Solar Installation Training Institute Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Solar Installation Training Institute Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Solar Installation Training Institute Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

SOLAR INSTALLATION TRAINING INSTITUTE FINANCIAL MODEL FOR STARTUP INFO

Highlights

Highly versatile and user-friendly solar installation training center revenue model designed for comprehensive financial planning, including profit and loss statement templates, cash flow analysis, and balance sheet forecasts on monthly and annual timelines. Ideal for startups or established solar training institutes, this financial projection for solar installation training incorporates detailed cost analysis, budgeting, and expense forecasting to support a robust solar installation education financial planning model. Utilize this solar training institute break-even analysis and funding requirements model to prepare compelling business plans and secure investment from banks or investors, ensuring effective fund management and maximizing the solar training institute's profitability model. Fully unlocked for complete customization and adaptation to any solar installation training program investment analysis needs.

This ready-made solar installation training institute financial model template effectively alleviates common pain points by streamlining complex financial planning tasks such as expense forecasting, revenue modeling, and cash flow analysis into an intuitive Excel format, allowing users to perform detailed cost analysis, budgeting, and break-even analysis without extensive financial expertise. It integrates a comprehensive financial projection for solar installation training programs, including funding requirements, capital expenditure planning, and profitability models, enabling clear visibility into income statement forecasts and investment analysis. By automating key financial performance metrics and providing a robust financial feasibility study framework, the model empowers entrepreneurs and administrators to confidently manage training fees, fund management, and growth strategies, ensuring sustainable business development and optimized financial outcomes with minimal effort.

Description

Our comprehensive solar installation training institute financial model business plan integrates detailed cost analysis, revenue modeling, and expense forecasting to provide a robust framework for operational management and investor review. This financial projection for solar installation training enables the creation of a 60-month financial forecast, including income statement forecasts, cash flow analysis, and capital expenditure financial models, allowing for precise budgeting and investment analysis. The model supports profitability assessment through break-even analysis and incorporates key financial performance metrics such as NPV, IRR, and free cash flow, ensuring a thorough solar training institute financial feasibility study. Designed to aid in fund management and funding requirements modeling, it streamlines the estimation of initial capital needs and working capital, facilitating informed decision-making for launching or expanding a solar installation training center.

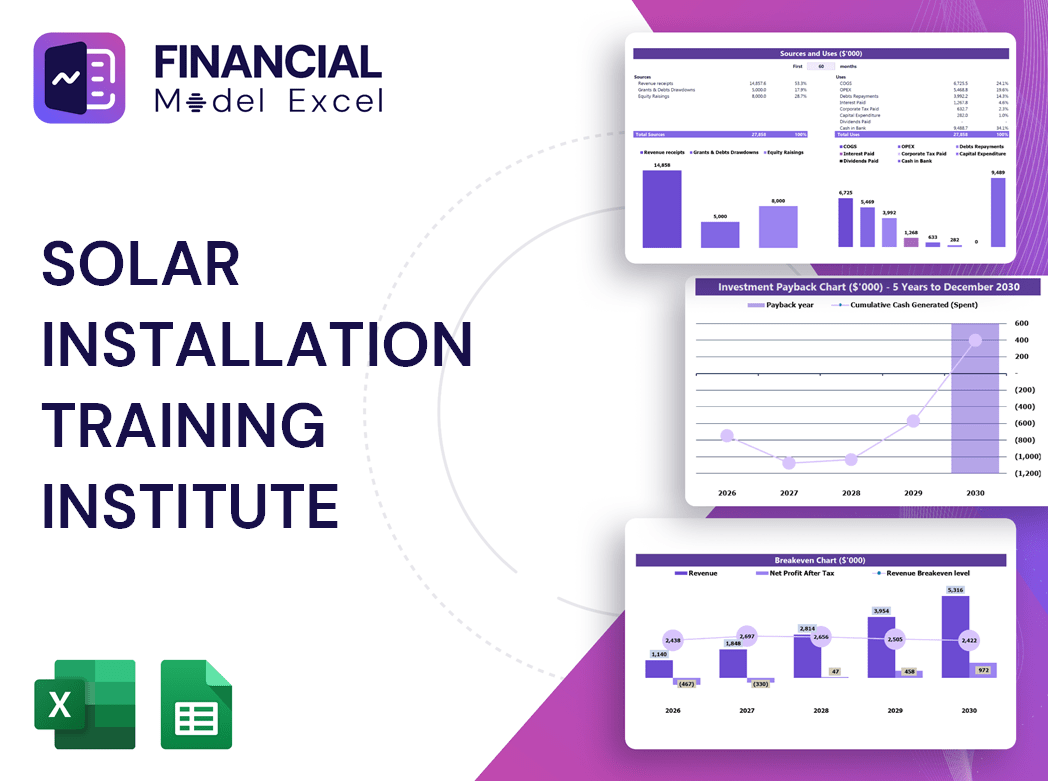

SOLAR INSTALLATION TRAINING INSTITUTE FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Whether launching a new solar installation training institute or expanding an existing center, our comprehensive business plan financial model delivers all essential reports. Access detailed solar training institute expense forecasting, cash flow analysis, and monthly profit and loss templates in Excel. Benefit from integrated solar training institute income statement forecasts, break-even analysis, and capital expenditure models. With clear financial projections and year-wise summaries, our solar training institute financial feasibility study and investment analysis tools empower you to strategically plan funding requirements and maximize profitability. Streamline your solar installation education financial planning with precision and confidence.

