Real Estate Development Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Real Estate Development Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Real Estate Development Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

REAL ESTATE DEVELOPMENT FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year real estate project financial forecasting model is designed for startups and entrepreneurs aiming to impress investors and secure funding. Featuring integrated real estate financial modeling tools, including property development budgeting models, real estate cash flow projections, and construction financial modeling for real estate, it offers detailed expense tracking, ROI calculation, and capital budgeting techniques. The template provides key financial charts, summaries, and real estate development income projections, making it an essential resource for real estate investment financial planning, property development cost estimation, and real estate financial feasibility studies—fully unlocked and customizable for maximum flexibility.

This ready-made real estate financial modeling tool addresses key pain points by offering a comprehensive property development financial analysis framework that streamlines real estate project financial forecasting and budgeting. It simplifies complex real estate investment financial planning by integrating real estate development ROI calculation, cash flow projection, and profit and loss modeling into an intuitive Excel template. Users can easily perform property development cost estimation, conduct real estate financial feasibility studies, and implement capital budgeting techniques while tracking expenses and projecting income with accuracy. The model enhances decision-making through real estate development scenario analysis and risk analysis, empowering investors and developers with robust real estate development valuation models and funding strategies to optimize financial performance metrics and secure sustainable property investment financial plans.

Description

Our comprehensive real estate development financial model offers an advanced framework for property development financial analysis, integrating real estate cash flow projection, construction financial modeling for real estate, and property development budgeting model components. This template features detailed real estate profit and loss model, real estate project financial forecasting, and real estate capital budgeting techniques to facilitate robust real estate investment financial plan creation, including real estate development income projection and real estate development ROI calculation. Equipped with real estate development risk analysis, real estate development valuation model, and real estate development expense tracking, the model supports accurate property development cost estimation and property development funding strategy formulation. With 5-year monthly and yearly financial statements, relevant real estate financial performance metrics, KPIs, and diagnostic tools, this tool enables investors and owners to perform a thorough real estate financial feasibility study and scenario analysis, ensuring informed decision-making and sustainable growth.

REAL ESTATE DEVELOPMENT FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our comprehensive real estate financial modeling tools offer a flexible 5-year forecast template, covering property development budgeting models, operating costs, and cap tables. Designed for seamless customization, this model supports detailed real estate project financial forecasting, income projection, and cash flow analysis. With unlocked formulas and editable inputs, it enables precise property development cost estimation, ROI calculation, and risk analysis. Whether refining real estate investment financial plans or conducting development feasibility studies, this powerful tool adapts to your needs, making it indispensable for informed decision-making and strategic property investment financial planning.

Dashboard

Leverage advanced real estate financial modeling tools to streamline your property development financial analysis. Our comprehensive five-year real estate investment financial plan integrates real estate cash flow projections, profit and loss models, and balance sheet forecasts. Customize real estate project financial forecasting with clear graphs and charts, enhancing decision-making efficiency. Whether it's property development budgeting models or construction financial modeling for real estate, maintain organized, accurate data to optimize your real estate development ROI calculation and capital budgeting techniques. Stay ahead with real estate development scenario analysis and risk analysis, ensuring robust financial performance metrics for your investment success.

Business Financial Statements

This real estate financial modeling tool offers streamlined, pre-built templates for profit and loss statements, balance sheet forecasts, and cash flow projections—configurable on monthly or annual timelines. Ideal for property development financial analysis, it integrates seamlessly with accounting platforms like QuickBooks, Xero, and FreshBooks, enhancing your real estate investment financial plan. Empower your real estate project financial forecasting and property development budgeting model with accurate, consolidated data to optimize real estate development ROI calculation and capital budgeting techniques. Achieve precise real estate financial feasibility studies and strengthen your property investment financial planning effortlessly.

