Invoice Management Systems Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Invoice Management Systems Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Invoice Management Systems Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

INVOICE MANAGEMENT SYSTEMS FINANCIAL MODEL FOR STARTUP INFO

Highlights

This five-year invoice processing software financial model business plan offers a comprehensive and automated billing system financial model designed for startups and entrepreneurs aiming to impress investors and secure funding. Featuring detailed financial charts, summaries, and metrics, along with funding forecasts, it integrates key aspects such as accounts payable management, purchase order automation, and digital invoice approval system financial models. The cloud-based invoicing solution financial model and expense tracking software financial model components enable precise cash flow forecasting and ERP invoice management integration, making it an essential tool to estimate startup costs and streamline vendor invoice tracking while ensuring tax compliance and efficient subscription billing management. Fully customizable and unlocked for edits, this pro forma financial statements template in Excel empowers you to optimize invoice workflow automation and payment reconciliation software financial models in one seamless platform.

This ready-made financial model excels at addressing critical pain points in invoice and billing management by offering comprehensive solutions such as automated billing system financial model and purchase order automation financial model, significantly reducing manual errors and time delays. Its cloud-based invoicing solution financial model and digital invoice approval system financial model streamline workflow automation and approval processes, enhancing efficiency and transparency across accounts payable management financial model and vendor invoice tracking software financial model. By integrating cash flow forecasting invoice management financial model and ERP invoice management integration financial model, this tool empowers small businesses to maintain accurate expense tracking and optimize subscription billing management financial model, while ensuring tax compliance invoice system financial model and multicurrency invoicing software financial model mitigate regulatory risks and complexities in global transactions.

Description

This comprehensive invoice processing software financial model offers streamlined automation for billing, accounts payable management, and purchase order automation, enabling precise cash flow forecasting and expense tracking. Designed with cloud-based invoicing solutions in mind, it integrates subscription billing management and payment reconciliation features, ensuring seamless digital invoice approval and invoice workflow automation. Ideal for small business invoicing software needs, this model supports multicurrency invoicing, tax compliance, and ERP invoice management integration, providing detailed pro forma profit and loss forecasts, NPV analysis, and key performance indicators to optimize financial planning and maximize ROI.

INVOICE MANAGEMENT SYSTEMS FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our modular financial model seamlessly integrates with cloud-based invoicing solutions and accounts payable management financial models, empowering startups to drive accurate cash flow forecasting and invoice workflow automation. Featuring fully editable templates—including expense tracking software and subscription billing management models—this tool adapts to diverse business needs. With open, unlocked Excel formulas, customize your purchase order automation and tax compliance invoice system effortlessly. Elevate your financial projections while streamlining vendor invoice tracking and payment reconciliation, ensuring scalable growth and operational efficiency tailored to your unique startup vision.

