Virtual Bookkeeping Service Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Virtual Bookkeeping Service Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Virtual Bookkeeping Service Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

VIRTUAL BOOKKEEPING SERVICE FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive 5-year virtual bookkeeping service financial model offers a scalable financial planning template, including detailed monthly profit and loss statements, virtual bookkeeping expense forecasts, and cash flow models. Designed to support your virtual bookkeeping service business plan, it provides accurate online bookkeeping financial analysis, enabling you to conduct thorough bookkeeping service cost analysis and revenue forecasts. With fully customizable financial statements in GAAP or IFRS formats, this virtual accounting service financial model facilitates precise virtual bookkeeping profitability modeling, budgeting, and growth projections—empowering you to evaluate and optimize your startup idea and achieve sustainable profit margins.

The ready-made virtual bookkeeping service financial model in Excel alleviates critical pain points by providing an all-encompassing solution that integrates profit and loss projection, cash flow forecasting, and a detailed sources and uses analysis spanning five years on a monthly basis. It simplifies complex bookkeeping service cost analysis and expense forecasting, ensuring accuracy and efficiency while mitigating manual errors. With automated consolidation of annual summaries into a comprehensive financial statement, users can effortlessly monitor virtual bookkeeping profit margins and evaluate virtual bookkeeping revenue forecasts. The scalable financial model supports dynamic virtual bookkeeping growth models and profitability assessments, enabling strategic financial projections and budgeting tailored to evolving business plans. This structured yet flexible bookkeeping financial planning template ultimately reduces the time, expertise, and risk associated with creating a reliable financial roadmap for virtual accounting and cloud bookkeeping services.

Description

Our scalable financial model for bookkeeping services provides a comprehensive framework for virtual bookkeeping revenue forecast, expense forecast, and profitability analysis, tailored for both startups and established businesses. This cloud bookkeeping financial plan integrates a detailed bookkeeping service cost analysis and budgeting model to facilitate precise financial projections virtual bookkeeping over a 60-month horizon. With automated bookkeeping financial model features, it produces a full set of virtual bookkeeping financial statement outputs—including projected income statement, cash flow model, and balance sheet templates—enhanced by dynamic sales and feasibility diagnostics for strategic business planning. Designed to optimize the virtual bookkeeping profit margin and support sustainable growth, the model is an essential tool embedded in a robust virtual bookkeeping service business plan to empower effective financial planning and online bookkeeping financial analysis.

VIRTUAL BOOKKEEPING SERVICE FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Develop a comprehensive virtual bookkeeping service financial model designed to visualize the future financial impact of your strategic decisions. This scalable financial model automatically generates all key financial statements—including projected profit and loss, balance sheet, and pro forma cash flow templates—while integrating essential KPIs in a dynamic dashboard. Ideal for crafting a robust virtual bookkeeping service business plan, this tool supports detailed cost analysis, revenue forecasting, and expense forecasting to optimize profitability and drive growth. Empower your bookkeeping startup financial planning with an automated, cloud-based solution that streamlines budgeting, cash flow management, and profitability modeling.

Dashboard

Our virtual bookkeeping service business plan includes a comprehensive financial model featuring an intuitive dashboard that visualizes key financial statements across all business phases. This dynamic tool presents cash flow models, profit and loss templates, and virtual bookkeeping revenue forecasts through clear charts and graphs. It supports detailed bookkeeping service cost analysis, expense forecasting, and scalability planning—empowering you to make informed decisions and optimize your virtual bookkeeping profit margin with ease.

Business Financial Statements

Our bookkeeping startup financial model offers expertly crafted Excel templates for essential financial reports: projected balance sheet, profit and loss statement, and cash flow forecasting. These interconnected templates ensure accurate, balanced financial projections tailored for virtual bookkeeping service business plans. Designed for seamless integration, they provide clear, professional financial statements ideal for investor presentations, pitch books, and online bookkeeping financial analysis. Empower your virtual bookkeeping profitability model and scalable financial planning with tools built for growth and precise expense forecasting.

