Structural Engineering Services Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Structural Engineering Services Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Structural Engineering Services Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

STRUCTURAL ENGINEERING SERVICES FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year structural engineering business financial model in Excel features a robust structural engineering service financial projections framework, including prebuilt consolidated P&L, balance sheet, and cash flow model templates specifically designed for financial forecasting and budget modeling for structural engineering firms. Equipped with key financial performance metrics, investment analysis capabilities, and pricing strategy insights, this structural engineering contract financial model supports detailed cost estimation and cash flow management, enabling thorough financial risk assessment and break-even analysis. Fully unlocked and editable, it provides essential financial planning tools and financial statement modeling to accurately evaluate the profitability and financial performance of structural engineering services prior to any transaction or strategic decision.

This ready-made structural engineering financial model template effectively addresses common pain points by delivering comprehensive financial forecasting and budgeting tools tailored specifically for structural engineering projects, allowing firms to perform accurate cost estimation and financial analysis. It streamlines financial planning for structural engineering services through integrated cash flow models, investment analysis, and financial risk assessment functionalities, empowering users to optimize their pricing strategy and enhance service profitability. With built-in structural engineering service financial projections, revenue modeling, and break-even analysis, this Excel template simplifies complex financial statement modeling and budget modeling, providing clear insights into financial performance metrics and enabling strategic decision-making with confidence.

Description

Our structural engineering project financial model offers comprehensive financial forecasting and cost estimation tailored to structural engineering services, enabling precise financial planning and budgeting for companies in this sector. This advanced financial analysis structural engineering projects tool integrates detailed financial statement modeling, cash flow modeling specific to structural engineering firms, and structural engineering service revenue models to support accurate investment analysis and financial risk assessment. With features such as break-even analysis, profitability modeling, and pricing strategy evaluation, the model facilitates robust structural engineering service financial projections and business financial modeling, ensuring companies can optimize their financial performance metrics and make data-driven decisions. Additionally, it incorporates diagnostic tools including cash burn analysis and debt service coverage ratios, helping firms secure financing through bank loans or equity funding while maintaining comprehensive financial budgeting and contract financial modeling capabilities.

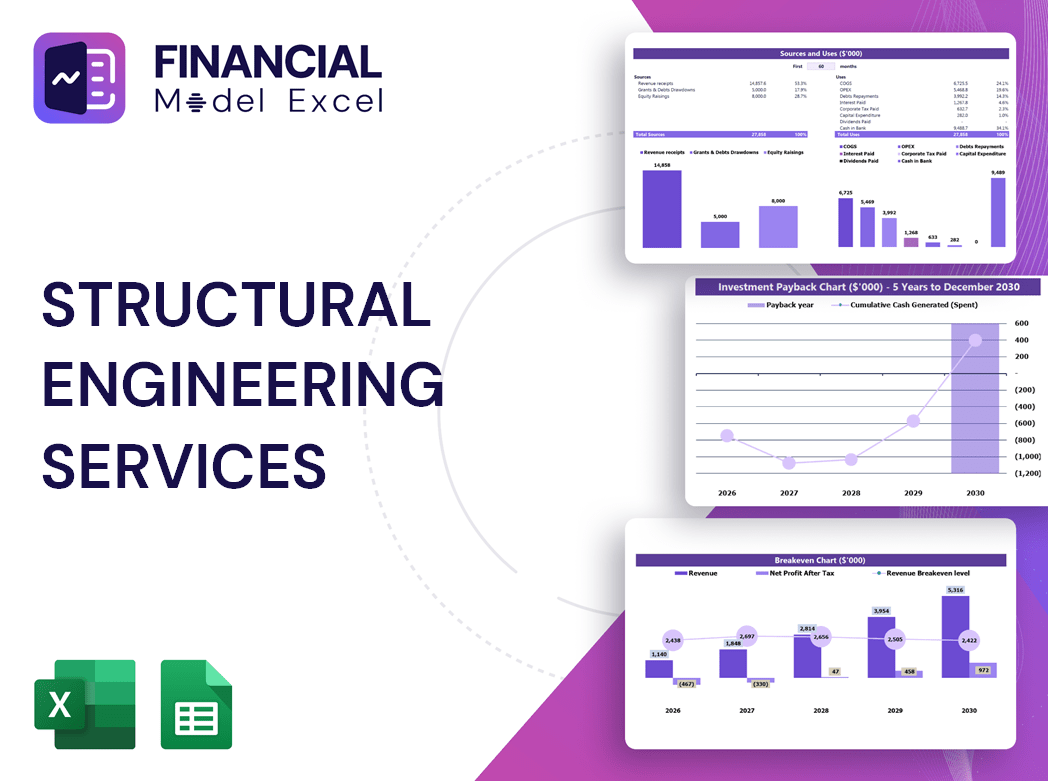

STRUCTURAL ENGINEERING SERVICES FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

A comprehensive structural engineering financial model integrates income statements, balance sheets, and cash flow models to provide a holistic view of your firm's financial health. Effective financial forecasting for structural engineering ensures accurate cost estimation, budget modeling, and profitability analysis. Utilizing detailed financial planning and contract financial models enhances investment analysis and risk assessment, supporting strategic pricing and break-even analysis. Preparing precise financial projections and conducting cost-benefit analysis are essential for sustainable growth and optimizing structural engineering service revenue models.

