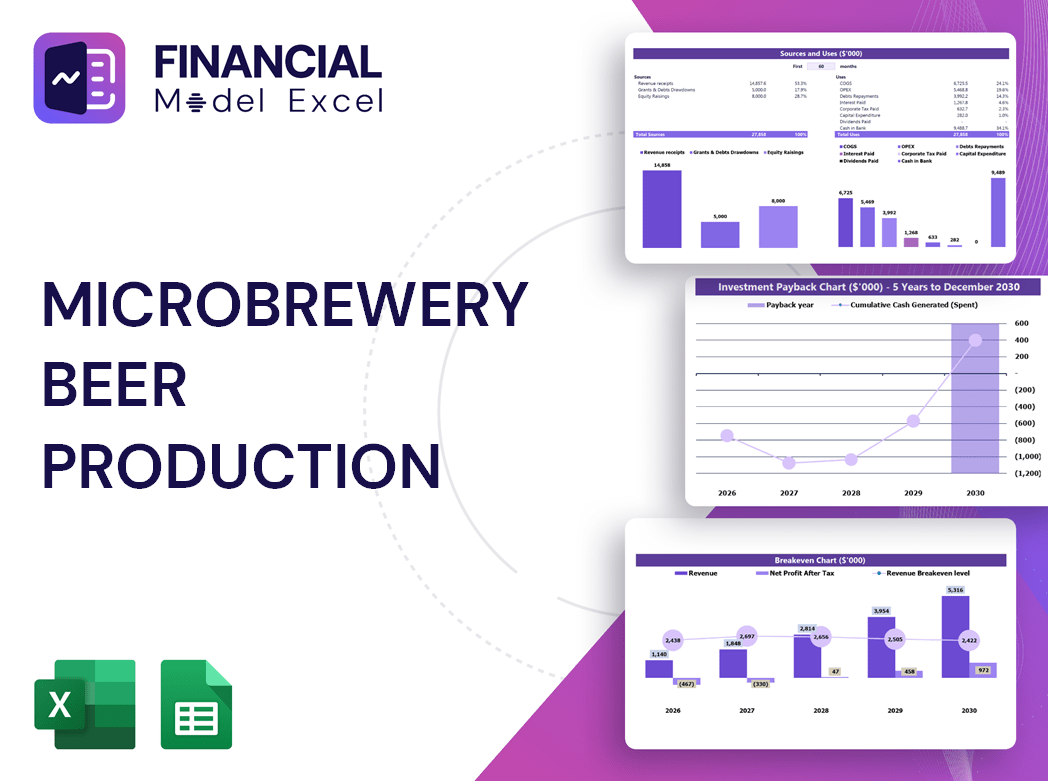

Microbrewery Beer Production Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Microbrewery Beer Production Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Microbrewery Beer Production Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

MICROBREWERY BEER PRODUCTION FINANCIAL MODEL FOR STARTUP INFO

Highlights

The microbrewery financial planning model is a comprehensive 5-year craft brewery revenue forecast and microbrewery startup financial plan designed for businesses in the beer production niche. This versatile template suits both new microbrewery startups and established operations, providing detailed beer production cost analysis, brewery cash flow projection, and craft beer profit margin modeling. Use this microbrewery budgeting template alongside the brewery capital expenditure forecast and craft brewery income statement template to secure funding from banks, angel investors, grants, and VC firms. Fully unlocked and customizable, it enables you to perform brewery investment return analysis, microbrewery break-even analysis, and optimize your craft beer pricing strategy calculator for maximum profitability.