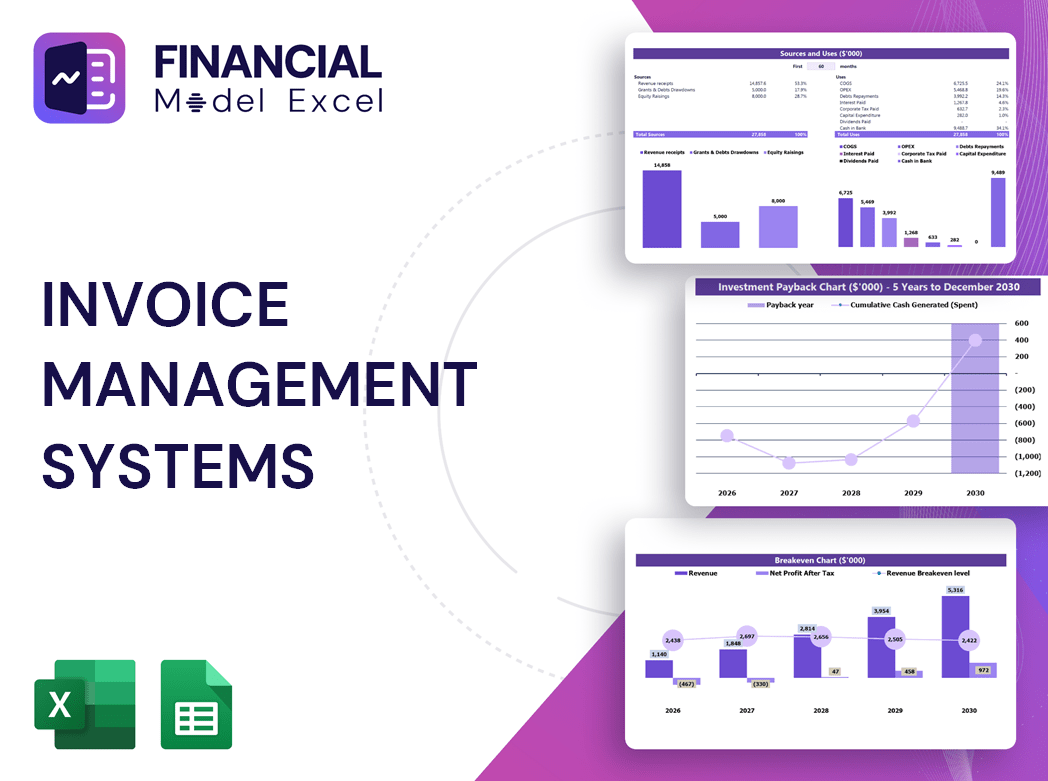

Dashboard

Our invoice processing software financial model features a dynamic dashboard that consolidates data from all key financial statements within a 3-year projection. Customize KPIs effortlessly as the dashboard automatically pulls and calculates vital metrics for your specified periods—monthly or yearly. Designed for seamless integration with accounts payable management and purchase order automation financial models, this cloud-based invoicing solution empowers you with real-time insights, enhancing cash flow forecasting and subscription billing management. Adapt your dashboard anytime to maintain precision and drive smarter, data-driven decisions tailored to your business growth strategies.

Business Financial Statements

When designing your invoice processing software financial model, prioritize clarity and completeness. Ensure all critical components are included within your three-statement financial model template—income statement, balance sheet, and cash flow forecast. An intuitive, well-structured financial model is essential, especially for stakeholders reviewing automated billing system or accounts payable management financial models. Clarity in templates like cloud-based invoicing solution or purchase order automation financial models enhances understanding and decision-making. Deliver a professional, easy-to-navigate financial plan that supports your startup’s success in subscription billing management or vendor invoice tracking software markets.

Sources And Uses Statement

This startup costs template features a comprehensive sources and uses Excel statement, detailing all financial inputs alongside their specific allocations. Designed to integrate seamlessly with invoice processing software financial models and automated billing system financial models, it provides clarity and precision in tracking expenses. Perfect for enhancing accounts payable management financial models or supporting cloud-based invoicing solution financial models, this tool empowers startups to optimize cash flow forecasting and ensure accurate budget planning from day one.

Break Even Point In Sales Dollars

This comprehensive financial model integrates invoice processing software and automated billing system features, providing a robust break-even sales analysis for up to five years. It delivers precise calculations of the break-even point in units sold, supported by clear numeric data and intuitive charts. Ideal for businesses leveraging cloud-based invoicing solutions or accounts payable management financial models, this tool enhances cash flow forecasting and optimizes invoice workflow automation for sustainable growth.

Top Revenue

This invoice processing software financial model offers a comprehensive analysis of your company’s revenue streams. It enables detailed tracking by product or service category, empowering businesses with precise insights. Seamlessly integrated with purchase order automation and accounts payable management financial models, it streamlines invoice workflow automation and cash flow forecasting. Ideal for small business invoicing software financial models, this solution enhances subscription billing management and vendor invoice tracking. Optimize your financial performance with a cloud-based invoicing solution financial model designed for accuracy and efficiency.

Business Top Expenses Spreadsheet

The Profit and Loss Projection outlines the company’s key annual expenses, categorized for clarity. This comprehensive financial model integrates accounts payable management and expense tracking software financial models to accurately reflect fixed and variable costs. It includes employee salary payments and customer acquisition expenses, supported by invoice workflow automation and purchase order automation financial models. Leveraging cloud-based invoicing solutions and payment reconciliation software ensures precise cash flow forecasting and effective vendor invoice tracking, providing a robust foundation for strategic financial planning and operational efficiency.

INVOICE MANAGEMENT SYSTEMS FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

A financial model business plan, featuring advanced invoice processing software financial model and automated billing system financial model, delivers precise expense projections. These insights enable you to identify and address critical weak points, enhancing accounts payable management and purchase order automation financial model effectiveness. Utilizing cloud-based invoicing solution financial model and subscription billing management financial model, you can streamline cash flow forecasting invoice management financial model for smooth operations. This robust forecast not only strengthens your business plan but also builds investor confidence for securing funding or loans. Embrace digital invoice approval system financial model to drive financial clarity and growth.

CAPEX Spending

Financial experts leverage advanced invoice processing software financial models to accurately monitor CAPEX spending related to property, plant, and equipment (PPE). These models incorporate additions, disposals, and depreciation, including assets acquired through financial leasing. Integrating ERP invoice management systems and automated billing system financial models ensures precise tracking and forecasting of capital investments. This comprehensive approach streamlines asset management and supports strategic decision-making by delivering real-time insights into fixed asset expenditures and their financial impact.

Loan Financing Calculator

Our financial model features an advanced invoice processing software financial model that streamlines loan amortization schedules with precision. Integrated within our 5-year forecast, this system employs built-in formulas to track loan details, terms, and repayment dates—whether monthly, quarterly, or annual. Designed for seamless accounts payable management, it ensures accuracy and efficiency, enhancing cash flow forecasting and overall financial planning. Ideal for businesses seeking automated billing system financial model capabilities combined with loan management, this solution delivers reliability and clarity in every repayment cycle.

