Middle Eastern Shawarma Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Middle Eastern Shawarma Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Middle Eastern Shawarma Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

MIDDLE EASTERN SHAWARMA FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive middle eastern shawarma business plan financial model offers a detailed five-year cash flow projection tailored for early-stage startups aiming to impress investors and secure funding from banks, angels, grants, and VC funds. It includes an in-depth shawarma restaurant revenue projection financial model, shawarma pricing strategy financial model, and shawarma operational cost financial model to ensure accurate shawarma sales and expense financial modeling. Additionally, it provides valuable insights through shawarma break-even analysis financial model and shawarma investment return financial model, empowering entrepreneurs to optimize profitability and growth strategies while managing staffing and supply chain costs effectively.

The ready-made middle eastern shawarma business plan financial model in Excel addresses key pain points by offering a comprehensive shawarma restaurant revenue projection and expense tracking system that simplifies complex budgeting processes, allowing users to easily forecast sales and operational costs. Its integrated shawarma pricing strategy and menu costing financial model help optimize profit margins while the break-even analysis and cash flow projection features provide clear insights into profitability and liquidity challenges. The template also includes detailed shawarma staffing cost and supply chain financial models, enabling effective cost control and scalability for multi-location growth strategies. With embedded shawarma franchise cost analysis and catering financial forecasting modules, users gain confidence in investment returns and strategic planning, eliminating common hurdles in financial management for shawarma startups and fast-food stands.

Description

This comprehensive middle eastern shawarma business plan financial model offers a robust 5-year shawarma restaurant revenue projection financial model, incorporating detailed shawarma sales and expense financial models to enable precise operational cost financial model assessments and profitability forecasting. Designed for startups and existing businesses alike, it features a full set of three financial statements—including pro forma profit and loss statements, cash flow projection financial models, and balance sheets—on both monthly and annual bases, alongside shawarma break-even analysis financial models and shawarma pricing strategy financial models to optimize menu costing and maintain competitive advantage. Additionally, this flexible excel template supports shawarma franchise cost analysis financial models and shawarma multi-location financial models, with built-in feasibility matrices, diagnostic tools, and financing options analysis for shawarma investment return financial models, accommodating equity funding and comprehensive shawarma supply chain financial models. The user-friendly bottom-up approach eliminates the need for advanced financial expertise, empowering entrepreneurs to execute precise shawarma startup financial budgeting models and shawarma growth strategy financial models that enhance staffing cost financial models and shawarma catering financial forecasting models, ensuring informed decision-making and sustainable expansion in the middle eastern fast food market.

MIDDLE EASTERN SHAWARMA FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Looking to evaluate your Middle Eastern shawarma business potential or secure funding? Our comprehensive Shawarma Financial Model Excel template offers a streamlined, customizable solution for accurate 5-year revenue projections, pricing strategies, operational costs, and capital requirements. Tailor inputs to generate detailed forecasts covering sales, expenses, break-even analysis, and investment returns. Whether launching a shawarma restaurant, catering service, or multi-location franchise, this financial modeling tool empowers you to confidently plan and grow your business with clarity and precision.

