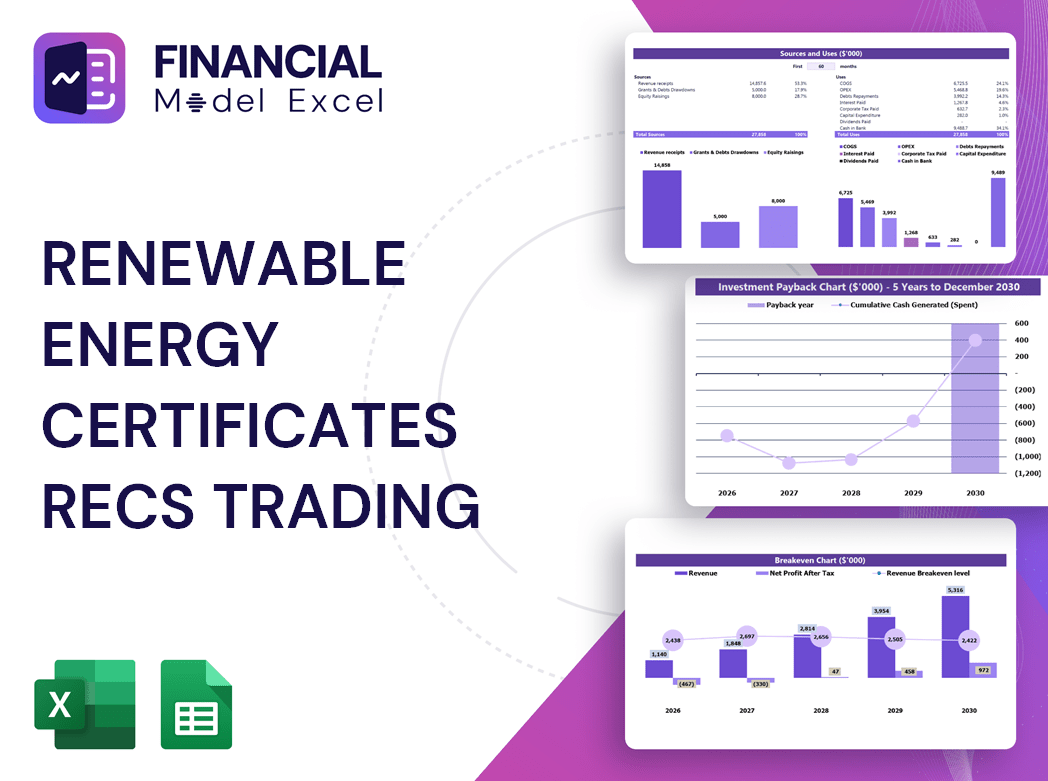

Renewable Energy Certificates RECs Trading Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Renewable Energy Certificates RECs Trading Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Renewable Energy Certificates RECs Trading Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

RENEWABLE ENERGY CERTIFICATES RECS TRADING FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year renewable energy certificates trading model in Excel integrates a robust RECs financial forecasting model featuring consolidated monthly profit and loss statements, balance sheet, and cash flow projections. It includes key financial charts, summaries, and funding forecasts tailored for renewable energy credits market analysis and RECs valuation methods. Designed to support renewable energy certificates financial planning and RECs trading platform financials, this template offers an advanced renewable energy certificates price modeling and RECs cost-benefit analysis framework, empowering users to simulate market price dynamics and execute informed RECs trading strategy financial models. Fully unlocked for customization, it is an essential tool for evaluating renewable energy credits investment models before committing to purchase.

This ready-made renewable energy certificates trading model Excel template addresses key pain points faced by buyers by integrating comprehensive RECs financial forecasting models and detailed renewable energy certificates revenue models, enabling accurate RECs price modeling and market price simulation to manage volatility. It simplifies complex renewable energy credits market analysis with built-in RECs supply and demand models and cost-benefit analysis, facilitating strategic investment decisions through reliable RECs trading strategy financial models. The template enhances financial planning and risk assessment by providing robust RECs cash flow projections and economic impact models, while its lifecycle financial analysis and accounting modules enable transparent tracking of profitability and expenses, ensuring buyers can confidently navigate the fluctuating market dynamics and optimize trading platform financials with ease.

