Mortgage Broker Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Mortgage Broker Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Mortgage Broker Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

MORTGAGE BROKER FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year mortgage brokerage startup financial model in Excel is designed to impress investors and secure funding by providing detailed mortgage broker business plan financials, including a mortgage broker revenue model, cash flow model, and expense forecasting model. It features key financial charts, summaries, and a mortgage broker break-even analysis alongside a mortgage broker income statement model and balance sheet model, making it an essential mortgage broker financial forecasting tool for banks, angels, grants, and VC funds. Fully unlocked and editable, this mortgage broker financial projection model enables you to perform thorough financial analysis with built-in KPIs and commission calculation models tailored to the mortgage broker industry.

Our mortgage broker financial projection model addresses critical pain points by providing a comprehensive mortgage brokerage cash flow model combined with expense forecasting to ensure accurate budgeting and profitability analysis. This ready-made financial model for mortgage brokerage streamlines the development of a mortgage broker business plan financials, offering an intuitive mortgage broker income statement model and mortgage broker balance sheet model to track performance in real-time. It includes a mortgage broker commission calculation model and client acquisition cost model, helping users optimize revenue streams and manage operational costs effectively. The mortgage broker break-even analysis and mortgage broker financial KPI model empower users to make data-driven decisions, while built-in visualization tools transform complex financial data into actionable insights, reducing stress and uncertainty in a competitive market.

Description

This comprehensive mortgage brokerage startup financial model offers an integrated mortgage broker financial projection model, combining a mortgage broker revenue model and mortgage brokerage cash flow model to accurately forecast income, expenses, and profitability over a 60-month period. Featuring a detailed mortgage broker income statement model, mortgage broker balance sheet model, and mortgage broker loan origination financial model, it supports dynamic mortgage broker expense forecasting, commission calculation, and client acquisition cost modeling to ensure precise mortgage broker budgeting and break-even analysis. With built-in diagnostic tools, feasibility assessments, and financing scenario options, this financial model for mortgage brokerage empowers users to conduct robust mortgage broker financial analysis and valuation, track critical mortgage broker financial KPIs, and optimize operational planning without requiring advanced financial expertise.

MORTGAGE BROKER FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

This mortgage brokerage startup financial model is expertly designed for ease and flexibility. With fully integrated formulas, any input changes instantly update across all worksheets, ensuring seamless financial forecasting. All key assumptions are centralized in a single, user-friendly worksheet, allowing you to quickly adjust parameters. Simply enter your data into the highlighted cells, and the mortgage broker income statement model will automatically generate accurate profit and loss projections. This intuitive tool streamlines mortgage broker financial planning, empowering you to confidently manage revenue forecasts, expense tracking, and profitability analysis.

