Tax Preparation Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Tax Preparation Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Tax Preparation Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

TAX PREPARATION FINANCIAL MODEL FOR STARTUP INFO

Highlights

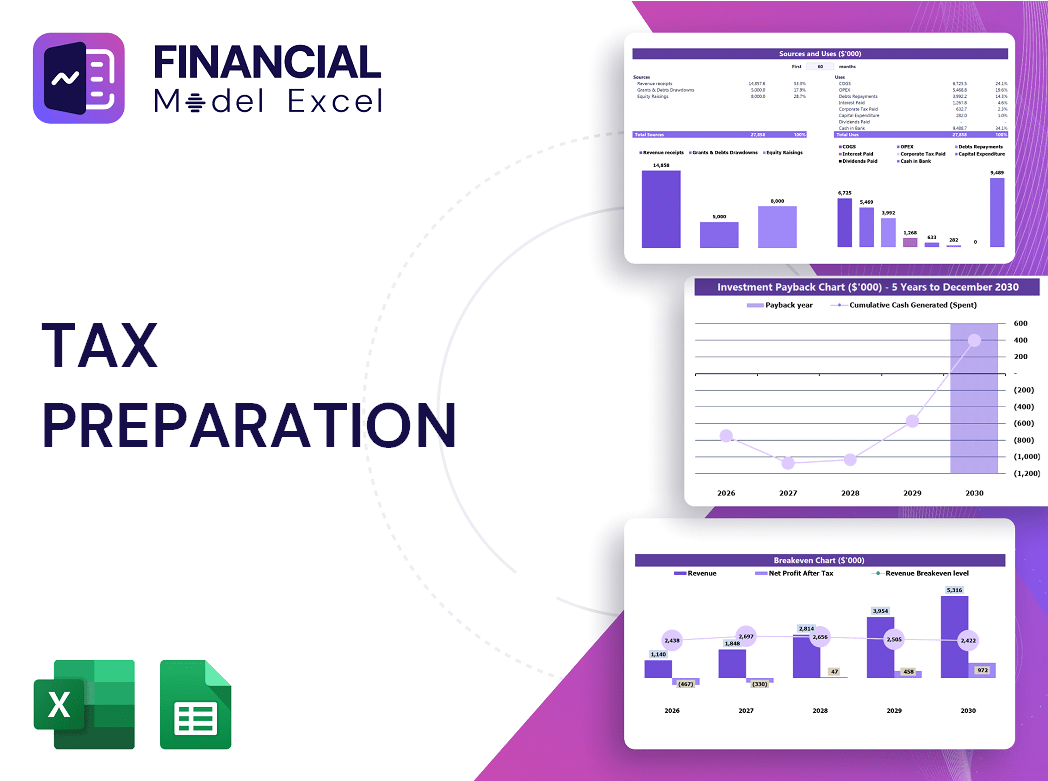

This comprehensive five-year tax preparation financial model template in Excel features prebuilt consolidated financial statements, including a forecasted profit and loss model, balance sheet, and cash flow financial projection model, tailored specifically for tax preparation businesses. It offers key financial charts, summaries, and funding forecasts designed to support tax preparation business financial planning, including startup financial models, expense tracking models, and pricing strategy models. Ideal for tax preparation startups seeking funding from banks, angels, grants, and VC funds, this fully unlocked template enables easy customization of all financial components such as budgeting, operational financial models, and customer acquisition models to drive growth and maximize profitability.

Our tax preparation financial forecasting model addresses critical pain points by providing a comprehensive tax preparation business financial model that streamlines startup financial projections, cost analysis, and budgeting, ensuring clarity in operational expenses and investment needs. This ready-made Excel template includes an integrated tax preparation profit and loss model alongside a cash flow financial model, allowing users to accurately monitor expense tracking and revenue streams while applying a strategic pricing strategy model tailored to enhance profitability. Furthermore, by incorporating a tax preparation customer acquisition model and marketing financial model, it empowers users to optimize growth and reduce uncertainty, making financial planning for tax preparation services less stressful, risk-averse, and actionable through insightful financial statement models and diagnostic charts.

Description

This comprehensive tax preparation financial model serves as an essential tool for projecting a tax preparation service revenue model and conducting a thorough tax preparation cost analysis model, incorporating a detailed tax preparation profit and loss model, tax preparation cash flow financial model, and tax preparation budgeting financial model for a 5-year financial forecast. Designed as a tax preparation startup financial model, it includes detailed financial statements, such as the projected income statement, balance sheet, and cash flow statement, while also enabling analysis of tax preparation pricing strategy model, customer acquisition model, and marketing financial model to optimize growth. By integrating tax preparation investment financial model metrics like Internal Rate of Return, Discounted Cash Flow, and break-even analysis, this tax preparation financial forecasting model supports effective financial planning and decision-making, ensuring the operational financial model aligns with business goals and investment requirements.

