Micro Funding For Local Projects Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Micro Funding For Local Projects Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Micro Funding For Local Projects Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

MICRO FUNDING FOR LOCAL PROJECTS FINANCIAL MODEL FOR STARTUP INFO

Highlights

The micro funding for local projects financial model provides a comprehensive financial framework designed to assist startups and established companies in raising capital efficiently from investors or bankers. It enables detailed financial forecasting for micro funding projects, including cash flow analysis models and cost estimation models tailored for community micro funding initiatives. This financial model supports the development of budgets, fund allocation strategies, and revenue models to enhance financial viability and sustainability of local projects. Additionally, the model incorporates risk assessment tools and performance metrics essential for micro funding project financial sustainability, making it a valuable resource to improve business plans and strategic financial planning before launching or expanding micro financing endeavors.

This ready-made financial model for micro funding local projects addresses common pain points by providing a comprehensive and user-friendly financial framework tailored for community micro funding and micro grant initiatives. It streamlines complex tasks such as financial forecasting, cash flow analysis, and cost estimation, enabling users to efficiently plan fund allocation and assess financial viability with built-in financial modeling tools. By integrating risk assessment features and offering clear financial projections along with a micro funding investment and revenue model, this Excel template simplifies financial performance tracking and sustainability planning, reducing the need for advanced financial expertise and saving valuable time in budgeting and managing local project micro financing strategies.

Description

The micro funding for local projects financial model provides a comprehensive 5-year cash flow projection template designed to support financial planning and budgeting for community micro funding initiatives, enabling clear visibility into revenue streams and cost estimations. This financial model for micro project funding integrates essential features such as financial forecasting, cash flow analysis, and fund allocation models that facilitate informed decision-making regarding profit and loss projections, investment requirements, and operational costs. Developed with advanced financial modeling tools, it includes three core financial statements and key performance indicators like financial ratios, investment and debt service coverage ratios, and cash burn analysis, ensuring a robust financial viability model for micro funded projects. Additionally, the framework incorporates risk assessment metrics and capital structure modeling that support strategic financial sustainability and performance evaluation, catering to the unique challenges of micro grant funding and local project micro financing strategies through adaptable capital and revenue models to attract investor equity or business loans effectively.

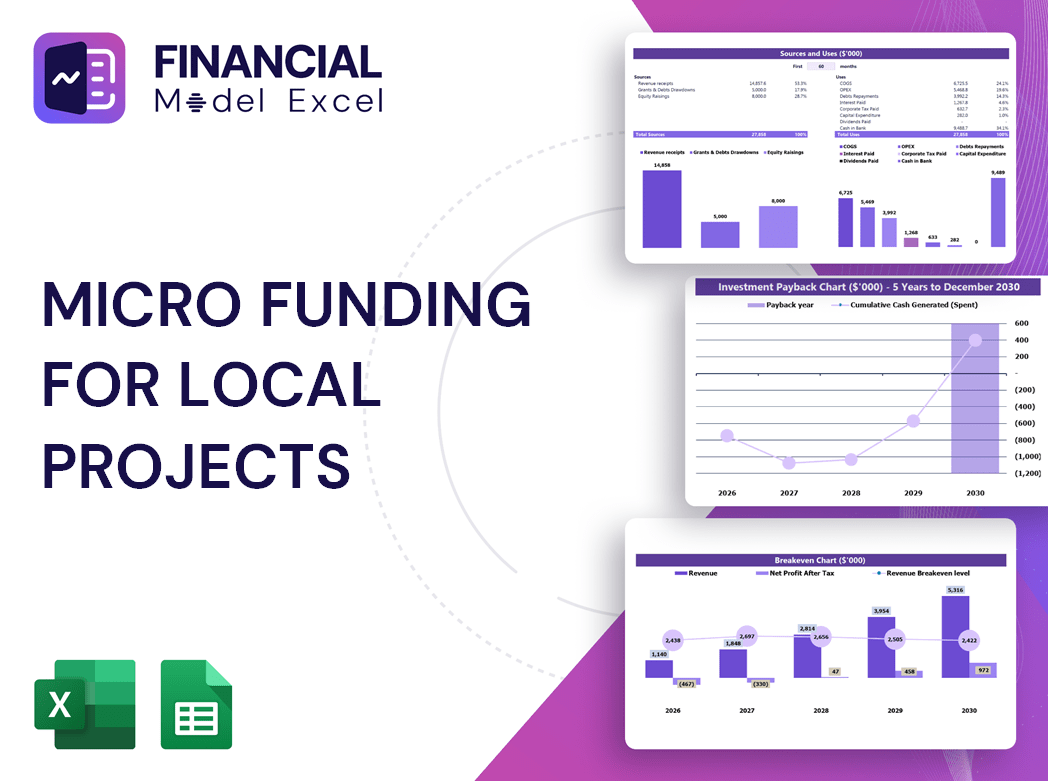

MICRO FUNDING FOR LOCAL PROJECTS FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

The micro funding for local projects financial model offers business managers and owners a comprehensive financial framework, integrating detailed assumptions on expenses, revenues, and cash flow. This financial modeling tool enables accurate budgeting, risk assessment, and forecasting for micro funding initiatives, ensuring informed decision-making and sustainable growth. By leveraging this financial performance model for micro funded projects, local initiatives can optimize fund allocation, enhance financial viability, and drive long-term community impact with clarity and confidence.