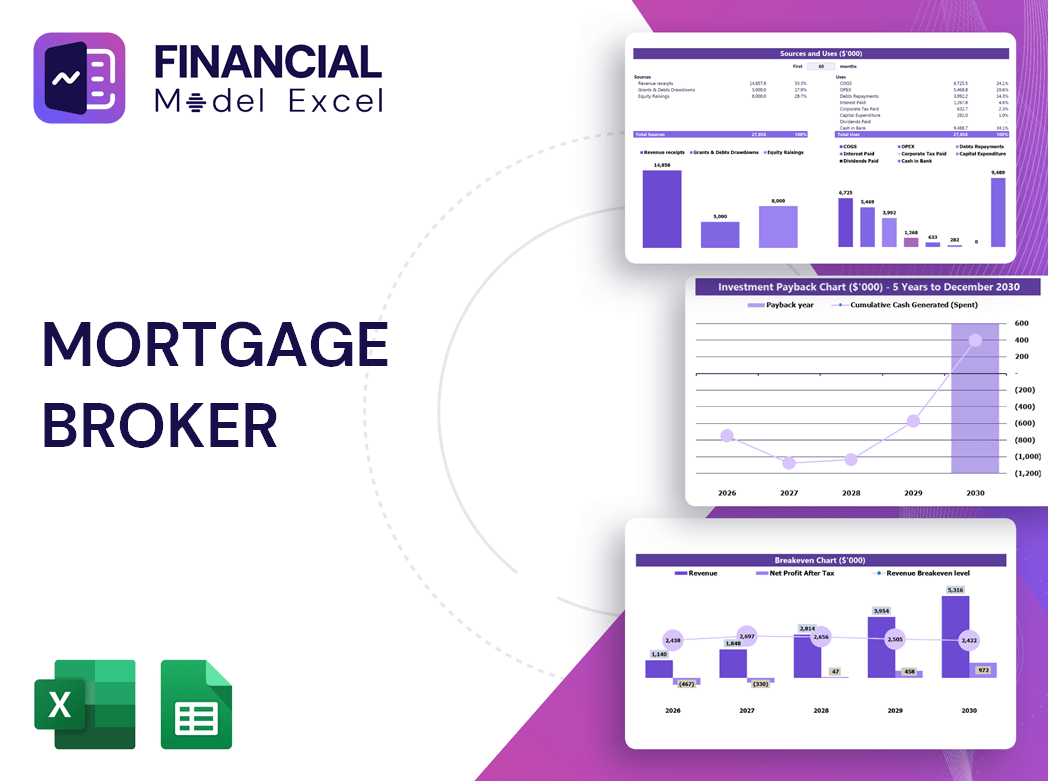

Dashboard

The All-in-One Dashboard within this mortgage broker financial projection model consolidates essential startup metrics and core financial inputs for in-depth analysis. It seamlessly integrates data from the mortgage broker balance sheet model, forecasted income statement, and mortgage brokerage cash flow model, empowering users with clear insights. Interactive graphs and charts enhance the mortgage broker financial analysis template, enabling efficient tracking of profitability, budgeting, and operational performance. This comprehensive tool simplifies financial forecasting and drives informed decision-making for mortgage brokerage success.

Business Financial Statements

This mortgage broker financial forecasting tool features a comprehensive financial summary, seamlessly integrating data from all key spreadsheets—including a pro forma balance sheet model, projected profit and loss statement, and cash flow forecasting model. Professionally formatted, this summary provides a clear snapshot of your mortgage brokerage’s financial health, making it an essential component for your business plan financials and pitch deck. Streamline your financial analysis with this ready-to-use mortgage broker financial projection model designed to enhance investor confidence and support strategic decision-making.

Sources And Uses Statement

A mortgage broker financial projection model includes a detailed Sources and Uses template that outlines how funds are acquired and allocated. The 'Sources' section highlights financing avenues such as loans, investor capital, or equity issuance, essential for mortgage brokerage startup financial models. Meanwhile, the 'Uses' section details expenditures like office setup, technology investments, and startup costs. This clear breakdown supports mortgage broker business plan financials, enabling precise cash flow management and expense forecasting, essential for profitability and operational financial modeling success.

Break Even Point In Sales Dollars

The Mortgage Broker Break-Even Analysis tool precisely calculates the annual revenue required to cover both fixed and variable costs, ensuring your business reaches profitability. This dynamic financial forecasting model can be tailored to reveal the exact number of months needed to break even, providing critical insights for effective mortgage broker financial planning. Ideal for integrating into your mortgage broker business plan financials, this calculator supports strategic decision-making by highlighting essential revenue targets and enhancing your mortgage brokerage cash flow model. Maximize profitability with accurate, actionable data designed specifically for mortgage brokerage financial analysis.

Top Revenue

This mortgage brokerage startup financial model features a dedicated tab for in-depth analysis of revenue streams. It enables users to evaluate mortgage broker revenue models across various product and service categories with precision. Designed for comprehensive financial forecasting, this tool supports strategic planning by breaking down income sources, enhancing the mortgage broker business plan financials. Ideal for optimizing profitability, it integrates seamlessly with mortgage broker income statement and cash flow models, empowering brokers to maximize growth and efficiency through detailed financial insights.