TAX PREPARATION FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Seeking investors? Our comprehensive tax preparation financial model pro forma in Excel is essential. This three-way financial model enables precise validation of required start-up capital and projects investor profitability clearly. A robust tax preparation business financial model, including profit and loss, cash flow, and budgeting components, demonstrates your strategic planning and operational foresight. Investors demand a well-structured financial projection model before committing funds—ensure your tax preparation service revenue model is detailed and compelling to secure confidence and investment.

Dashboard

The Dashboard tab in the tax preparation financial model delivers a comprehensive snapshot through dynamic charts, graphs, and key ratios. This visual summary instantly communicates your tax preparation business’s financial health, including revenue, cash flow, and profit and loss insights. Tailored for seamless integration, it’s an invaluable tool for enhancing your pitch deck, supporting financial forecasting, budgeting, and growth strategies with clarity and professionalism.

Business Financial Statements

Our tax preparation startup financial model streamlines your financial planning by automatically generating comprehensive annual financial statements. Simply input your assumptions, and the model handles detailed profit and loss, cash flow, budgeting, and forecasting analyses. Designed to support your tax preparation business’s growth, this operational financial model integrates revenue projections, expense tracking, and cost analysis, empowering you with accurate insights for strategic decision-making. Elevate your tax preparation service revenue model effortlessly with our intuitive, all-in-one financial projection solution.

Sources And Uses Statement

The Sources and Uses of Capital statement is a vital component of any tax preparation financial planning model. Essential for both startups and established businesses, it supports bank loan applications and investor meetings by clearly outlining funding sources and expense allocations. Integrated within tax preparation budgeting and cash flow financial models, this statement highlights your company’s financial strategy and growth roadmap. Lenders and investors value its clarity in summarizing operational plans and financial management, making it indispensable for informed decision-making and successful capital acquisition.

Break Even Point In Sales Dollars

The break-even point in your tax preparation financial model identifies the sales volume needed to cover fixed and variable costs, resulting in zero profit or loss. Surpassing this threshold signals the start of profitability in your tax preparation profit and loss model. Utilizing our tax preparation cash flow financial model with customizable break-even charts, you can visualize minimum sales required to cover expenses. This analysis is vital for investors, aiding evaluation of profitability potential and estimating the time to recoup investments, enhancing confidence in your tax preparation business financial model’s growth and sustainability.

Top Revenue

In tax preparation financial planning models, revenue forecasting stands as the cornerstone of a robust financial plan. Accurately projecting revenue drives critical metrics within tax preparation profit and loss models and overall business valuation. Financial analysts must prioritize a precise tax preparation financial forecasting model, incorporating growth assumptions grounded in historical data. Our tax preparation financial projection model integrates best-practice components, ensuring reliable insights for business planning. By leveraging this comprehensive approach, users can optimize their tax preparation service revenue model and enhance strategic financial decision-making with confidence.

Business Top Expenses Spreadsheet

The Top Expenses tab in our tax preparation financial planning model provides a detailed breakdown of annual costs, categorized into four key groups. This comprehensive cost analysis—covering fixed expenses and customer acquisition costs—empowers you to gain clear insights into your spending patterns. Utilizing this tax preparation cost analysis model helps you maintain strict control over your finances, optimize budgeting, and drive profitability. Effective expense tracking is essential for informed decision-making and sustainable growth within your tax preparation business financial model.

TAX PREPARATION FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our tax preparation profit and loss model is an essential financial tool that captures both actual and projected expenses, enabling precise financial planning and resource allocation. Coupled with a robust tax preparation cost analysis model, it identifies key savings opportunities and optimizes budget focus. This integrated financial forecasting model not only streamlines operational budgeting but also strengthens your tax preparation startup financial model, enhancing credibility in investor pitches and loan applications. Harness these advanced tax preparation financial models to drive informed decisions and foster sustainable business growth.

CAPEX Spending

Capital expenditure analysis is a critical component of a comprehensive tax preparation financial planning model. It captures investments in property, plant, and equipment (PPE) within a tax preparation business financial model, integrating depreciation, additions, and disposals. Our pro forma template seamlessly incorporates these elements, including fixed assets under financial leasing, ensuring accurate capital budgeting. This precise approach enhances the tax preparation financial forecasting model, supporting robust tax preparation profit and loss projections and informed financial decision-making for sustainable growth.

Loan Financing Calculator

Our tax preparation financial model features an integrated loan amortization schedule, streamlining your debt management within your tax preparation business financial model. This template provides detailed tracking of repayment dates, installment breakdowns between principal and interest, and key loan terms such as interest rate, repayment frequency, and duration. Designed for ease of use, it supports accurate tax preparation financial forecasting and expense tracking models, empowering precise budgeting and cash flow management to optimize your tax preparation service revenue model and overall financial planning.

