Real Estate Developer Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Real Estate Developer Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Real Estate Developer Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

REAL ESTATE DEVELOPER FINANCIAL MODEL FOR STARTUP INFO

Highlights

Generate a comprehensive 5-year real estate developer financial projection model that includes pro forma cash flow, real estate development budgeting and forecasting, and a dynamic financial dashboard with core metrics in GAAP/IFRS formats. Utilize this real estate development budget template and real estate financial planning tools to perform detailed real estate project cash flow analysis, real estate development cost estimation modeling, and real estate developer profitability analysis. Designed as a fully unlocked, editable financial modeling for property development excel template, it streamlines your real estate investment financial model to secure funding from banks, angels, grants, and VC funds effortlessly.

The real estate developer financial projection model Excel template significantly alleviates common pain points by offering an all-encompassing and user-friendly solution for financial modeling for property development, including real estate development budget templates and real estate development cost estimation models that streamline budgeting and forecasting processes. It integrates real estate project cash flow analysis, loan amortization schedules, and capital expenditure modeling into one cohesive tool, reducing time spent on manual calculations and minimizing errors. Built-in real estate developer profitability analysis and risk assessment models empower users to make informed decisions by providing clear insights into project feasibility and expected returns. Additionally, dynamic real estate cash flow forecasting templates and scenario analysis features allow developers to anticipate challenges and optimize investment strategies, while real estate project valuation and real estate development return on investment models help secure financing with confidence. Overall, this comprehensive toolkit addresses critical needs for accuracy, efficiency, and strategic planning in real estate financial planning tools, enhancing project success and investor confidence.

Description

The real estate developer financial projection model offers a comprehensive platform for detailed real estate financial planning tools, integrating a robust real estate development budget template and advanced financial modeling for property development to optimize capital allocation. This model facilitates precise real estate project cash flow analysis and real estate development cost estimation modeling, enabling accurate forecasting of real estate development revenue projection and real estate cash flow forecasting templates over a 60-month period. Incorporating a real estate development loan amortization model alongside real estate financial scenario analysis, it empowers users to conduct thorough real estate developer profitability analysis and real estate developer risk assessment model evaluations. Designed for both startups and established enterprises, the template supports real estate financial statement modeling and real estate capital expenditure model tracking, culminating in a real estate project valuation model and real estate development return on investment model for effective decision-making and investor negotiations.

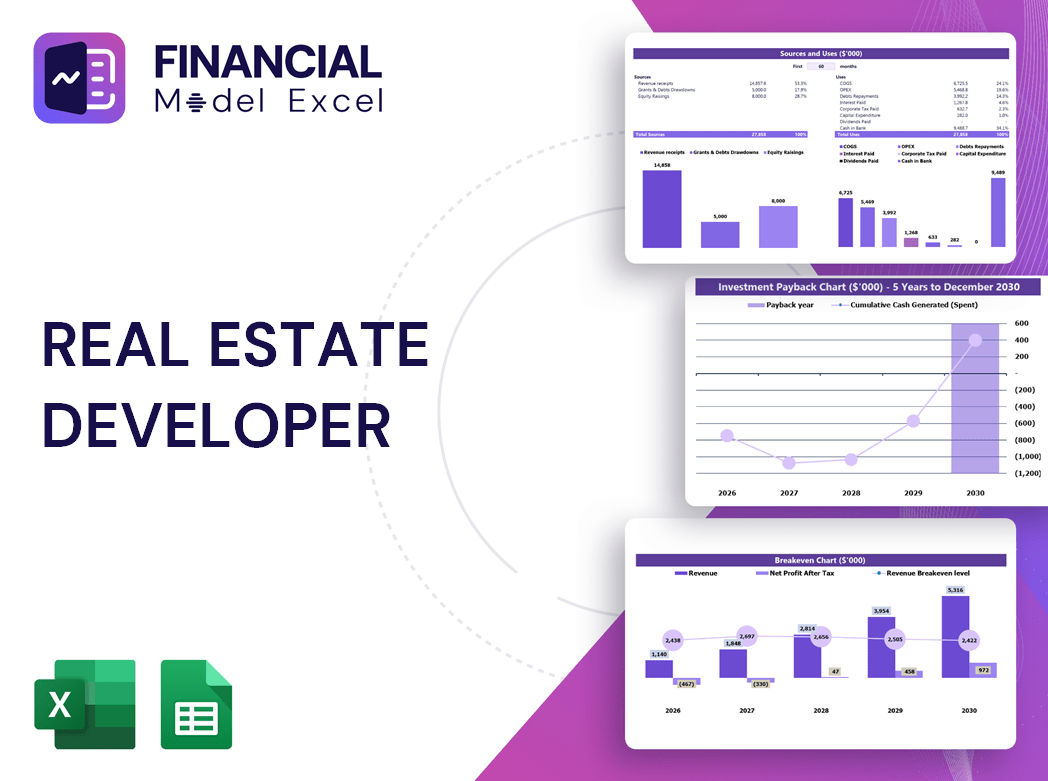

REAL ESTATE DEVELOPER FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Make informed strategic decisions with our comprehensive real estate developer financial projection model. Designed for clarity and depth, this intuitive tool automates your real estate development budgeting and forecasting, including cash flow analysis, profitability assessment, and loan amortization. Easily generate detailed financial statements, project valuation, and ROI models through a user-friendly dashboard, empowering you to evaluate risks and optimize capital expenditure. Streamline your property development feasibility study and enhance your financial planning with precision and professional insight.

