Tapas Bar Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Tapas Bar Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Tapas Bar Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

TAPAS BAR FINANCIAL MODEL FOR STARTUP INFO

Highlights

A comprehensive tapas bar startup financial plan, including detailed financial projections for a tapas restaurant, is crucial for securing funding and managing restaurant budgeting and forecasting effectively. Utilizing a profit and loss model for a tapas bar alongside cash flow analysis helps startups and established eateries track operational costs and revenue forecasting techniques, ensuring accurate expense tracking and optimizing the cost structure within tapas bar financials. Incorporating financial statement templates tailored for restaurants facilitates robust investment analysis and break-even analysis, essential components of the tapas bar business plan financial section. Employing advanced financial modeling for small eateries, including sales forecasting for tapas kitchens and restaurant financial KPI metrics, supports strategic financial planning for the hospitality industry and mitigates financial risk through comprehensive cash management models and operational cost modeling.

This ready-made tapas bar startup financial plan template effectively addresses common pain points by offering a comprehensive profit and loss model for tapas bar operations, simplifying complex financial modeling for small eateries with clear restaurant budgeting and forecasting tools. It includes detailed cost structure tapas bar financials alongside restaurant revenue forecasting techniques, enabling precise sales forecasting for tapas kitchens and operational cost modeling. With integrated cash flow analysis tapas bar business capabilities and expense tracking tapas bar model features, it eases cash management and financial risk assessment for new ventures. The inclusion of financial statement templates for restaurants and restaurant financial KPI metrics further streamlines investment analysis tapas bar startup decisions and break-even analysis tapas bar business planning, providing actionable insights that save time and reduce errors even for users with limited financial expertise.

Description

This comprehensive tapas bar startup financial plan template offers robust financial projections for tapas restaurants, incorporating detailed restaurant budgeting and forecasting alongside financial modeling for small eateries. It features a profit and loss model for tapas bars, cash flow analysis specific to tapas bar business operations, and restaurant revenue forecasting techniques to optimize sales forecasting for tapas kitchens. The tool includes cost structure tapas bar financials, financial statement templates for restaurants, and investment analysis to evaluate tapas bar startup funding requirements and break-even analysis. Designed to streamline tapad bar operational cost modeling and expense tracking tapas bar models, it provides essential restaurant financial KPI metrics and financial risk assessment tailored to the hospitality industry. With an integrated tapad bar cash management model and a tapad bar business plan financial section, this solution ensures accurate, automated financial planning that supports liquidity management, profitability planning, and funding strategy development.

TAPAS BAR FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Leverage our comprehensive tapas bar financial model to streamline your restaurant budgeting and forecasting with ease. This adaptable 3-way financial template automates profit and loss modeling, cash flow analysis, and break-even assessments tailored to your tapas bar startup. Designed for flexibility, it accommodates diverse scenarios, ensuring precise financial projections and investment analysis. Scalable and customizable, it grows alongside your business, empowering you to track expenses, forecast sales, and monitor key restaurant financial KPIs—all within a professional, user-friendly Excel framework built for smart financial planning in the hospitality industry.

Dashboard

A comprehensive financial dashboard is essential in the tapas bar startup financial plan, consolidating key restaurant financial KPI metrics into an intuitive Excel model. It features standardized financial statement templates for restaurants and supports dynamic restaurant budgeting and forecasting. By inputting data over specific periods, users gain real-time insights for financial projections, profit and loss modeling, and cash flow analysis. This tool streamlines expense tracking, sales forecasting for tapas kitchens, and break-even analysis, enabling precise financial planning and risk assessment tailored to the hospitality industry’s unique cost structure and operational demands.

Business Financial Statements

This comprehensive tapas bar startup financial plan template offers pre-built, detailed financial statements, including a monthly profit and loss model, 5-year projected balance sheet, and pro forma cash flow analysis. Designed for restaurant budgeting and forecasting, it supports both monthly and annual views. Easily integrate financial data from QuickBooks, Xero, FreshBooks, and other accounting platforms to streamline your tapas bar’s cash flow management and revenue forecasting. Ideal for financial modeling of small eateries, this tool simplifies investment analysis, expense tracking, and break-even analysis, empowering entrepreneurs to optimize operational cost modeling and track key restaurant financial KPI metrics with confidence.