This microbrewery financial planning model Excel template effectively addresses common pain points by providing a comprehensive craft brewery revenue forecast alongside a detailed beer production cost analysis, enabling users to accurately anticipate expenses and maximize craft beer profit margins. With built-in microbrewery budgeting templates and brewery cash flow projection tools, it simplifies the complexities of managing operational budgets and funding requirements, while the craft beer pricing strategy calculator ensures competitive yet profitable pricing. Additionally, the model includes brewery capital expenditure forecasts, beer production expense breakdowns, and a microbrewery break-even analysis to support informed decision-making and investment return analysis. Its intuitive microbrewery sales forecasting model, combined with craft brewery income statement templates and production capacity planning features, eliminates guesswork and enhances financial performance metrics, making it an indispensable asset for any microbrewery startup financial plan.

Description

The microbrewery financial planning model offers a comprehensive framework for startups and established breweries, integrating a craft brewery revenue forecast alongside a detailed beer production cost analysis to ensure accurate budgeting and strategic decision-making. Featuring a microbrewery budgeting template and brewery cash flow projection tools, this model facilitates precise tracking of operational expenses and capital expenditure forecasts, while incorporating a craft beer profit margin model and microbrewery break-even analysis for profitability assessment. Additionally, the inclusion of a craft brewery income statement template and brewery production capacity planning enables effective sales forecasting and financial performance metrics evaluation, supported by a brewery funding requirement model and craft beer pricing strategy calculator to optimize investment return analysis and working capital forecasts.

MICROBREWERY BEER PRODUCTION FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

This comprehensive microbrewery financial planning model offers a detailed beer production cost analysis and brewery cash flow projection, empowering entrepreneurs to visualize their craft brewery revenue forecast and operational budget. Designed as a startup financial plan, it integrates microbrewery sales forecasting models and break-even analysis to optimize cash utilization and profitability. By leveraging key financial performance metrics and a craft beer profit margin model, this template guides informed decision-making, ensuring sustainable growth and strategic capital expenditure forecasting for long-term success in the competitive craft beer industry.

Dashboard

Our microbrewery financial planning model features a dynamic dashboard that delivers precise analysis using intuitive charts and graphs. Designed for in-depth evaluation of craft brewery income statement templates and beer production cost analysis, it enables accurate brewery cash flow projections and craft brewery revenue forecasts. This robust tool empowers stakeholders with critical financial insights, supporting effective brewery capital expenditure forecasts and microbrewery operational budget modeling. Optimize your craft beer profit margin model and streamline brewery investment return analysis with this comprehensive financial dashboard built for strategic growth.

Business Financial Statements

A comprehensive microbrewery financial planning model includes three key statements: the craft brewery income statement template details revenue, expenses, depreciation, and taxes; the balance sheet outlines assets, liabilities, and shareholders’ equity ensuring financial balance; while the brewery cash flow projection tracks cash inflows and outflows to assess profitability. Together, these tools support brewery capital expenditure forecasting, microbrewery budgeting templates, and nuanced beer production cost analysis—essential for accurate craft brewery revenue forecasts and optimized microbrewery financial performance metrics.

Sources And Uses Statement

The Sources and Uses of Funds Statement is essential in any microbrewery financial planning model. Vital for bank loan applications and investor meetings, it clearly details funding sources and expense allocation. Both start-ups and established craft breweries rely on this statement to manage brewery funding requirements and control beer production expense breakdowns. Lenders value it for summarizing financial plans and brewery cash flow projections, showcasing a company’s strategy for startup capital or future expansion. Incorporating this into your microbrewery startup financial plan ensures robust financial management and builds investor confidence.

Break Even Point In Sales Dollars

Understanding your microbrewery break-even analysis is crucial for assessing business viability and guiding stakeholders. Using a microbrewery financial planning model, you can pinpoint the minimum sales needed to cover all expenses, providing clarity on your craft brewery revenue forecast. This precise insight enables optimization of costs, improving your craft beer profit margin model. Additionally, the break-even point aids in forecasting when investments will be recouped, essential for managing expectations. Leveraging detailed financial data through a microbrewery startup financial plan ensures informed decisions, driving sustainable growth and profitability.

