Retail Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Retail Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Retail Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

RETAIL FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year retail financial planning model in Excel features prebuilt consolidated profit and loss, balance sheet, and monthly retail cash flow statements, designed specifically for retail business financial modeling. Equipped with key financial KPIs, detailed retail expense forecasting model components, and retail revenue forecasting tools, this retail business financial model provides thorough financial projections for retail startups and established stores alike. Ideal for retail financial analysis and margin analysis, it supports funding presentations and investment decisions, allowing full customization to meet the needs of retail operating budget models and retail finance forecasting tools. Unlock full editing capabilities to tailor the retail investment financial model and secure funding from banks or investors with confidence.

The retail financial planning model addresses common pain points faced by retailers by providing a comprehensive, easy-to-navigate retail budgeting financial model that simplifies complex financial projections for retail businesses. This ready-made retail revenue forecasting model offers accurate retail sales forecasting and expense forecasting capabilities, enabling users to confidently create financial projections for retail operations without needing advanced Excel skills. The integrated retail cash flow model, combined with retail profit and loss model features, ensures a clear understanding of your store’s financial health, while retail financial KPI model and margin analysis tools help track and optimize performance effectively. Additionally, the retail startup financial model and retail investment financial model components support new ventures and funding efforts, making this retail business financial model an invaluable retail finance forecasting tool for making data-driven decisions and impressing investors from day one.

Description

Our comprehensive retail business financial model is an essential tool that integrates retail revenue forecasting, expense forecasting, and profit and loss modeling to provide accurate financial projections for retail operations. Designed as a versatile retail financial templates package, it includes a retail cash flow model and retail operating budget model to ensure effective retail budgeting financial management. By leveraging this retail financial analysis model and retail finance forecasting tool, businesses can perform detailed retail margin analysis and cost modeling, enhancing decision-making processes for retail startups or established retail stores. This retail investment financial model also incorporates a retail sales forecasting model and retail financial KPI model, enabling entrepreneurs to optimize their retail financial statement model while mitigating liquidity risks and fostering sustainable financial growth.

RETAIL FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

A robust retail startup financial model with an investor-friendly interface is essential to secure funding for your business. Combining a comprehensive retail financial statement model with precise retail revenue forecasting and expense forecasting models, you can confidently validate your investment needs. Leveraging retail financial templates and a detailed retail profit and loss model ensures clarity and professionalism, making your financial projections for retail compelling to potential investors. This integrated retail financial planning model serves as the foundation to build trust and demonstrate the viability of your proposed retail venture.

