Personal Financial Advisory App Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Personal Financial Advisory App Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Personal Financial Advisory App Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

PERSONAL FINANCIAL ADVISORY APP FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year personal financial advisory app financial model template is ideal for startups and entrepreneurs aiming for effective fundraising and business planning. It integrates key personal finance management tools, including dynamic financial modeling techniques, cash flow projection models, and sensitivity analysis in financial models, to provide accurate financial forecasts for advisory services. Designed with features tailored for personal budgeting and advisory apps, this template supports financial planning and analysis app development, incorporating essential revenue models and financial app monetization strategies. Users can track personal financial goals and assess financial risk through a robust investment planning financial model, making it a top choice for building a financial model that enhances advisory app user engagement metrics and portfolio management financial models.

This ready-made personal financial advisory app financial model template addresses common pain points faced by buyers by offering comprehensive personal finance management tools and dynamic financial modeling techniques that simplify how to build a financial model tailored to advisory services. It integrates key features such as cash flow projection models, sensitivity analysis in financial models, and financial risk assessment models to ensure accurate forecasting and insightful financial planning and analysis app capabilities. Designed with the best financial model for startups in mind, this template supports portfolio management financial models and investment planning financial models while enhancing advisory app user engagement metrics through clear visualization of personal budgeting and advisory app data. Additionally, it incorporates financial app monetization strategies and personal finance app revenue model elements, empowering users to track personal financial goals effectively while optimizing the financial forecast for advisory services and enabling seamless financial advisor app development.

Description

This comprehensive personal financial advisory app financial model template offers an adaptable and dynamic 5-year cash flow projection model, integrating essential financial planning and analysis app features such as profit and loss statements, projected balance sheets, and business plan cash flow forecasts tailored for startups and existing businesses. Designed with sensitivity analysis in financial models and dynamic financial modeling techniques, it facilitates accurate financial risk assessment and investment planning financial model evaluations, while enabling users to track personal financial goals and optimize portfolio management financial model strategies. The model supports financial advisor app development by providing key advisory app user engagement metrics and detailed financial performance ratios and KPIs sought by banks and investors for liquidity and profitability assessment, making it an indispensable tool for building the best financial model for startups and guiding financial app monetization strategies in the personal finance management tools sector.