Top Revenue

This microbrewery financial planning model features a dedicated tab for in-depth analysis of revenue streams. Users can leverage this craft brewery income statement template to evaluate income sources by individual product or service, enabling precise beer production cost analysis and accurate brewery cash flow projection. Ideal for microbrewery startup financial plans, this tool supports detailed craft beer profit margin models and microbrewery sales forecasting to optimize budgeting and enhance financial performance metrics.

Business Top Expenses Spreadsheet

Effective microbrewery financial planning hinges on vigilant cost management to sustain profitability. Our microbrewery financial planning model features a Top Expense Report that consolidates the four largest cost categories alongside ‘other’ expenses. This streamlined beer production expense breakdown empowers craft brewery owners to monitor and optimize their highest costs effortlessly. By leveraging this brewery cash flow projection tool, users can identify spending trends and make informed decisions to enhance their microbrewery’s financial performance metrics and long-term viability.

MICROBREWERY BEER PRODUCTION FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our microbrewery financial planning model features a comprehensive cost budget with detailed expense breakdowns and flexible accounting treatments. It supports up to 60 months of brewery cash flow projection and integrates pre-defined expense forecasting curves, enabling precise tracking of costs as a percentage of revenues, variable growth rates, and recurring expenses. Users can allocate expenses to categories like COGS, fixed or variable costs, wages, and CAPEX, ensuring accurate beer production cost analysis and streamlined brewery capital expenditure forecasting for effective microbrewery budgeting and operational planning.

CAPEX Spending

CAPEX start-up expenses represent significant investments in assets essential for a microbrewery’s growth. These capital expenditures, each with defined timelines, are critical components of the microbrewery startup financial plan and must be accurately reflected in the pro forma balance sheet. Primarily aimed at enhancing technology and equipment, CAPEX drives operational efficiency and production capacity planning. These costs also influence the brewery capital expenditure forecast and should be incorporated within the brewery cash flow projection and profit and loss templates to provide a comprehensive view of the brewery’s financial health and investment return analysis.

Loan Financing Calculator

Our comprehensive microbrewery financial planning model includes a robust loan amortization schedule designed to manage all loan types effectively. It meticulously tracks key details such as principal amount, interest type and rate, loan duration, and repayment timelines. Integrating seamlessly with your craft brewery revenue forecast and brewery cash flow projection, this tool empowers you to optimize your brewery funding requirement model and enhance your brewery investment return analysis with precision and confidence.

MICROBREWERY BEER PRODUCTION FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Earnings Before Interest and Taxes (EBIT), also known as operational income or operating profit, is a key metric in a microbrewery financial planning model. It represents the difference between craft brewery revenue forecasts and operational expenses, excluding interest and taxes. This figure highlights a brewery’s true profitability and efficiency in managing beer production cost analysis, operational budgets, and capital expenditure forecasts. Monitoring EBIT within your microbrewery startup financial plan provides essential insight into financial performance metrics, ensuring effective brewery cash flow projections and optimizing craft beer profit margins for sustainable growth.

Cash Flow Forecast Excel

A comprehensive microbrewery financial planning model is essential for startups aiming to succeed. Utilizing tools like brewery cash flow projections and craft brewery revenue forecasts allows for accurate budgeting and funding requirement analysis. Proper beer production cost analysis combined with a microbrewery budgeting template ensures precise expense breakdowns, aiding in profitability. Incorporating brewery capital expenditure forecasts and microbrewery sales forecasting models strengthens your craft brewery income statement template, providing clear insight into operational costs and profit margins. Effective financial planning empowers breweries to optimize decision-making, secure loans, and attract investment, laying a solid foundation for sustainable growth and success.

KPI Benchmarks

A benchmarking study, integrated within a microbrewery financial planning model, helps startups evaluate key performance metrics—such as craft brewery profit margins, beer production cost analysis, and brewery cash flow projections—against industry peers. By comparing financial indicators like cost per unit and productivity margins, startups can identify gaps and adopt best practices. This strategic tool enhances microbrewery budgeting templates and sales forecasting models, ensuring informed decision-making. Leveraging benchmarking empowers craft breweries to optimize operational budgets, improve financial performance metrics, and strengthen brewery investment return analysis for sustainable growth.

