Pakistani Restaurant Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Pakistani Restaurant Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Pakistani Restaurant Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

PAKISTANI RESTAURANT FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year Pakistani restaurant startup financial plan offers an advanced financial modeling solution designed to help entrepreneurs impress investors and secure funding. Featuring detailed restaurant revenue forecasting for Pakistani food, cost analysis, profit and loss modeling, and break-even analysis, this pro forma template provides essential financial dashboards and KPIs tailored specifically for Pakistani cuisine businesses. It streamlines cash flow planning, expense management, and inventory cost modeling while delivering a clear financial feasibility and valuation framework. Ideal for use in restaurant budgeting and funding plan development, this Pakistani restaurant financial statement template ensures precise financial forecasting and supports successful financial projections to attract banks or investors.

This comprehensive pakistani restaurant financial model template effectively addresses common pain points such as inaccurate restaurant revenue forecasting pakistani food, complex cost analysis pakistani restaurant model challenges, and the need for precise cash flow pakistani restaurant financial planning. By integrating detailed profit and loss pakistani restaurant model features with break even analysis pakistani cuisine restaurant tools, it streamlines expense management through a pakistani restaurant expense management model and improves decision-making using a customizable financial dashboard pakistani restaurant operations. Users benefit from a ready-made financial feasibility pakistani food business assessment, clear restaurant budgeting pakistani food business insights, and reliable pakistani restaurant sales forecast model projections, eliminating guesswork in startup financial plans while ensuring investor confidence with a robust pakistani restaurant investment financial model.

Description

The Pakistani restaurant financial projections model provides a comprehensive framework tailored for financial modeling of Pakistani cuisine businesses, incorporating detailed startup financial plans, cost analysis, and restaurant revenue forecasting specific to Pakistani food. This Excel-based template offers a robust financial dashboard for Pakistani restaurant operations, including profit and loss statements, cash flow management, and expense tracking, facilitating effective restaurant budgeting and expense management. With features such as break-even analysis, sales forecast models, and inventory cost modeling, it supports thorough financial forecasting and investment planning. The model also includes essential KPIs for Pakistani cuisine ventures, aiding in funding plans, valuation assessments, and overall financial feasibility studies, ensuring stakeholders can make informed decisions based on accurate, actionable financial data.