Dashboard

Our comprehensive solar installation training institute financial model features an intuitive dashboard presenting key financial performance metrics across defined timeframes. This includes a detailed cash flow analysis, annual revenue breakdowns aligned with the solar training center revenue model, and precise profit forecasts. Designed for in-depth financial planning, it supports solar training institute expense forecasting, budgeting, and fund management, empowering stakeholders with actionable insights to optimize profitability and ensure sustainable growth.

Business Financial Statements

Our comprehensive solar installation training institute financial model offers an integrated approach, consolidating key data from detailed spreadsheets such as pro forma balance sheets, profit and loss statements, and cash flow forecasts. Expertly designed for your solar training center’s business plan, this model supports financial projection, expense forecasting, and revenue model analysis. It streamlines your solar training program’s budgeting, funding requirements, and profitability assessment, delivering a professional financial overview ideal for investor presentations and strategic planning. Empower your solar installation education venture with this dynamic financial planning tool tailored for growth and success.

Sources And Uses Statement

The financial model XLS serves as an advanced tool for solar installation training institutes, enabling clear identification of internal funding sources and strategic allocation of resources. By integrating expense forecasting, revenue modeling, and cash flow analysis, it supports comprehensive financial planning and empowers informed decision-making. This dynamic model enhances budgeting accuracy, investment analysis, and profitability forecasting, ensuring sustainable growth and operational efficiency for solar education enterprises.

Break Even Point In Sales Dollars

A break-even analysis is a vital financial modeling tool for solar installation training institutes, pinpointing when the business or new program reaches profitability. This model accurately forecasts the sales volume required to cover both fixed and variable costs, providing clear insights into cost management and revenue targets. Incorporating this into your solar training institute’s financial forecast enhances decision-making, supports funding requirements, and strengthens your revenue model, ensuring a sustainable and profitable operation.

Top Revenue

Revenue is a cornerstone of any solar installation training institute’s financial model, directly impacting profitability and growth. Our comprehensive financial projection for solar installation training centers incorporates detailed revenue models, historical growth rates, and expense forecasting to ensure accurate income statement forecasts. By leveraging sophisticated assumptions and investment analysis, we deliver a robust financial feasibility study tailored to your solar training program. This enables precise budgeting, cash flow analysis, and break-even assessments, empowering stakeholders to make informed decisions and optimize the institute’s financial performance metrics for long-term success.

Business Top Expenses Spreadsheet

In the Top Expenses section of our solar installation training institute financial model, categorize your key costs into four distinct groups for clear visibility. An additional 'Other' category offers flexibility to tailor expenses according to your specific business needs. This comprehensive solar training institute income statement forecast allows you to input historical data or develop a detailed five-year profit and loss template. Customize it to accurately project your solar training institute expense forecasting, ensuring precise financial planning and enhanced decision-making for sustained profitability.

SOLAR INSTALLATION TRAINING INSTITUTE FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Each solar installation training institute financial model includes a detailed 5-year projection, emphasizing crucial start-up costs that significantly impact early operations. Monitoring these expenses is vital to avoid underfunding or unexpected cost surges. Our comprehensive financial projection template features a proforma outlining costs and funding requirements, enabling users to effectively manage expenses, plan budgets, and ensure sustainable growth. This invaluable tool supports precise financial planning, cash flow analysis, and break-even assessment, empowering solar training centers to achieve long-term profitability and operational success.

CAPEX Spending

The capital expenditure financial model outlines the essential investments required to enhance and sustain the solar installation training institute’s competitive edge. Excluding staff salaries and operating expenses, this analysis identifies priority areas for strategic investment, ensuring optimal allocation of resources. Given the variability of capital costs across different solar training institute business plans, incorporating a detailed capex forecast is critical for informed financial planning and maximizing profitability. This targeted expenditure forecasting empowers stakeholders with clear insights for effective fund management and long-term growth within the solar training education sector.

Loan Financing Calculator

Our solar installation training institute financial model includes a comprehensive loan amortization schedule, seamlessly integrated within the pro forma income statement template. This advanced tool forecasts repayment amounts, detailing principal and interest components for each installment—monthly, quarterly, or annually. Designed for precise expense forecasting and cash flow analysis, it empowers your solar training center to manage capital expenditure efficiently, supporting accurate financial projection and break-even analysis. Optimize your solar training program’s investment planning and funding requirements with this dynamic financial planning model, ensuring sustainable profitability and operational success.

