Real Estate Syndication Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Real Estate Syndication Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Real Estate Syndication Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

REAL ESTATE SYNDICATION FINANCIAL MODEL FOR STARTUP INFO

Highlights

Generates a comprehensive 5-year real estate syndication pro forma financial model featuring detailed cash flow forecasting, a dynamic financial dashboard, and core metrics aligned with GAAP/IFRS standards. This robust real estate syndication investment analysis tool allows you to evaluate your startup idea effectively, leveraging a real estate syndication ROI calculator and equity waterfall model to project investment returns accurately. Fully unlocked and editable, it supports real estate syndication underwriting models, budget forecasts, and sensitivity analysis, empowering you to optimize your real estate syndication deal analysis and capital stack modeling with ease.

This ready-made real estate syndication financial model Excel template effectively alleviates common pain points by offering a comprehensive cash flow model and robust real estate syndication investment analysis tools that simplify complex underwriting and return modeling processes. Its dynamic dashboard integrates real estate syndication ROI calculator features and equity waterfall model calculations to ensure accurate and transparent financial projections, while the inclusion of budget forecasts and debt service models supports meticulous financial forecasting and debt management. Designed for scalability, this pro forma template supports long-term partnership modeling and sensitivity analysis, enabling users with limited financial expertise to execute precise real estate syndication deal analysis, optimize capital stack models, and confidently evaluate internal rate of return and cash-on-cash return metrics through intuitive profit and loss models and income projections.

Description

Our real estate syndication financial model combines a comprehensive real estate syndication pro forma with detailed financial projections to facilitate precise investment analysis and deal analysis. This model incorporates advanced features such as a real estate syndication equity waterfall model, capital stack model, and debt service model to ensure thorough underwriting and budgeting forecasts. Utilizing a robust real estate syndication ROI calculator and internal rate of return computations, it offers insightful real estate syndication return modeling and sensitivity analysis to evaluate cash flow models and cash-on-cash return scenarios. Designed to optimize the partnership model and support profit and loss assessments, this real estate syndication investment return model equips stakeholders with critical data to drive strategic decisions that enhance financial health and foster sustainable growth.

REAL ESTATE SYNDICATION FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

This user-friendly real estate syndication financial model seamlessly integrates all key assumptions on a single sheet. Designed for efficiency, its structured formulas automatically update across 15+ sheets, delivering accurate financial projections. Simply input your parameters in highlighted cells, and the pro forma effortlessly generates monthly profit and loss statements. Ideal for real estate syndication investment analysis, this model supports robust financial forecasting, cash flow modeling, and ROI calculations—empowering savvy investors to make informed decisions with confidence.

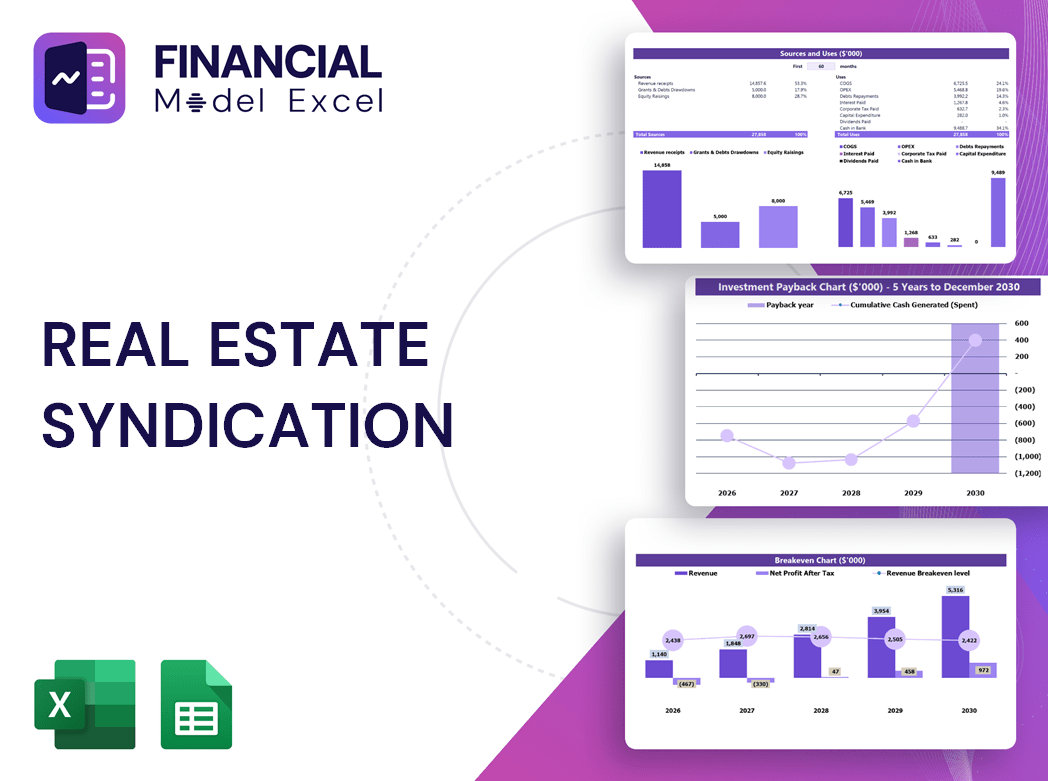

Dashboard

This comprehensive real estate syndication financial forecasting model integrates key indicators from your Excel reporting, delivering detailed cash flow budgets, pro forma projections, and investment return analysis. Access a clear breakdown of annual revenues, debt service models, and equity waterfall structures—all designed to empower your syndication deal analysis. Ideal for assessing overall financial health, this dashboard supports strategic planning with real-time insights into ROI, cash-on-cash return, and sensitivity analysis, ensuring your partnership model and capital stack align perfectly with your investment goals. Elevate your real estate syndication underwriting with precision and confidence.