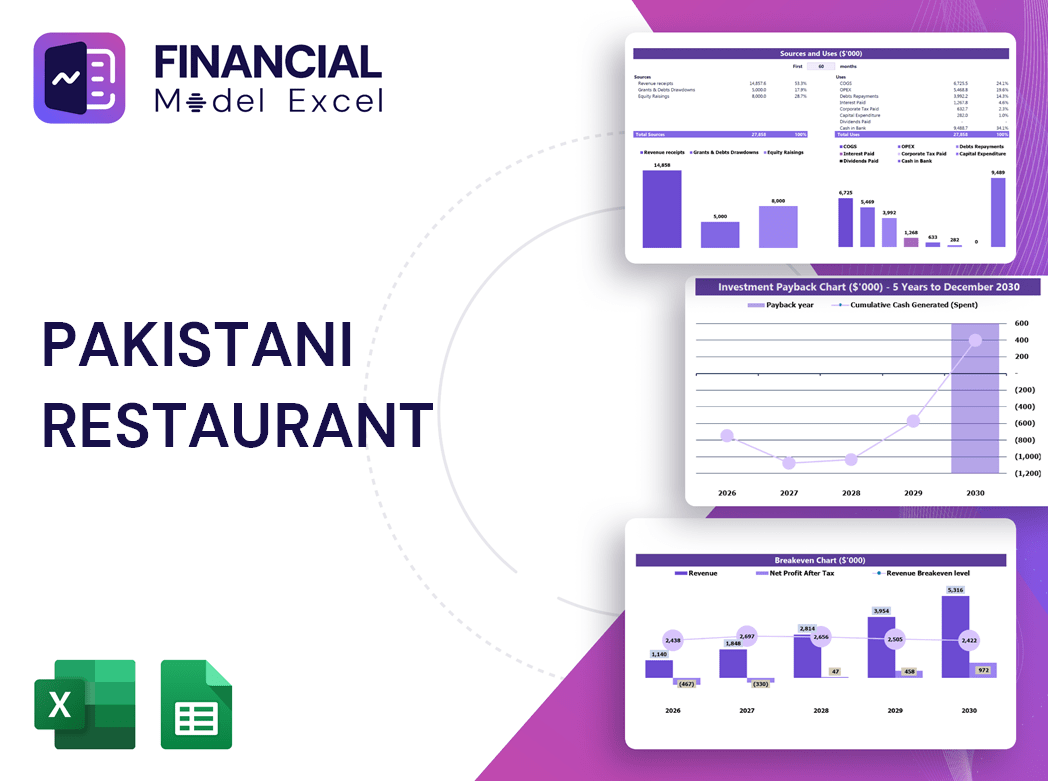

PAKISTANI RESTAURANT FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

If you’re developing a pakistani restaurant startup financial plan, our comprehensive financial modeling software is your ideal tool. It seamlessly integrates operational analysis—covering overhead costs, payroll, sales metrics, and expense management—with robust financial forecasting and restaurant revenue forecasting for pakistani food ventures. Featuring editable tables and data sheet templates, it enables dynamic cash flow planning, profit and loss analysis, and investment modeling. Designed for precise restaurant budgeting and financial dashboard insights, this solution empowers you to optimize cost analysis and streamline your pakistani cuisine business’s financial feasibility with ease.

Dashboard

Our comprehensive Pakistani restaurant financial projections tool delivers precise cash flow forecasting and expense management tailored for Pakistani cuisine businesses. Effortlessly generate monthly or annual financial statements, including profit and loss reports and budgeting insights. The intuitive financial dashboard presents data visually through dynamic charts, supporting informed decisions in restaurant revenue forecasting and investment planning. Designed for startup financial plans or expansion models, this solution streamlines financial modeling, break-even analysis, and KPI tracking, empowering restaurateurs with clear, actionable insights to optimize operations and maximize profitability.

Business Financial Statements

This comprehensive Pakistani restaurant financial projections template is an essential tool for precise financial modeling tailored to your cuisine business. It includes detailed proformas for profit and loss, cash flow, and expense management models, enabling effective restaurant budgeting and cost analysis. Designed to support your startup financial plan, it facilitates accurate revenue forecasting and break-even analysis, ensuring informed investment decisions. Use this financial dashboard to monitor key performance indicators and drive sustainable growth in your Pakistani dining venture with confidence.

Sources And Uses Statement

A detailed funding plan for your Pakistani restaurant business model is essential to transparently track income sources and allocate resources efficiently. Utilizing a comprehensive pakistani restaurant financial projections framework ensures precise expense management and optimized cash flow. This approach supports accurate restaurant revenue forecasting Pakistani food ventures, enabling informed decision-making and robust financial planning. Integrating financial modeling for Pakistani cuisine businesses enhances budget control, cost analysis, and profitability, ultimately driving sustainable growth and maximizing return on investment.

Break Even Point In Sales Dollars

Breakeven analysis is essential in a pakistani restaurant startup financial plan, pinpointing when revenue from pakistani cuisine covers all expenses to generate profit. This involves detailed financial modeling distinguishing fixed costs—like rent and administrative salaries—from variable costs that fluctuate with sales volume, such as inventory and shipping expenses. Incorporating a precise breakeven analysis within your restaurant budgeting pakistani food business ensures effective expense management and enhances your financial forecasting pakistani restaurant venture, ultimately supporting sustainable growth and profitability in the competitive pakistani restaurant market.

Top Revenue

Effective financial modeling for a Pakistani cuisine business hinges on accurate restaurant revenue forecasting. A precise Pakistani restaurant startup financial plan is vital, as revenue projections drive the entire financial dashboard and impact profit and loss statements. Utilizing a detailed Pakistani restaurant financial statement template ensures management can perform reliable cost analysis and expense management. This approach enables robust cash flow planning and break-even analysis, essential for restaurant budgeting and investment decisions. Meticulous financial forecasting within the Pakistani restaurant venture enhances valuation accuracy and supports strategic growth, making it a cornerstone for sustainable business success.