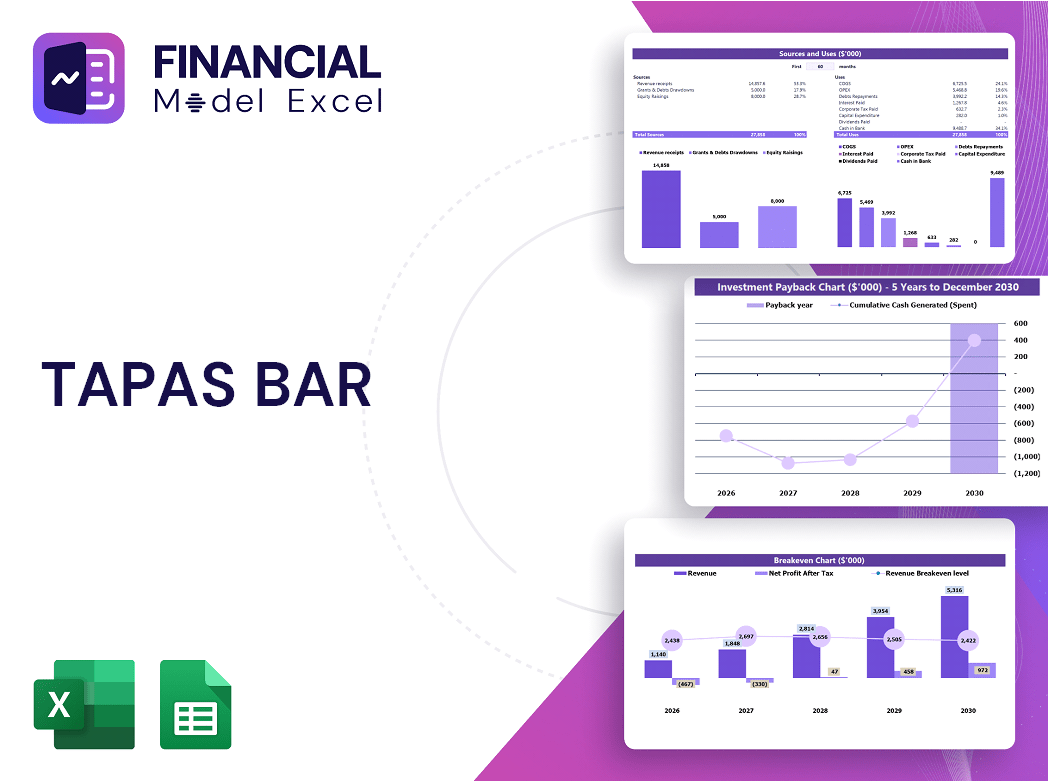

Sources And Uses Statement

Companies favor sources and uses of cash statements as they clearly outline funding origins and cash flow directions for startups or established businesses. For a tapas bar startup, integrating this statement within the financial plan enhances transparency in cash management and supports accurate restaurant budgeting and forecasting. This clarity aids in investment analysis, cash flow analysis, and financial risk assessment, empowering owners to optimize operational cost modeling and apply robust restaurant revenue forecasting techniques. Ultimately, it strengthens the profit and loss model and aligns with best practices in financial planning for the hospitality industry.

Break Even Point In Sales Dollars

Curious about when your tapas bar startup will turn profitable? Our break-even analysis tool provides clear financial projections for your tapas restaurant by pinpointing the precise sales volume needed to cover all operational costs. This essential financial modeling resource integrates seamlessly into your restaurant budgeting and forecasting, offering real-time insights into your profit and loss model. Perfect for effective cash flow analysis and investment analysis, it empowers you to optimize your cost structure and manage financial risks. Leverage this tool to enhance your tapas bar business plan’s financial section and drive informed decision-making for sustainable growth.