Business Top Expenses Spreadsheet

In mortgage broker financial projection models, the top line represents total revenue—critical for assessing growth in your mortgage brokerage’s income statement model. Sustainable top-line growth signals increasing client acquisition and loan origination success, positively impacting your brokerage’s cash flow and profitability models. Conversely, the bottom line reflects net income after expenses, highlighting true profitability in your mortgage broker expense forecasting and break-even analysis. Investors closely monitor these metrics within comprehensive financial models for mortgage brokerage to evaluate operational efficiency, forecast future performance, and guide strategic decisions for long-term success.

MORTGAGE BROKER FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

The mortgage broker financial projection model enables precise forecasting of revenue, expenses, and cash flow over five years. Utilizing key parameters like income percentages, payroll, fixed and variable costs, and COGS, this financial model for mortgage brokerage streamlines expense forecasting and budgeting. It categorizes costs into startup budget, wages, and operational expenses, empowering brokers with a clear mortgage brokerage cash flow model and profitability insights. This comprehensive mortgage broker business plan financials tool is essential for informed decision-making, ensuring accurate financial analysis and sustainable growth through effective financial forecasting and expense management.

CAPEX Spending

Capital expenditures (CAPEX) in a mortgage broker startup represent significant investments in assets critical to growth. Each CAPEX item is accounted for over its useful life, reflected in the mortgage broker balance sheet model and integrated into the financial projection model. These expenses enhance operational efficiency and technology, driving higher outputs. Accurately capturing CAPEX in your mortgage brokerage startup financial model ensures precise expense forecasting, impacting both the income statement model and cash flow forecasting tools. Proper CAPEX planning is essential for reliable mortgage broker financial analysis and long-term profitability.

Loan Financing Calculator

Our mortgage broker budgeting model features an integrated loan amortization schedule, accurately calculating both principal and interest payments. This financial model for mortgage brokerage streamlines your cash flow projections by incorporating loan amount, interest rate, term length, and payment frequency. Leverage this mortgage broker financial forecasting tool to optimize your mortgage brokerage business plan financials and ensure precise expense forecasting and profitability analysis.

MORTGAGE BROKER FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

EBITDA, a key metric in mortgage broker financial analysis, reflects true profitability by encompassing revenues, cost of goods sold, and essential expenses like headcount. Integrated within mortgage broker income statement models and profitability models, EBITDA provides clear insight into operational efficiency over set periods—monthly, quarterly, or annually. This metric is vital for mortgage brokerage valuation models, financial projection models, and break-even analysis, offering a comprehensive view of leveraged buyout potential and financial health. Utilizing EBITDA enhances the precision of mortgage broker business plan financials and strengthens strategic decision-making across the brokerage’s financial forecasting tools.

Cash Flow Forecast Excel

The mortgage brokerage cash flow model is a crucial element within the comprehensive financial projection model. It enables detailed analysis of operating, investing, and financing cash flows, ensuring accurate forecasting. This model drives seamless integration across the mortgage broker financial plan, linking the income statement, balance sheet, and expense forecasting models. Without precise cash flow projections, the mortgage broker balance sheet model cannot reconcile properly, impacting the overall mortgage broker startup financial model’s reliability. Leveraging this financial forecasting tool empowers brokers to optimize profitability, manage liquidity, and make informed decisions for sustainable growth.

KPI Benchmarks

Unlock powerful insights with our mortgage broker financial projection model featuring an intuitive benchmarking analysis tab. Easily compare your mortgage brokerage’s revenue, profitability, cash flow, and expense forecasting against industry peers. This peer-to-peer financial analysis highlights key performance gaps and operational strengths, helping you optimize client acquisition costs, loan origination, and commission calculations. Ideal for startups, our comprehensive mortgage broker business plan financials and forecasting tools empower you to refine strategies, boost profitability, and confidently drive growth in a competitive market.