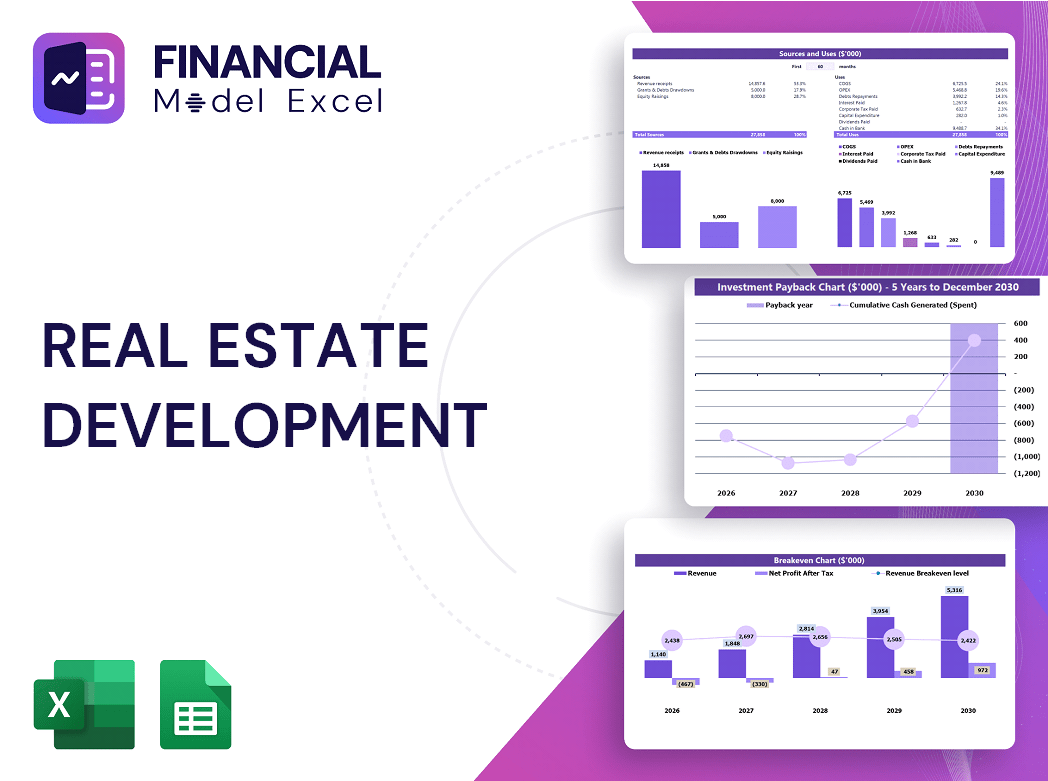

Sources And Uses Statement

The sources and uses of funds table is a vital component of real estate investment financial planning, clearly outlining capital acquisition and allocation across property development budgeting models. This tool highlights primary funding sources and intended expenditures, supporting real estate financial feasibility studies and enhancing transparency for stakeholders. It is essential for informed decision-making in real estate project financial forecasting, ensuring effective real estate capital budgeting techniques and construction financial modeling for real estate ventures. For start-ups, this analysis guides strategic funding strategies while providing clarity on real estate development expense tracking and overall financial performance metrics.

Break Even Point In Sales Dollars

A break-even point (BEP) calculation is essential in real estate financial modeling tools, helping determine when total costs equal total revenues. Utilizing property development financial analysis, this model identifies the sales volume or revenue needed to cover fixed and variable expenses. By analyzing contribution margin—the difference between sales price and variable cost per unit—developers gain insights into profitability. Integrating BEP within real estate project financial forecasting enhances property development budgeting models and supports accurate real estate investment financial plans, ensuring optimized construction financial modeling, risk analysis, and ROI calculation for successful project outcomes.

Top Revenue

Revenue stands as the cornerstone in real estate financial modeling tools, driving all key metrics within any startup financial model. Accurate revenue projections are essential for effective property development financial analysis and real estate investment financial plans. Leveraging historical data, our flexible revenue tab enables dynamic real estate project financial forecasting through multiple scenario analyses. This approach empowers analysts to optimize real estate development income projections and enhance property development budgeting models, ensuring robust and reliable financial feasibility studies for successful project outcomes.

Business Top Expenses Spreadsheet

Effective real estate financial modeling tools include a top spending report that breaks down major expense categories, streamlining property development budgeting models. By categorizing the four largest costs and grouping others as “miscellaneous,” users gain clear insights into expense trends. This approach supports comprehensive real estate financial feasibility studies and enhances real estate cash flow projection accuracy. For startups and established ventures alike, consistent expense analysis, planning, and control are essential to optimizing ROI and ensuring profitability in property development financial analysis and investment financial planning.

REAL ESTATE DEVELOPMENT FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Effective management of initial start-up costs is crucial for real estate ventures. Utilizing advanced real estate financial modeling tools, including a comprehensive property development budgeting model and real estate development expense tracking, ensures accurate cost estimation and funding strategy alignment. Our financial plan template features a detailed proforma designed for real estate investment financial planning, enabling developers to monitor expenses, forecast cash flow, and optimize their real estate development ROI calculation. By closely tracking costs early on, businesses can avoid underfunding and maintain financial feasibility, driving successful project outcomes with confidence and precision.

CAPEX Spending

CapEx, or startup budget, encompasses a company’s total expenditures on acquiring and developing capital assets within a period. These significant investments in real estate financial modeling tools and property development cost estimation provide long-term value beyond a single reporting cycle. Consequently, CapEx is reflected in the pro forma balance sheet template rather than fully expensed in the profit and loss model. Integrating this approach ensures accurate real estate financial feasibility studies and reliable real estate development income projection, supporting strategic property investment financial planning and effective real estate capital budgeting techniques.

Loan Financing Calculator

Our Excel-based real estate financial modeling tool features a comprehensive loan amortization schedule located in the 'Capital' tab. This sophisticated property development financial analysis component includes pre-built formulas designed for accurate internal calculations of loans, interest, and equity. Streamline your real estate investment financial plan with precise loan tracking, enhancing your property development budgeting model and ensuring reliable real estate cash flow projection for informed decision-making.