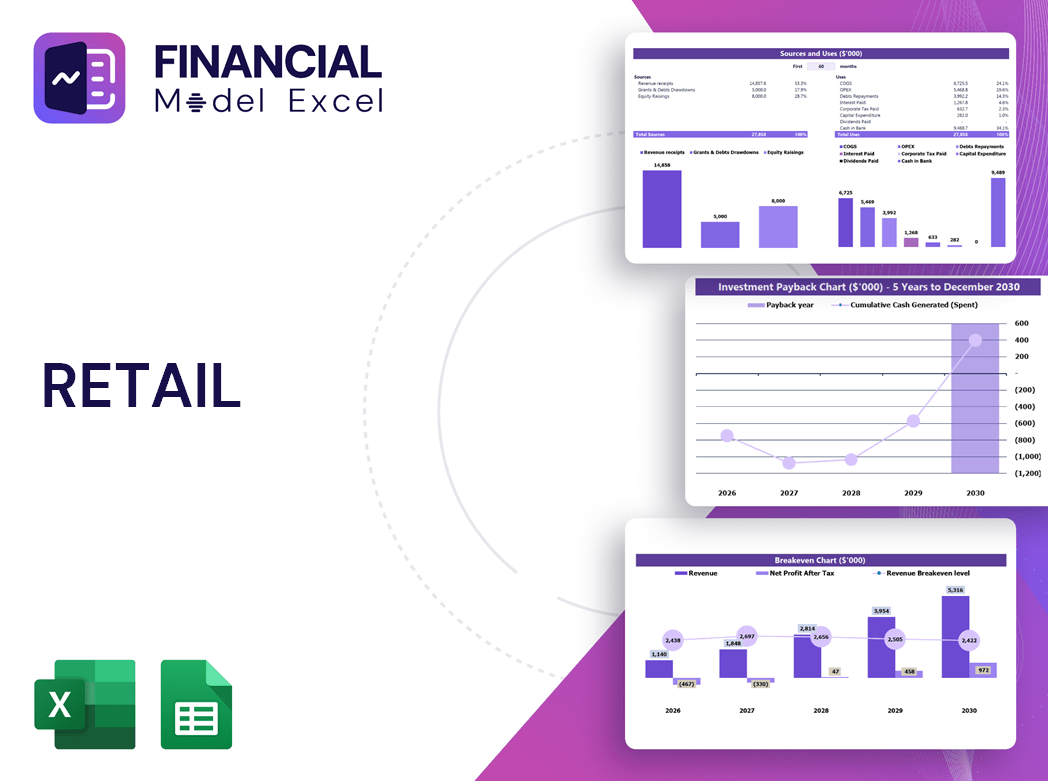

Dashboard

Our retail financial planning model features an intuitive dashboard that provides a comprehensive overview of your retail business financial model. Easily visualize retail revenue forecasting, expense forecasting, and profit and loss insights—all within a single platform. Share these dynamic retail financial templates effortlessly with stakeholders to drive informed decisions and optimize financial projections for retail success.

Business Financial Statements

This comprehensive retail financial planning model effortlessly generates all three essential annual financial statements. Simply input your key assumptions, and our advanced retail startup financial model will automate detailed financial projections for retail operations. Designed to streamline retail budgeting, cash flow, revenue forecasting, and profit and loss analysis, this template empowers you to make informed decisions with ease and precision. Ideal for retail business financial modeling, it saves time while delivering actionable insights to drive profitability and growth.

Sources And Uses Statement

The Sources and Uses of Funds tab within the retail financial planning model offers a clear overview of your company’s capital inflows and categorizes expenditures with precision. This essential feature enhances your retail business financial model by tracking funding sources and aligning them with specific spending areas, ensuring accurate financial projections for retail operations. Ideal for retail budgeting financial models, this tool supports effective retail expense forecasting and drives informed decision-making to optimize cash flow and profitability.

Break Even Point In Sales Dollars

Our retail financial planning model includes a comprehensive break-even revenue calculator, enabling businesses to pinpoint the exact pricing needed to cover costs and achieve profitability. By integrating this tool into your retail budgeting financial model, you can optimize pricing strategies and enhance financial projections for retail operations. Utilize our retail financial templates to seamlessly analyze costs, forecast revenues, and drive informed decision-making with precision and confidence.

Top Revenue

The Top Revenue tab in your retail business financial model enables detailed demand reporting for products and services, revealing profitability and financial appeal across scenarios. Utilize the retail revenue forecasting model to build a revenue bridge, analyzing key drivers like sales volume and unit price over time. This insight supports accurate retail sales forecasting and resource allocation, optimizing sales strategies for different periods such as weekdays and weekends. Leverage these retail financial templates and forecasting tools to enhance financial projections, improve cash flow management, and strengthen overall retail financial planning for sustainable growth.

Business Top Expenses Spreadsheet

The Top Expenses tab in this retail financial planning model categorizes costs into four key groups, providing clear insight into company spending. Featuring a dynamic chart, it visualizes annual expenses such as customer acquisition, payroll, and other operational costs. This retail profit and loss model serves as a vital tool for startups and business planners, enabling accurate retail expense forecasting and informed financial projections. Utilize this comprehensive retail financial analysis model to optimize budgeting, enhance cash flow management, and drive strategic decision-making for sustainable growth.

RETAIL FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our comprehensive retail financial planning model offers precise retail expense forecasting and cash flow management, ensuring your financial resources align with projected costs. Leveraging this retail business financial model, you can identify key budget priorities and optimize spending effectively. This retail startup financial model seamlessly integrates into your business plan, empowering you to deliver clear, data-driven financial projections for retail operations. Impress investors and lenders with transparent retail revenue forecasting and robust retail profit and loss insights, making your financial strategy both actionable and compelling.

CAPEX Spending

The capital expense budget is a critical component of any retail financial planning model. It enables financial analysts to accurately determine startup costs and monitor essential investments. These startup expenses directly impact the retail business’s financial projections and overall performance. Furthermore, capital expenditures are integral to the retail cash flow model, ensuring precise budgeting strategies for new ventures. Incorporating capital expenses into retail financial templates enhances the accuracy of retail expense forecasting models and supports robust financial analysis, empowering retailers to plan confidently and optimize their financial outcomes from day one.

Loan Financing Calculator

Our retail financial planning model features an integrated loan amortization schedule, designed to streamline your retail financial analysis. This user-friendly template breaks down each repayment into principal and interest, aligning with your retail budgeting financial model. Key details include repayment dates, installment amounts, loan terms, interest rates, and payment frequency. Perfectly suited for retail business financial models, it ensures accurate financial projections for retail operations, supporting efficient cash flow management and informed decision-making. Enhance your retail store financial model with this essential tool for precise loan management and forecasting.

