Invoice Financing Platforms Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Invoice Financing Platforms Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Invoice Financing Platforms Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

INVOICE FINANCING PLATFORMS FINANCIAL MODEL FOR STARTUP INFO

Highlights

Develop a comprehensive 5-year invoice financing financial model tailored for platforms, incorporating detailed financial projections for invoice financing, including forecasted income statements, financial statements, and key financial ratios prepared under GAAP or IFRS standards. This SaaS invoice financing model allows entrepreneurs to perform in-depth financial analysis of invoice factoring and accounts receivable financing models, while optimizing cash flow forecasting and working capital finance strategies. Utilize this invoice financing startup model and invoice financing underwriting model to refine your invoice financing revenue model and cost structure, ensuring robust financial viability and enhanced profitability. Perfect for securing funding from banks or investors, this unlocked Excel financial projection tool streamlines the evaluation of invoice discounting financial plans and fintech invoice financing models, accelerating your path to successful invoice financing business model execution.

The ready-made invoice financing financial model in Excel addresses critical pain points by providing a comprehensive accounts receivable financing model that streamlines cash flow forecasting for invoice financing and enhances working capital management, reducing the complexity traditionally associated with trade finance financial models. This template integrates sophisticated invoice factoring business model components with an intuitive invoice discounting financial plan, allowing users to generate accurate financial projections for invoice financing startups or established platforms effortlessly. It incorporates a robust invoice financing underwriting model and a fintech invoice financing model framework, ensuring thorough financial analysis for invoice factoring and debt financing model for invoices, which improves decision-making and risk assessment. Additionally, the model’s invoice financing profitability model and invoice financing cost structure are designed to deliver deep insights into the invoice financing revenue model, supporting investor-ready financial reporting and SaaS invoice financing model adaptability, ultimately mitigating time-intensive manual calculations and enhancing strategic financial planning.

Description

The invoice financing startup model integrates a comprehensive financial projections framework incorporating a proforma income statement, projected balance sheet, and cash flow forecasting invoice financing to provide a detailed analysis of working capital finance models. This adaptable Excel-based model enables dynamic scenario planning through its invoice financing underwriting model, blending elements of the invoice factoring business model and invoice discounting financial plan to assess profitability, liquidity, and overall financial performance ratios critical for investment decisions. Leveraging fintech invoice financing and SaaS invoice financing models, it offers insights into the invoice financing cost structure and revenue model while consolidating discounted cash flow valuations and financial analysis invoice factoring to evaluate risk, optimize capital allocation, and support strategic planning within trade finance financial models or debt financing models for invoices.

