitive charts and graphs, empowering brokers with clear, real-time financial projections and performance indicators for strategic decision-making.

Business Financial Statements

Our financial model template for insurance brokers streamlines your workflow by automatically generating comprehensive financial statements. Simply update your key assumptions, and the insurance brokerage revenue forecast model, profit and loss projections, and cash flow analyses are instantly prepared. Designed for precise insurance broker business valuation and efficient expense budgeting, this tool empowers you with reliable financial planning and performance insights. Elevate your insurance brokerage operations with our integrated financial projection model, ensuring accurate underwriting evaluations, commission calculations, and KPI tracking—all in one powerful Excel template.

Sources And Uses Statement

The Source and Use of Funds tab within the financial model template for insurance brokers clearly outlines the origin of company capital alongside planned expenditure activities. This detailed section supports precise insurance brokerage revenue forecast models and expense budgeting, ensuring transparent financial planning. By integrating this with cash flow models for insurance brokerages and operational cost models, brokers gain a comprehensive understanding of fund allocation, enhancing accuracy in financial projections and strategic decision-making.

Break Even Point In Sales Dollars

The insurance broker financial projections model helps determine the break-even point—where total fixed and variable costs are covered, resulting in zero profit. Using our financial model template for insurance brokers, you can create a customized break-even chart showing the minimum sales needed to cover expenses. Surpassing this point signals profitability, crucial for investors assessing the insurance brokerage’s growth financial model. This insight into sales forecasting and profit potential enhances confidence in returns, enabling investors to estimate when their investments will be recouped based on projected income beyond the break-even threshold.

Top Revenue

The startup costs spreadsheet’s Top Revenue tab provides a comprehensive annual breakdown of your insurance brokerage’s revenue streams. Leveraging this financial model template for insurance brokers, you can analyze revenue depth and bridge with precision. This powerful insurance brokerage revenue forecast model supports strategic decision-making to optimize growth and profitability.

Business Top Expenses Spreadsheet

Achieving financial success requires precise expense management. Our financial model template for insurance brokers offers a comprehensive expense budgeting model, categorizing costs into four key groups plus an “other” section for additional expenses. This detailed insurance brokerage profit and loss model enables users to accurately estimate and monitor expenses, providing crucial insights into operational efficiency. By analyzing annual expenses through the insurance broker financial performance model, you can identify trends and optimize cost control, ensuring your brokerage stays financially healthy and positioned for sustainable growth.

INSURANCE BROKER FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

A 5-year insurance broker financial projections model is an essential tool to accurately forecast expenses, assess risks, and project key financial ratios. It highlights critical areas needing focused attention to mitigate potential losses and enhance future performance. Additionally, this insurance brokerage revenue forecast model plays a pivotal role in securing investor funding by providing a clear, data-driven outlook on company expenses and growth potential. Utilizing a comprehensive financial model template for insurance brokers empowers strategic decision-making and drives sustainable business success.

CAPEX Spending

Capital expenditures (CAPEX) form the foundation of a startup’s budget, driving the company’s growth and development. Utilizing an insurance broker financial projections model ensures precise CAPEX investment decisions, enabling effective financial management. Business owners rely on this financial model template for insurance brokers to create accurate business plans, optimize cash flow, and forecast revenue with confidence. By leveraging such comprehensive models—like insurance brokerage profit and loss or expense budgeting models—companies can achieve improved financial performance and sustainable growth.

Loan Financing Calculator

Simplify your financial planning with our comprehensive insurance broker financial projections model. Designed for precision, this template effortlessly calculates loan amortization—breaking down principal and interest payments based on total loan amount, tenor, and maturity. It integrates key elements like interest rates, repayment schedules, and maturity dates, providing a clear, all-in-one solution. Ideal for insurance brokerages seeking accurate revenue forecast models, profit and loss analysis, and cash flow management, this tool drives confident decision-making and optimizes financial performance with ease.

INSURANCE BROKER FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Return on capital is a key metric reflecting the alignment between the balance sheet forecast and the proforma income statement in your insurance brokerage financial model. It measures how effectively earnings are generated from the capital employed, serving as a vital indicator of financial performance. Utilizing an insurance broker business valuation model or an insurance brokerage profit and loss model can help identify companies with strong financial management, as they consistently deliver superior returns on capital. Accurate financial projections and scenario analysis ensure informed decision-making and sustainable growth for insurance brokerages.

