Real Estate Acquisition Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Real Estate Acquisition Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Real Estate Acquisition Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

REAL ESTATE ACQUISITION FINANCIAL MODEL FOR STARTUP INFO

Highlights

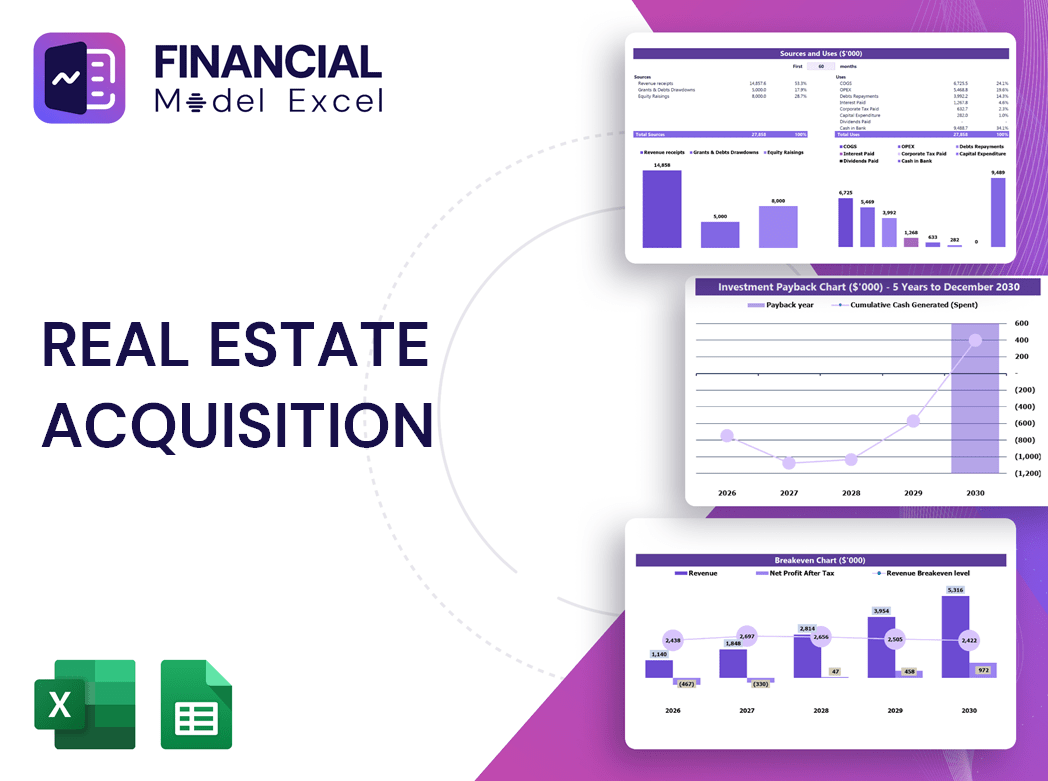

The real estate acquisition financial model template is a comprehensive 5-year financial planning tool designed for businesses involved in real estate investment acquisition financial modeling. Ideal for both startups and established companies, this real estate acquisition proforma financial model enables detailed budgeting, cost analysis, and investment analysis to evaluate startup ideas and ongoing operations. Fully unlocked and editable, the model incorporates best practices in real estate acquisition financial modeling, supporting both commercial and residential acquisition projects with accurate financial projections and cash flow analysis.

The real estate acquisition financial model template in Excel effectively addresses common pain points by providing a comprehensive, ready-made tool that streamlines complex forecasting and budgeting processes, eliminating the need for manual data compilation and reducing errors. Designed with real estate acquisition and development financial modeling best practices, it integrates detailed cost analysis, acquisition valuation, and deal underwriting within a user-friendly proforma financial model, enabling precise investment analysis and financial feasibility assessments for commercial, residential, and multifamily projects. This financial projection model includes dynamic cash flow projections, industry-specific assumptions, and customizable KPIs that facilitate accurate real estate acquisition budgeting and performance monitoring, allowing buyers to quickly generate insightful reports and scenario analyses, thereby accelerating decision-making and improving investment confidence.