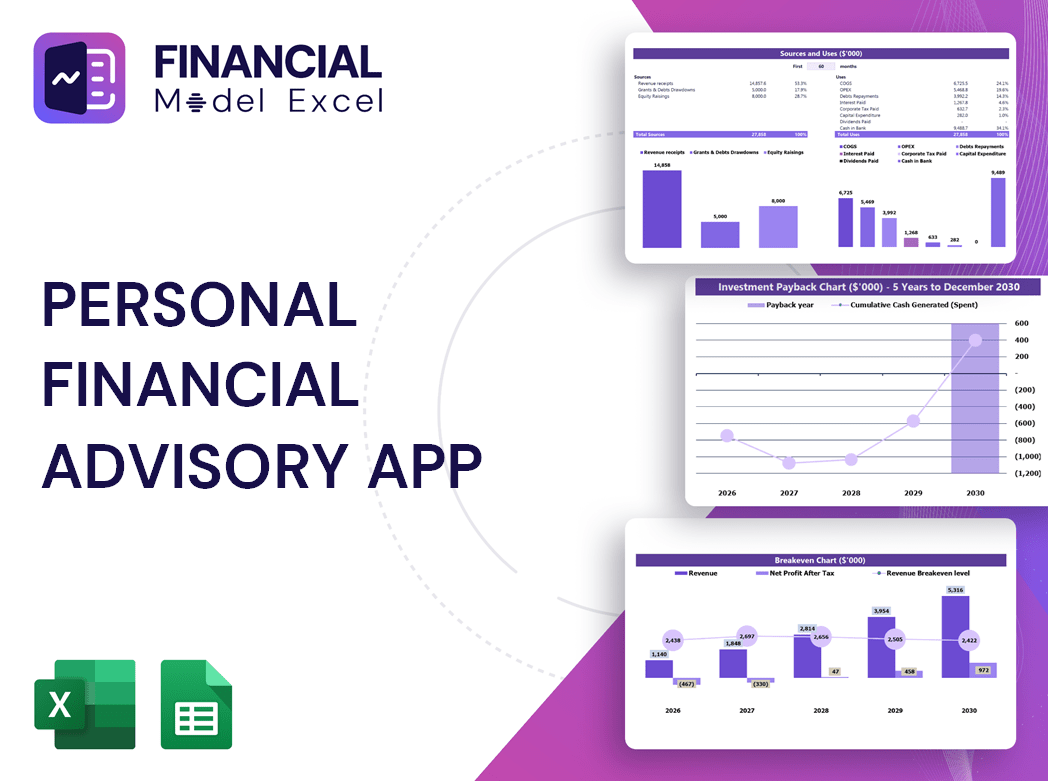

PERSONAL FINANCIAL ADVISORY APP FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Discover our sophisticated and scalable personal financial advisory app financial model template—designed to support diverse business strategies. This dynamic financial modeling tool offers intuitive cash flow projection models and personal budgeting and advisory app features that simplify financial planning and analysis. Whether you're new to financial modeling for wealth management or refining investment planning financial models, this template empowers you to customize and expand with ease. Perfect for startups seeking the best financial model or established firms aiming to enhance advisory app user engagement metrics and monetization strategies. Build a clear roadmap for success with our comprehensive financial forecast and sensitivity analysis capabilities.

Dashboard

This comprehensive financial model template for personal finance features an all-in-one dashboard, providing a clear snapshot of your startup’s key metrics. Gain instant insights into core financials, revenue breakdowns, cash flow projection models, profitability forecasts, and cumulative cash flow—all visualized through dynamic charts and graphs. Ideal for financial planning and analysis app development, this tool empowers startups with advanced personal budgeting and advisory app capabilities, supporting effective financial risk assessment and investment planning. Enhance decision-making with sensitivity analysis and dynamic financial modeling techniques for sustainable growth and optimized portfolio management.

Business Financial Statements

Our five-year financial forecast template features pre-built proformas in Excel, including projected balance sheets, profit and loss statements, and monthly cash flow projection models. Designed for startups and advisory services, it supports both monthly and annual views. By inputting key financial assumptions, users can effortlessly build dynamic financial models, enabling accurate financial planning and analysis. This template is an essential personal finance management tool for developing robust investment planning financial models and conducting sensitivity analysis in financial models, streamlining financial advisor app development and enhancing portfolio management financial models with precision.

Sources And Uses Statement

The Sources and Uses Chart of Funds statement is essential in financial planning, especially within pro forma income statement templates. Crucial for both startups and large companies, it effectively supports bank loan applications and investor meetings. Startups rely on this financial model template for personal finance to manage funding sources and control expenses. Lenders and investors value this dynamic financial modeling technique as it succinctly presents a company’s financial forecast and strategic plans, showcasing sound financial management and investment planning for growth and expansion. Incorporating this tool enhances credibility in financial advisory app development and portfolio management strategies.

Break Even Point In Sales Dollars

A break-even analysis within financial planning and analysis apps is crucial for startups and advisory services. It distinguishes between sales, revenue, and profit—key concepts in personal finance management tools and financial modeling for wealth management. Revenue represents total income from products or services, while profit deducts all fixed and variable expenses. Integrating this analysis into financial forecast and cash flow projection models enhances accuracy in personal budgeting and advisory apps, enabling smarter investment planning and risk assessment. Understanding these dynamics supports the best financial model for startups and drives effective financial advisor app development.

