Retail Bank Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Retail Bank Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Retail Bank Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

RETAIL BANK FINANCIAL MODEL FOR STARTUP INFO

Highlights

This robust retail banking financial projection model offers a comprehensive 5-year forecast including projected cash flow statements, profit and loss projections, and detailed financial statements in GAAP or IFRS formats. Designed for precise retail bank budgeting and financial planning, it integrates retail banking revenue models, asset liability management, interest income modeling, and expense forecasting to deliver actionable insights. Perfect for assessing branch performance, loan portfolio management, and customer acquisition costs, this editable template supports capital adequacy analysis and risk assessment financial models tailored to retail banks. Utilize this financial statement model and retail bank cash flow forecasting model to confidently secure funding from banks or investors and optimize your retail bank’s cost structure and profitability.

The retail banking financial forecast model addresses critical pain points by offering a comprehensive retail bank budgeting financial model that simplifies complex financial planning processes in the retail sector. Designed to reduce manual errors and streamline data input, it integrates key components such as the retail bank profit and loss model, loan portfolio financial model retail bank, and retail bank cash flow forecasting model, enabling precise interest income modeling retail banking and expense forecasting. This ready-made Excel template also incorporates vital risk assessment financial model retail bank features and capital adequacy financial model retail bank checks, providing users with actionable insights into asset liability management and branch performance financial model retail bank metrics. Additionally, the retail bank deposit growth model and customer acquisition cost retail bank model help optimize revenue streams and cost structures, while the financial sensitivity analysis retail bank function allows scenario testing to mitigate uncertainties, making it indispensable for stakeholders aiming for accurate, data-driven decision-making without the burden of building intricate models from scratch.

Description

Our retail banking financial forecast model is expertly crafted to support comprehensive bank financial planning in the retail sector, integrating key components such as loan portfolio financial modeling retail bank, asset liability management, and capital adequacy financial models. This sophisticated retail bank budgeting financial model enables the projection of detailed financial statements, including a retail bank profit and loss model and cash flow forecasting model, facilitating accurate forecasting of interest income and service fee revenue. By incorporating elements like retail bank cost structure financial model, customer acquisition cost retail bank model, and branch performance financial model retail bank, it delivers a holistic view of operational efficiency and financial health. Additionally, its robust financial sensitivity analysis retail bank and risk assessment financial model retail bank functionalities empower users to navigate uncertainty with confidence, making it an indispensable tool for optimizing deposit growth and expense forecasting in today’s dynamic retail banking environment.

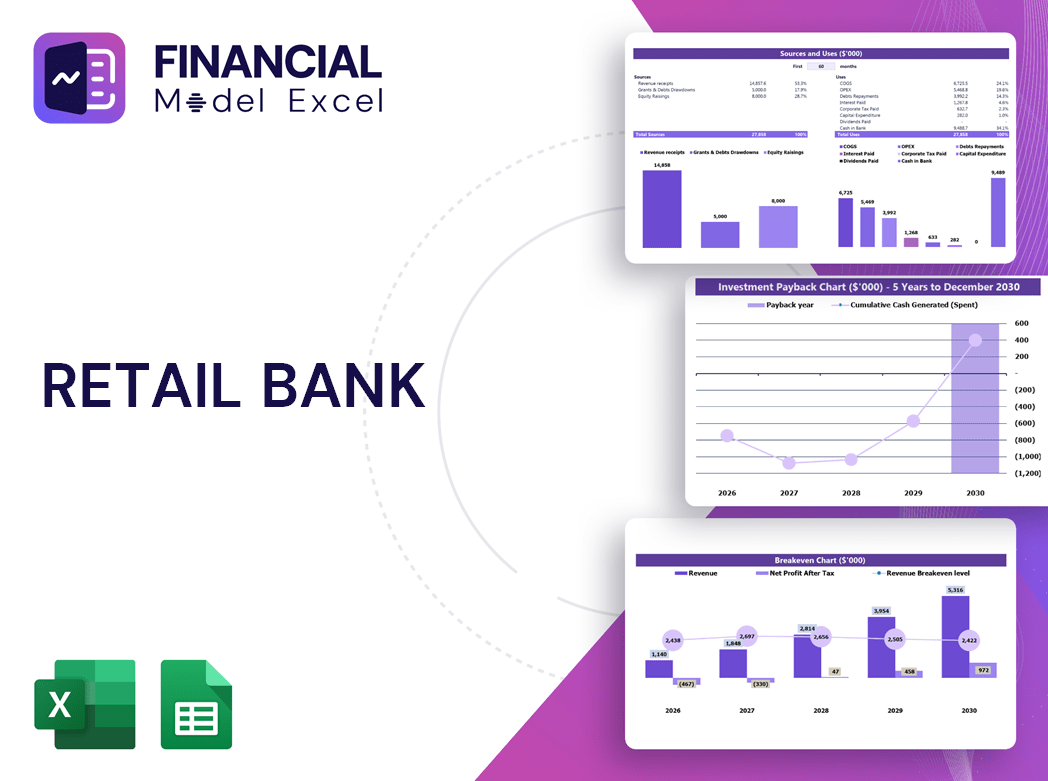

RETAIL BANK FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

A comprehensive retail banking financial forecast model integrates key financial statements: income statement, cash flow forecasting model, and balance sheet. Retail banks regularly update their financial projection models to reflect changes in loan portfolio performance, branch performance, and customer acquisition cost. Annual retail bank profit and loss models validate resource allocation and business strategies, ensuring alignment with budgeting and expense forecasting. This dynamic financial planning enables banks to optimize asset liability management, capital adequacy, and service fee revenue models, driving sustainable growth and profitability in the retail banking sector.