Business Financial Statements

The real estate syndication pro forma balance sheet offers a precise snapshot of assets, liabilities, and equity at a specific date, typically the reporting period’s end. Integrated within our comprehensive financial projections and cash flow model, users input key data to automatically generate essential reports—including detailed deal analysis and investment return models. This dynamic tool streamlines underwriting, capital stack modeling, and ROI calculations, empowering investors with accurate financial forecasting and sensitivity analysis for confident decision-making in real estate syndication.

Sources And Uses Statement

The sources and uses chart is a critical element within a comprehensive real estate syndication pro forma, providing clear insights into funding origins and cash allocation. This essential tool enhances real estate syndication financial forecasting and investment analysis by illustrating capital stack models and cash flow distributions. Accurate sources and uses data support effective real estate syndication underwriting models and equity waterfall models, enabling investors to optimize ROI and cash-on-cash returns. Integrating this chart into your real estate syndication deal analysis ensures transparent budget forecasts and strengthens overall return modeling for confident investment decisions.

Break Even Point In Sales Dollars

A Break Even Point in real estate syndication is essential for precise investment analysis. Utilizing a real estate syndication pro forma and cash flow model, investors can identify when total costs equal total revenues, ensuring profitability. Integrating a break even sales calculator within real estate syndication financial projections helps determine necessary revenue to cover fixed and variable expenses. Understanding contribution margins through this underwriting model directly influences investment return models and ROI calculators, empowering stakeholders to optimize deal analysis, equity waterfall models, and overall capital stack strategies for maximum cash-on-cash return and long-term success.

Top Revenue

This 5-year real estate syndication pro forma offers a comprehensive cash flow model with detailed revenue stream analysis by individual product or service categories. Designed for precise investment analysis, it integrates financial projections, equity waterfall modeling, and sensitivity analysis to optimize ROI calculations. Perfect for underwriting models and partnership structures, this template empowers investors to forecast budgets and evaluate deal performance with clarity. Harness this tool for robust real estate syndication financial forecasting and maximize your investment returns confidently.

Business Top Expenses Spreadsheet

Effective cost management is crucial for startups and established firms to sustain strong profitability. Leveraging a real estate syndication pro forma and financial forecasting tools enables precise expense tracking and optimization. Our pro forma financial statements template includes a Top Expense Report, highlighting the four largest expense categories alongside an 'Other' segment. This streamlined real estate syndication investment analysis supports continuous monitoring of cost trends, empowering investors to enhance their budget forecast and maximize ROI through informed decision-making.

REAL ESTATE SYNDICATION FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

A comprehensive real estate syndication financial forecasting plan is essential to accurately estimate costs, assess risks, and project key financial ratios. Utilizing models such as the real estate syndication pro forma and cash flow model, investors gain clear insights into potential deal performance and areas requiring strategic focus. These forecasts not only enhance investment return modeling and sensitivity analysis but also play a crucial role in securing investor confidence by transparently outlining expenses and projected returns. Ultimately, robust financial projections drive informed decision-making and position your syndication for long-term success.

CAPEX Spending

A well-structured capital expenditure budget is essential in real estate syndication pro forma and financial projections. It provides critical insight into asset growth, enabling accurate real estate syndication investment analysis and effective monitoring of capital spending. Integrating CAPEX data within your real estate syndication underwriting model ensures precise startup expense forecasting, enhancing your real estate syndication ROI calculator and overall deal analysis. This thorough approach supports reliable real estate syndication financial forecasting, empowering investors to optimize cash flow and maximize returns.

Loan Financing Calculator

In real estate syndication, an accurate cash flow model and pro forma are essential for tracking loan commitments and repayment schedules. Incorporating the debt service model into the investment analysis and financial projections ensures precise monitoring of interest payments and maturity terms. This approach strengthens the capital stack model and equity waterfall model while aligning with budget forecasts and profit and loss models. By integrating these elements, sponsors can enhance their ROI calculator and internal rate of return assessments, enabling strategic decisions based on comprehensive sensitivity analysis and partnership models for long-term success.

REAL ESTATE SYNDICATION FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Our real estate syndication budget forecast model enables you to visually track critical financial KPIs over 24 months to five years. Monitor EBITDA/EBIT for operational performance, analyze detailed cash flow projections to understand inflows and outflows, and forecast your cash balance to manage liquidity effectively. This comprehensive financial forecasting tool supports your investment analysis, underwriting model, and ROI calculations, empowering confident real estate syndication deal analysis and strategic decision-making.