REAL ESTATE DEVELOPMENT FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Incorporating gross profit margin into your property development budgeting model is essential for robust real estate financial modeling tools. This key financial ratio serves as a leading indicator of your project’s financial health, highlighting the gap between revenue and cost of sales. An improving gross profit margin signals increased revenue or reduced selling expenses, strengthening your real estate investment financial plan. Regularly analyzing this metric within your real estate profit and loss model enhances financial forecasting accuracy and supports effective capital budgeting techniques for maximizing development ROI.

Cash Flow Forecast Excel

The cash flow projection is a critical element in real estate financial modeling tools, essential for mastering property development budgeting and financial analysis. This Excel template tracks cash inflows and outflows, integrating key inputs like receivable and payable days, income, working capital, and debt. It provides accurate real estate development income projections and net cash flow calculations, enabling effective real estate cash flow management. Ideal for real estate investment financial plans, this model supports detailed financial feasibility studies, helping optimize development ROI and streamline expense tracking for confident property investment financial planning.

KPI Benchmarks

A benchmarking study within real estate financial modeling tools evaluates key performance metrics—such as profit margins, cost per unit, and productivity—by comparing them against industry peers. This approach is vital for property development financial analysis, allowing businesses to identify strengths and weaknesses relative to competitors. For start-ups, benchmarking supports real estate investment financial planning by highlighting best practices, enhancing real estate project financial forecasting, and optimizing property development budgeting models. Ultimately, it drives informed decision-making, boosts real estate development ROI calculation, and refines capital budgeting techniques for greater financial feasibility and success.

P&L Statement Excel

Monthly reports generated using this property development budgeting model deliver highly accurate financial performance metrics. They offer clear insights into revenues, gross margins, and key real estate cash flow projections. By streamlining real estate financial modeling tools, these reports enhance property development financial analysis and support informed, strategic decision-making. Empower your real estate investment financial plan with precise data for effective management and optimized project outcomes.

Pro Forma Balance Sheet Template Excel

The projected balance sheet is a vital component of real estate financial modeling tools, offering a clear snapshot of current and long-term assets, liabilities, and equity. For property development financial analysis, this forecast underpins accurate real estate cash flow projection and ROI calculation. It’s essential for constructing a robust real estate investment financial plan, enabling precise real estate development income projection and supporting effective real estate capital budgeting techniques. Incorporating this report ensures comprehensive real estate financial feasibility studies and enhances property investment financial planning for informed decision-making.

REAL ESTATE DEVELOPMENT FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Effortlessly impress investors with our comprehensive real estate financial modeling tools. Our property development financial analysis features pre-built valuation templates that automate critical metrics like WACC, ensuring accurate real estate development ROI calculation. Utilize advanced real estate cash flow projection and discounted cash flow models to demonstrate clear financial feasibility and free cash flow available for distribution. With integrated real estate capital budgeting techniques and profit and loss forecasting, our property development budgeting model provides a transparent, professional real estate investment financial plan—empowering confident decision-making and strategic funding strategies for your project’s success.

Cap Table

The cap table model, integrated within a proforma business plan template, is an essential financial modeling tool for start-ups and early-stage ventures. It provides a detailed breakdown of company securities, investor ownership, value, and dilution over time. Utilizing this model enhances property development financial analysis and supports precise real estate investment financial planning. By integrating robust real estate financial performance metrics, it ensures transparent real estate development valuation and aids in strategic capital budgeting techniques, empowering businesses to optimize funding strategies and forecast development ROI with confidence.

REAL ESTATE DEVELOPMENT SIMPLE FINANCIAL PROJECTIONS TEMPLATE ADVANTAGES

Set clear objectives to optimize real estate development financial models for accurate forecasting and maximized investment returns.

Enhance lender confidence with precise real estate financial modeling tools that prove your repayment reliability effortlessly.

Gain stakeholder trust confidently with precise real estate financial modeling tools enhancing investment decision-making success.

Maximize returns confidently with our real estate development financial model, empowering precise investment and risk analysis.

The 3 Statement Financial Model Excel Template ensures accurate cash flow projection, safeguarding your real estate investment’s affordability.

REAL ESTATE DEVELOPMENT FINANCIAL MODEL TEMPLATE FOR STARTUP ADVANTAGES

Real estate financial modeling tools enable better decision-making through precise project forecasting and risk analysis.

Enhance decision-making confidence by using real estate cash flow projection for accurate forecasting and impact analysis.

Real estate financial modeling tools enable accurate forecasts, satisfying banks and enhancing investment confidence.

Our real estate profit and loss model ensures precise projections, satisfying banks’ regular financial review requirements confidently.

Optimize property development budgeting models to accurately track expenses and ensure projects stay within budget.

Real estate cash flow projection tools empower precise future planning by forecasting inflows, outflows, and aligning with budgets effectively.

Real estate financial modeling tools empower startups with accurate cash flow projections and risk analysis for confident investment decisions.

Real estate financial modeling tools streamline accurate financial forecasts, enhancing investor confidence and optimizing development ROI.

Real estate financial modeling tools simplify complex analyses, enhancing accuracy and accelerating profitable property development decisions.

Streamline decisions with a clear, color-coded real estate financial model enhancing transparency across 15+ focused planning tabs.