Description

The real estate acquisition financial model template is designed to provide a comprehensive and dynamic Excel tool that supports robust financial forecasting and investment analysis for both residential and commercial projects. By integrating best practices in real estate acquisition financial modeling, this model exemplifies a bottom-up approach to revenue estimation based on pricing assumptions while incorporating detailed operating expenses, capital expenditures, and other critical inputs to generate accurate profit and loss projections, cash flow forecasts, and balance sheet templates. This proforma financial model excels in delivering essential metrics such as break-even analysis, KPIs, and diagnostic charts to facilitate effective budgeting, valuation, underwriting, and deal structuring. Whether applied to multifamily, development, or investment acquisition scenarios, the real estate acquisition financial feasibility model empowers entrepreneurs and investors to confidently evaluate financial projections, manage cash flow formats in Excel, and optimize overall business performance with clarity and precision.

REAL ESTATE ACQUISITION FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Looking to evaluate your real estate acquisition’s potential or secure funding quickly? Our real estate acquisition financial model template offers a comprehensive 5-year cash flow projection in Excel, designed with real estate acquisition financial modeling best practices. Customize month-by-month sales, expenses, investments, and funding assumptions with ease. Whether you’re working on a commercial or residential real estate acquisition financial feasibility model, this tool lets you analyze multiple scenarios, optimize budgeting, and forecast financial performance accurately. Streamline your investment analysis and confidently prepare your acquisition deal with our intuitive, editable real estate acquisition proforma financial model.

Dashboard

Our real estate acquisition financial model excel features an intuitive dashboard that consolidates data from all underlying spreadsheets. Easily set and track your key performance indicators (KPIs), seamlessly integrated into comprehensive financial statements. This real estate acquisition financial projection model allows month-by-month analysis, providing clear visibility into your investment’s performance. Customize your dashboard anytime to reflect updated assumptions or priorities, ensuring precise, real-time insights that support informed decision-making throughout the acquisition and development process. Ideal for commercial, multifamily, or residential projects, this tool exemplifies real estate acquisition financial modeling best practices.

Business Financial Statements

Mastering real estate acquisition financial modeling best practices is essential for investors and developers. Utilizing a comprehensive real estate acquisition financial model template in Excel—whether for multifamily, commercial, or residential projects—provides clear insights into cash flow, valuation, and investment analysis. The profit and loss statement highlights core operations driving earnings, while the acquisition cash flow financial model and projected balance sheet focus on capital management, assets, and financial structure. Employing a robust real estate acquisition proforma financial model ensures accurate feasibility, underwriting, and budgeting, empowering stakeholders to make informed, strategic decisions with confidence.

Sources And Uses Statement

The sources and uses of funds statement is a critical component in any real estate acquisition financial model Excel. It provides investors with clear insights into investment size, funding needs, and revenue strategies. This transparency is essential for lenders and stakeholders assessing commercial or residential real estate acquisition financial feasibility. A well-structured real estate acquisition budgeting financial model ensures precise tracking of cash flow and funding allocation. By aligning the sources and uses template with comprehensive financial projections, you enhance accuracy and confidence in your real estate acquisition financial analysis, supporting informed decision-making and effective deal underwriting.

Break Even Point In Sales Dollars

Break-even analysis is essential in real estate acquisition financial modeling, revealing when revenue fully covers both fixed and variable costs. This critical point indicates no profit or loss, guiding investment decisions. Utilizing a real estate acquisition financial model template or excel tool enhances accuracy in assessing costs and revenues. Applying real estate acquisition financial modeling best practices ensures a deeper understanding of the break-even threshold, helping investors optimize cash flow and profitability in residential, commercial, or multifamily real estate acquisition projects. Effective break-even analysis supports sound budgeting, valuation, and financial feasibility assessments within your acquisition strategy.

Top Revenue

Unlock detailed annual revenue insights with our real estate acquisition financial model Excel template. The Top Revenue tab offers a clear breakdown of income streams by each offering, while the comprehensive financial modeling features provide in-depth revenue depth and bridge analyses. Designed following real estate acquisition financial modeling best practices, this tool empowers investors and developers with transparent, accurate financial projections for informed decision-making. Whether for commercial or residential real estate acquisition, this model combines clarity and precision to optimize your investment strategy.