Business Top Expenses Spreadsheet

The Top Expenses tab within our financial modeling for Pakistani cuisine startups offers a clear snapshot of your four highest costs. This comprehensive five-year Pakistani restaurant financial projection template delivers in-depth cost analysis, covering customer acquisition expenses and fixed costs. By accurately forecasting restaurant expenses and utilizing detailed cost analysis Pakistani restaurant models, you gain valuable insights to optimize financial planning. This empowers you to manage cash flow, enhance profitability, and drive sustainable growth in your Pakistani food business.

PAKISTANI RESTAURANT FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

A comprehensive 5-year cash flow projection template is essential for accurate financial planning in a Pakistani restaurant startup. It enables detailed expense tracking and aligns financial resources with operational needs. Coupled with a precise cost analysis Pakistani restaurant model, this tool highlights key areas for cost savings and efficiency improvements. Additionally, it strengthens your restaurant financial planning by supporting funding plans, investor pitches, and loan applications. Utilize this financial dashboard tailored for Pakistani cuisine businesses to optimize budgeting, cash flow management, and restaurant revenue forecasting, ensuring a solid foundation for long-term profitability and growth.

CAPEX Spending

The CAPEX plan in a Pakistani restaurant financial projections outlines essential investments required to enhance business performance, excluding day-to-day operating expenses like salaries. This focused capital expenditure analysis provides clear insight into key areas for resource allocation within your Pakistani cuisine business. As CAPEX requirements differ across ventures, incorporating detailed capital expenditure reports in your Pakistani restaurant startup financial plan is vital for informed decision-making and robust financial planning.

Loan Financing Calculator

Effective loan repayment schedules are crucial for Pakistani restaurant startups and growing businesses, providing clear details on principal, terms, maturity, and interest rates. These schedules play a vital role in cash flow Pakistani restaurant financial planning, directly influencing cash flow forecasting and pro forma statements. Timely monitoring ensures accurate restaurant revenue forecasting for Pakistani food ventures and supports debt management within the profit and loss Pakistani restaurant model. Integrating loan repayments into financial modeling for Pakistani cuisine businesses enhances expense management, strengthens financial feasibility assessments, and supports robust restaurant budgeting and investment planning.

PAKISTANI RESTAURANT FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Our comprehensive Pakistani restaurant financial projections offer a dynamic dashboard to monitor essential KPIs for up to five years. This financial modeling for your Pakistani cuisine business includes detailed EBITDA and EBIT metrics to evaluate operational performance, precise cash flow analysis tracking inflows and outflows, and a forecasted cash balance to ensure optimal liquidity. Designed to support your restaurant financial planning, this model streamlines expense management, revenue forecasting, and break-even analysis—empowering your Pakistani restaurant startup financial plan with clarity and confidence.

Cash Flow Forecast Excel

A robust Pakistani restaurant startup financial plan hinges on precise cash flow Pakistani restaurant financial planning to ensure timely liability payments. Utilizing a comprehensive cash flow projection template tailored for Pakistani cuisine businesses demonstrates your venture’s capacity to generate sufficient cash. This clarity is crucial for securing funding, as banks require reliable restaurant financial projections showcasing your ability to repay loans. Incorporating detailed expense management models and revenue forecasting strengthens your restaurant investment financial model, instilling confidence in lenders and investors about your Pakistani food business’s financial feasibility and growth potential.

KPI Benchmarks

The 5-year forecast template’s benchmark tab calculates key financial KPIs critical for Pakistani restaurant financial projections. By highlighting average metrics and conducting comparative analysis, it delivers valuable insights for financial modeling of Pakistani cuisine businesses. This rigorous evaluation supports effective restaurant budgeting, expense management, and break-even analysis—especially vital for startups. Consistent monitoring of these indicators empowers strategic management and informed decision-making, enhancing profitability and sustainability in Pakistani restaurant ventures. Harnessing this financial dashboard accelerates growth and ensures robust financial planning tailored to the unique dynamics of the Pakistani food business.

