Temporary Restaurant Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Temporary Restaurant Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Temporary Restaurant Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

TEMPORARY RESTAURANT FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year temporary restaurant financial projections model offers a robust restaurant financial forecasting model tailored for startups and entrepreneurs in the pop-up dining industry. Featuring an integrated financial analysis for temporary eateries, the model includes a detailed income statement temporary restaurant setup, a profit and loss model for temporary restaurants, and a temporary restaurant cash flow forecast to ensure precise financial planning for temporary restaurant ventures. With built-in key financial charts, summaries, and a restaurant budget template temporary setup, it facilitates efficient expense tracking and startup cost analysis temporary, while providing financial scenario planning for pop-up restaurants to support fundraising and business growth.

This ready-made temporary restaurant financial model Excel template addresses common challenges faced by pop-up and short-term dining ventures by providing an intuitive restaurant financial forecasting model that requires minimal Excel skills, allowing users to effortlessly input their data and receive automatic updates in key temporary food service financial metrics. It includes a comprehensive temporary restaurant cash flow forecast, income statement, and profit and loss model for temporary restaurants, facilitating accurate financial analysis for temporary eateries and enabling detailed restaurant startup cost analysis temporary setups demand. The built-in operating budget temporary dining establishment and restaurant break-even analysis temporary setups empower users to gauge financial feasibility and optimize resource allocation, while the temporary restaurant expense tracking model and financial scenario planning for pop-up restaurants help mitigate risks by exploring various revenue and cost outcomes. This holistic financial planning tool ultimately streamlines the creation of a compelling temporary restaurant financial dashboard, enhancing decision-making and investor presentations with ready-to-use, customizable reports.

Description

This comprehensive temporary restaurant financial forecasting model provides a dynamic 5-year monthly and yearly timeline featuring a detailed profit and loss model for temporary restaurants, cash flow forecasting tools, and a pro forma balance sheet tailored for pop-up restaurants and short-term dining ventures. It incorporates critical components such as restaurant startup cost analysis temporary setups, break-even analysis temporary setups, and a financial feasibility study to assess viability and profitability. The template enables seamless financial planning for temporary restaurant ventures by tracking expenses through a dedicated temporary restaurant expense tracking model and projecting revenue via a pop-up restaurant revenue model. Additionally, it delivers essential financial metrics and KPIs through an interactive temporary restaurant financial dashboard, facilitating scenario planning and strategic decision-making to optimize operating budgets for temporary dining establishments while ensuring readiness for financing requirements through comprehensive income statement temporary restaurant and discounted cash flow valuations.