RETAIL FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Net profit margin is a key metric within retail financial models, reflecting how effectively a business converts gross revenue into profit. This ratio, found in retail profit and loss models and financial projections for retail, shows net income as a percentage of total sales after deducting costs and expenses. It offers critical insight into a company’s efficiency and profitability, helping guide strategic decisions in retail budgeting financial models and retail revenue forecasting models. Monitoring net profit margin ensures sustainable growth by highlighting how well income exceeds expenses, driving smarter financial planning and stronger retail business performance.

Cash Flow Forecast Excel

Ensure your retail business maintains optimal liquidity with our comprehensive retail cash flow model. Designed to track cash inflows and outflows accurately, this retail financial planning model integrates key metrics like Payable and Receivable Days, working capital, and long-term debt. Ideal for startups and established stores alike, it forecasts net cash flow and cash balances to prevent financing gaps. Utilize this retail finance forecasting tool to confidently manage operations, meet creditor obligations, and sustain profitability. Elevate your financial strategy with a robust retail business financial model tailored for effective cash flow management.

KPI Benchmarks

Our retail financial analysis model includes industry benchmarks that empower you to gauge your company’s performance against top competitors. By leveraging these insights, you can identify key areas for improvement and strategically focus efforts to optimize results. Whether utilizing our retail budgeting financial model or retail revenue forecasting model, this tool guides smarter decision-making to drive profitability and growth within your retail business.

P&L Statement Excel

To make informed business decisions, a robust retail startup financial model is essential. A reliable retail profit and loss model offers clear projections of revenue, expenses, and income, enabling accurate financial analysis. Utilizing this retail financial planning model helps you identify key strengths, optimize operations, and address weaknesses effectively. With comprehensive retail financial templates, including retail revenue forecasting and expense forecasting models, you gain the insights needed to drive sustainable growth and profitability in your retail business.

Pro Forma Balance Sheet Template Excel

A retail startup financial model combines a projected balance sheet and profit and loss model to deliver a comprehensive financial outlook. The balance sheet template highlights the company’s assets, liabilities, and net worth at a specific point, reflecting equity versus debt. Meanwhile, the retail profit and loss model details operational income and expenses over time. Together, they support retail financial analysis by revealing key KPIs like liquidity, solvency, and turnover ratios. This integrated approach enables precise retail revenue forecasting and informed decision-making for sustainable growth.

RETAIL FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our retail startup financial model integrates advanced calculators for Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF). WACC assesses the cost of capital from debt and equity, serving as a vital risk metric in retail finance forecasting tools—widely used by banks when evaluating loan approvals. The DCF component accurately values future cash flows, empowering precise retail investment financial modeling and strategic decision-making. This comprehensive retail financial planning model enhances financial projections for retail ventures, ensuring robust retail revenue forecasting and informed investment analysis.

Cap Table

The retail financial planning model integrates essential tools such as cap table management to track securities including common stock, preferred stock, and options. Maintaining an organized, up-to-date cap table is crucial for retail business owners to make informed decisions on fundraising, employee equity, and potential acquisitions. Leveraging retail financial templates alongside cash flow and revenue forecasting models enhances strategic financial projections for retail, ensuring optimized budgeting, margin analysis, and overall business growth.

RETAIL 5 YEAR PROJECTION TEMPLATE ADVANTAGES

Avoid cash flow shortfalls and boost accuracy with our comprehensive retail financial planning model in Excel.

The retail financial planning model empowers accurate cash flow projections, enhancing strategic decision-making and financial confidence.

Identify payment issues early using the retail financial analysis model for accurate, proactive cash flow management.

The retail financial planning model empowers accurate forecasts, driving strategic growth and attracting top industry talent.

The retail financial planning model minimizes risk by accurately forecasting opportunities for smarter, data-driven business decisions.

RETAIL FINANCIAL PROJECTION MODEL ADVANTAGES

Our simple-to-use retail financial planning model boosts accuracy and streamlines your business’s financial projections effectively.

Our retail financial model delivers fast, accurate projections with minimal Excel skills, empowering businesses at any development stage.

Optimize surplus cash management with a precise retail cash flow model for improved financial control and growth.

The retail cash flow model enables precise forecasting to optimize surplus cash reinvestment and strengthen financial stability.

The retail revenue forecasting model delivers accurate predictions, enabling smarter decisions and maximizing your retail profits effortlessly.

Our retail financial planning model ensures clear, color-coded projections for precise budgeting, forecasting, and transparent financial analysis.

The retail financial planning model empowers better decision making through precise forecasting and comprehensive financial analysis.

Optimize retail cash flow with scenario-based forecasting, empowering confident decisions on staffing and equipment investments.

Optimize spending and stay within budget effortlessly using our precise retail budgeting financial model for confident decision-making.

The retail cash flow model enables precise future cash planning, enhancing budgeting accuracy and informed financial decision-making.