Dashboard

Our platform provides an intuitive dashboard featuring a comprehensive retail banking financial forecast model, enabling seamless collaboration with your stakeholders. Effortlessly access and share detailed financial projection models for retail banks, including loan portfolio, cash flow forecasting, and customer acquisition cost models. Enhance your bank’s financial planning in the retail sector with real-time insights into revenue streams, expense forecasting, and asset-liability management. Streamline budgeting and risk assessment to drive informed decision-making and optimize profitability across your retail banking operations.

Business Financial Statements

A comprehensive retail banking financial forecast model integrates the pro forma profit and loss to detail core revenue-generating operations. Meanwhile, the projected balance sheet and retail bank cash flow forecasting model focus on capital management, encompassing assets, liabilities, and liquidity. Together, these models provide a complete view of a retail bank’s financial health, supporting strategic planning, risk assessment, and performance evaluation across the retail banking sector.

Sources And Uses Statement

This retail banking financial forecast model expertly calculates sources and uses of funds, providing clear insight into their movement and allocation. Designed for precision, it supports comprehensive bank financial planning in the retail sector—enhancing budgeting, cash flow forecasting, and expense management. Utilize this financial projection model for retail banks to optimize loan portfolio management, customer acquisition cost analysis, and branch performance evaluation, ensuring robust profit and loss outcomes and capital adequacy compliance. Elevate your retail bank’s strategic decisions with this dynamic and reliable financial statement and revenue modeling tool.

Break Even Point In Sales Dollars

The break-even point is a vital metric in retail banking financial forecast models, revealing when revenue covers both fixed and variable costs. Our retail bank budgeting financial model integrates break-even analysis visually and mathematically, pinpointing the sales volume needed at a set price to achieve profitability. This essential insight supports effective bank financial planning in the retail sector, ensuring investments and loan portfolios generate positive returns while optimizing the retail bank cost structure financial model for sustainable growth.

Top Revenue

In the Top Revenue tab of your retail banking financial forecast model, generate detailed demand reports for products and services to evaluate profitability across scenarios. The pro forma template enables in-depth analysis of revenue depth and revenue bridges, allowing precise forecasting of demand variations across time periods like weekdays and weekends. This insight empowers strategic resource allocation, optimizing operational efficiency and enhancing the retail bank’s profit and loss model. Harnessing this approach supports accurate retail bank budgeting and financial planning in the retail sector, ultimately driving sustainable growth and revenue optimization.

Business Top Expenses Spreadsheet

The Top Expenses tab provides a detailed summary cost report, essential for tracking and categorizing expenses within your retail bank budgeting financial model. This internal report enables precise monitoring of costs, streamlining tax preparation and supporting accurate retail banking cash flow forecasting. By analyzing expense trends monthly, quarterly, or annually, you can assess variances against projections, facilitating informed adjustments. Leveraging this data enhances your bank financial planning in the retail sector, enabling refined scenario analysis and strategic development of your retail bank profit and loss model for sustainable growth and efficiency.

RETAIL BANK FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

A comprehensive retail banking financial forecast model must incorporate start-up costs, which arise before strategic initiatives begin. Properly managing these expenses is crucial to prevent unforeseen losses or funding shortfalls. Our Retail Bank Financial Projection Model offers a detailed proforma, enabling precise control over initial costs. Designed for retail bank budgeting and financial planning, it supports accurate expense forecasting and capital adequacy analysis, ensuring your institution’s strong financial foundation from day one. Trust our model to guide your loan portfolio, deposit growth, and revenue projections with confidence and clarity.

CAPEX Spending

The automatic startup expenses are integrated within the retail bank cash flow forecasting model, reflecting precise capital expenditures and offering a comprehensive view of cash movement. Additionally, this financial projection model for retail banks incorporates data on alternative revenue streams, enhancing accuracy in the bank’s financial planning retail sector. By leveraging this detailed insight, institutions can optimize their retail banking revenue model and strategically manage costs, ensuring robust financial health from inception.

Loan Financing Calculator

Our retail bank loan portfolio financial model features a comprehensive loan amortization schedule within the 'Capital' tab. This dynamic tool includes pre-built proformas and advanced formulas designed for accurate internal calculations of loan balances, interest income modeling, and equity tracking. Ideal for financial planning in the retail banking sector, it streamlines your bank’s loan management and supports precise forecasting, enhancing your retail bank budgeting and cash flow forecasting models with efficiency and clarity.