Dashboard

Full transparency with stakeholders enhances trust and drives business success. Sharing your financial model for micro project funding, including detailed cash flow analysis and budgeting for local initiatives, empowers stakeholders to provide valuable insights. This collaborative approach not only improves financial projections for community micro funding but also strengthens your financial viability model and risk assessment strategies. Leveraging financial modeling tools for micro funding projects fosters a deeper understanding of your micro funding capital structure model, ultimately optimizing fund allocation and ensuring sustainable growth for local projects.

Business Financial Statements

Our 5-year micro funding cash flow analysis model integrates seamlessly with comprehensive financial projections, including a projected balance sheet, P&L forecast, and cash flow pro forma—all crafted in Excel. This financial summary, developed using advanced financial modeling tools for micro funding projects, streamlines your pitch deck preparation. Designed to support local project micro financing strategies, it enhances financial planning and risk assessment while ensuring robust financial viability and sustainability of community micro funding initiatives. Trust our expertly formatted financial framework to elevate your fund allocation model and optimize financial performance metrics for your micro grant funding projects.

Sources And Uses Statement

Effective micro funding for local projects relies on a robust financial model development, including financial forecasting and cash flow analysis. Utilizing a micro funding budgeting and cost estimation model ensures precise fund allocation and risk assessment, enhancing project sustainability. By adopting comprehensive financial planning and performance models, communities gain clarity on revenue streams and investment structures, enabling informed decisions that drive growth and avoid deficits. Implementing these financial modeling tools empowers startups and local initiatives to optimize resources, secure micro grant funding, and strengthen their financial viability for long-term success.

Break Even Point In Sales Dollars

The 5-year breakeven tab within this financial model for micro project funding provides clear insights into when your local initiative is projected to achieve profitability. This essential financial forecasting tool illustrates the point at which your community micro funding revenues surpass expenses, ensuring informed decisions for sustainable growth. Incorporating this breakeven analysis enhances the micro funding budgeting for local projects by identifying key milestones in financial viability and supporting effective fund allocation strategies.

Top Revenue

The Top Revenue tab in the financial model for micro project funding streamlines your revenue insights by offering a clear, annual summary of each offering’s income. This tool supports financial forecasting for micro funding projects by highlighting revenue depth and bridges, enabling precise fund allocation models. Ideal for community micro funding financial planning, it enhances visibility into your micro funding revenue model for local projects, facilitating informed decision-making and ensuring financial viability. Utilize this strategic feature to optimize your micro grant funding financial framework and drive sustainable growth in your local initiatives.

Business Top Expenses Spreadsheet

In micro funding for local projects, developing a robust financial model is crucial. The “top line” represents total funds raised, indicating growth in community micro funding efforts. A well-structured financial forecasting and cash flow analysis model ensures accurate fund allocation and budgeting for local initiatives. Meanwhile, the “bottom line” reflects net financial viability, showcasing profitability after expenses. Utilizing financial modeling tools and risk assessment in micro funding enhances project sustainability and investment potential, empowering communities with effective micro grant funding frameworks and strategic local project micro financing.

MICRO FUNDING FOR LOCAL PROJECTS FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Start-up costs are pivotal in the early phases of any venture, directly impacting its financial viability. Effective micro funding budgeting for local initiatives requires precise financial forecasting and cost estimation models to ensure sufficient capital allocation. Our financial modeling tools for micro funding projects include comprehensive proforma templates, empowering you to monitor expenses, streamline fund allocation, and develop robust financial projections. This strategic approach helps safeguard against unforeseen costs, enhancing the sustainability and success of community micro funded projects through sound financial planning and risk assessment.

CAPEX Spending

Capital expenditures play a crucial role in developing a robust financial model for micro funding local projects. Financial specialists utilize detailed cost estimation models and cash flow analysis to define startup budgets and monitor investments. Accurate assessment of initial expenses ensures the financial viability and sustainability of micro funded initiatives. Incorporating these figures into pro forma cash flow statements supports sound financial planning and effective fund allocation. A disciplined approach to budgeting and financial forecasting is essential for optimizing resource use and driving successful community micro funding projects.

Loan Financing Calculator

Our financial model for micro project funding includes a comprehensive loan amortization schedule, designed to streamline tracking of loans, interest, and equity. Accessible via the 'Capital' tab, this tool features pre-built formulas for accurate internal calculations, enhancing financial forecasting for community micro funding. Ideal for micro funding budgeting and financial planning, it supports effective fund allocation and cash flow analysis, ensuring financial sustainability and performance in local initiatives. Leverage this financial modeling tool to optimize your micro funding investment strategies and project viability with precision and confidence.

MICRO FUNDING FOR LOCAL PROJECTS FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The financial model template for micro funding local projects offers a detailed proforma chart with monthly revenue projections for five default products. This adaptable framework supports financial forecasting and budgeting for local initiatives, allowing users to easily add products or adjust the analysis period. Designed to enhance financial viability and performance, it integrates core aspects of micro funding cash flow analysis and cost estimation, ensuring a robust financial planning and investment model tailored to community micro funding projects.