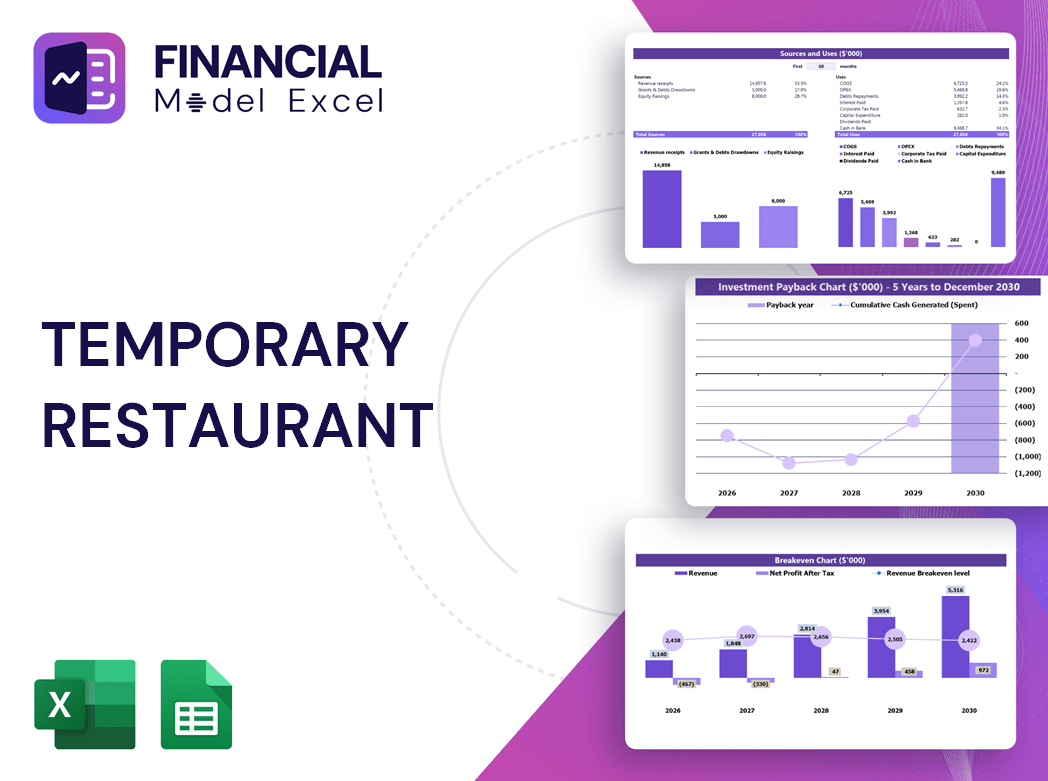

TEMPORARY RESTAURANT FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Whether launching a pop-up or managing a temporary eatery, our comprehensive 5-year restaurant financial forecasting model provides all essential reports for informed decision-making. Access detailed profit and loss models for temporary restaurants, cash flow forecasts, and pro forma balance sheets—all customizable in Excel. Benefit from monthly and yearly financial scenario planning, ensuring precise temporary restaurant financial feasibility studies and expense tracking. Streamline your financial planning for temporary restaurant ventures with our user-friendly budget templates and financial dashboards designed for short-term setups. Empower your temporary dining establishment with expert financial analysis and backed insights for lasting success.

Dashboard

Our temporary restaurant financial dashboard offers precise financial modeling and reporting tailored for pop-up ventures. Designed to ensure transparency, it enables accurate income statements, cash flow forecasts, and expense tracking models—crucial for informed decision-making. By leveraging this restaurant financial forecasting model, stakeholders gain real-time insights into startup costs, revenue projections, and break-even analysis specific to temporary dining setups. This reliable tool empowers users to conduct in-depth financial analysis, optimize operating budgets, and craft effective strategies, ultimately driving profitability and long-term success in short-term restaurant ventures.

Business Financial Statements

Our comprehensive restaurant financial forecasting model includes a pre-built financial summary that integrates detailed data from key spreadsheets—projected balance sheet, forecasted profit and loss statement, and cash flow forecast templates. Designed specifically for temporary restaurant ventures and pop-up concepts, this financial dashboard streamlines your financial planning and enhances your pitch deck. Benefit from expert-crafted short-term restaurant financial modeling that covers startup cost analysis, expense tracking, and break-even analysis, empowering you with reliable insights for informed decision-making and successful temporary dining operations.

Sources And Uses Statement

The sources and uses statement within this three-way restaurant financial forecasting model clearly outlines cash inflows and outflows for temporary dining establishments. It offers a comprehensive financial analysis for pop-up restaurants, highlighting where revenue is generated and how expenses are allocated. This essential component supports accurate financial planning for temporary restaurant ventures, enabling effective budget management, cash flow forecasting, and profit and loss tracking. Use this model to enhance your restaurant startup cost analysis and ensure financial feasibility through detailed scenario planning and expense tracking.

Break Even Point In Sales Dollars

A break-even analysis is essential in temporary restaurant financial planning, pinpointing the sales volume needed to cover all fixed and variable costs. This restaurant financial forecasting model enables owners to assess the feasibility of their pop-up or temporary dining venture. By leveraging a profit and loss model for temporary restaurants, managers can set optimal pricing strategies to ensure profitability. Utilizing a temporary restaurant financial dashboard and cash flow forecast, stakeholders gain clarity on when the establishment is expected to become financially sustainable, supporting confident decision-making for short-term restaurant financial modeling and operational success.