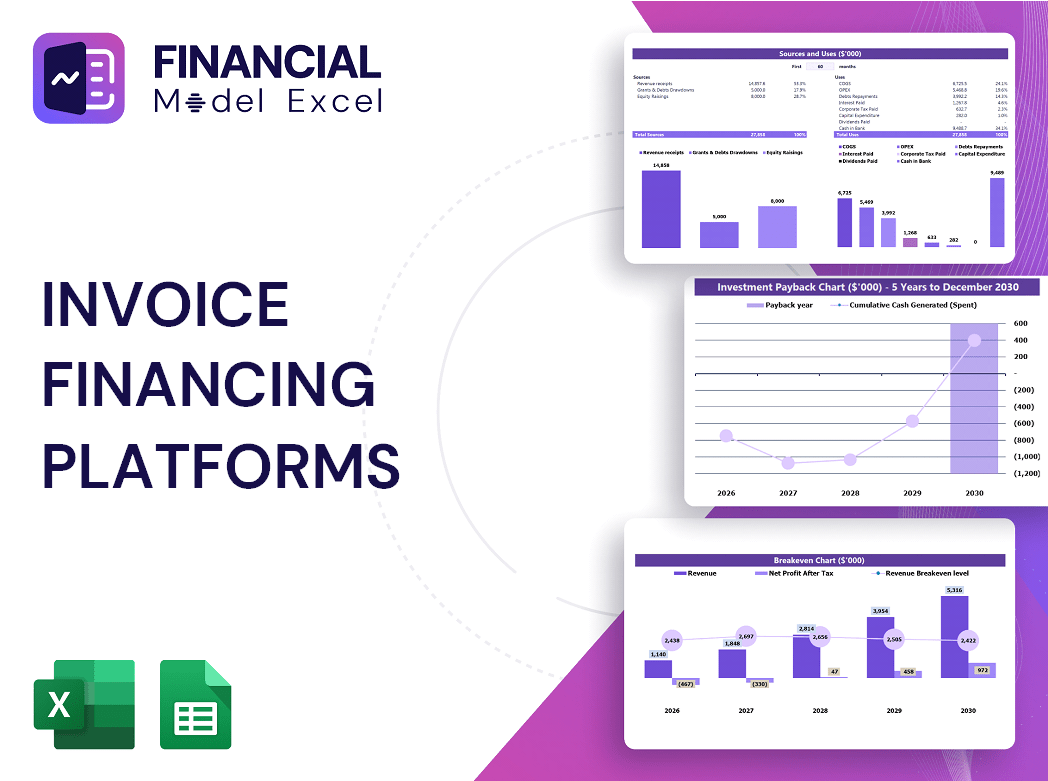

INVOICE FINANCING PLATFORMS FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Every business, whether small or large, requires a robust invoice financing financial model to drive strategic decisions. An effective model integrates cash flow forecasting, projected income statements, and balance sheets into a comprehensive financial projection for invoice financing. This holistic approach captures the invoice financing cost structure, revenue streams, and profitability insights throughout the fiscal year. Leveraging a detailed invoice financing startup model or a fintech invoice financing model ensures accurate financial analysis and supports sustainable growth. A well-crafted invoice financing underwriting model is essential for optimizing working capital finance and maximizing investment potential.

Dashboard

This invoice financing financial model features a dynamic dashboard presenting key metrics crucial to your business. Gain instant insights into your revenue breakdown by year, detailed cash flow forecasting, and profitability projections tailored for factoring and accounts receivable financing models. Designed to support invoice financing startups and SaaS invoice financing models, this comprehensive financial analysis tool enhances your working capital finance strategy, ensuring accurate financial projections and streamlined decision-making. Leverage this dashboard to monitor cumulative cash flows and optimize your invoice financing revenue model effectively.

Business Financial Statements

In an invoice financing financial model, three core reports interconnect to ensure accuracy and insight. The Income Statement captures revenues, expenses, depreciation, taxes, and interest related to invoice factoring business operations. The Balance Sheet offers a snapshot of assets, liabilities, and equity, balancing at all times. Meanwhile, the Cash Flow Statement details cash inflows and outflows across operating, investing, and financing activities, critical for cash flow forecasting in invoice financing. Together, these statements drive robust financial projections for invoice financing startups, supporting effective working capital finance management and profitability analysis within the fintech invoice financing model.

Sources And Uses Statement

The sources and uses of funds schedule is essential for transparent financial analysis in invoice financing models. It precisely tracks the origin of raised capital and details its allocation across expenditures, ensuring accurate cash flow forecasting and enhancing the invoice financing profitability model. This clarity supports robust financial projections for invoice financing startups, strengthens underwriting models, and optimizes the working capital finance model, ultimately driving informed investment decisions within fintech invoice financing business models.

Break Even Point In Sales Dollars

This 5-year financial projection template specializes in invoice financing profitability models, featuring a break-even graph to pinpoint when revenue surpasses total costs. Essential for fintech invoice financing models or working capital finance models, it enables management to forecast cash flow and optimize sales strategies. By analyzing the interplay between fixed and variable costs, users gain clarity on the critical sales volume and pricing needed to cover expenses. Ideal for startups and SaaS invoice financing models, this tool enhances financial analysis and supports strategic decision-making to drive sustainable profitability and growth.