Dashboard

Our comprehensive real estate financial planning tools feature an intuitive dashboard presenting critical financial indicators for your project timeline. This includes a detailed real estate project cash flow analysis, annual revenue projections, profitability forecasts, and overall fund flow insights. Designed for real estate developers, this model integrates real estate development budgeting and forecasting, enabling accurate financial scenario analysis and strategic decision-making. Elevate your property development feasibility study and investment planning with clear, actionable data at your fingertips.

Business Financial Statements

A real estate investment financial model’s projected income statement reveals profitability by detailing income, expenses, gains, and losses over a set period. Unlike real estate project cash flow analysis, it doesn’t distinguish cash from non-cash transactions. As a core component alongside the real estate development budget template and pro forma balance sheet, this financial modeling for property development tool provides essential insights into revenue and cost dynamics. Integrating real estate developer profitability analysis with financial planning tools ensures accurate real estate development budgeting and forecasting for informed decision-making and successful project execution.

Sources And Uses Statement

Leveraging investor funds accelerates profit growth for real estate developers. Utilizing a real estate developer financial projection model and real estate project cash flow analysis enables precise tracking of cash sources and uses, revealing financial strengths and weaknesses. Accurate real estate development budgeting and forecasting help prevent deficits by clearly identifying profits and losses. These real estate financial planning tools empower developers to make informed decisions, optimize profitability, and safeguard their investments. Implementing a robust source and use of funds statement template is essential for every startup aiming for sustainable success in property development.

Break Even Point In Sales Dollars

A comprehensive real estate development financial projection model distinguishes between sales, revenue, and profit to enhance accuracy. While revenue reflects the total income generated from property sales, profit factors in all fixed and variable expenses. Utilizing real estate financial planning tools, including cash flow forecasting templates and development budgeting models, ensures precise break-even point calculations. This clarity drives informed decision-making in real estate investment financial models, improving profitability analysis and supporting successful project financing and return on investment assessments.

Top Revenue

This real estate investment financial model features a dedicated tab for comprehensive revenue projection and analysis. Users can effortlessly evaluate revenue streams by individual property or development phase, enhancing accuracy in real estate financial planning tools. Ideal for developers, this model supports detailed cash flow forecasting and profitability analysis, empowering informed decisions and strategic growth.

Business Top Expenses Spreadsheet

Designed with real estate developers in mind, our financial projection model features a comprehensive Top Expenses tab that categorizes annual costs into four key groups. This real estate development budgeting and forecasting tool offers detailed analysis—from customer acquisition expenses to fixed costs—enabling precise real estate project cash flow analysis. By clearly identifying spending origins, our model empowers you to control costs effectively, optimize profitability, and enhance financial planning. Harness this real estate financial scenario analysis to make informed decisions and drive your property development project toward success.

REAL ESTATE DEVELOPER FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

The real estate developer financial projection model is an essential tool designed to assess project feasibility by analyzing total costs and profit potential. Utilizing financial modeling for property development, it enables accurate real estate development budgeting and forecasting, ensuring informed decision-making. This model also supports real estate developer profitability analysis by identifying financial challenges early and offering strategic solutions to optimize cash flow and returns. Ideal for startups and seasoned developers alike, it streamlines real estate financial planning tools to enhance project valuation and investment outcomes with precision and confidence.

CAPEX Spending

This 5-year real estate investment financial model features a dedicated tab for comprehensive revenue projection and real estate development budgeting and forecasting. It systematically breaks down revenue streams by product or service, enabling precise real estate project cash flow analysis and enhancing your financial modeling for property development. Ideal for developers seeking accurate real estate development return on investment models and real estate developer profitability analysis, this template streamlines financial planning and decision-making with clarity and detail.

Loan Financing Calculator

Start-ups and early-stage real estate developers rely on precise loan amortization models to manage repayment schedules effectively. These schedules provide detailed breakdowns of loan amounts and maturity terms, essential for accurate real estate project cash flow analysis. Integrating loan repayments and interest expenses into financial modeling for property development ensures reliable cash flow forecasting and strengthens real estate financial planning tools. This detailed approach enhances real estate development budgeting and forecasting, enabling developers to optimize profitability and project valuation throughout the development lifecycle.

