Restaurant Delivery Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Restaurant Delivery Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Restaurant Delivery Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

RESTAURANT DELIVERY FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive restaurant delivery financial planning model offers a detailed five-year financial projection template, including a cash flow model and core financial metrics in GAAP/IFRS formats, ideal for business plans and investment analysis. The integrated restaurant delivery cost analysis model and expense tracking model enable precise budgeting and cost structure management, while the sales projection and revenue forecast models help optimize pricing strategy and maximize profit margins. With its versatile three-way financial framework, this startup financial model allows you to evaluate financial viability, perform break-even analysis, and monitor financial performance, all fully unlocked for customization to support your restaurant delivery business's growth and operational success.

This comprehensive restaurant delivery financial planning model addresses critical pain points by integrating a robust restaurant delivery cost analysis model, expense tracking model, and pricing strategy model, enabling users to optimize profit margins and operational efficiency. It simplifies complex financial forecasting through a dynamic restaurant delivery revenue forecast model and sales projection model, aiding in realistic budgeting and cash flow management. With built-in restaurant delivery break-even analysis and investment analysis models, it provides clarity on financial viability and startup sustainability, while the income statement and financial statement models offer transparent insights into business performance, allowing buyers to confidently anticipate financial outcomes and make informed strategic decisions.

Description

The restaurant delivery financial planning model offers a comprehensive framework combining essential components such as cost analysis, revenue forecast, expense tracking, and break-even analysis to provide a clear picture of financial viability and performance. Integrating a robust restaurant delivery budgeting model and pricing strategy model, it enables precise profit margin calculations and cash flow management, all supported by detailed financial statement models including projected income statements and cash flow templates. This operational financial model is designed to streamline startup financials, enhance investment analysis, and deliver actionable sales projection insights, making it an indispensable tool for both emerging and established restaurant delivery businesses aiming to optimize their cost structure and maximize profitability.

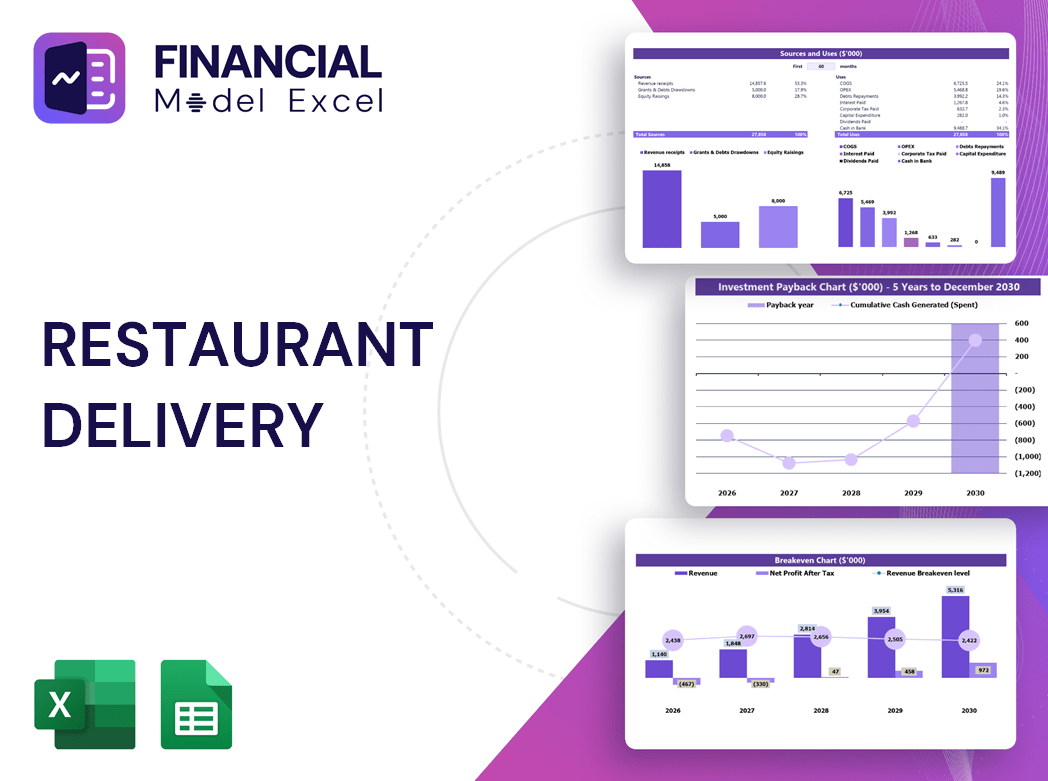

RESTAURANT DELIVERY FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Unlock growth with our comprehensive restaurant delivery financial planning model, featuring robust 3-statement integration and dynamic scenario analysis. Designed for scalability, this template encompasses expense tracking, revenue forecasting, cost structure, and profit margin models to ensure your business plan is both resilient and adaptable. Tailor key assumptions and projections to your unique operations, enabling precise budgeting, cash flow management, and break-even analysis. Our tested restaurant delivery financial model empowers confident decision-making for startups and established businesses alike, providing clarity on financial viability and optimizing your pricing strategy for sustained success.