Dashboard

Our platform delivers an intuitive dashboard offering a comprehensive overview of your structural engineering business financial model. Effortlessly visualize financial projections, cost estimation models, and cash flow analysis designed specifically for structural engineering projects. Easily share critical financial performance metrics and budgeting insights with stakeholders, enhancing transparency and strategic decision-making. Empower your team with robust financial forecasting and investment analysis tools tailored to structural engineering services, driving profitability and optimizing pricing strategies. Streamline your financial planning and risk assessment with precision and clarity—all within a user-friendly interface built for your firm’s success.

Business Financial Statements

Each financial statement plays a crucial role in the structural engineering business financial model, offering comprehensive insights into financial performance. The pro forma profit and loss highlights revenue and expenses, revealing profitability from core engineering services. The startup’s pro forma balance sheet captures the firm's capital structure and financial position at a specific moment. Meanwhile, the cash flow model for structural engineering firms tracks operating, investing, and financing cash movements. Together, these tools enable precise financial forecasting, budgeting, and risk assessment, empowering informed decision-making and strategic planning for sustained growth in structural engineering projects.

Sources And Uses Statement

The Sources and Uses of Funds statement in a 5-year structural engineering financial model outlines the firm’s funding strategies and spending priorities. Under ‘Sources,’ it details capital inflows from loans, investors, or equity offerings supporting business operations. The ‘Uses’ section highlights how funds are allocated—such as investments in land, facilities, equipment, or start-up expenses. This clear financial planning and budgeting ensure effective cash flow management and support sound financial forecasting for structural engineering projects, enhancing profitability and investment analysis within the structural engineering service revenue model.

Break Even Point In Sales Dollars

Break-even analysis is essential for financial planning in structural engineering services, pinpointing when projects begin generating profit. By analyzing fixed costs—like office rent and salaried staff—and variable costs tied directly to project volume, such as materials and labor, firms can develop accurate structural engineering cost estimation models. This financial forecasting enables precise budget modeling and cash flow management, ensuring profitability. Integrating this into a comprehensive structural engineering service financial projections framework supports strategic pricing strategies and informed investment analysis, enhancing overall financial performance metrics and risk assessment for sustainable growth.

Top Revenue

When developing a structural engineering project financial model, accurate revenue forecasting is paramount. Revenue drives the firm’s valuation and underpins strategic financial planning. Effective financial forecasting for structural engineering requires integrating historical data with growth rate assumptions to ensure reliability. Our structural engineering service financial projections incorporate comprehensive revenue modeling, enabling precise cash flow analysis and profitability assessment. This approach supports robust budgeting, risk assessment, and pricing strategy development, empowering firms to optimize financial performance and confidently navigate investment decisions.

Business Top Expenses Spreadsheet

The Top Expenses tab in this 5-year structural engineering financial model details committed costs across four key categories, providing clear financial forecasting for structural engineering services. This budget modeling tool highlights where funds are allocated—whether towards client acquisition, employee compensation, or operational needs—enabling precise cost estimation and financial planning. Such comprehensive financial analysis for structural engineering projects ensures transparency and supports effective pricing strategy and cash flow management, enhancing the firm’s overall financial performance metrics and profitability model.

STRUCTURAL ENGINEERING SERVICES FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Start-up costs are critical within any structural engineering project financial model, accruing before operations commence. Early monitoring through financial forecasting for structural engineering ensures precise budgeting and prevents overspending or underfunding. Our structural engineering services financial projections include a detailed start-up cost proforma, capturing both funding sources and expenses. This robust cost estimation model empowers firms to track expenditures accurately and develop effective financial planning structural engineering services, optimizing budget modeling for structural engineering projects and enhancing overall financial performance metrics.

CAPEX Spending

The CAPEX schedule in the structural engineering project financial model outlines essential resource investments to sustain and grow your firm, excluding headcount and operating costs. Our detailed financial analysis identifies high-value assets to prioritize, optimizing your company’s capital allocation. Capital expenditure requirements differ across structural engineering services, making precise budget modeling and financial forecasting crucial. Integrating this CAPEX insight into your structural engineering business financial model ensures informed decision-making and strengthens overall financial planning and performance metrics.

Loan Financing Calculator

Our startup's financial model integrates a comprehensive loan amortization schedule, detailing principal repayment and interest calculations. This structural engineering business financial model ensures precise financial forecasting for structural engineering projects by accurately projecting payment amounts based on loan principal, interest rate, duration, and payment frequency. By leveraging this financial planning tool, firms can enhance their structural engineering service financial projections, optimize cash flow models, and execute informed investment analysis, ultimately improving profitability and minimizing financial risk in structural engineering services.