Cash Flow Forecast Excel

Stakeholders, including banks, often require a comprehensive insurance brokerage cash flow model to evaluate your company’s capability to repay loans. Utilizing a robust financial model template for insurance brokers, such as a cash flow model for insurance brokerages, demonstrates your firm’s solid financial planning and strong cash management. This empowers lenders to confidently assess your insurance brokerage revenue forecast model and financial projections model, ensuring your business’s ability to generate sufficient cash flow and meet debt obligations with clarity and precision.

KPI Benchmarks

Our 5-year cash flow model for insurance brokerages evaluates key financial indicators, providing benchmark comparisons to highlight average and relative values. This insurance broker financial projections model is essential for effective financial planning, particularly for startups, enabling strategic management through data-driven insights. By controlling and recording these critical KPIs, brokers can optimize operational costs and revenue forecasts, ensuring informed decision-making and sustained growth. Harness the power of our financial model template for insurance brokers to enhance your business valuation and drive profitable outcomes confidently.

P&L Statement Excel

A Profit and Loss Statement Template Excel is essential for insurance brokers to analyze core income streams and expenses effectively. This insurance brokerage profit and loss model reveals the company’s financial performance, highlighting profitability and operational efficiency. By leveraging this financial model template for insurance brokers, firms can confidently project earnings, optimize expense budgeting, and inform strategic decisions. It’s a cornerstone tool within an insurance brokerage financial planning model, empowering brokers to forecast revenue, assess risks, and drive sustainable growth with precision and clarity.

Pro Forma Balance Sheet Template Excel

The insurance broker financial projections model integrates key elements like assets, liabilities, and capital to provide a clear financial position. Accurate assumptions, grounded in historical data, are vital for reliable forecasts in your insurance brokerage revenue forecast model. Linking projected income statements with balance sheet assumptions—such as working capital and capital expenditures—ensures cohesive insights. This alignment enhances your insurance brokerage profit and loss model and cash flow model for insurance brokerages, driving strategic decisions and robust business valuation through comprehensive financial scenario analysis.

INSURANCE BROKER FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

The pre-seed valuation worksheet integrates key financial metrics such as the Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF). WACC reflects the insurance broker’s capital cost by balancing equity and debt, serving as a vital risk assessment model for lenders. Meanwhile, the DCF calculation projects the present value of future cash flows, essential for informed investment decisions. Leveraging this insurance brokerage financial performance model enables accurate business valuation and strategic financial planning for sustainable growth.

Cap Table

A cap table startup is an essential tool providing comprehensive insights into investments, shareholders, and financial resource limits. It supports detailed financial planning models for insurance brokers, enabling accurate revenue forecast models, commission calculation, and expense budgeting. With its capabilities, insurance brokerages can perform precise business valuation, profit and loss modeling, and cash flow management, driving informed decision-making and sustainable growth. Harnessing such a robust financial model template empowers brokers to optimize operational costs, assess risks, and forecast sales, ensuring effective capital requirement management and long-term financial performance.

INSURANCE BROKER P&L TEMPLATE EXCEL ADVANTAGES

Create a flexible 5-year insurance broker financial model for accurate forecasting, budgeting, and strategic growth planning.

The insurance broker financial projections model streamlines assumptions input, enhancing accuracy and decision-making efficiency.

Optimize startup expenses with our precise insurance broker financial model, ensuring accurate budgeting and confident investment decisions.

Streamline your pitch with a financial summary tailored for your insurance broker financial model, enhancing clarity and confidence.

Reduce risks and optimize growth with a comprehensive insurance broker financial projections model.

INSURANCE BROKER FINANCIAL MODEL TEMPLATE ADVANTAGES

Get a robust, fully expandable insurance broker financial model for accurate revenue forecasting and strategic growth planning.

This powerful insurance broker financial model enables precise forecasting, tailored analysis, and strategic growth planning for your business.

Optimize growth and profitability with the insurance brokerage financial scenario analysis for informed decision-making.

A clear, well-structured insurance broker financial model ensures efficient hypothesis testing and strategic decision-making.

Optimize growth and profitability with our comprehensive insurance brokerage revenue forecast model for accurate financial decisions.

Implementing an insurance broker cash flow model ensures sustainable growth by forecasting financial impact and minimizing risk effectively.

Accelerate funding with our insurance broker financial model, delivering precise projections and strategic growth insights.

Impress investors with a strategic insurance broker financial model that drives confident decisions and maximizes growth potential.

Run different scenarios effortlessly with our insurance broker financial projections model for accurate, strategic decision-making.

The cash flow model empowers insurance brokers to forecast impacts and optimize financial decisions through dynamic scenario analysis.