RETAIL BANK FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Understanding Customer Acquisition Cost is vital for retail banks aiming to expand their client base. This metric measures the total marketing expenses divided by the number of new customers acquired within a given year. A lower acquisition cost indicates greater efficiency and improved profitability. Our retail bank financial projection model for startups seamlessly integrates this metric, empowering banks with precise insights for strategic growth and optimized budgeting. Leverage this key indicator within our comprehensive retail banking financial forecast model to drive smarter financial planning and enhanced customer acquisition outcomes.

Cash Flow Forecast Excel

Forecasting the cash flow statement is the crucial final step in building a comprehensive retail banking financial forecast model. This process relies heavily on projected balance sheet figures and non-cash items from the income statement, ensuring accurate cash flow forecasting for retail banks. Integrating this within a retail bank cash flow forecasting model enables precise financial planning and budgeting, supporting optimized asset liability management and profitability analysis.

KPI Benchmarks

This retail banking financial forecast model offers a comprehensive benchmarking tool to input critical metrics, enabling detailed comparison with industry peers. By leveraging our retail bank cash flow forecasting model and financial projection model for retail banks, users gain clear insights into operational and financial performance relative to competitors. This powerful retail bank budgeting financial model highlights areas needing improvement, empowering strategic decisions to optimize profitability and growth. With our 5-year financial statement model retail banking, you can confidently address weak spots and strengthen your retail bank’s market position for sustainable success.

P&L Statement Excel

For precise retail banking financial forecasts, an Excel-based retail bank profit and loss model is essential. This versatile financial projection model for retail banks supports monthly and long-term planning, up to five years. It enables accurate budgeting, cash flow forecasting, and interest income modeling, empowering effective bank financial planning in the retail sector. Beyond profit and loss, it provides detailed insights into asset liability management, deposit growth, and expense forecasting. Utilize this financial statement model for retail banking to enhance sales analysis, risk assessment, and overall branch performance, ensuring informed, data-driven decisions that drive sustainable growth.

Pro Forma Balance Sheet Template Excel

The balance sheet forecast is a vital financial statement that offers a clear snapshot of a retail bank’s assets, liabilities, and equity at a specific period. Integral to the retail banking financial forecast model, it enables precise tracking of financial position monthly, quarterly, or annually. Coupled with financial projection models for retail banks, it supports robust bank financial planning, asset liability management, and capital adequacy assessments. Our advanced balance sheet forecast template empowers retail banks to monitor their financial health, evaluate trends, and enhance decision-making with accuracy and confidence.

RETAIL BANK FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This comprehensive retail banking financial forecast model empowers users to conduct detailed Discounted Cash Flow (DCF) valuations with precision. Equipped with tools for analyzing residual value, replacement costs, market comparables, and recent transaction comparables, it enhances financial planning for retail banks. Ideal for retail bank budgeting, profit and loss modeling, and asset liability management, this model supports accurate revenue forecasting and risk assessment. Leverage this financial projection model to optimize your retail bank’s capital adequacy, cost structure, and loan portfolio performance effectively.

Cap Table

The pro forma template, integrated with a detailed cap table, provides a comprehensive overview of your investors’ profiles, their equity stakes, and the capital contributions made. This essential tool supports precise financial forecasting and capital adequacy modeling for retail banks, ensuring transparent ownership representation and informed decision-making in your retail banking financial planning and projection models.

RETAIL BANK FINANCIAL PROJECTION ADVANTAGES

The retail bank cash flow forecasting model accurately predicts break-even points and maximizes return on investment efficiently.

The retail banking financial forecast model empowers precise planning, enhancing profitability and risk management for sustained growth.

The retail banking financial forecast model ensures precise cash flow management, guaranteeing business affordability and sustained growth.

Our retail banking revenue model enhances accurate forecasting, optimizing profitability and strategic financial planning for retail banks.

Retail bank cash flow forecasting model empowers precise budgeting and accelerates strategic financial decision-making for sustained growth.

RETAIL BANK BUSINESS FINANCIAL MODEL TEMPLATE ADVANTAGES

The retail bank budgeting financial model simplifies forecasting, enhancing accuracy and strategic decision-making with ease.

Simplify banking forecasts with our sophisticated, user-friendly retail bank financial projection model—precise results, minimal expertise needed.

The retail bank cash flow forecasting model enables early identification of potential cash shortfalls, ensuring proactive financial management.

The retail banking financial forecast model enables proactive cash flow management, ensuring early detection of potential financial challenges.

Identify cash gaps and surpluses before they happen with our precise retail bank cash flow forecasting model.

The retail bank cash flow forecasting model enables proactive cash management, preventing deficits and optimizing growth opportunities.

Optimize startup growth with our retail banking financial forecast model for accurate, strategic, and actionable financial planning.

Our retail banking financial forecast model delivers clear, concise summaries to enhance your pitch deck’s impact.

Optimize profits and plan future growth with our comprehensive retail banking financial forecast model.

The retail bank cash flow forecasting model empowers precise growth planning and strategic financial decision-making with ease.