Small Plates Restaurant Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Small Plates Restaurant Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Small Plates Restaurant Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

SMALL PLATES RESTAURANT FINANCIAL MODEL FOR STARTUP INFO

Highlights

Generate a comprehensive 5-year small plates restaurant financial projection utilizing a detailed financial model business plan forecast template, including cash flow charts, a financial dashboard, and core metrics aligned with GAAP/IFRS standards. This small plates restaurant financial planning tool supports accurate restaurant expense tracking, small plates menu pricing strategy, and break-even analysis to optimize operational costs and maximize profitability. Leverage this model for investment analysis and funding requirements, enabling you to secure capital from banks, angels, grants, and VC funds. Fully unlocked and customizable, this restaurant startup financial model ensures efficient budgeting and financial control through a robust small plates restaurant sales forecast and capital expenditure plan.

This small plates restaurant financial model Excel template effectively addresses critical pain points by providing a comprehensive restaurant startup financial model that includes detailed small plates restaurant cost analysis, a break-even analysis, and a dynamic small plates restaurant cash flow model. It simplifies complex financial planning processes with integrated restaurant financial dashboard small plates features and an easy-to-use restaurant expense tracking template, ensuring precise operational cost management. The model’s small plates menu pricing strategy and small plates restaurant sales forecast enable accurate revenue forecasts and financial projections for small plates dining, empowering users to optimize their budget plan and funding requirements. With a fully structured restaurant profit and loss statement and capital expenditure plan, this template facilitates informed investment analysis and financial control, making it an indispensable tool for aligning all stakeholders on realistic financial assumptions and driving business growth confidently.

Description

The small plates restaurant financial model template is a comprehensive startup financial planning tool designed to streamline your budget plan, sales forecast, and expense tracking while providing detailed restaurant profit and loss statements and cash flow models. This adaptable financial projection for small plates dining includes a 5-year monthly and yearly forecast, incorporating key elements such as break-even analysis, operational costs, and capital expenditure plans. With integrated small plates menu pricing strategies and investment analysis, this model supports effective restaurant budgeting and financial control, enabling accurate revenue forecasts and a robust small plates restaurant financial dashboard for monitoring business performance and funding requirements.