Business Top Expenses Spreadsheet

Optimize your real estate acquisitions with our comprehensive real estate acquisition financial model template. Whether you’re managing multifamily or commercial properties, mastering real estate acquisition financial modeling best practices is key to controlling expenses and maximizing returns. Our real estate acquisition financial feasibility model and cash flow financial model provide clear insights into your company’s major cost drivers, enabling precise budgeting and cost analysis. Gain full visibility into your investments and confidently steer your projects toward profitability with a robust real estate acquisition underwriting financial model that transforms financial data into strategic growth.

REAL ESTATE ACQUISITION FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Start-up costs play a critical role in any real estate venture. Our Real Estate Acquisition Financial Model Excel template provides a comprehensive financial projection, helping you monitor expenses and safeguard your investment. Designed with real estate acquisition financial modeling best practices, this proforma offers detailed insights into costs, investments, and cash flow management. Whether you’re using a commercial real estate acquisition financial model or a residential acquisition budgeting financial model, this tool enables precise financial analysis and forecasting. Stay in control, optimize your real estate acquisition deal financial model, and confidently project your company’s financial future with ease.

CAPEX Spending

The CAPEX investment in a real estate acquisition financial model represents all capital expenditures dedicated to enhancing asset value and performance. It excludes operating costs like salaries or day-to-day expenses. A well-structured real estate acquisition budgeting financial model clearly identifies where to allocate resources for maximum impact. Since capital expenditures differ by project type—be it commercial, multifamily, or residential—detailing CAPEX within the acquisition financial model template is essential for accurate financial feasibility and investment analysis. Following real estate acquisition financial modeling best practices ensures your CAPEX plan drives sustainable growth and informed decision-making.

Loan Financing Calculator

Our real estate acquisition financial model Excel template features a built-in loan amortization schedule with automated formulas that precisely outline repayment timelines. Each installment details principal and interest components on a monthly, quarterly, or annual basis, enhancing financial clarity. This proforma financial model ensures accurate cash flow projections and supports robust investment analysis—crucial for commercial or residential real estate acquisition deals. Designed following real estate acquisition financial modeling best practices, it empowers investors and developers to make informed decisions backed by thorough underwriting and budgeting insights.

REAL ESTATE ACQUISITION FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Optimize your real estate acquisition strategy with our comprehensive financial model template. Designed for commercial and multifamily real estate acquisition, this Excel-based tool incorporates best practices in financial modeling, including cash flow analysis, budgeting, and valuation. Track your investment’s performance effortlessly using clear financial KPIs displayed through dynamic graphs. Whether you’re focusing on acquisition feasibility, underwriting, or development projections, this proforma financial model empowers you to make informed, data-driven decisions that enhance portfolio growth and maximize ROI. Elevate your acquisition process with a professional, scalable real estate acquisition financial model tailored to your needs.

Cash Flow Forecast Excel

A real estate acquisition cash flow financial model proforma illustrates the movement of cash balances over a specific period, highlighting key inflows and outflows. Utilizing a comprehensive real estate acquisition financial model template enables investors and developers to accurately forecast liquidity, evaluate financial feasibility, and optimize budgeting strategies. Integrating real estate acquisition financial modeling best practices ensures precise cash flow projections, supporting informed decision-making throughout acquisition and development phases. Whether for commercial, multifamily, or residential projects, this approach is essential for effective real estate investment acquisition financial analysis and valuation.

KPI Benchmarks

A real estate acquisition financial model template leverages benchmark analysis to evaluate key performance indicators against industry peers. Utilizing a real estate acquisition financial model excel, companies gain clear insights into financial feasibility and profitability. Incorporating best practices in real estate acquisition financial modeling ensures accurate comparison of metrics, enabling startups to plan strategically, minimize losses, and sustain consistent profits. Whether using a commercial or multifamily real estate acquisition financial model, benchmarking is vital for informed decision-making and effective financial projection in property investments.