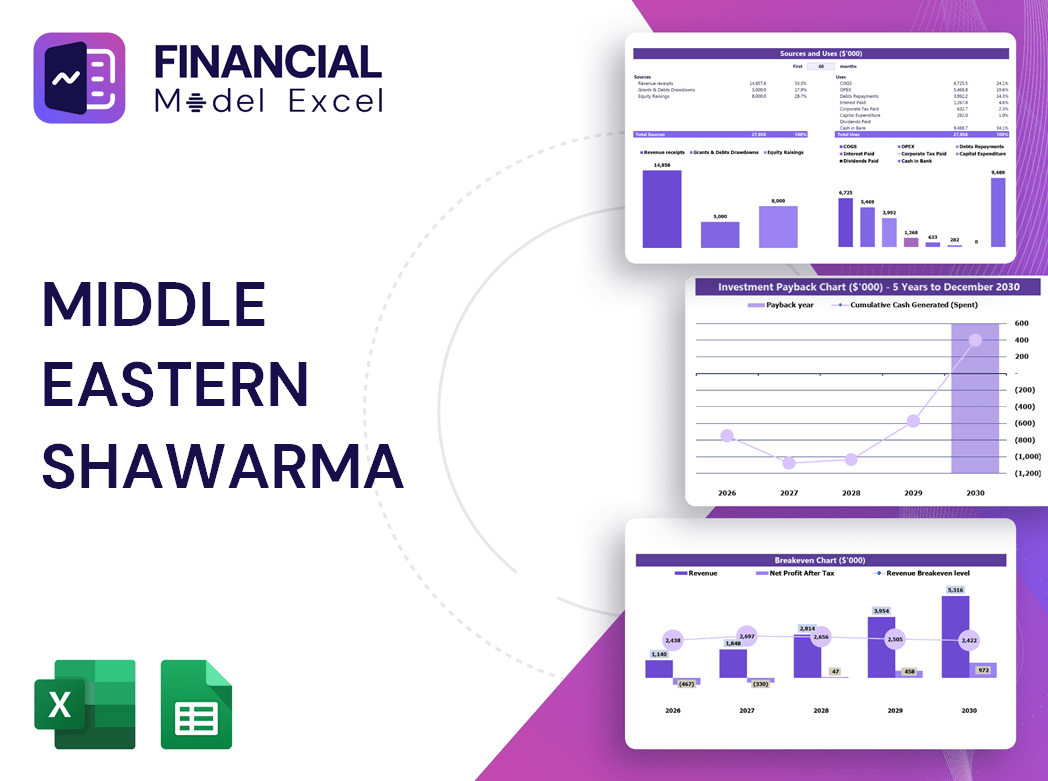

Dashboard

Our Shawarma Business Plan Financial Model features an intuitive dashboard that consolidates all key metrics for your middle eastern shawarma venture. Easily monitor revenue projections, operational costs, cash flow forecasts, and profitability indicators in one place. This dynamic tool streamlines financial modeling, empowering you to analyze expenses, optimize pricing strategies, and forecast growth confidently. With comprehensive insights at your fingertips, achieve financial clarity and drive your shawarma restaurant or franchise toward sustained success.

Business Financial Statements

All three financial statements are essential for a comprehensive analysis of your shawarma business’s performance. The profit and loss forecast within a shawarma restaurant revenue projection financial model reveals core operational earnings, while the projected balance sheet and cash flow projection financial models emphasize effective capital management, asset allocation, and liquidity. Integrating these tools empowers informed decisions, enhances profitability, and drives sustainable growth in your middle eastern shawarma business plan.

Sources And Uses Statement

Our shawarma startup financial budgeting model offers a clear sources and uses chart to map capital flows, guiding effective funding allocation for your Middle Eastern food business. Tailored for flexibility, it adapts to unique operational needs—whether for shawarma restaurant revenue projection, pricing strategy, or franchise cost analysis. The model highlights funding timelines and investment return expectations, ensuring balanced capital management. An essential tool for break-even analysis, cash flow projection, and profitability assessment, it empowers informed decisions without complexity, driving your shawarma business toward sustainable growth and success.

Break Even Point In Sales Dollars

A shawarma break-even analysis financial model is essential to pinpoint when your Middle Eastern shawarma business will cover all expenses and start generating profit. By accurately identifying fixed costs—like rent and administrative salaries—and variable costs—including inventory, shipping, and production—you gain clarity on your operational cost financial model. Understanding this balance empowers informed decisions on pricing strategy, staffing costs, and financial budgeting, ensuring a profitable and sustainable shawarma restaurant or franchise.

Top Revenue

This 5-year shawarma business plan financial model features a dedicated tab for in-depth revenue stream analysis. It meticulously breaks down income by product and service, enabling precise shawarma restaurant revenue projection and strategic decision-making. Ideal for shawarma franchise cost analysis, pricing strategy optimization, and forecasting profitability, this model empowers effective financial budgeting and cash flow projection for sustainable business growth.

Business Top Expenses Spreadsheet

Effective cost management is critical for shawarma businesses to maximize profitability. Our comprehensive 3-way financial model includes a detailed expense report, highlighting the top four cost categories and grouping all others as "other" for easy tracking. This feature empowers users to monitor and analyze expense trends annually, supporting strategic decisions in shawarma operational cost management and pricing strategy. Whether launching a shawarma startup or scaling a multi-location franchise, vigilant expense oversight ensures sustainable growth and improved return on investment. Prioritizing financial budgeting and cost optimization is essential for long-term success in the competitive Middle Eastern fast food market.

MIDDLE EASTERN SHAWARMA FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our Middle Eastern shawarma financial model offers a comprehensive startup budgeting and cost analysis tool, enabling precise forecasting of revenues, expenses, and cash flow. It highlights critical operational costs and staffing expenses while assessing profitability and break-even points. Designed for shawarma restaurants, food stands, or catering services, this financial model supports informed decision-making on pricing strategy, supply chain, and growth planning. Present clear, investor-ready financial insights that streamline resource allocation and ensure sustainable business success.

CAPEX Spending

Accurate revenue forecasting is crucial in any shawarma business plan financial model, driving sustainable growth and enterprise value. Whether developing a shawarma restaurant revenue projection or a shawarma franchise cost analysis model, precise assumptions on sales growth and expenses shape reliable financial outcomes. Management and analysts must focus on detailed, data-driven strategies within the shawarma startup financial budgeting model to ensure profitability and effective cash flow projection. Leveraging comprehensive proforma templates enables sound financial planning, supporting informed decisions on pricing, operational costs, and expansion through multi-location or catering financial forecasting models.

Loan Financing Calculator

Our Middle Eastern shawarma business plan financial model features an integrated loan amortization schedule with embedded formulas, enabling precise tracking of principal versus interest payments. This dynamic tool effortlessly calculates repayment amounts, including frequency and total duration, empowering you to manage your shawarma startup financial budgeting and cash flow projection with confidence. Optimize your shawarma restaurant revenue projection and streamline your financial planning for sustained profitability and growth.