Top Revenue

This temporary restaurant financial plan features a dedicated tab for comprehensive revenue stream analysis. Users can leverage the restaurant financial forecasting model to evaluate income by each product or service category individually. Designed for pop-up restaurants and short-term dining ventures, this tool enhances financial scenario planning and supports precise temporary restaurant cash flow forecasts. Elevate your temporary eatery’s profitability insights with our streamlined financial dashboard and expense tracking model.

Business Top Expenses Spreadsheet

The Top Expenses tab in this three-way restaurant financial forecasting model offers a clear, annual breakdown of your temporary dining establishment’s costs. Categorized into customer acquisition, cost of sales (COSS), wages & salaries, fixed and variable expenses, it provides a comprehensive view of your temporary restaurant’s financial outlays. Designed as a robust financial planning tool for pop-up restaurants, this Excel template streamlines expense tracking and enhances your restaurant’s budget management for short-term ventures. Use it to optimize your temporary restaurant financial projections and ensure successful, data-driven decision-making.

TEMPORARY RESTAURANT FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our expertly crafted restaurant budget template for temporary setups streamlines salary cost tracking by capturing all full-time and part-time employees efficiently. This data seamlessly integrates across your temporary restaurant financial plan, enhancing accuracy in your short-term restaurant financial modeling. Whether developing a financial model for pop-up restaurants or conducting a temporary restaurant financial feasibility study, this tool ensures comprehensive expense tracking and supports robust financial forecasting. Optimize your temporary dining financial plan with our dynamic template, designed to provide clear insights into staffing costs and improve overall financial analysis for temporary eateries.

CAPEX Spending

Accurate startup cost analysis for temporary restaurants is crucial for optimizing capital investments in fixed assets, directly impacting operational capacity. In short-term restaurant financial modeling, significant CAPEX expenses—primarily property, plant, and equipment—must be carefully forecasted. These projections integrate seamlessly across the restaurant financial forecasting model, including the income statement, cash flow forecast, and balance sheet templates. Utilizing a comprehensive financial plan for temporary restaurant ventures ensures effective expense tracking and enhances financial feasibility, enabling strategic decisions for pop-up restaurants and other temporary dining setups.

Loan Financing Calculator

A comprehensive temporary restaurant financial forecasting model includes a loan amortization schedule that details periodic payments for amortizing loans. This schedule tracks principal reduction over the loan’s term with consistent payments. Integrated into restaurant financial projections, such as pop-up restaurant revenue models or temporary dining financial plans, it helps stakeholders visualize outstanding balances and repayment timelines. Using a financial model for pop-up restaurants with pre-built amortization calculators enables precise tracking of loan obligations, supporting accurate cash flow forecasts and enhancing financial planning for temporary restaurant ventures.

TEMPORARY RESTAURANT FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Return on Assets (ROA) is a key metric in temporary restaurant financial forecasting models. Calculated by dividing net income from the income statement temporary restaurant by total assets from the projected balance sheet template, ROA reveals how efficiently your temporary dining establishment utilizes assets to generate profits. A higher ROA indicates effective asset management and stronger financial performance in your financial model for pop-up restaurants. Incorporating ROA into your temporary restaurant financial plan aids in robust financial scenario planning and enhances your restaurant break-even analysis for temporary setups.

Cash Flow Forecast Excel

The startup cash flow forecast is a crucial component of temporary restaurant financial projections, especially for pop-up and short-term dining ventures. This financial model for pop-up restaurants highlights current cash reserves, enabling precise financial planning and operating budget management. By tracking cash inflows and outflows, it provides early warnings if funds fall short, ensuring the business remains eligible for financing. Incorporating this into a comprehensive temporary restaurant financial dashboard enhances decision-making, driving profitability and sustainability in dynamic, temporary food service environments.

KPI Benchmarks

A comprehensive financial analysis for temporary restaurants leverages benchmarking within a restaurant financial forecasting model. By comparing key metrics—such as cost margins, gross profit, and unit costs—from top-performing temporary eateries, businesses can identify strengths and weaknesses. This data-driven approach informs strategic decisions, ensuring optimized financial planning for pop-up restaurant ventures. Utilizing tools like a temporary restaurant financial dashboard or expense tracking model enhances visibility into operating budgets and cash flow forecasts, ultimately driving profitability and long-term success in short-term dining establishments.