Description

Our renewable energy certificates trading model incorporates a comprehensive RECs financial forecasting model featuring detailed 5-year cash flow projections and revenue modeling, designed to streamline financial planning and operational decision-making. This dynamic Excel-based template integrates renewable energy credits market analysis and RECs price modeling with advanced valuation methods, enabling users to perform robust cost-benefit analysis, economic impact assessments, and risk evaluation tailored for the renewable energy certificates market dynamics. The model offers monthly and yearly projected income statements, balance sheets, and cash flow analysis templates, consolidating discounted cash flow valuation for precise RECs trading profitability modeling. Additionally, it calculates critical financial performance ratios and KPIs that support renewable energy credits investment models, accounting frameworks, and lifecycle financial analyses, all optimized to enhance RECs trading platform financials and trading strategy financial models for both startups and established entities.

RENEWABLE ENERGY CERTIFICATES RECS TRADING FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our Renewable Energy Certificates (RECs) Trading Financial Model offers comprehensive financial planning tools essential for startups and established businesses. Featuring detailed profit and loss projections, cash flow forecasts, and balance sheet templates, it supports robust RECs financial forecasting and market price simulation. This model enables in-depth renewable energy credits market analysis, lifecycle financial analysis, and cash flow projections, empowering users to assess trading profitability and execute strategic decision-making with confidence. Ideal for navigating renewable energy certificates market dynamics, it ensures precise valuation methods and cost-benefit analysis to optimize your RECs trading platform financials.

Dashboard

Our financial planning dashboard integrates advanced renewable energy certificates price modeling and RECs cash flow projections, presenting key metrics through intuitive graphs and charts. It offers a detailed breakdown of revenues by year, profit and loss insights, and dynamic renewable energy credits market analysis. Designed for precision and clarity, this platform streamlines forecasting and risk assessment, enabling informed decisions based on comprehensive RECs valuation methods and market dynamics. Experience enhanced financial planning with accurate, well-organized data that drives profitability and strategic growth in the renewable energy certificates trading model.

Business Financial Statements

Our comprehensive RECs cash flow projections and financial forecasting model empower entrepreneurs to accurately analyze renewable energy certificates market dynamics and revenue streams. Equipped with advanced renewable energy credits market analysis and price modeling tools, this template streamlines the creation of detailed financial statements and projections. Dynamic charts and graphs enhance stakeholder presentations, clearly communicating insights from RECs valuation methods and trading profitability models. Ideal for investors and decision-makers, this solution supports robust renewable energy certificates financial planning and risk assessment, driving informed investments within the renewable energy certificates trading model.

Sources And Uses Statement

A robust sources and uses template is essential for accurately tracking the origins of company income and the allocation of funds. Integrating this with a comprehensive renewable energy certificates trading model or RECs financial forecasting model enhances transparency and decision-making. This approach supports effective renewable energy certificates financial planning and facilitates precise renewable energy credits market analysis, ultimately optimizing RECs cash flow projections and improving overall profitability within the renewable energy certificates revenue model.

Break Even Point In Sales Dollars

A break-even analysis graph is vital in renewable energy certificates financial planning, distinctly separating sales, revenue, and profit. Revenue reflects the total income from REC sales, while profit accounts for revenue minus all fixed and variable expenses. Integrating this with RECs cash flow projections and trading platform financials enhances accuracy. Leveraging RECs economic impact models alongside cost-benefit analysis ensures informed decisions in the renewable energy credits market. This clarity drives effective RECs trading strategy financial models, boosting profitability and sustainable growth within the renewable energy certificates market dynamics.

Top Revenue

In financial planning, projecting the top line and bottom line in income statements is crucial. The top line reflects revenue growth—essential for assessing a company’s sales performance and its impact on overall financial health. Analysts and investors closely monitor these metrics quarterly and annually, as they drive key outcomes like profitability and cash flow. Applying this to renewable energy certificates trading models, incorporating RECs revenue models and price modeling enhances accurate financial forecasting, enabling strategic decision-making and optimized market performance.