REAL ESTATE DEVELOPER FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

For real estate developers, accurately capturing customer acquisition costs is essential in financial modeling for property development. Incorporating this metric into your real estate development budgeting and forecasting ensures precise cost estimation. By dividing total marketing expenses by the number of new clients acquired annually, developers can refine their real estate project cash flow analysis and enhance the real estate developer profitability analysis. This data-driven approach strengthens your real estate financial planning tools and supports informed decision-making throughout the development lifecycle.

Cash Flow Forecast Excel

Present your annual financials and key metrics with clarity using our real estate developer financial projection model. This comprehensive yet concise table seamlessly integrates into reports and pitches, enhancing your real estate development budgeting and forecasting. Ideal for financial modeling for property development, it streamlines real estate project cash flow analysis and profitability insights. Elevate your presentations with a professional real estate financial planning tool designed to support real estate investment financial models and project valuation. Empower your development decisions with precision and confidence.

KPI Benchmarks

This real estate developer financial projection model includes a dedicated benchmarking tab, enabling comprehensive financial scenario analysis. It benchmarks your project's performance against industry peers, evaluating productivity, efficiency, and profitability. By leveraging this real estate development budgeting and forecasting tool, you can enhance your financial planning tools, optimize cash flow forecasting, and improve real estate developer risk assessment. Drive informed decision-making with a robust real estate project valuation model that supports strategic growth and investment success.

P&L Statement Excel

The Profit and Loss Statement, a cornerstone in real estate financial planning tools, highlights key revenue streams and expense areas for stakeholders. Utilizing a real estate developer financial projection model, users can assess profitability, cost structure, and loan repayment capacity with precision. Integrating this with a real estate development budgeting and forecasting approach enhances insight into future financial performance. Leveraging real estate investment financial models and property development feasibility study models empowers developers to forecast revenue and optimize strategic decisions confidently.

Pro Forma Balance Sheet Template Excel

Our real estate financial planning tools include a comprehensive pro forma balance sheet forecast, essential for every development project. This report details current and long-term assets, liabilities, and equity, offering critical insights for real estate developer profitability analysis and financial modeling for property development. By integrating this balance sheet into your real estate development budgeting and forecasting process, you gain the accuracy needed for informed decision-making, risk assessment, and cash flow forecasting. It’s a vital component to support your property development feasibility study model and optimize your return on investment with confidence.

REAL ESTATE DEVELOPER FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Leverage our comprehensive real estate project valuation model combined with a 5-year cash flow forecasting template to provide investors with precise financial insights. Incorporating Weighted Average Cost of Capital (WACC) ensures accurate discount rates reflecting all capital sources—equity, preferred stock, and debt. Utilizing discounted cash flow (DCF) methodology, this real estate investment financial model delivers reliable property development revenue projections and profitability analysis. Equip your team with advanced real estate financial planning tools for effective financial modeling, budgeting, and risk assessment, driving confident decision-making throughout your development lifecycle.

Cap Table

A pro forma cap table is an essential real estate financial planning tool that details ownership distribution, investor share prices, and equity stakes. Integrated within a comprehensive real estate developer financial projection model, it transparently reflects each investor’s percentage of ownership and dilution effects. This enables precise real estate developer profitability analysis and supports accurate financial modeling for property development, ensuring informed decision-making throughout the project lifecycle.

REAL ESTATE DEVELOPER STARTUP FINANCIAL PLAN TEMPLATE ADVANTAGES

Accurately assess project feasibility and maximize returns with our real estate developer financial modeling excel template.

Optimize your investment with a real estate developer financial projection model for accurate cost planning and cash flow forecasting.

A real estate financial model streamlines budgeting, improving accuracy and maximizing profitability for your development projects.

The real estate financial projection model enhances accuracy in forecasting, optimizing investment decisions and competitive advantage.

Create flexible, 5-year real estate development financial models for accurate forecasting and optimized investment decisions.

REAL ESTATE DEVELOPER FINANCIAL FORECAST TEMPLATE ADVANTAGES

Optimize profits with our real estate developer financial projection model, enhancing accuracy and strategic decision-making.

Consistent formatting in real estate financial modeling ensures efficient testing of new hypotheses and accurate decision-making.

The real estate development budget template saves you time by streamlining accurate cost estimation and forecasting.

The real estate financial modeling tool streamlines budgeting and forecasting, maximizing developer profitability and project success.

Unlock accurate real estate investment insights with our comprehensive financial modeling and print-ready report tools.

Streamline real estate financial planning with comprehensive, print-ready reports for accurate analysis and confident investment decisions.

Optimize decision-making and plan for future growth with our real estate developer financial projection model’s precise insights.

The real estate financial planning tools empower accurate cash flow forecasting for strategic growth and informed investment decisions.

Unlock precise real estate development budgeting and forecasting for great value and confident financial decision-making.

Maximize profits with our proven 5-year real estate developer financial projection model—affordable, transparent, and expertly designed.