P&L Statement Excel

A comprehensive real estate acquisition financial model—whether a commercial or multifamily template—integrates detailed financial forecasting to guide strategic decisions. Utilizing an Excel-based proforma financial model example, including projected P&L statements and cash flow analyses, helps evaluate net operating income and gross profit margins effectively. This best practice approach enhances your real estate acquisition and development financial feasibility model by providing clear insights into profitability and investment potential. With accurate financial projections, you gain confidence in your acquisition deal’s viability, empowering you to optimize budgeting, valuation, and underwriting processes for stronger business positioning.

Pro Forma Balance Sheet Template Excel

Our real estate acquisition financial model Excel includes a comprehensive 5-year projected balance sheet, essential for informed investment decisions. This detailed report outlines current and long-term assets, liabilities, and equity, serving as a critical tool in real estate acquisition financial modeling best practices. It enables precise analysis of financial health and supports accurate calculation of key ratios, enhancing the robustness of your real estate acquisition financial feasibility model. Whether for commercial, multifamily, or residential projects, this template ensures thorough financial projection and valuation insights to optimize acquisition strategy and investment performance.

REAL ESTATE ACQUISITION FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive real estate acquisition financial model template delivers all essential data investors need for seamless funding decisions. Leveraging best practices in real estate acquisition financial modeling, it integrates key metrics such as Weighted Average Cost of Capital (WACC) to quantify investment returns on operating capital. The model also emphasizes free cash flow valuation, highlighting cash available to shareholders and creditors, while applying discounted cash flow techniques to accurately project future cash flows in present terms. Ideal for both commercial and residential real estate acquisition analysis, this template streamlines underwriting and investment feasibility assessments with precision and clarity.

Cap Table

In real estate acquisition financial modeling, using a comprehensive financial model template—such as a real estate acquisition financial projection model or underwriting financial model—is essential. These tools provide clarity on ownership structure, investment valuation, and cash flow forecasts. Similar to a cap table in startups, a real estate acquisition financial model example outlines investor shares, pricing, and ownership percentages, ensuring transparent deal analysis. Employing best practices in commercial or multifamily real estate acquisition financial models enhances budgeting, feasibility, and investment analysis, empowering confident decision-making throughout the acquisition and development process.

REAL ESTATE ACQUISITION 5 YEAR FINANCIAL PROJECTION TEMPLATE EXCEL ADVANTAGES

A real estate acquisition financial model ensures precise projections, satisfying banks’ demands for accurate, up-to-date analysis.

The real estate acquisition financial model excel streamlines investment analysis, ensuring accurate, data-driven decision-making for profitable deals.

Optimize investment decisions confidently using the real estate acquisition financial model Excel template for precise business planning.

Take control of cash flow with our real estate acquisition financial model for precise, confident investment decisions.

Run two valuation methods effortlessly with the real estate acquisition financial model for precise budgeting and analysis.

REAL ESTATE ACQUISITION 5 YEAR FINANCIAL PROJECTION ADVANTAGES

Optimize investments confidently with our real estate acquisition financial model, predicting the influence of upcoming market changes accurately.

The real estate acquisition financial model enables precise cash flow forecasting for informed investment and budgeting decisions.

Optimize investment decisions with our real estate acquisition financial model Excel, ensuring accurate projections and confident lender approvals.

Optimize your real estate acquisition deals with a comprehensive financial model ensuring accurate valuation and confident investor negotiations.

The real estate acquisition financial model template saves time and money by streamlining investment analysis and decision-making.

The real estate acquisition financial model Excel template simplifies planning with no formulas, formatting, or costly consultants needed.

Optimize spending and ensure budget control with our real estate acquisition budgeting financial model’s precise tracking features.

The real estate acquisition financial model excel enables precise cash flow forecasting, optimizing investment decisions and budgeting accuracy.

Boost investor confidence with our real estate acquisition financial model excel for accurate, insightful investment analysis.

The real estate acquisition financial model template accelerates investor interest by delivering clear, compelling P&L insights in Excel.