Business Top Expenses Spreadsheet

In the Top Expenses section of our business plan template, key company costs are categorized into four main areas. The ‘Other’ category offers flexibility to include any additional, company-specific expenses essential to your operations. Utilize the integrated RECs financial forecasting model within the Excel template to accurately track and project your renewable energy certificates price modeling, cash flow projections, and overall financial performance over five years. This ensures strategic financial planning aligned with market dynamics and enhances your renewable energy credits investment model for sustainable growth.

RENEWABLE ENERGY CERTIFICATES RECS TRADING FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our advanced renewable energy certificates financial planning model is your essential tool for accurate cost estimation, risk assessment, and financial ratio analysis. By integrating RECs market dynamics and price modeling, it presents data clearly to identify potential challenges and optimize resource allocation. This comprehensive RECs trading profitability model empowers you to make informed decisions, ensuring operational efficiency and stakeholder confidence. Ideal for investors and creditors, it’s a critical component of any renewable energy credits investment model, helping you navigate market complexities with precision and foresight.

CAPEX Spending

Effective financial planning hinges on precise capital expenditure forecasts, integral to strengthening the company’s position across all dimensions. Incorporated within the startup budget, these forecasts ensure strategic allocation of investments, addressing every organizational need. Leveraging advanced RECs financial forecasting models and renewable energy certificates revenue models enables optimized investment in modern technologies and innovative business management methods. By combining renewable energy certificates market dynamics with RECs cost-benefit analysis, companies can drive sustainable growth while maximizing financial performance and competitive advantage in the renewable energy credits market.

Loan Financing Calculator

Start-ups and growing businesses must integrate detailed loan payback schedules into their financial planning, capturing principal amounts, maturities, and interest costs. Incorporating this into cash flow projections ensures accurate forecasting of debt-related outflows, directly impacting the renewable energy certificates trading platform financials. Interest expenses influence cash flow models, while principal repayments reflect in monthly cash flow statements and projected balance sheets. Leveraging robust RECs financial forecasting models and cost-benefit analysis enhances strategic decision-making, optimizing capital management and aligning debt servicing with sustainable growth in renewable energy credits investment models.

RENEWABLE ENERGY CERTIFICATES RECS TRADING FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Leverage our Renewable Energy Certificates (RECs) trading financial model to track your company’s performance with precision. This pro forma projection integrates essential KPIs, presenting clear, dynamic charts that enhance financial planning and decision-making. Optimize your renewable energy credits market analysis and streamline cash flow projections to boost profitability. Empower your investment strategy with advanced RECs price modeling and cost-benefit analysis, ensuring a comprehensive view of market dynamics and economic impact. Elevate your financial forecasting and unlock the full potential of your RECs trading platform with insightful, data-driven performance metrics.

Cash Flow Forecast Excel

The operating cash flow model within our renewable energy certificates trading platform financials focuses exclusively on cash generated through core business operations. By isolating operational cash flows from secondary income like interest or investments, this RECs financial forecasting model delivers precise insights into the company’s core revenue strength. Utilize this model for accurate RECs cash flow projections, enabling informed decision-making and robust renewable energy certificates financial planning that drives sustainable growth and profitability in the dynamic RECs market.

KPI Benchmarks

The renewable energy certificates trading model incorporates a benchmark tab that calculates key financial indicators to validate company performance. By comparing these metrics against industry peers through renewable energy credits market analysis, businesses gain valuable insights. This comparative approach supports strategic financial planning, enabling optimized RECs cost-benefit analysis and risk assessment. Especially for start-ups, leveraging RECs financial forecasting models and market price simulations ensures informed, data-driven decisions. Ultimately, these benchmark indicators empower your company to enhance RECs trading strategy financial models and maximize profitability in the dynamic renewable energy credits market.