Cash Flow Forecast Excel

Stakeholders, including banks, often require a comprehensive financial model for micro project funding to evaluate your company’s ability to repay loans. Utilizing advanced financial modeling tools for micro funding projects—such as a cash flow analysis model or a micro funding budgeting framework—demonstrates strong financial planning and viability. A well-structured cash flow statement in Excel showcases your company’s proven capacity to manage cash efficiently, ensuring financial sustainability and confidence in loan repayment. This strategic approach enhances credibility and supports successful fund allocation for local micro funded initiatives.

KPI Benchmarks

The pro forma template benchmark tab is essential for evaluating financial viability in micro funding projects. By comparing key financial metrics across similar local initiatives, it offers invaluable insights into performance and potential. Startups leveraging this financial model for micro project funding gain clarity on strengths, weaknesses, and growth opportunities. Incorporating benchmarking into your community micro funding financial planning ensures informed decision-making, enhancing financial sustainability and risk assessment. Don’t overlook this critical tool in your micro funding budgeting and forecasting process—it’s key to driving successful, financially sound local project micro financing strategies.

P&L Statement Excel

Financial forecasting is vital for community micro funding financial planning. A comprehensive financial model for micro project funding not only reveals net income but highlights strong gross profit margins, providing clear financial projections for community micro funding. Utilizing financial modeling tools for micro funding projects enhances your ability to assess financial viability and develop cost estimation models. This strategic approach empowers local initiatives with a robust fund allocation model and strengthens confidence in project sustainability and profitability, ultimately elevating your organization’s financial performance and standing within the community.

Pro Forma Balance Sheet Template Excel

A robust financial model for micro project funding integrates a pro forma balance sheet and projected profit and loss to assess local initiative viability. The balance sheet reveals assets, liabilities, and the capital structure model, highlighting equity versus borrowed funds. Meanwhile, the profit and loss projection captures operational income and expenses over time, essential for micro funding budgeting and financial forecasting. Together, these financial modeling tools enable risk assessment, cash flow analysis, and performance metrics, ensuring sustainable fund allocation and long-term financial sustainability in community micro funding projects.

MICRO FUNDING FOR LOCAL PROJECTS FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

The financial projections spreadsheet integrates key metrics such as Return on Investment, Investor’s Future Equity Share, and Cash Burn Rate Analysis. This comprehensive financial model enhances the financial viability assessment for micro-funded projects, enabling precise financial forecasting and effective fund allocation. By leveraging these financial modeling tools for micro funding projects, stakeholders can confidently evaluate project sustainability and attract potential investors with clear insights into performance and risk. This strategic approach streamlines community micro funding financial planning and strengthens local project micro financing strategies.

Cap Table

The cap table is a crucial element in any start-up or company, providing a clear financial model for micro project funding by detailing share distribution and ownership percentages. It serves as a vital tool in financial planning and fund allocation models for micro funding initiatives, offering transparency on investor expenses and equity stakes. Incorporating a well-structured pro forma cap table enhances financial forecasting for micro funding projects, ensuring accurate financial projections and supporting the financial viability model for community micro funded projects. This foundation aids in strategic decision-making and sustainable growth within local project micro financing strategies.

MICRO FUNDING FOR LOCAL PROJECTS 5 YEAR FINANCIAL PROJECTION TEMPLATE EXCEL ADVANTAGES

Boost local project success with a financial model streamlining micro funding strategies for precise budgeting and forecasting.

Optimize startup expenses with a financial model that ensures sustainable micro funding for local projects.

Make informed hiring decisions using a financial model that ensures sustainable micro funding for local projects.

Our financial model streamlines assumptions input, enhancing accuracy and efficiency in micro funding project planning.

Enhanced decision-making with micro funding financial models ensures precise forecasting and sustainable local project success.

MICRO FUNDING FOR LOCAL PROJECTS STARTUP FINANCIAL PROJECTION TEMPLATE ADVANTAGES

Our financial model ensures reliable forecasting and risk assessment, maximizing returns for investors in local micro funding projects.

Our financial model ensures precise cash flow analysis and sustainability for successful micro funding of local community projects.

Our financial model ensures precise forecasting, maximizes fund allocation, and guarantees sustainable success for micro funding projects.

Boost investor confidence and accelerate funding with our precise, comprehensive financial model for micro funding local projects.

Leverage our financial model for micro funding to ensure optimal budgeting, forecasting, and sustainable local project success.

Impress investors with a proven financial model ensuring sustainable micro funding and strategic growth for local projects.

Optimize cash flow and ensure project sustainability with advanced financial modeling tools for micro funding initiatives.

A micro funding cash flow analysis model highlights late payments, enhancing financial planning and cash flow accuracy for local projects.

Save time and money with a financial model optimizing micro funding cash flow and project sustainability for local initiatives.

Our micro funding financial model simplifies planning, eliminating complex formulas and costly consultants for efficient local project growth.