STRUCTURAL ENGINEERING SERVICES FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Return on Investment (ROI) is a key profitability metric within a structural engineering project financial model. It measures the ratio of cash inflows to outflows from investment activities, providing critical insight for financial forecasting and investment analysis of structural engineering services. By dividing net investment gains by total investment costs, ROI helps firms evaluate project viability, optimize pricing strategies, and enhance financial planning. Incorporating ROI into your structural engineering service financial projections ensures informed decision-making and maximizes profitability across engineering projects.

Cash Flow Forecast Excel

A projected cash flow statement offers a clear financial forecasting tool for structural engineering projects by detailing cash inflows and outflows across operating, investing, and financing activities. Similar to budget modeling for structural engineering, it covers a defined period, enabling precise financial planning structural engineering services. This essential model enhances financial analysis of structural engineering projects, supporting effective cost estimation and investment analysis while improving overall structural engineering financial performance metrics and risk assessment.

KPI Benchmarks

This structural engineering financial model includes a dedicated tab for financial benchmarking studies, enabling comprehensive financial analysis of structural engineering projects. By comparing your firm’s performance metrics against industry standards, it provides critical insights into competitiveness, efficiency, and productivity. This financial planning tool empowers structural engineering companies to identify areas for improvement, optimize cost estimation models, and enhance profitability. Leveraging benchmarking enhances your financial forecasting and investment analysis, ensuring data-driven decisions for sustainable growth within the structural engineering services sector.

P&L Statement Excel

The Profit and Loss Statement (P&L) is essential for financial analysis of structural engineering projects, highlighting key revenue streams and major cost centers. This structural engineering financial statement modeling enables stakeholders to assess profitability, cost structures, and loan repayment capacity. Integrating financial forecasting for structural engineering with a comprehensive structural engineering service financial projections model supports informed decision-making. Accurate budget modeling for structural engineering ensures your firm’s financial performance metrics are optimized, guiding revenue growth and investment analysis within the structural engineering business financial model for sustainable success.

Pro Forma Balance Sheet Template Excel

Accurate financial forecasting for structural engineering projects is vital, integrating projected balance sheets with profit and loss and cash flow models. While balance sheets may seem less striking than income statements, they play a crucial role in budget modeling and cash flow analysis for structural engineering firms. A well-crafted structural engineering financial model enables investors to assess profitability through key performance metrics like return on equity and invested capital. This comprehensive approach enhances investment analysis, financial risk assessment, and financial planning, ensuring realistic projections and informed decision-making within structural engineering services.

STRUCTURAL ENGINEERING SERVICES FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive structural engineering project financial model delivers all essential data investors need for funding, integrated seamlessly into your financial planning and business plan. The Weighted Average Cost of Capital (WACC) represents the investment return on operating capital, while the free cash flow valuation highlights cash available to shareholders and creditors. Utilizing discounted cash flow analysis, our model accurately projects future cash flows in present value terms, empowering precise financial forecasting and investment analysis for structural engineering services. Optimize your financial strategy with our expert budget modeling and profitability assessment tools designed specifically for structural engineering firms.

Cap Table

A comprehensive structural engineering business financial model integrates key elements like financial forecasting, cost estimation, and cash flow modeling to optimize project profitability. Utilizing tools such as budget modeling and pricing strategy for structural engineering services ensures precise financial planning and risk assessment. Our financial analysis for structural engineering projects includes investment analysis, break-even analysis, and service revenue modeling to drive informed decisions. This robust approach empowers firms to manage equity shares, anticipate ownership dilution through funding rounds, and project accurate financial performance metrics—essential for sustainable growth and stakeholder confidence.

STRUCTURAL ENGINEERING SERVICES BUSINESS PROJECTION TEMPLATE ADVANTAGES

Enhance accuracy and efficiency by forecasting all three financial statements with our structural engineering Excel financial model.

Our financial model accurately forecasts break-even points and maximizes ROI for structural engineering projects with precision.

Structural engineering financial models enhance accurate forecasting, optimize budgeting, and boost project profitability effectively.

Raise capital confidently with a structural engineering financial model delivering precise projections and strategic investment insights.

Enhance investor confidence with a precise structural engineering services financial model ensuring transparent, reliable startup projections.

STRUCTURAL ENGINEERING SERVICES FINANCIAL PLANNING MODEL ADVANTAGES

The structural engineering financial model ensures confident, precise budgeting and forecasting for sustainable project success and growth.

Our structural engineering financial model ensures accurate forecasting, risk management, and strategic cash flow planning for sustained growth.

Our simple-to-use financial model ensures accurate budgeting and forecasting for profitable structural engineering projects.

Optimize your structural engineering projects with an easy, reliable financial model requiring minimal Excel or planning expertise.

Optimize project success with dynamic financial modeling tailored for structural engineering services—update anytime for precise forecasting.

Easily refine your structural engineering financial model anytime to optimize forecasting, budgeting, and profitability throughout your project lifecycle.

Identify cash shortfalls early with our precise financial forecasting for structural engineering projects to secure profitability.

The financial model acts as an early warning system, optimizing cash flow and enhancing structural engineering project profitability.

Optimize profitability and mitigate risks with our comprehensive structural engineering financial model and detailed forecasting reports.

Our structural engineering financial model streamlines reporting with lender-ready templates, saving time and ensuring accuracy.