Top Revenue

In personal financial advisory app development, understanding key metrics like the top line and bottom line is crucial. The top line, representing a company’s revenue or gross sales, signals growth when increasing—a vital insight for financial planning and analysis apps. Investors closely monitor these figures using dynamic financial modeling techniques, such as sensitivity analysis in financial models and cash flow projection models. Integrating these elements into a personal budgeting and advisory app enhances user engagement metrics and supports accurate financial forecasts, positioning your app as a leading personal finance management tool with a robust revenue model.

Business Top Expenses Spreadsheet

The Top Expenses tab in this startup financial model template provides a comprehensive breakdown of the company’s annual costs, categorized into four key groups. With detailed analysis spanning customer acquisition costs to fixed expenses, this financial planning and analysis app feature enables precise cash flow projection and insightful financial risk assessment. Leveraging dynamic financial modeling techniques, it empowers startups to understand spending origins, optimize personal finance management tools, and maintain control over finances for sustainable growth. This approach is essential in building the best financial model for startups and enhancing advisory app user engagement metrics.

PERSONAL FINANCIAL ADVISORY APP FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Start-up costs are crucial and easily managed using our personal financial advisory app’s dynamic financial modeling techniques. This comprehensive financial model template for personal finance integrates a pro forma income statement, cash flow projection model, and sensitivity analysis in financial models. It empowers users to track expenses, investments, and forecast financial outcomes, ensuring sound financial planning and analysis. Designed for startups and wealth management alike, this app enhances personal budgeting and advisory services while optimizing financial risk assessment models to safeguard your company’s future. Harness our innovative financial advisor app development to keep your finances clear and under control.

CAPEX Spending

CAPEX is a vital element in any financial model template for personal finance and startups. Financial advisors leverage dynamic financial modeling techniques to set accurate startup budgets and monitor investments effectively. Understanding initial expenditures is essential for crafting reliable cash flow projection models that drive strong financial planning and analysis. Careful estimation of capital expenditures not only enhances the financial forecast for advisory services but also supports sustainable growth and optimal resource allocation, ensuring robust revenue models and long-term financial success.

Loan Financing Calculator

The loan amortization schedule template in this financial model provides a clear breakdown of periodic payments, detailing both principal and interest components. It is essential for cash flow projection models, offering precise timelines for repayment until the loan is fully settled. Integrating this with personal finance management tools or financial planning and analysis apps enhances budgeting accuracy and financial risk assessment. This dynamic financial modeling technique ensures startups and advisory services can forecast liabilities effectively, supporting robust investment planning and portfolio management strategies.

PERSONAL FINANCIAL ADVISORY APP FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) is a key metric in financial modeling for wealth management and advisory services, highlighting a company's core profitability. Unlike cash flow projections, EBITDA includes both monetary and non-monetary items, offering a comprehensive view within financial planning and analysis apps. Widely applied in startup financial models and investment planning financial models, it’s essential for sensitivity analysis and dynamic financial modeling techniques. Leveraged buyouts especially rely on EBITDA to assess potential profitability, making it integral to portfolio management financial models and personal financial advisory app features.

Cash Flow Forecast Excel

A cash flow projection model in Excel provides a clear visualization of cash inflows and outflows over a specific period, showcasing changes in the cash balance from start to finish. This dynamic financial modeling technique is essential for startups and advisory services to anticipate liquidity needs, optimize financial planning, and support robust financial forecast for advisory services. Integrating such models within personal finance management tools or financial planning and analysis apps enhances decision-making and risk assessment, driving better financial outcomes and user engagement.

KPI Benchmarks

This startup financial model template Excel includes a dedicated tab for dynamic financial modeling techniques, enabling comprehensive comparative financial analysis. By benchmarking financial results across companies within the same industry, it offers clients an in-depth understanding of each company’s financial position. This robust approach supports accurate financial forecasting for advisory services, empowering startups with actionable insights to optimize cash flow projections and investment planning. Ideal for personal financial advisory app development or financial planning and analysis apps, this model enhances strategic decision-making and drives user engagement through transparent, data-driven evaluations.