Dashboard

Our restaurant delivery financial planning model features a dynamic dashboard for precise financial forecasting and reporting, vital for stakeholder confidence. This tool streamlines cost analysis, revenue forecasting, and budgeting, empowering startups to monitor expense tracking, profit margins, and cash flow effortlessly. By integrating break-even analysis and sales projections, it ensures a comprehensive financial viability assessment. Designed to enhance operational financial management, this model supports data-driven strategies that drive growth and maximize resources, making it an indispensable asset for any restaurant delivery business aiming for sustainable success.

Business Financial Statements

The restaurant delivery startup financial model encompasses three key statements: the income statement details revenues, expenses, and non-cash items like depreciation; the balance sheet provides a snapshot of assets, liabilities, and equity, adhering to the fundamental accounting equation; and the cash flow model tracks cash inflows and outflows from operating, investing, and financing activities. Together, these financial planning and forecasting tools enable comprehensive cost analysis, profit margin evaluation, and break-even insight, essential for informed budgeting, pricing strategies, and investment analysis in the restaurant delivery business.

Sources And Uses Statement

The sources and uses of funds schedule is essential in a restaurant delivery financial planning model, offering clear visibility into capital inflows and their specific allocation. By integrating this with expense tracking and budgeting models, businesses can accurately monitor investments, control costs, and optimize cash flow. This transparency supports effective financial forecasting and strengthens the overall financial viability of the restaurant delivery venture.

Break Even Point In Sales Dollars

A restaurant delivery break-even analysis model identifies the sales volume needed to cover fixed and variable costs, pinpointing when profitability begins. Integrated within a comprehensive restaurant delivery financial planning model, it enables precise revenue forecasting and expense tracking. This tool empowers management to optimize pricing strategy and cost structure, ensuring financial viability. By adjusting assumptions and sales projections, stakeholders gain insights into investment return timelines and overall business sustainability, making it essential for startup financial modeling and ongoing operational financial performance evaluation.

Top Revenue

The restaurant delivery startup financial model template Excel’s Top Revenue tab provides a detailed annual breakdown of your revenue streams. Utilize this financial forecasting template to analyze revenue depth, bridge gaps, and enhance your restaurant delivery revenue forecast model. This tool supports comprehensive financial planning, allowing you to optimize your pricing strategy, cost structure, and overall financial performance for sustainable growth.

Business Top Expenses Spreadsheet

This comprehensive restaurant delivery financial planning model features a dedicated "Top Expenses" tab, categorizing costs into four key areas plus an additional "Other" category. This flexible structure allows precise tracking and analysis of diverse expense types, empowering you to optimize your restaurant delivery budgeting model and enhance overall financial performance.

RESTAURANT DELIVERY FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

The restaurant delivery financial planning model is a vital tool designed to analyze costs, forecast revenues, and evaluate financial viability. By incorporating expense tracking, pricing strategy, and break-even analysis models, it provides a comprehensive outlook on profit margins and cash flow management. This operational financial model identifies potential challenges early, enabling strategic solutions to optimize performance. Essential for securing investments and loans, it ensures precise budgeting and accurate financial projections, empowering restaurant delivery businesses to make informed decisions and achieve sustainable growth.

CAPEX Spending

CAPEX start-up expenses represent significant investments in assets critical to a restaurant delivery startup’s success. Each capital expenditure follows a specific accounting timeline and must be accurately captured in the restaurant delivery startup financial model. These strategic investments enhance operational efficiency, technology, or equipment, driving higher outputs and profitability. Proper integration of CAPEX in the projected balance sheet, profit and loss statement model, and monthly cash flow model ensures precise financial forecasting and informed decision-making for sustainable growth.

Loan Financing Calculator

Start-ups and early-stage restaurant delivery businesses must meticulously manage loan repayment schedules within their financial planning models. These schedules provide a detailed breakdown of loan amounts and maturity terms, crucial for accurate cash flow forecasting. Incorporating principal repayments under financing activities and tracking interest expenses ensures precise projections in the restaurant delivery cash flow model. This integration directly impacts the company’s financial viability, supporting robust financial forecasting and investment analysis. Utilizing a comprehensive restaurant delivery operational financial model enables businesses to maintain healthy profit margins and make informed budgeting and cost analysis decisions.

RESTAURANT DELIVERY FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Our restaurant delivery financial forecasting template includes a comprehensive internal rate of return (IRR) analysis within its 5-year projection model. IRR represents the discount rate that brings net present value (NPV) to zero based on the business’s net cash flows from investments. This key metric empowers investors and owners to evaluate financial viability effectively. A higher IRR signals stronger profitability and makes the restaurant delivery business more attractive to stakeholders, enhancing confidence in the restaurant delivery revenue forecast model and overall investment analysis strategies.