TAX PREPARATION FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Return on Investment (ROI) is a critical metric within any tax preparation startup financial model. It measures profitability by comparing cash inflows to cash outflows resulting from investments. Calculated as net investment gains divided by total investment costs, ROI provides clear insight into the effectiveness of your tax preparation business financial model. Leveraging ROI within your tax preparation financial forecasting model ensures informed decision-making, optimized resource allocation, and a data-driven approach to maximizing returns in a competitive market.

Cash Flow Forecast Excel

The tax preparation cash flow financial model is vital for managing your service’s liquidity and profitability. It consolidates key data—payables, receivables, income, working capital, and debt—to project net cash flow and closing balances. This tax preparation financial forecasting model provides clear insights into cash generation, enabling informed decisions and strategic planning. Ideal for startups and established businesses alike, it enhances cash flow management and supports growth, investment, and operational budgeting within your tax preparation financial planning model.

KPI Benchmarks

Leverage our tax preparation financial forecasting model with its intuitive benchmarking feature to effortlessly compare your business performance against industry peers. This tax preparation operational financial model highlights key metrics including profitability, cash flow, and expense tracking, enabling precise analysis of your financial position. Ideal for start-ups, it reveals performance gaps and growth opportunities, guiding strategic decisions to enhance your tax preparation service revenue model. Elevate your financial planning with data-driven insights that optimize capital use and drive success within the competitive tax preparation industry.

P&L Statement Excel

This expertly crafted tax preparation financial projection model empowers you to manage your business without needing advanced financial expertise. User-friendly and Excel-based, it requires only basic computer skills. The detailed monthly profit and loss model offers comprehensive insights into your income and expenses, enabling informed decision-making. Leverage this tax preparation operational financial model to optimize strategies, enhance profitability, and drive sustainable growth with confidence.

Pro Forma Balance Sheet Template Excel

The tax preparation financial model integrates a projected balance sheet and pro forma income statement to deliver comprehensive insights. While the balance sheet reveals assets, liabilities, and equity—highlighting net worth and funding structure at a specific point—the income statement details operational revenue and expenses over time. This dual approach supports robust financial forecasting, profit and loss analysis, and cash flow management. Key metrics like liquidity, solvency, and turnover ratios derived from these models drive informed decision-making for tax preparation startups aiming to optimize growth, profitability, and financial stability.

TAX PREPARATION FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Leverage our comprehensive tax preparation financial forecasting model to provide investors with critical insights, including a detailed seed valuation embedded within a robust 3-way financial framework. Our tax preparation cash flow financial model highlights free cash flows accessible to both shareholders and creditors, while the weighted average cost of capital (WACC) demonstrates the minimum expected return on invested enterprise funds. Additionally, the discounted cash flow analysis offers a precise valuation of future cash flows in present terms, empowering stakeholders with transparent, data-driven financial projections essential for strategic decision-making and investor confidence.

Cap Table

Incorporating a clear cap table within your tax preparation business financial model is essential. This table details securities such as common stock, preferred stock, options, and warrants, alongside ownership information. Maintaining an organized and current cap table supports strategic decisions in fundraising, employee equity distribution, and acquisition offers. Integrating this into your tax preparation financial planning model enhances transparency and drives informed growth, aligning with your tax preparation service revenue model and overall financial forecasting efforts.

TAX PREPARATION BUSINESS PLAN FINANCIAL TEMPLATE ADVANTAGES

The tax preparation financial forecasting model proactively identifies cash flow gaps and surpluses, optimizing your financial strategy.

The tax preparation cash flow financial model ensures consistent cash availability to pay suppliers and employees efficiently.

Optimize cash flow efficiently using the tax preparation cash flow financial model paired with a feasibility study template in Excel.

The tax preparation profit and loss model pinpoints break-even and maximizes return on investment with precise financial insights.

Generate confident growth insights using the tax preparation financial projection model to optimize your business strategy effectively.

TAX PREPARATION FINANCIAL MODEL TEMPLATE ADVANTAGES

The tax preparation financial forecasting model empowers accurate planning for future growth and strategic decision-making.

The tax preparation cash flow financial model empowers precise forecasting for scalable growth and informed expense management.

The tax preparation financial forecasting model simplifies planning, boosting accuracy and empowering smarter business decisions.

Maximize accuracy and growth with our user-friendly tax preparation financial model, requiring minimal experience yet delivering reliable results.

The tax preparation financial forecasting model ensures confident, data-driven decisions for sustainable business growth and profitability.

Our tax preparation financial forecasting model empowers accurate planning, risk prevention, cash flow management, and five-year growth projections.

Unlock strategic growth with a tax preparation financial model featuring all-in-one dashboard visualization for seamless insights.

The tax preparation financial forecasting model delivers instant, comprehensive insights on a single, user-friendly dashboard for quick decisions.

Optimize profits and accuracy from the start with our precise tax preparation financial forecasting model.

A tax preparation startup financial model boosts investor confidence by clearly forecasting profitability and growth potential.