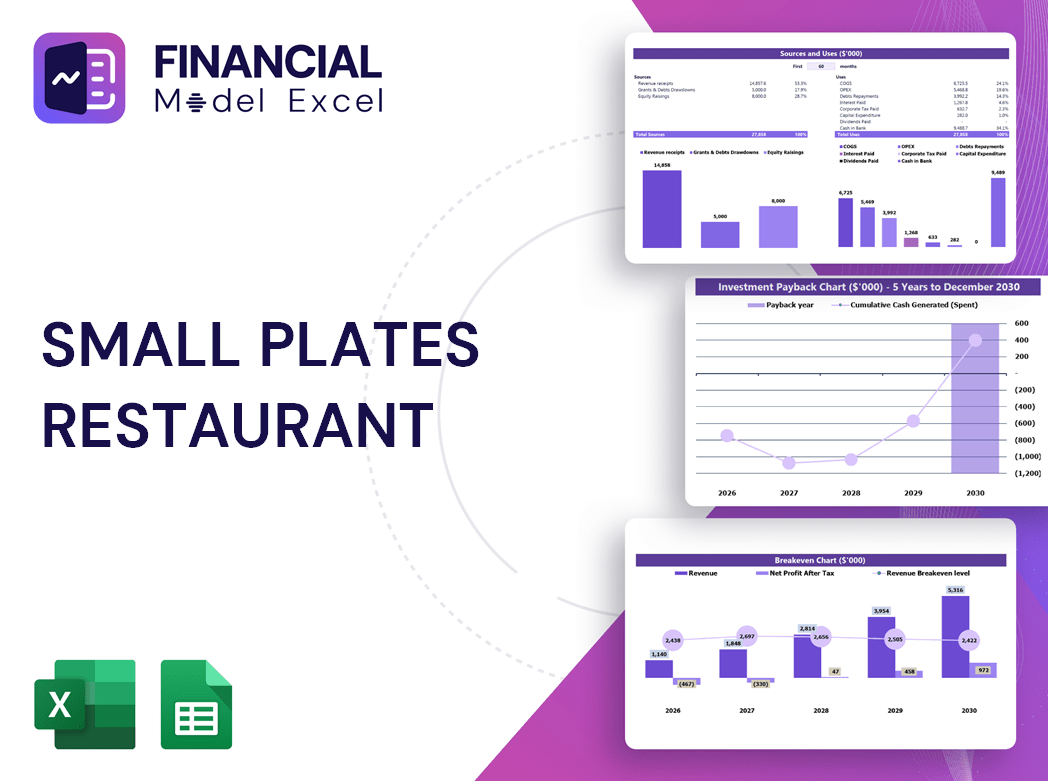

SMALL PLATES RESTAURANT FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

A comprehensive restaurant startup financial model integrates key statements: income statement, cash flow model, and balance sheet. For small plates restaurants, updating this financial projection annually ensures accurate cost analysis, sales forecast, and operational cost management. Utilizing restaurant financial planning tools and budgeting templates allows for effective tracking of expenses and revenue, supporting informed decisions on menu pricing strategy and capital expenditure plans. Regular review of these financial assumptions and profit and loss statements validates resource allocation and enhances profitability, positioning your small plates dining venture for sustained success.

Dashboard

Develop a robust small plates restaurant financial projection with our comprehensive startup financial model. Our restaurant financial dashboard offers dynamic charts, break-even analysis, and example income statements to guide your budgeting and financial control. Utilize proven small plates menu pricing strategies and cost analysis tools to optimize revenue forecasts and accurately track operational costs. This tailored restaurant startup plan ensures your funding requirements and capital expenditure plans are clear, making your investment analysis and profit and loss statements highly attractive to stakeholders. Elevate your small plates dining venture with precise, professional financial planning tools.

Business Financial Statements

Our comprehensive restaurant financial planning tools enable small plates restaurant owners to effortlessly generate detailed financial projections, including revenue forecasts, cost analyses, and cash flow models. This robust Excel template automates key reports such as profit and loss statements, income statements, and break-even analyses, ensuring precise financial control and budgeting. With built-in sales forecasts and capital expenditure plans, it simplifies investment analysis and funding requirements. Additionally, visually engaging dashboards and charts help communicate operational results clearly to stakeholders and potential investors, making your small plates dining business’s financial strategy both transparent and compelling.

Sources And Uses Statement

The Sources and Uses of Funds statement within the restaurant financial planning tools is essential for small plates restaurant startups. This financial projection for small plates dining clearly outlines funding sources and operational cost allocations, aiding in precise restaurant budgeting and financial control. By integrating this statement into your restaurant startup financial model, you gain invaluable insight into capital expenditure plans and cash flow management, ensuring a comprehensive small plates restaurant revenue forecast and investment analysis. This template is crucial for informed decision-making and sustainable growth in the competitive small plates dining sector.

Break Even Point In Sales Dollars

The break-even analysis is a crucial component of the 5-year financial projection for a small plates restaurant. It determines the precise revenue level needed to cover all operational costs, including taxes, ensuring a clear understanding of when the business will become profitable. This insight is vital for startups, guiding informed decisions on the feasibility of the venture and supporting effective restaurant budgeting and financial control. By pinpointing the break-even point, owners can strategically plan funding requirements and optimize their small plates menu pricing strategy to maximize profitability and investment returns.

Top Revenue

When developing a small plates restaurant financial projection, revenue forecast stands as the cornerstone of any effective restaurant startup financial model. Accurate revenue predictions, grounded in historical data and thoughtful growth assumptions, drive the small plates restaurant income statement and overall financial planning tools. Utilizing a comprehensive small plates restaurant sales forecast and cost analysis ensures precise restaurant profit and loss statements, cash flow models, and break-even analysis. For optimal budgeting and financial control, incorporating a small plates menu pricing strategy alongside expense tracking templates empowers management to craft a robust financial projection for small plates dining success.