INVOICE MANAGEMENT SYSTEMS FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The net profit margin in a financial model, such as an automated billing system or cloud-based invoicing solution financial model, measures a company’s efficiency in converting revenue into profit. This key metric reveals how each dollar earned drives profitability, essential for forecasting cash flow and managing sustainable growth. Integrating net profit margin insights within invoice processing software or accounts payable management financial models empowers businesses to optimize expense tracking, streamline invoice workflow automation, and enhance overall financial health—crucial for long-term success and strategic decision-making.

Cash Flow Forecast Excel

Effective cash flow forecasting is vital for any startup’s success. Leveraging a comprehensive cash flow forecasting invoice management financial model enables precise tracking of payments and receipts, helping businesses optimize capital turnover and revenue. Integrating cloud-based invoicing solutions with automated billing system financial models streamlines invoice processing and expense tracking, enhancing financial visibility. Whether you’re a small business or a large enterprise, implementing these advanced financial models ensures seamless accounts payable management and strengthens overall financial planning for sustainable growth.

KPI Benchmarks

The benchmarking tab in our financial model offers vital insights by comparing your invoice processing software’s performance against industry standards. It highlights key financial metrics and benchmarks, enabling precise analysis of your automated billing system’s effectiveness. This feature identifies top-performing competitors and pinpoints areas for improvement in accounts payable management and invoice workflow automation. By leveraging these benchmarks, you can optimize your purchase order automation and cloud-based invoicing solutions, ensuring your financial strategies remain competitive and growth-focused.

P&L Statement Excel

The projected income statement for your new business is a vital component of your invoice processing software financial model. It enables you to track financial performance while forecasting income and expenses over the coming years. By leveraging monthly reports from your cloud-based invoicing solution financial model, you gain the insights needed for accurate cash flow forecasting and strategic growth planning. This proactive approach empowers you to optimize accounts payable management and enhance revenue through informed decision-making and streamlined invoice workflow automation.

Pro Forma Balance Sheet Template Excel

Our financial model integrates invoice processing software and automated billing system capabilities, enabling precise cash flow forecasting and accounts payable management. This cloud-based invoicing solution streamlines purchase order automation and expense tracking, offering seamless ERP invoice management integration. With robust invoice workflow automation and digital invoice approval system features, users gain real-time visibility into vendor invoice tracking and payment reconciliation. Designed for small business invoicing software needs, our model ensures tax compliance and supports multicurrency invoicing, empowering you to generate accurate pro forma balance sheets reflecting your company’s financial position at a specific point in time.

INVOICE MANAGEMENT SYSTEMS FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Empower your investor presentations with our comprehensive financial model tailored for invoice processing software. Showcase key metrics like weighted average cost of capital (WACC) to highlight minimal return expectations. Deliver transparent insights into free cash flow available to all investors, including shareholders and creditors. Utilize discounted cash flow analysis to accurately project the present value of future cash flows. This robust financial model integrates seamlessly with automated billing systems, expense tracking software, and cloud-based invoicing solutions—providing stakeholders a clear, professional view of your startup’s financial potential.

Cap Table

In financial modeling, an equity cap table provides a comprehensive overview of a company’s securities distribution among investors. It details the percentage of shares held by each participant, including common and preferred shares, alongside their respective prices. This essential tool complements advanced financial models such as invoice processing software financial model or ERP invoice management integration financial model, enabling precise ownership tracking and informed decision-making for stakeholders.

INVOICE MANAGEMENT SYSTEMS PRO FORMA TEMPLATE ADVANTAGES

Optimize cash flow and accuracy with a cloud-based invoicing solution financial model for smarter business decisions.

Optimize startup costs and boost efficiency with a comprehensive invoice management systems financial model spreadsheet.

Boost accuracy and efficiency by forecasting all three financial statements using our invoice management systems financial model.

Optimize startup loan repayments efficiently with the invoice management systems financial model, ensuring precise cash flow forecasting.

Boost investor confidence and streamline funding with a comprehensive invoice management systems financial model startup plan.

INVOICE MANAGEMENT SYSTEMS FINANCIAL PROJECTION TEMPLATE EXCEL ADVANTAGES

Optimize cash flow with our ERP invoice management integration financial model—great value for money and efficiency.

Leverage our proven invoice processing software financial model for affordable, transparent, and efficient startup financial planning.

Optimize cash flow forecasting invoice management financial model by running different scenarios for strategic decision-making.

The cash flow forecasting invoice management financial model enables dynamic scenario analysis to optimize your business’s financial health.

The automated billing system financial model saves you time by streamlining invoice processing and enhancing cash flow forecasting.

Our cloud-based invoicing solution financial model streamlines cash flow forecasting, freeing time to grow your business effectively.

Optimize cash flow and accuracy with our automated billing system financial model—because we do the math for you.

Streamline finances effortlessly with our all-in-one financial model—no formulas, coding, or costly consultants required.

Optimize cash flow confidently with our cloud-based invoicing solution financial model, ensuring seamless and accurate billing.

Our financial model empowers precise cash flow forecasting, risk prevention, and strategic planning for sustained business growth.