P&L Statement Excel

Leverage our comprehensive restaurant financial forecasting model to create precise, pro forma income statements tailored for temporary dining ventures. This dynamic financial tool enables detailed analysis and tracking of your pop-up restaurant’s revenue, expenses, and cash flow. Empower daily management decisions with accurate short-term restaurant financial modeling, including profit and loss, break-even analysis, and startup cost insights. Gain clear visibility into your temporary restaurant’s financial feasibility and performance through our customizable budget templates and financial dashboards—ensuring you confidently identify strengths, mitigate risks, and optimize profitability in every temporary setup.

Pro Forma Balance Sheet Template Excel

We incorporated a comprehensive pro forma balance sheet within our restaurant financial forecasting model, essential for any startup venture. This report details both current and long-term assets, liabilities, and equity, providing critical data for accurate short-term restaurant financial modeling. By leveraging this financial analysis for temporary eateries, operators can conduct thorough restaurant startup cost analysis and enhance financial planning for temporary restaurant ventures. The balance sheet serves as a foundation for evaluating key financial metrics, enabling precise profit and loss modeling and informed decision-making for pop-up restaurants and temporary dining establishments alike.

TEMPORARY RESTAURANT FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our restaurant financial forecasting model incorporates key metrics like Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF) to deliver a comprehensive temporary restaurant financial plan. WACC evaluates the proportional cost of equity and debt, serving as a vital risk assessment tool for lenders. Meanwhile, the DCF calculation projects the present value of future cash flows, guiding informed investment decisions. This robust financial model for pop-up restaurants supports accurate short-term restaurant financial modeling, ensuring your temporary dining venture's financial feasibility and profitability.

Cap Table

Our comprehensive financial model for pop-up restaurants integrates the funding rounds directly into the temporary restaurant cash flow forecast. It aligns capital inflows with financial instruments like equity and convertible notes, offering precise insight into ownership structure and dilution impacts. This dynamic temporary restaurant financial dashboard empowers entrepreneurs to conduct thorough financial scenario planning and monitor key metrics, ensuring informed decisions that optimize restaurant startup cost analysis and profitability for short-term ventures.

TEMPORARY RESTAURANT BUSINESS PLAN FINANCIAL TEMPLATE ADVANTAGES

Optimize profits and manage costs effortlessly with our comprehensive temporary restaurant financial forecasting model.

Unlock success with a precise financial model for pop-up restaurants, ensuring accurate revenue forecasting and profit optimization.

Better decision making with a temporary restaurant financial model ensures accurate forecasts and optimized profitability.

The financial model for pop-up restaurants predicts challenges early, ensuring proactive, profitable temporary dining management.

A financial model for pop-up restaurants identifies strengths and weaknesses, enabling strategic, data-driven decision-making for success.

TEMPORARY RESTAURANT 5 YEAR FINANCIAL PROJECTION TEMPLATE ADVANTAGES

Optimize profits and control costs effortlessly with our temporary restaurant financial model, ensuring accurate budget tracking.

A temporary restaurant cash flow forecast enables precise financial planning, ensuring profitable operations and informed decision-making.

Create confident pitches with a precise temporary restaurant financial model for accurate forecasting and funding success.

Impress investors confidently with a strategic, proven temporary restaurant financial model and pro forma income statement template.

Our financial model for pop-up restaurants delivers comprehensive, real-time insights for confident short-term dining financial planning.

Our financial model simplifies temporary restaurant projections, providing comprehensive lender-ready reports and essential calculations effortlessly.

Easily run different scenarios with our temporary restaurant financial forecasting model to optimize profits and control costs.

The temporary restaurant financial forecasting model lets you easily test scenarios to optimize cash flow and profitability.

A tailored financial model ensures accurate forecasting and profitability for your temporary or pop-up restaurant ventures.

A clear, well-structured temporary restaurant financial model streamlines hypothesis testing and enhances decision-making efficiency.