P&L Statement Excel

A robust renewable energy certificates trading model is essential for investors and entrepreneurs to evaluate market potential before committing resources. Utilizing RECs financial forecasting models and renewable energy credits market analysis enables precise RECs price modeling and cash flow projections. This approach offers clear insights into profitability through RECs trading platform financials and comprehensive RECs cost-benefit analysis. By applying advanced RECs valuation methods and renewable energy certificates revenue models, stakeholders can confidently navigate market dynamics, optimize trading strategies, and enhance financial planning for sustainable, profitable investments in the renewable energy credits market.

Pro Forma Balance Sheet Template Excel

The pro forma balance sheet is a critical financial statement showcasing your renewable energy certificates (RECs) trading model’s assets, liabilities, and equity at a specific point in time. This snapshot is essential for projecting your RECs trading platform financials, providing transparency on key assets like equipment and infrastructure. Lenders and investors rely heavily on this statement to evaluate loan security and investment viability. Integrating advanced RECs financial forecasting models and cost-benefit analyses ensures accurate renewable energy certificates market dynamics are reflected, strengthening your renewable energy credits investment model and supporting strategic financial planning.

RENEWABLE ENERGY CERTIFICATES RECS TRADING FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Understanding the inherent risks in business, our seed stage valuation sheet integrates key RECs financial forecasting models, offering a clear snapshot of NPV, IRR, and ROIC. This comprehensive 5-year renewable energy certificates revenue model consolidates critical market dynamics and customer data, enabling accurate cash flow projections. Designed for strategic financial planning, it empowers stakeholders to evaluate sustainability, optimize RECs trading profitability models, and make informed investment decisions within the renewable energy credits market.

Cap Table

Our comprehensive renewable energy certificates (RECs) trading financial model provides in-depth market value analysis, integrating RECs price modeling and market dynamics. The pro forma cap table empowers investors to evaluate share capital and optimize financial planning for RECs trading strategies. Featuring advanced RECs financial forecasting, cash flow projections, and valuation methods, this Excel template offers all essential proformas for thorough renewable energy credits market analysis. Equip yourself with precise RECs trading profitability models and risk assessments to make informed investment decisions—available now for immediate purchase.

RENEWABLE ENERGY CERTIFICATES RECS TRADING FINANCIAL MODELING FOR STARTUPS ADVANTAGES

Unlock growth potential with RECs trading financial model delivering precise startup financial projections and strategic market insights.

The RECs financial forecasting model empowers strategic decisions by accurately projecting cash flows and optimizing profitability.

Enhance your pitch with a tailored financial summary for your RECs trading financial model, showcasing clear investment advantages.

The RECs trading financial model accurately forecasts startup expenses, enabling strategic investment and optimized financial planning.

Our RECs trading financial model accurately forecasts expenses, optimizing strategic planning and maximizing renewable energy investment returns.

RENEWABLE ENERGY CERTIFICATES RECS TRADING BUSINESS PLAN FORECAST TEMPLATE ADVANTAGES

Our RECs financial forecasting model empowers investors with precise insights for maximizing renewable energy credits trading profitability.

Our RECs financial forecasting model delivers precise cash flow projections and monthly profit and loss statements for optimized profitability.

Optimize budgets effectively with the RECs financial forecasting model, ensuring precise spending control and profitable investments.

The RECs cash flow projections model enables precise forecasting of future revenues and expenses for strategic financial planning.

Optimize funding pitches with our RECs trading strategy financial model for accurate forecasting and maximum profitability.

Impress investors with a strategic RECs trading financial model that ensures accurate forecasting and maximizes renewable energy revenue.

Our RECs financial forecasting model ensures confident, data-driven decisions for maximizing renewable energy investment returns.

Our RECs financial forecasting model enables precise planning, risk management, and five-year cash flow projection for informed decisions.

Our RECs financial forecasting model empowers strategic planning, maximizing profitability and ensuring sustainable future growth.

The RECs cash flow projections model empowers precise financial planning, driving sustainable growth and strategic renewable energy investments.