Top Revenue

Unlock clear, detailed insights with our invoice financing financial model Excel template. The Top Revenue tab presents an annual breakdown of revenue streams by each offering, providing transparent financial projections for invoice financing. Users benefit from in-depth revenue depth and revenue bridge analyses, enabling precise cash flow forecasting and profitability assessment. Ideal for invoicing startups, factoring businesses, and fintech models, this comprehensive tool supports robust financial analysis and strategic planning within the invoice financing market. Elevate your working capital finance model with clarity and accuracy today.

Business Top Expenses Spreadsheet

Our invoice financing startup model features a comprehensive expenses template, categorizing major costs into four key areas for precise tracking. An adaptable 'other' category allows customization to fit your unique business needs. Whether incorporating historical data or projecting future financials, this flexible financial plan template supports up to five years of cash flow forecasting and financial projections for invoice financing. Designed to enhance financial analysis and optimize your invoice financing profitability model, it’s an essential tool for effective working capital management and strategic decision-making.

INVOICE FINANCING PLATFORMS FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our invoice financing startup model includes robust financial projections with a comprehensive cost structure and detailed expense planning. It supports diverse accounting treatments—COGS, variable, fixed expenses, wages, and CAPEX—while enabling cash flow forecasting for up to 60 months. Expense forecasting leverages flexible curves based on revenue percentages, growth rates, and recurring costs, tailored to optimize working capital finance models. This sophisticated approach enhances financial analysis for invoice factoring and strengthens profitability models, ensuring accurate budgeting aligned with the dynamics of the invoice financing market.

CAPEX Spending

An effective invoice financing financial model hinges on strategic capital expenditure planning. Incorporating CAPEX into your pro forma template—using methods like straight-line or double depreciation—enhances accuracy in cash flow forecasting and strengthens financial projections for invoice financing. This approach improves control over capital outlays within the accounts receivable financing model, supporting robust working capital finance management and maximizing profitability in your invoice factoring business model.

Loan Financing Calculator

Our invoice financing financial model includes a comprehensive loan amortization schedule designed to optimize your working capital finance strategy. Featuring pre-built formulas, this template clearly details each installment’s breakdown of principal and interest repayments, adaptable for monthly, quarterly, or annual periods. Ideal for fintech invoice financing models and invoice factoring business models, it provides accurate financial projections for invoice financing, supporting cash flow forecasting and profitability analysis. Streamline your invoice financing underwriting model and enhance your invoice financing cost structure with this essential tool for startups and established businesses alike.

INVOICE FINANCING PLATFORMS FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Net Present Value (NPV) is a crucial metric in invoice financing financial models, reflecting the present worth of your business’s projected cash flows. This bottom-up financial analysis discounts future cash inflows, answering key questions like, “What is today’s value of $1 received years from now?” In invoice factoring or accounts receivable financing models, NPV aggregates all discounted cash flows over multiple periods, providing a clear picture of your invoice financing profitability model. Incorporating NPV into your invoice financing startup model or fintech invoice financing plans ensures accurate financial projections and informed investment decisions.

Cash Flow Forecast Excel

An effective invoice financing financial model integrates detailed cash flow forecasting to optimize working capital management. By leveraging a comprehensive accounts receivable financing model, businesses can enhance financial projections for invoice financing, ensuring accurate revenue and profitability analysis. Whether developing a fintech invoice financing model or refining an invoice factoring business model, precise financial analysis and underwriting models are essential for strategic decision-making. This approach empowers startups and established firms to design robust invoice financing cost structures, driving sustainable growth and investment success in dynamic trade finance markets.

KPI Benchmarks

A robust invoice financing financial model starts with detailed financial projections and benchmark analysis to evaluate key performance indicators. By comparing industry averages and conducting thorough financial analysis, startups can optimize their invoice factoring business model and improve cash flow forecasting. This approach enhances the invoice financing revenue model and cost structure, ensuring a clear path to profitability. Understanding these metrics from the outset empowers fintech and SaaS invoice financing startups to build a scalable, efficient working capital finance model that supports sustainable growth and investment readiness.