P&L Statement Excel

This comprehensive financial model for Pakistani cuisine businesses is designed for both experts and newcomers. It offers detailed profit and loss projections, enabling precise restaurant revenue forecasting and expense management. Ideal for crafting a robust Pakistani restaurant startup financial plan, it supports cash flow analysis, break-even calculations, and cost analysis. Utilize this tool to enhance financial forecasting, budgeting, and investment planning, ensuring a clear view of your venture’s profitability and operational performance through an intuitive financial dashboard tailored to Pakistani restaurant operations.

Pro Forma Balance Sheet Template Excel

Included within the financial modeling for Pakistani cuisine business is a comprehensive 5-year projected balance sheet in Excel format. This essential report details current and long-term assets, liabilities, and equity, providing critical insights for the startup’s financial planning. By utilizing this projected balance sheet, owners can accurately perform restaurant revenue forecasting, break-even analysis, and calculate key financial ratios, ensuring informed decision-making. This foundational tool empowers effective cost analysis and supports robust cash flow and expense management models crucial for a successful Pakistani restaurant financial plan.

PAKISTANI RESTAURANT FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

In the pakistani restaurant startup financial plan, the Weighted Average Cost of Capital (WACC) defines the blended cost of equity and debt, essential for risk assessment and securing funding. Utilizing discounted cash flows (DCF) within the pakistani restaurant financial projections reveals the present value of future cash inflows, guiding investment decisions. Free Cash Flows (FCF) analysis supports accurate restaurant revenue forecasting pakistani food ventures. Together, these financial modeling tools empower comprehensive restaurant budgeting and cash flow pakistani restaurant financial planning, ensuring a robust pakistani cuisine business model that attracts investors and drives sustainable growth.

Cap Table

Our comprehensive financial modeling for Pakistani cuisine businesses includes an advanced Cap Table model, detailing investor information, equity shares, and capital contributions. This essential component integrates seamlessly with your Pakistani restaurant startup financial plan, enabling accurate restaurant revenue forecasting and expense management. Utilize our financial dashboard tailored for Pakistani restaurant operations to monitor key performance indicators, support funding plans, and optimize cash flow. Elevate your restaurant valuation and profitability with precise profit and loss analysis, inventory cost modeling, and break-even analysis—all designed specifically for Pakistani dining ventures seeking sustainable growth and investor confidence.

PAKISTANI RESTAURANT BOTTOM UP FINANCIAL MODEL ADVANTAGES

Create multiple scenarios with a 3-way Pakistani restaurant financial model to optimize forecasting and strategic decision-making effectively.

Master cash flow effortlessly with our comprehensive financial model tailored for your Pakistani restaurant’s success.

Start your Pakistani restaurant confidently with a precise financial model for accurate projections and profitable growth planning.

Accurate financial modeling for Pakistani restaurants ensures timely break-even analysis and maximizes return on investment.

Easily optimize profits and manage cash flow with our simplified Pakistani restaurant financial projections and modeling template.

PAKISTANI RESTAURANT 3 WAY FINANCIAL MODEL TEMPLATE ADVANTAGES

Experience streamlined financial forecasting for your Pakistani restaurant with an all-in-one, visually intuitive dashboard model.

This financial model dashboard ensures instant, comprehensive visibility of all key Pakistani restaurant metrics without switching sheets.

Optimize profits and streamline expenses with our dynamic financial modeling for Pakistani restaurant startups—update anytime effortlessly.

Easily refine your Pakistani restaurant financial model throughout launch and growth for precise, dynamic business planning.

Unlock precise revenue forecasting and expense management with our comprehensive Pakistani restaurant financial modeling solution.

A comprehensive Pakistani restaurant financial model enables precise cash flow forecasting, minimizing risk and ensuring sustainable growth.

Optimize surplus cash efficiently with our comprehensive financial modeling for your Pakistani restaurant business.

Optimize reinvestment and debt repayment with precise cash flow forecasting in your Pakistani restaurant financial planning model.

Optimize your Pakistani restaurant startup with precise financial modeling, ensuring accurate forecasting and profitable operations from day one.

Streamline your Pakistani restaurant startup with precise financial modeling and forecasting for confident, data-driven investor presentations.