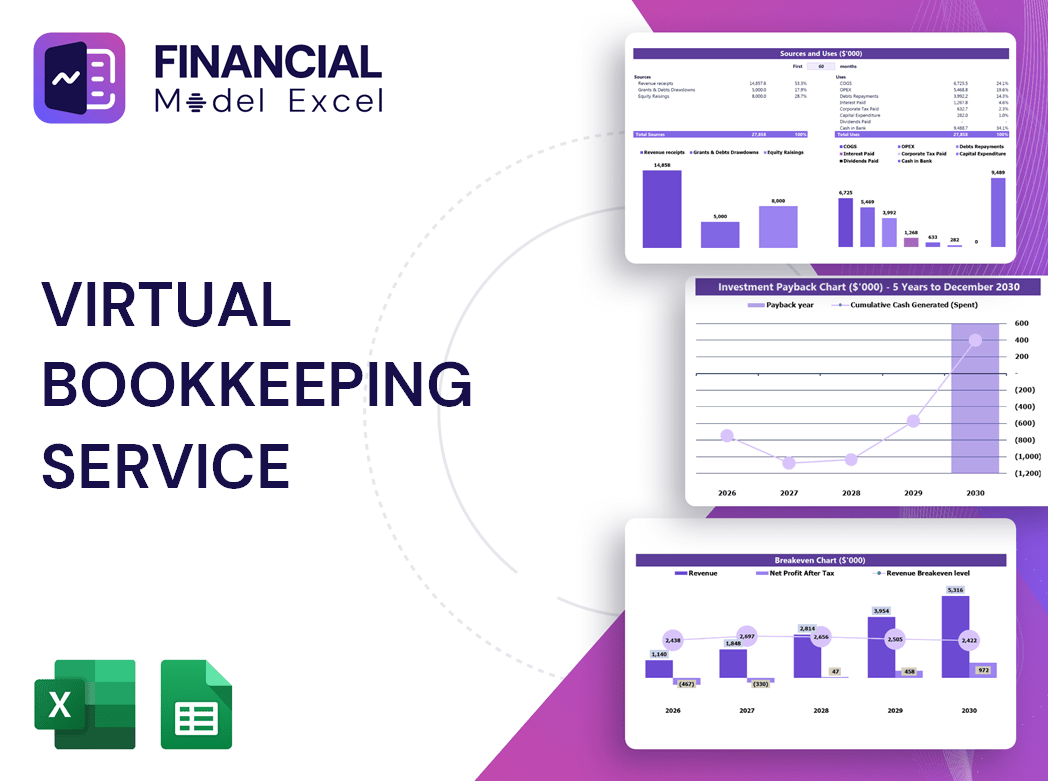

Sources And Uses Statement

To enhance professionalism and streamline financial oversight, our virtual bookkeeping financial planning template includes a dedicated "Sources and Uses" tab. This feature clearly categorizes the origins of company funding alongside the planned allocation of these resources, ensuring precise bookkeeping service cost analysis and supporting accurate virtual bookkeeping cash flow models. By integrating this scalable financial model for bookkeeping services, businesses gain actionable insights into their virtual bookkeeping revenue forecast and profitability model, fostering informed decision-making and robust financial projections within the virtual accounting service financial model framework.

Break Even Point In Sales Dollars

The Break-Even in Sales tab within this 5-year virtual bookkeeping financial model highlights the precise unit sales needed to achieve profitability. This critical metric demonstrates when your virtual bookkeeping service’s overall revenues surpass expenses, signaling the transition to sustainable profit margins. Incorporating this analysis into your bookkeeping service business plan ensures accurate financial projections and informs strategic decision-making, supporting a scalable financial model for bookkeeping growth and profitability.

Top Revenue

Enhance your virtual bookkeeping business plan with our comprehensive Excel financial model. This scalable tool features specialized tabs for in-depth revenue analysis by product or service category, enabling precise virtual bookkeeping revenue forecasts and cost analysis. Utilize the bookkeeping financial planning template to isolate streams, refine your virtual bookkeeping profit margin, and optimize your virtual bookkeeping cash flow model. Perfect for creating detailed virtual bookkeeping expense forecasts and supporting your bookkeeping startup financial model, this solution empowers strategic financial projections and profitability modeling for sustainable growth. Elevate your virtual accounting service financial model with clarity and confidence.

Business Top Expenses Spreadsheet

The Top Expenses tab in our startup financial projections offers a detailed bookkeeping service cost analysis, categorizing expenses into four key groups. Featuring a clear chart, it highlights annual costs for customer acquisition, payroll, and other critical areas. This virtual bookkeeping financial planning template is essential for startups and business planners aiming to build a scalable financial model bookkeeping framework. By integrating an accurate virtual bookkeeping expense forecast, it supports precise virtual bookkeeping revenue forecasts and robust financial projections, ensuring insightful online bookkeeping financial analysis and effective bookkeeping startup financial model development.