P&L Statement Excel

Leverage our dynamic financial forecast for advisory services to build a comprehensive and accurate monthly profit and loss statement. Designed as a robust financial model template for personal finance, this tool empowers you to analyze cash flow projections and assess financial risk effectively. Ideal for financial advisor app development, it enables informed daily management decisions by revealing strengths and weaknesses within your personal financial advisory app features. Harness sensitivity analysis in financial models to optimize your personal budgeting and advisory app’s performance and drive strategic growth with confidence.

Pro Forma Balance Sheet Template Excel

The projected balance sheet template, combined with the projected profit and loss statement, is essential in financial planning and analysis apps. It highlights the investment required to support forecasted sales and profits, offering a clear view of your company’s financial position over time. Utilizing dynamic financial modeling techniques, including sensitivity analysis, enhances your cash flow projection model’s accuracy. This approach is vital for startups developing the best financial model or advisors building portfolio management financial models to optimize forecasting and strategic decision-making.

PERSONAL FINANCIAL ADVISORY APP FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This comprehensive three-way financial model template is designed for pre-revenue startups, enabling precise Discounted Cash Flow (DCF) valuation. It integrates dynamic financial modeling techniques to assess key metrics including residual value, replacement costs, market comparables, and recent transaction comparables. Ideal for financial planning and analysis apps or personal finance management tools, it supports accurate financial forecasting and risk assessment. Whether you're building a financial advisor app or developing an investment planning financial model, this template streamlines cash flow projection and sensitivity analysis for robust, data-driven decision-making.

Cap Table

The equity cap table is a vital component of any startup’s financial model template. It clearly outlines ownership stakes, detailing who holds equity, preferred shares, and options, along with their respective values. Integrating this with a comprehensive financial forecast for advisory services enhances transparency for investors. Utilizing dynamic financial modeling techniques, startups can leverage this tool to optimize cash flow projection models and drive effective personal finance management tools. This foundational element supports robust financial planning and analysis apps, empowering founders to build and refine the best financial model for startups with precision and confidence.

PERSONAL FINANCIAL ADVISORY APP FINANCIAL PROJECTION STARTUP ADVANTAGES

Compute startup costs accurately with our personal financial advisory app model, streamlining budgeting and boosting financial planning efficiency.

Optimize your personal financial advisory app with a dynamic cash flow projection model for superior control and growth.

Avoid cash flow shortfalls with a dynamic personal financial advisory app financial model for precise financial planning.

Leverage dynamic financial modeling techniques to optimize startup growth and personalize advisory app user engagement metrics effectively.

A financial model template for personal finance empowers precise forecasting, revealing strengths and weaknesses to optimize your strategy.

PERSONAL FINANCIAL ADVISORY APP STARTUP COSTS SPREADSHEET ADVANTAGES

Dynamic financial modeling techniques enable startups to run different scenarios for accurate forecasting and strategic decision-making.

Dynamic cash flow projection models empower startups to forecast impacts and optimize financial planning with scenario analysis.

Leverage dynamic financial modeling to accurately forecast and optimize startup growth with precision and confidence.

Discover how a dynamic financial model boosts startup funding success by accurately projecting personal finance advisory app growth.

Unlock growth with dynamic financial modeling techniques for startups, offering simple-to-use, accurate, and adaptable forecasting tools.

Our financial model template delivers quick, reliable forecasts with minimal Excel skills for all startup stages and sizes.

Leverage dynamic financial modeling techniques to build compelling plans and pitch confidently for startup funding success.

Impress investors with a dynamic financial model boosting accuracy and confidence in personal financial advisory app decisions.

Leverage dynamic financial modeling techniques to enhance accuracy, boost advisory app user engagement, and optimize monetization strategies.

Our financial model template simplifies reporting, ensuring compliance with lender requirements and saving you time and effort.