P&L Statement Excel

A comprehensive mortgage broker financial projection model is essential for evaluating profitability and sustainability. By using a detailed mortgage broker income statement model, you can accurately forecast revenues against expenses, ensuring your business model is viable. This financial forecasting tool consolidates monthly profit and loss projections into an annual report, providing clear insights into after-tax balances and net profit. Especially crucial for startups, the mortgage broker business plan financials help you confidently assess the potential success and make informed decisions for growth and stability.

Pro Forma Balance Sheet Template Excel

The mortgage broker balance sheet model outlines assets and liabilities, revealing net worth and equity-versus-debt proportions over a 5-year horizon. Complementing this, the mortgage broker income statement model captures operational revenues and expenses, reflecting profitability across periods. Together, these financial models form the backbone of a comprehensive mortgage broker business plan financials, enabling precise liquidity, solvency, and turnover ratio analysis. Leveraging these tools ensures accurate mortgage brokerage financial projections and supports strategic decision-making for sustainable growth and profitability.

MORTGAGE BROKER FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our mortgage brokerage startup financial model offers a comprehensive business plan financials package, delivering key insights your investors and lenders demand. With integrated mortgage broker break-even analysis and weighted average cost of capital (WACC), it clearly demonstrates the minimum required returns. The model’s free cash flow valuation highlights available cash beyond operational needs, while discounted cash flow projections accurately assess the present value of future earnings. This mortgage broker financial projection model empowers confident decision-making and strengthens your investment pitch.

Cap Table

The capitalization table is vital for analyzing share value and assessing market capitalization in mortgage brokerage. Using our cap table Excel, you can accurately evaluate the mortgage broker financial projection model’s market value before investing. Our comprehensive cash flow statement template includes detailed proformas for all key reports, supporting thorough financial analysis—ideal for mortgage broker business plan financials and profitability modeling. Equip yourself with an all-in-one mortgage brokerage cash flow model and financial forecasting tool to make informed, strategic decisions with confidence. Get access now for a complete financial assessment solution.

MORTGAGE BROKER FINANCIAL MODEL IN EXCEL ADVANTAGES

The mortgage broker financial model accurately forecasts break-even points and ROI, empowering smarter business decisions.

Optimize cash flow and profitability accurately with a mortgage broker financial projection model tailored for strategic decisions.

The mortgage broker financial projection model minimizes risks by accurately forecasting profitable opportunities and guiding strategic decisions.

Optimize loan repayments efficiently with a comprehensive mortgage broker financial model for accurate, bottom-up forecasting.

The mortgage broker financial projection model empowers precise planning and maximizes profitability across 161 currency settlements.

MORTGAGE BROKER THREE STATEMENT FINANCIAL MODEL ADVANTAGES

Optimize cash flow and manage accounts receivable efficiently with our comprehensive mortgage broker financial projection model.

A mortgage brokerage cash flow model accurately forecasts late payments, optimizing cash flow and enhancing financial decision-making.

Our mortgage broker financial projection model delivers accurate forecasts banks and stakeholders confidently rely on.

A mortgage broker financial model ensures accurate forecasts, satisfying bank requirements and optimizing business profitability.

Optimize profitability and growth with our mortgage broker financial projection and cash flow models—print-ready for seamless reporting.

Unlock precise mortgage broker financial forecasting with print-ready reports, cash flow tools, and comprehensive ratio analyses.

Gain confidence in the future with a mortgage broker financial forecasting tool optimizing profitability and cash flow accuracy.

Our mortgage broker financial model enables precise planning, risk management, and 5-year cash flow forecasting in Excel.

Optimize growth with a 5-year mortgage broker financial model, enhancing profitability and strategic decision-making.

Streamline your mortgage brokerage planning with a 5-year integrated financial model offering automatic monthly and annual summaries.