Top Revenue

When developing a financial model for a tapas bar startup, accurate revenue forecasting is paramount. Sales forecasting for tapas kitchens must incorporate realistic growth rate assumptions grounded in historical data. Our financial statement templates for restaurants provide comprehensive tools for precise restaurant budgeting and forecasting, ensuring robust financial projections for tapas restaurants. By integrating profit and loss models, cash flow analysis, and expense tracking tapas bar models, investors and managers gain critical insights for effective financial planning in the hospitality industry. This approach supports sound investment analysis and optimizes operational cost modeling for lasting business success.

Business Top Expenses Spreadsheet

The company’s expenses are organized within the tapas bar startup financial plan, segmented into four categories—including an ‘Other’ section for added flexibility. This structure simplifies restaurant budgeting and forecasting, allowing precise tracking of operational costs. Designed as a comprehensive tool, the Excel financial statement template facilitates accurate financial projections for tapas restaurants over a five-year horizon. By integrating cost structure tapas bar financials and sales forecasting for tapas kitchens, this model supports strategic financial planning and investment analysis, empowering entrepreneurs to optimize profitability and manage cash flow effectively.

TAPAS BAR FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

A comprehensive financial model Excel template for your tapas bar startup is essential to accurately capture initial costs and avoid underfunding or overspending. Our business plan financial section includes a detailed Pro-forma, designed to provide clear insights into funding requirements, cost structure, and cash flow analysis. This restaurant budgeting and forecasting tool enables precise expense tracking and sales forecasting for tapas kitchens, supporting effective financial planning for the hospitality industry. Utilize these financial statement templates for restaurants to confidently manage your operational costs and drive profitable growth from day one.

CAPEX Spending

In a tapas bar startup financial plan, development costs represent long-term assets like equipment, capitalized on the projected balance sheet and depreciated annually in the profit and loss model. For example, a computer’s purchase is capital expenditure, while ongoing electricity costs are recorded as operational expenses in the income statement. Accurate financial modeling for small eateries incorporates depreciation to reflect asset value reduction, ensuring transparency in cash flow analysis and expense tracking. This comprehensive approach supports effective restaurant budgeting and forecasting, offering stakeholders clear insights into capital investments and operational costs within the tapas bar business plan’s financial section.

Loan Financing Calculator

Successful tapas bar startups rely on precise financial planning, including detailed loan payback schedules outlining amounts, maturities, and terms. Integrating this loan structure into cash flow analysis ensures accurate pro forma projections, reflecting interest expenses and principal repayments. These impact the profit and loss model and closing debt figures on financial statement templates for restaurants. Incorporating loan repayments within the restaurant budgeting and forecasting framework enhances the tapad bar cash management model, supporting reliable revenue forecasting and effective expense tracking critical for sustainable growth in the hospitality industry.

TAPAS BAR FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The Net Profit Margin (NPM) is a key financial KPI metric that reveals the profitability of your tapas bar startup. It measures the percentage of revenue remaining after all expenses, showcasing how effectively your business converts sales into profit. This profit and loss model metric is essential for restaurant budgeting and forecasting, helping you evaluate operational efficiency and manage long-term growth. Incorporating NPM into your financial projections for a tapas restaurant enables informed decisions on cost structure and investment analysis, ensuring sustainable success within the competitive hospitality industry.

Cash Flow Forecast Excel

The Cash Flow statement is vital for any tapas bar startup’s financial plan, reflecting true cash generation—a key business goal. This financial modeling template provides clear insights into your tapas bar’s cash-ins and outs, supporting effective cash management. It incorporates essential inputs like Payable and Receivable Days, yearly revenue, working capital, and debt, enabling precise net cash flow and balance forecasts. Ideal for restaurant budgeting and forecasting, this model aids investment analysis, cash flow analysis, and break-even calculations—empowering you to optimize operational costs and drive sustainable growth in the hospitality industry.