Cash Flow Forecast Excel

A restaurant delivery cash flow model provides a detailed overview of all cash inflows and outflows within a specific period. This essential financial tool enables accurate tracking of liquidity, ensuring your business maintains operational efficiency. By integrating this model into your restaurant delivery financial planning, you gain valuable insights to optimize budgeting, forecast revenue, and manage expenses effectively. Harness the power of a comprehensive cash flow statement to enhance your financial forecasting and secure sustained profitability in a competitive market.

KPI Benchmarks

A benchmarking study is vital for an accurate restaurant delivery income statement model, enabling objective assessment of business potential. By comparing key financial metrics—such as unit costs, profit margins, and productivity—with industry peers, restaurant delivery startups gain strategic insights. This approach enhances financial forecasting, cost analysis, and revenue projections, ensuring a robust operational financial model. Ultimately, benchmarking drives informed decision-making, strengthens financial viability, and elevates restaurant delivery business model financials for sustainable growth.

P&L Statement Excel

The monthly profit and loss projection is essential for assessing your restaurant delivery startup’s financial health, enabling accurate long-term revenue forecast and cost analysis. Utilizing a reliable 5-year restaurant delivery financial planning model empowers you to estimate profits, losses, and cash flow with precision. Integrating this with a comprehensive expense tracking and budgeting model enhances your business planning, delivering insightful financial performance metrics. This holistic approach ensures your restaurant delivery financial viability, supports investment analysis, and refines pricing strategy, driving your business toward sustainable success and informed decision-making.

Pro Forma Balance Sheet Template Excel

Our comprehensive restaurant delivery financial planning model includes a detailed monthly and yearly pro forma balance sheet, seamlessly integrated with a 5-year cash flow projection template. It also features a projected profit and loss statement alongside key financial inputs, enabling precise budgeting, cost analysis, and revenue forecasting. This model empowers startups to optimize pricing strategy, monitor expense tracking, and assess financial viability with confidence, ensuring a robust foundation for sustainable growth and profitability in the competitive restaurant delivery market.

RESTAURANT DELIVERY FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Net Present Value (NPV) is a critical component of any restaurant delivery financial planning model, capturing the present value of all future cash flows—both positive and negative—throughout the investment’s lifespan. This comprehensive restaurant delivery financial forecasting template integrates key metrics including initial investment, equity raised, projected net income, total investment, WACC, EBITDA, and growth rate. Leveraging this model enhances your restaurant delivery business model financials by providing precise investment analysis and cash flow insights, crucial for strategic decision-making and maximizing profitability in a competitive market.

Cap Table

Our restaurant delivery financial planning model features a comprehensive cap table excel, empowering business owners to accurately assess shareholder ownership dilution. Designed with flexibility, the cap table incorporates up to four funding rounds, allowing users to apply one, two, or all rounds seamlessly within their financial projections. This robust tool integrates effortlessly with revenue forecast, cost analysis, and profit margin models, enabling precise financial forecasting and strategic decision-making to drive your restaurant delivery business toward sustained profitability.

RESTAURANT DELIVERY EXCEL FINANCIAL MODEL TEMPLATE ADVANTAGES

The restaurant delivery financial forecasting template minimizes risk by accurately projecting five-year revenue and expense growth.

The restaurant delivery financial forecasting template optimizes budgeting and boosts profitability through precise, data-driven insights.

The restaurant delivery budgeting model ensures precise spending control, maximizing profit and sustaining financial health efficiently.

Unlock profitable insights and drive growth with our comprehensive restaurant delivery financial planning model.

Easily optimize profits and forecast cash flow with our comprehensive restaurant delivery financial model for strategic planning.

RESTAURANT DELIVERY BUSINESS PROJECTION TEMPLATE ADVANTAGES

Our restaurant delivery financial planning model builds stakeholder trust through transparent, accurate, and insightful financial projections.

A restaurant delivery cash flow model ensures clear financial foresight, building investor confidence and securing critical funding.

Simplify budgeting and boost profits with our simple-to-use restaurant delivery financial planning model.

This sophisticated restaurant delivery financial model delivers quick, reliable insights with minimal Excel skills, fueling confident business growth.

The restaurant delivery financial planning model ensures accurate budgeting and maximizes profitability for sustainable business growth.

A restaurant delivery cash flow model empowers strategic decisions by accurately forecasting financial impacts and minimizing business risks.

Our restaurant delivery financial planning model ensures accurate forecasts, maximizing profitability and securing investor confidence confidently.

Accelerate funding with a precise restaurant delivery financial model showcasing clear metrics and boosting investor confidence.

Optimize profits and streamline budgeting with our dynamic restaurant delivery financial planning model—update anytime for real-time insights.

Easily refine your restaurant delivery financial model in Excel to optimize costs, revenue, and profitability from launch onward.