Cash Flow Forecast Excel

A robust real estate syndication cash flow model is essential for accurately forecasting income and expenses, ensuring sufficient cash inflows to cover operational costs like payroll and overhead. Integrated within a comprehensive real estate syndication pro forma, this tool enables precise financial projections and investment analysis, helping sponsors assess liquidity without relying on additional financing. Leveraging a detailed cash flow forecasting model supports informed decision-making, optimizes capital stack management, and drives stronger syndication ROI through proactive budgeting and sensitivity analysis.

KPI Benchmarks

A benchmarking study is essential in real estate syndication financial forecasting, providing an objective foundation for profit and loss models. By comparing key metrics—such as unit costs, profit margins, and productivity—against industry leaders or similar ventures, you gain valuable insights. This comparative analysis enhances your real estate syndication investment analysis and ROI calculator accuracy, helping startups and seasoned investors optimize their equity waterfall models and cash flow projections. Ultimately, benchmarking delivers a comprehensive evaluation of your financial base, driving smarter deal analysis and more confident underwriting decisions.

P&L Statement Excel

The projected profit and loss model is a crucial component of real estate syndication financial projections, offering investors a clear view of profitability relative to operating costs. While the profit and loss forecast provides valuable insight into income generation, it doesn’t reveal cash flow, capital stack, or asset-liability details. For comprehensive real estate syndication investment analysis, combining the profit and loss model with cash flow models, equity waterfall structures, and underwriting models ensures a holistic understanding of deal performance and ROI potential. Integrating these tools leads to more accurate financial forecasting and smarter investment decisions.

Pro Forma Balance Sheet Template Excel

Our real estate syndication pro forma balance sheet offers a precise snapshot of assets, liabilities, and equity at a given time, essential for comprehensive investment analysis. Designed to integrate seamlessly with your real estate syndication cash flow model and financial projections, it empowers investors to assess the capital stack model and debt service with clarity. This tool enhances your real estate syndication underwriting model by delivering accurate financial forecasting and supports informed decision-making through detailed profit and loss insights. Elevate your deal analysis and ROI calculations with a reliable pro forma balance sheet tailored for successful syndication partnerships.

REAL ESTATE SYNDICATION FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our real estate syndication pro forma integrates Weighted Average Cost of Capital (WACC) to accurately assess capital costs across equity and debt layers in the capital stack model. Utilizing discounted cash flows (DCF) within the financial forecasting framework, we precisely value future cash flows to enhance investment return modeling. This approach strengthens real estate syndication deal analysis and underwriting models, empowering investors with reliable insights into cash flow models, ROI calculators, and internal rate of return metrics to optimize partnership models and maximize cash-on-cash returns.

Cap Table

A pro forma cap table is a vital financial tool in real estate syndication, seamlessly integrated into our comprehensive financial forecasting model. It details ownership stakes through multiple funding rounds, including equity shares, preferred shares, and convertible instruments. This precision supports accurate real estate syndication investment analysis by projecting shareholder dilution and capital structure shifts. Leveraging this model enhances your ability to perform real estate syndication deal analysis, equity waterfall modeling, and partnership assessments, ultimately optimizing your investment return model and ensuring informed decision-making throughout your syndication journey.

REAL ESTATE SYNDICATION FINANCIAL MODELING FOR STARTUPS ADVANTAGES

The real estate syndication financial model delivers precise clarity and maximizes investor confidence through detailed financial projections.

Unlock confident investments with real estate syndication financial forecasts, empowering precise 5-year cash flow and ROI projections.

Start a new business with real estate syndication financial models that optimize ROI and enhance investment decision-making.

The real estate syndication pro forma Excel model enhances team alignment and streamlines investment decision-making effectively.

The real estate syndication financial model enhances accurate ROI forecasting and optimizes investment decision-making efficiently.

REAL ESTATE SYNDICATION BUSINESS PLAN FORECAST TEMPLATE ADVANTAGES

Maximize investor confidence with a precise real estate syndication cash flow model for strategic funding and growth planning.

Impress investors with a proven real estate syndication financial model that ensures accurate ROI and confident investment decisions.

The real estate syndication cash flow model confidently proves your loan repayment ability with accurate, data-driven financial forecasting.

Real estate syndication cash flow models provide lenders clear repayment forecasts, increasing loan approval confidence and investment success.

Real estate syndication financial forecasting ensures accurate cash flow projections, building stakeholder trust and streamlining investment decisions.

Accurate real estate syndication financial models ensure clear projections, satisfying bank loan requirements and optimizing investor confidence.

The real estate syndication cash flow model maximizes ROI by providing accurate, dynamic financial projections for smarter investment decisions.

Streamlined real estate syndication financial models enable efficient hypothesis testing and precise investment decision-making.

Real estate syndication cash flow models identify potential cash shortfalls early, ensuring proactive financial management and stability.

The real estate syndication financial forecasting model empowers proactive decisions by identifying risks and maximizing investment returns early.