Business Top Expenses Spreadsheet

Effective small plates restaurant financial planning hinges on precise revenue forecasts within the startup financial model. Accurate small plates restaurant revenue forecasts drive the entire financial projection, influencing the income statement, cash flow model, and profit and loss statement. Utilizing detailed restaurant financial planning tools and operational cost analysis ensures management crafts a solid small plates menu pricing strategy and break-even analysis. Proforma templates and restaurant financial dashboards help incorporate realistic sales forecasts and financial assumptions, enabling confident decision-making and sustainable growth in a competitive dining market.

SMALL PLATES RESTAURANT FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our 5-year financial projection template for small plates restaurants offers a seamless, user-friendly experience. Featuring automated end-to-end formulas, it eliminates manual updates, ensuring accurate and timely projections. Utilize this powerful tool for budgeting and financial planning, revenue forecasting, cost analysis, and cash flow modeling. Perfect for crafting a precise small plates restaurant sales forecast, capital expenditure plan, and profit and loss statement, it empowers you to make informed decisions with confidence. Optimize your restaurant’s financial control and investment analysis effortlessly with this essential financial dashboard tailored for small plates dining success.

CAPEX Spending

The planned capital expenditure in the small plates restaurant financial model outlines essential investments to sustain and drive growth, excluding headcount and operating costs. Our comprehensive analysis identifies which assets merit increased funding based on their value contribution, ensuring efficient allocation. Since capital expenditures differ across businesses, incorporating this detailed capital expenditure plan into your restaurant’s financial projection and budgeting strategy is crucial for informed decision-making and optimized financial performance.

Loan Financing Calculator

Start-ups and early-stage small plates restaurants must carefully monitor their loan repayment schedules as part of comprehensive financial planning. Detailed schedules outline loan amounts and maturity terms, essential for accurate cash flow modeling and restaurant profit and loss statements. Principal repayments impact financing activities within cash flow forecasts, while interest expenses influence both the small plates restaurant income statement and debt balances. Integrating loan management into your restaurant financial dashboard ensures precise expense tracking and enhances your small plates restaurant revenue forecast and funding strategy for sustainable growth.

SMALL PLATES RESTAURANT FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The Internal Rate of Return (IRR) within a small plates restaurant financial projection is the discount rate that produces a net positive present value from projected cash flows. As a key metric in restaurant financial planning tools, IRR helps investors assess the profitability of your small plates restaurant investment analysis. Expressed as a percentage, it reflects the potential return on capital and guides budget planning, revenue forecasting, and operational cost management. Incorporating IRR into your restaurant startup financial model ensures informed decisions that optimize your small plates dining income statement and overall financial performance.

Cash Flow Forecast Excel

A crucial component of your small plates restaurant financial planning tools is the cash flow model, which highlights cash inflows and outflows more effectively than traditional profit and loss statements. This fully integrated restaurant startup financial model offers a detailed small plates restaurant cash flow projection, customizable for monthly or annual periods up to five years. Utilizing this enhances your small plates restaurant budget plan and improves accuracy in forecasting operational costs, funding requirements, and overall financial control—key to making informed decisions and driving sustainable revenue growth.

KPI Benchmarks

The benchmark tab in a small plates restaurant financial model compares key indicators against industry averages, highlighting strengths and weaknesses in the five-year revenue forecast and cost analysis. This insight empowers startups to refine their budget plan, optimize menu pricing strategy, and enhance operational costs management. Leveraging benchmarking within restaurant financial planning tools enables strategic decision-making, ensuring a solid break-even analysis and improving profit and loss statements. Accurate restaurant expense tracking and financial dashboards are essential for controlling cash flow and meeting funding requirements, ultimately supporting sustainable growth and maximizing investment returns in the competitive small plates dining market.