MIDDLE EASTERN SHAWARMA FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) serves as a critical metric in shawarma business plan financial models, offering clear insight into operational profitability. Whether assessing a shawarma shop profitability financial model or conducting a break-even analysis, EBITDA highlights core earnings by excluding non-operational costs. Incorporating EBITDA into shawarma restaurant revenue projection financial models and cash flow projections empowers investors and managers with a transparent view of true business performance and growth potential within the competitive Middle Eastern fast food market.

Cash Flow Forecast Excel

Lenders and investors often require a comprehensive 5-year shawarma startup financial budgeting model to evaluate your business’s ability to manage cash flow and meet loan obligations. Utilizing a detailed shawarma cash flow projection financial model demonstrates your middle eastern shawarma business plan’s strength in sustaining operational costs and generating consistent revenue. This financial transparency builds trust by showcasing your shawarma restaurant revenue projection financial model’s capacity to effectively handle expenses and deliver timely debt repayment, ensuring confidence in your venture’s long-term profitability and growth potential.

KPI Benchmarks

Benchmarking in a shawarma business plan financial model allows owners to compare key financial indicators—like profit margins, operational costs, and productivity—against industry standards. Utilizing a shawarma restaurant revenue projection financial model with benchmarking highlights where your business ranks and identifies areas for sharpening your pricing strategy and cost control. This strategic tool is vital for startups, enabling competitive advantage by pinpointing strengths and growth opportunities within the middle eastern fast food market. Integrating benchmarking into your shawarma startup financial budgeting model drives smarter decisions and sustainable profitability.

P&L Statement Excel

This Shawarma Financial Model template is designed for both beginners and experts, streamlining your middle eastern shawarma business plan. It automates income, expense, and cash flow projections, eliminating the need for manual calculations. Utilize this comprehensive tool for accurate shawarma restaurant revenue projection, pricing strategy, and operational cost analysis. Drive informed decisions on profitability, growth strategy, and investment returns with ease. Perfect for shawarma startups, franchises, and multi-location enterprises aiming to optimize financial forecasting and budgeting.

Pro Forma Balance Sheet Template Excel

Creating a comprehensive middle eastern shawarma startup financial budgeting model is vital for accurate five-year projections. Integrating the pro forma balance sheet with profit and loss, cash flow, and break-even analysis ensures cohesive financial forecasting. Though less attention-grabbing than income statements, the balance sheet underpins cash flow projection models that investors prioritize. It also enables evaluation of profitability through metrics like return on equity and investment return financial models, providing a clear picture of realistic net income and operational viability for shawarma restaurant growth strategies and multi-location planning.

MIDDLE EASTERN SHAWARMA FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our Middle Eastern shawarma business plan financial model expertly calculates Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF). WACC provides a precise breakdown of equity and debt proportions, serving as a crucial risk assessment tool for lenders. Meanwhile, DCF evaluates the present value of future cash flows, empowering shawarma investors with insightful financial forecasting. This model supports robust shawarma startup financial budgeting and investment return analysis, ensuring your shawarma restaurant’s profitability and growth strategy are data-driven and strategically sound.

Cap Table

The cap table Excel is a dynamic financial model designed to track four rounds of financing, clearly illustrating the impact of investor equity on company earnings. This tool provides comprehensive post-round data, enabling precise evaluation of ownership changes over time. Ideal for shawarma business plans seeking accurate investment return analysis, it supports informed decision-making by visualizing equity distribution and its effect on profitability and cash flow projections.

MIDDLE EASTERN SHAWARMA FINANCIAL MODEL EXCEL ADVANTAGES

Optimize your Middle Eastern shawarma business plan with a financial model that accurately forecasts costs and operational activities.

Gain precise control and maximize profits using the Middle Eastern shawarma business plan financial model Excel template.

Optimize your Middle Eastern Shawarma business growth with our 5-year financial projection and tax planning model.

The shawarma financial model proactively detects cash shortfalls, ensuring your business stays financially secure and growth-ready.

The Middle Eastern Shawarma Financial Model reveals growth opportunities through comprehensive three-statement financial insights.

MIDDLE EASTERN SHAWARMA FINANCIAL PLAN FOR BUSINESS PLAN ADVANTAGES

Optimize your shawarma business cash flow and maximize profitability with our comprehensive financial forecasting model.

Our shawarma cash flow projection financial model empowers strategic reinvestment and ensures timely surplus cash management.

Optimize your shawarma business profitability with our simple, incredibly practical financial model for precise revenue and cost forecasting.

Easily maximize your shawarma business growth with our sophisticated financial model—reliable results and expert support guaranteed.

The shawarma business plan financial model saves you time by streamlining revenue and expense projections efficiently.

The shawarma financial model streamlines cash flow forecasting, freeing you to focus on growth, products, and customer success.

The shawarma cash flow projection financial model identifies potential cash shortfalls early, ensuring proactive financial management.

The shawarma financial model acts as an early warning system, ensuring precise cash flow forecasting and budgeting success.

Our comprehensive shawarma financial model ensures precise profitability and growth insights to confidently attract savvy investors.

Our shawarma financial model integrates all data, delivering investor-ready projections that drive confident, profitable decisions.