P&L Statement Excel

In any invoice financing startup model, the income statement is vital—it reveals profitability and highlights levers for future gains. It presents historical and projected revenues and expenses within the invoice financing financial model. However, relying solely on this statement provides an incomplete view. Key elements like assets, liabilities, and cash flow forecasting invoice financing are essential to understanding complete financial health. Integrating the income statement with balance sheets and cash flow analyses offers a comprehensive trade finance financial model, enabling precise financial projections for invoice financing and informed decision-making.

Pro Forma Balance Sheet Template Excel

A projected balance sheet is essential in any invoice financing startup model, providing a clear snapshot of current and long-term assets, liabilities, and shareholders’ equity. This financial cornerstone supports accurate cash flow forecasting and informs key financial projections for invoice financing. Integrating this data enhances your invoice financing profitability model and debt financing strategies, enabling precise financial analysis and robust working capital finance planning. Use this essential tool to optimize your invoice factoring business model and drive informed decision-making for sustainable growth.

INVOICE FINANCING PLATFORMS FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

With minimal inputs on Cost of Capital, this sophisticated invoice financing financial model enables users to perform a detailed Discounted Cash Flow valuation seamlessly. Ideal for startups and established firms alike, it integrates cash flow forecasting, invoice financing profitability analysis, and financial projections for invoice financing. Whether assessing an invoice factoring business model or optimizing a fintech invoice financing model, this tool delivers precise financial insights to drive strategic decisions and secure sustainable working capital finance.

Cap Table

A robust invoice financing financial model is essential for startups to map out cash flow forecasting and working capital requirements. Integrated with a comprehensive cap table, it clearly outlines ownership stakes, investor pricing, and dilution impacts. Utilizing a factoring financial model or SaaS invoice financing model enhances financial projections for invoice financing, driving strategic decision-making. This financial analysis supports optimal invoice financing cost structure and profitability models, ensuring sustainable growth. For any fintech invoice financing startup model, combining invoice discounting financial plans with detailed trade finance financial models delivers a clear path to scalable revenue and investment success.

INVOICE FINANCING PLATFORMS FINANCIAL MODEL BUSINESS PLAN ADVANTAGES

The invoice financing financial model drives accurate cash flow forecasting, boosting profitability and strategic funding decisions.

The invoice financing financial model optimizes cash flow forecasting, enhancing profitability and investment decision accuracy.

Optimize startup expenses and operational cash flow with our comprehensive invoice financing platforms financial model.

The invoice financing financial model ensures optimal cash flow, empowering startups to pay suppliers and employees promptly.

Invoice financing financial model enhances accurate forecasting, boosting competitive advantage and strategic decision-making.

INVOICE FINANCING PLATFORMS FINANCIAL MODEL IN EXCEL ADVANTAGES

The invoice financing profitability model enhances stakeholder trust by delivering clear, data-driven financial projections and risk assessments.

A robust invoice financing financial model builds investor trust by clearly projecting future cash flow and profitability.

The invoice financing financial model streamlines cash flow forecasting, saving time and reducing costs effectively.

The invoice financing financial model simplifies 5-year projections, enabling effortless, accurate planning without technical hassles or costly consultants.

Our invoice financing profitability model optimizes cash flow, accelerating growth while minimizing financial risk for your business.

The invoice financing financial model enables precise input adjustments, enhancing forecast accuracy from launch through ongoing operations.

Optimize cash flow and attract investors with a robust, data-driven invoice financing profitability model.

The invoice financing financial model ensures compelling projections that attract investors and secure valuable funding meetings effortlessly.

Our invoice financing financial model delivers precise cash flow forecasting and boosts working capital efficiency for your startup.

Our invoice financing financial model streamlines accurate reports, fully aligned with lender requirements for effortless projections.