P&L Statement Excel

A detailed pro forma income statement is essential for any small plates restaurant financial model, enabling owners to accurately track monthly income and expenses. This powerful restaurant financial planning tool supports reliable small plates dining income statements and sales forecasts, helping to identify operational costs and optimize menu pricing strategies. Leveraging these financial projections allows for informed decisions to enhance revenue, manage cash flow, and control expenses effectively. By integrating break-even analysis and expense tracking templates, small plates restaurants can build a robust budget plan that drives long-term profitability and growth.

Pro Forma Balance Sheet Template Excel

The pro forma balance sheet for a small plates restaurant startup offers a comprehensive financial projection, detailing assets, liabilities, and equity. Integrated with your restaurant financial planning tools, it supports precise cost analysis, cash flow modeling, and capital expenditure planning. This essential document empowers informed decision-making, enhances your small plates restaurant revenue forecast, and guides budgeting and financial control to optimize profitability and investment analysis.

SMALL PLATES RESTAURANT FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our restaurant financial planning tools include a comprehensive small plates restaurant financial projection, incorporating Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flow (FCF) analyses. WACC gauges the cost of capital from debt and equity, serving as a crucial risk assessment metric for lenders. Meanwhile, DCF evaluates the present value of future cash flows, supporting accurate investment analysis and revenue forecasting. Together, these metrics enhance your small plates restaurant budget plan, cost analysis, and funding requirements, ensuring informed decisions for sustainable profitability and growth.

Cap Table

The three-statement financial model is a vital tool for small plates restaurant financial planning, enabling precise revenue forecasts and profit and loss analyses. It effectively estimates key financial indicators, including sales and operational costs, supporting informed budgeting and financial control. Complemented by a cap table Excel, this model offers structured calculations and enhanced clarity, streamlining investment analysis and funding requirement assessments. Together, they empower restaurateurs to optimize menu pricing strategies, track expenses meticulously, and project cash flow confidently, ensuring a robust foundation for sustainable growth and profitability in the competitive small plates dining sector.

SMALL PLATES RESTAURANT THREE WAY FINANCIAL MODEL ADVANTAGES

The financial model proactively identifies cash shortfalls, enabling strategic planning and ensuring small plates restaurant profitability.

Optimize profits with our small plates restaurant financial model supporting 161 currencies for precise global forecasting.

Boost stakeholder trust with a comprehensive small plates restaurant financial model for accurate budgeting and forecasting.

The financial model ensures precise budgeting, optimizing small plates restaurant profitability and controlling operational costs efficiently.

Our small plates restaurant financial model ensures accurate revenue forecasting for confident budgeting and strategic growth planning.

SMALL PLATES RESTAURANT FINANCIAL PROJECTION MODEL EXCEL ADVANTAGES

The small plates restaurant financial model ensures accurate budgeting, maximizing profits and enabling confident investment decisions.

A small plates restaurant financial model empowers precise cash flow forecasting, minimizing risks and driving sustainable growth.

Build your small plates restaurant financial model to secure funding and optimize revenue with accurate forecasting tools.

Impress investors with a proven small plates restaurant financial model boosting accurate forecasts and confident funding decisions.

Optimize profits and plan growth confidently with a comprehensive small plates restaurant financial model.

Our small plates restaurant cash flow model reveals optimal growth strategies by forecasting funding impacts and financial outcomes.

Our small plates restaurant financial model powers accurate revenue forecasts and optimized budget planning for maximum profitability.

Maximize profits effortlessly with our Startup Pro Forma Template—complete, easy, and cost-effective financial modeling for small plates restaurants.

Our small plates restaurant financial model offers great value for money by optimizing budget planning and maximizing revenue forecasts.

Optimize profits confidently with our proven 5-year small plates restaurant cash flow Excel financial model—affordable, no hidden fees.