P&L Statement Excel

A craft brewery income statement template projects your revenues and expenses, providing a clear view of your net income or bottom line. Utilizing a microbrewery financial planning model alongside beer production cost analysis helps refine your craft brewery revenue forecast and optimize profit margins. Incorporating brewery cash flow projections and budgeting templates ensures efficient capital management, while microbrewery break-even analysis and operational budget models guide sustainable growth. This comprehensive financial approach empowers precise brewery investment return analysis and informs strategic decisions for long-term success in the competitive craft beer market.

Pro Forma Balance Sheet Template Excel

Your microbrewery financial planning model captures key assets like building and equipment within the projected balance sheet, providing a clear snapshot of your startup’s financial position. It details liabilities and equity at a specific date, essential for accurate brewery cash flow projection and operational budget modeling. Importantly, loan security is a critical component of your pro forma balance sheet template, serving as a crucial metric for banks during loan applications. Leveraging this comprehensive craft brewery financial plan ensures confident decision-making and strengthens your brewery investment return analysis.

MICROBREWERY BEER PRODUCTION FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This comprehensive 5-year microbrewery financial planning model includes a robust valuation analysis template designed for precise discounted cash flow (DCF) valuation. Beyond DCF, it enables detailed brewery investment return analysis by calculating key financial metrics such as residual value, replacement costs, market comparables, and recent transaction comparables. Ideal for craft brewery revenue forecasting and brewery capital expenditure forecasting, this model empowers craft brewery owners with actionable insights to optimize profitability and strategic growth.

Cap Table

Our comprehensive microbrewery financial planning model seamlessly integrates the cap table with cash flow projections, aligning funding rounds to financial instruments like equity and convertible notes. This integration provides clear visibility into how capital raises affect share ownership and dilution, empowering informed decision-making. By incorporating brewery investment return analysis and brewery funding requirement models, it ensures precise tracking of financial performance metrics to support sustainable growth and optimize craft brewery revenue forecasts.

MICROBREWERY BEER PRODUCTION PRO FORMA TEMPLATE ADVANTAGES

Accelerate success by establishing clear milestones with our microbrewery beer production financial model template.

The microbrewery financial planning model proves your loan repayment ability, enhancing investor confidence and securing funding.

The microbrewery financial planning model proactively identifies cash shortfalls, ensuring smooth operations and informed decision-making.

Develop targeted sales strategies using a microbrewery financial model for precise beer production and revenue forecasting.

Effortlessly manage startup loan repayments with our microbrewery financial planning model for precise beer production projections.

MICROBREWERY BEER PRODUCTION PROFORMA BUSINESS PLAN TEMPLATE ADVANTAGES

Optimize profits and growth with our comprehensive microbrewery financial planning model—your roadmap to sustainable success.

Our microbrewery cash flow projection model reveals funding impacts, guiding strategic growth beyond organic options effectively.

Unlock precise revenue forecasts and maximize profits with our Great Value microbrewery financial planning model.

Optimize profits with our proven microbrewery financial planning model—affordable, comprehensive, and free from hidden fees.

Run different scenarios with our microbrewery financial planning model to optimize profitability and secure smart investments.

The brewery cash flow projection empowers dynamic scenario planning, optimizing financial decisions for sustained business growth.

Save time and money with our microbrewery financial planning model that streamlines budgeting and boosts profitability.

The microbrewery financial planning model streamlines budgeting and forecasting without complex formulas or costly consultants.

Streamline decision-making with our all-in-one microbrewery financial planning model for accurate cash flow and profit forecasting.

Comprehensive microbrewery financial planning model ensures accurate forecasts, insightful KPIs, and clear performance summaries for confident decisions.