SOLAR INSTALLATION TRAINING INSTITUTE FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Return on equity (ROE) is a key solar training institute financial performance metric, derived from the pro forma balance sheet and income statement forecast. It evaluates how effectively the institute’s equity investment generates profits, revealing the efficiency of capital utilization within the solar installation training business plan. Accurate ROE calculations support the solar installation training institute’s financial projection and profitability model, guiding strategic decisions in expense forecasting and fund management. This metric is essential for assessing the economic viability and investment potential of solar installation education financial planning models.

Cash Flow Forecast Excel

The solar installation training institute cash flow analysis is crucial for demonstrating your ability to manage cash streams effectively and meet financial obligations. A comprehensive solar training institute income statement forecast ensures transparency in revenue and expense tracking. Lenders and investors rely on your solar installation training institute financial model to confirm sufficient liquidity for timely loan repayments. Integrating detailed expense forecasting and profitability models enhances confidence in your solar training program investment analysis, driving successful funding and sustainable growth.

KPI Benchmarks

Our solar installation training institute financial projection model features a comprehensive benchmarking study tab, enabling businesses to conduct comparative financial analysis. By evaluating key financial performance metrics and expense forecasting against industry peers, companies can identify gaps and optimize their solar training institute profitability model. This insightful benchmarking guides strategic decisions, enhancing revenue models and improving cash flow analysis. For startups, understanding and leveraging these financial insights—from income statement forecasts to break-even analysis—is crucial for sustainable growth and maximizing returns in the competitive solar installation education sector.

P&L Statement Excel

The solar installation training institute financial model offers detailed monthly and yearly profit and loss forecasts, ideal for continuous financial performance tracking. Featuring comprehensive income statement templates, it captures all revenue streams, gross and net earnings, and detailed expense insights. This robust model supports accurate revenue analysis, break-even assessment, and cash flow forecasting, empowering business owners to evaluate profitability effectively. Enhanced with key financial metrics—such as EBIT, margins, and expense ratios—this tool ensures precise financial planning, budget management, and investment analysis critical for a successful solar training center’s sustainable growth.

Pro Forma Balance Sheet Template Excel

A comprehensive solar installation training institute financial model pairs the balance sheet forecast with the profit and loss projection to reveal critical investment requirements supporting projected sales and profitability. This integrated approach enables clear visibility into the institute’s financial position over time, aiding in precise budgeting, cash flow analysis, and break-even assessment. Utilizing this financial planning model ensures informed decision-making for sustainable growth and optimal resource allocation within the solar training business plan.

SOLAR INSTALLATION TRAINING INSTITUTE FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

The seed stage valuation tool within the solar installation training institute financial model calculates key metrics such as Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF). WACC quantifies the capital cost mix of equity and debt, serving as a vital risk assessment metric for lenders. Meanwhile, DCF enables investors to evaluate the present value of future cash flows, essential for informed investment decisions. Together, these metrics empower business owners, creditors, and investors to confidently analyze financial feasibility and forecast profitability for sustainable growth.

Cap Table

Wondering what a cap table model is? It’s a crucial financial planning tool designed to analyze and manage cash flow effectively. This model provides comprehensive insights into equity distribution, investments, promissory notes, and other funding sources. For a solar installation training institute, leveraging a cap table alongside a robust financial model—such as expense forecasting, investment analysis, and break-even analysis—ensures informed decision-making and optimized financial performance. Harnessing these tools empowers your solar training institute to maximize profitability and sustain growth in a competitive market.

SOLAR INSTALLATION TRAINING INSTITUTE 5 YEAR PROJECTION PLAN ADVANTAGES

The financial model ensures accurate forecasts, maximizing solar training institute profitability and securing sustainable cash flow management.

Optimize your solar installation training institute’s budget and operations with a precise financial model for cost planning.

Set clear objectives to optimize your solar installation training institute financial model for maximum profitability and growth potential.

Optimize your solar training institute’s growth with a precise financial model for strategic planning and increased profitability.

A comprehensive solar training financial model boosts credibility, attracting investors and ensuring strategic business growth.

SOLAR INSTALLATION TRAINING INSTITUTE 3 STATEMENT FINANCIAL MODEL TEMPLATE ADVANTAGES

Our solar installation training financial model ensures accurate budgeting, maximizing profitability and guiding confident business decisions.

The financial model enables dynamic input adjustments, ensuring precise forecasts and optimized decision-making for your solar training institute.

Our solar training financial model ensures clear proof of loan repayment through detailed revenue and expense forecasting.

A detailed solar training institute cash flow analysis convinces lenders of your loan repayment and boosts approval chances.

Our solar training financial model saves you time by streamlining budgeting, forecasting, and profitability analysis effortlessly.

Our solar training institute financial model streamlines budgeting and forecasting, maximizing focus on growth and profitability.

The solar training institute financial model ensures clear budgeting and maximizes profitability for sustainable business growth.

Streamlined, color-coded financial model ensures clear, precise forecasting for profitable solar installation training institute planning.

Our solar installation training financial model simplifies budgeting and forecasting, ensuring clear profitability and investment insights.

Unlock swift, reliable financial insights with our user-friendly solar installation training institute financial model—no expertise needed.