KPI Benchmarks

Our financial projections for tapas restaurant come with a comprehensive Excel template tailored for benchmarking key restaurant financial KPI metrics. By comparing your tapas bar’s cost structure, revenue forecasting, and operational costs against industry peers, you gain valuable insights into your business’s relative performance. The 5-year cash flow analysis and profit and loss model enable precise restaurant budgeting and forecasting, helping identify financial risks and areas needing improvement. This financial modeling for small eateries ensures your tapas bar startup’s financial plan is robust, driving informed decisions and maximizing profitability in the competitive hospitality industry.

P&L Statement Excel

Financial forecasting is vital for a tapas bar startup’s success. Utilizing a comprehensive profit and loss model with detailed financial projections enables precise restaurant budgeting and forecasting. This 5-year projection highlights key metrics like net income and gross profit margins, offering clear insight into your tapas bar’s cost structure and revenue potential. Coupled with cash flow analysis and break-even assessment, it empowers confident decision-making, strengthens your financial planning, and enhances investor confidence. Employing these restaurant financial KPI metrics ensures robust financial modeling for small eateries, setting a solid foundation for growth and profitability in the hospitality industry.

Pro Forma Balance Sheet Template Excel

The projected balance sheet template in Excel provides a clear snapshot of your tapas bar startup’s key assets—such as property, equipment, and inventory—alongside liabilities and equity at a specific date. This crucial financial statement supports your restaurant budgeting and forecasting efforts, enabling precise financial projections for tapas restaurants. Lenders and investors rely on this document to evaluate loan security and investment risk, making it an essential tool for your tapas bar business plan financial section. Accurate asset reporting enhances your financial modeling and cash flow analysis, strengthening your overall financial planning in the hospitality industry.

TAPAS BAR FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This comprehensive tapas bar financial plan integrates two robust valuation methods within its profit and loss model. It offers dynamic options for conducting either a discounted cash flow (DCF) analysis or a weighted average cost of capital (WACC) calculation, empowering accurate and insightful financial projections. This dual approach enhances restaurant budgeting and forecasting, providing critical clarity for investment analysis and financial risk assessment in your tapas bar startup.

Cap Table

The capitalization table is a crucial component of your tapas bar startup financial plan, clearly outlining each investor’s ownership percentage, investment amount, and stake in the business. This transparency is essential for accurate cash flow analysis and effective financial planning for hospitality industry ventures. Understanding ownership distribution helps maintain precise financial records, supports investment analysis, and ensures seamless restaurant budgeting and forecasting. Proper management of the capitalization structure ultimately strengthens your tapas bar’s financial modeling and contributes to informed decision-making in your profit and loss model.

TAPAS BAR FINANCIAL MODEL EXCEL SPREADSHEET ADVANTAGES

Identify payment issues early using profit and loss projections for precise financial control in your tapas bar startup.

The financial model ensures accurate budgeting, helping your tapas bar startup confidently manage costs and maximize profitability.

Optimized financial modeling for tapas bars ensures accurate forecasting, efficient budgeting, and maximized profitability.

Establish milestones confidently with a tapas bar financial model, optimizing budgeting and accelerating startup success.

Optimize sales strategy confidently with our tapas bar financial model and accurate Excel-based financial forecast template.

TAPAS BAR FINANCIAL PROJECTION ADVANTAGES

Optimize your tapas bar startup with precise financial modeling to attract investors and maximize profitability confidently.

The tapas bar financial model accelerates investor interest by showcasing precise financial projections and compelling business insights.

Leverage precise financial modeling to secure funding and confidently forecast your tapas bar’s profitable future.

Impress investors with a strategic tapas bar financial model delivering precise forecasts and confident decision-making every time.

Our financial model ensures accurate cash flow analysis and profit forecasting for your € tapas bar startup success.

Our financial model ensures precise cash flow and profit forecasting, empowering your tapas bar startup’s strategic growth.

Optimize your tapas bar startup with precise financial modeling, ensuring accurate budgeting and maximizing profitability effectively.

A comprehensive cash flow analysis empowers your tapas bar startup with precise budgeting, forecasting, and strategic financial planning.

A robust financial model for tapas bars enables better decision making through accurate forecasting and comprehensive expense tracking.

Optimize operational decisions confidently using cash flow analysis and scenario forecasting in your tapas bar financial model.