VIRTUAL BOOKKEEPING SERVICE FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Startup costs, a vital component of every virtual bookkeeping financial model, arise before initiating any client work. Careful monitoring of these expenses within your bookkeeping service cost analysis is essential to prevent financial shortfalls or underfunding. Our specialized bookkeeping startup financial model and pro-forma in the business plan template provide clear insights into funding requirements and spending patterns. Regularly utilizing our financial projections virtual bookkeeping template enables precise expense forecasting and strategic budgeting, ensuring sustainable growth and maximizing virtual bookkeeping profit margins.

CAPEX Spending

The startup budget highlights essential capital expenditures focused on acquiring high-value assets poised to drive substantial future benefits. Utilizing a comprehensive bookkeeping startup financial model, including pro forma financial statements and capital cost analysis tools, empowers business owners to accurately project long-term growth and development. Distinguishing these investments from operational expenses or depreciation is crucial for precise virtual bookkeeping financial planning. Incorporating scalable financial models and expense forecasts ensures robust virtual bookkeeping profitability models that support sustainable business expansion and financial health.

Loan Financing Calculator

Start-ups and early-stage businesses must diligently manage loan repayment schedules, detailing each loan’s amount and maturity. These schedules are essential components of cash flow forecasting and appear on the balance sheet, directly impacting virtual bookkeeping financial statements. Principal repayments are recorded under financing activities, while interest expenses influence the company’s cash flow projection template and overall bookkeeping financial planning. Incorporating a scalable financial model for bookkeeping services ensures accurate virtual bookkeeping expense forecasts and strengthens financial projections, enabling informed decision-making within your virtual bookkeeping service business plan.

VIRTUAL BOOKKEEPING SERVICE FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Net profit margin is a key metric within virtual bookkeeping financial models that measures how effectively your business converts gross revenue into actual profit. Expressed as a percentage, it reflects net income after deducting costs and operating expenses from total sales. Utilizing this profitability model in your virtual bookkeeping service business plan enables precise financial projections and expense forecasts, guiding strategic decisions. Monitoring net profit margin through scalable financial models and online bookkeeping financial analysis is essential for optimizing profitability and supporting sustainable growth in your bookkeeping startup’s revenue forecast.

Cash Flow Forecast Excel

The virtual bookkeeping cash flow model provides a clear, categorized overview of all cash inflows and outflows—operating, investing, and financing—over a set period. This essential component of your bookkeeping financial planning template ensures that the ending cash balance aligns seamlessly with the balance sheet forecast, offering accurate financial projections for bookkeeping services. Utilizing this scalable financial model for bookkeeping enhances virtual bookkeeping profitability by delivering precise expense forecasts and revenue forecasts, empowering your virtual bookkeeping service business plan with actionable insights and robust financial statement analysis.

KPI Benchmarks

This virtual bookkeeping financial planning template includes a dedicated tab for comprehensive financial benchmarking studies. By analyzing performance metrics and comparing key financial indicators against industry peers, users gain valuable insights into their bookkeeping service’s competitiveness, efficiency, and productivity. Leveraging this scalable financial model for bookkeeping services enables informed decisions to optimize profit margins and drive sustainable growth. Whether refining your virtual bookkeeping service pricing model or forecasting expenses, this tool enhances your bookkeeping startup financial model with data-driven clarity and strategic foresight.

P&L Statement Excel

To maintain clear oversight of your company’s finances, leveraging a virtual bookkeeping financial statement or P&L template is essential. Integrating a scalable financial model for bookkeeping services into your business plan allows accurate calculation of net income percentages and cash flow projections. A forecasted income statement offers real-time insight into financial performance, enabling effective management of income and expenses. By utilizing a bookkeeping service budgeting model or virtual accounting service financial model, you can optimize profitability and ensure your virtual bookkeeping revenue forecast aligns with strategic growth objectives.

Pro Forma Balance Sheet Template Excel

The projected 5-year balance sheet is a vital component of your virtual bookkeeping service financial model, detailing key assets—from cash and equipment to fixed assets—alongside current and long-term liabilities and equity. This comprehensive financial projection, presented clearly in Excel, supports your bookkeeping startup financial plan by illustrating profitability, cash flow, and capital structure. It’s essential for engaging creditors and investors, providing transparent insight into your business’s financial health and scalability. Leveraging this financial statement enhances credibility, aiding in successful loan applications and strategic growth planning within the virtual bookkeeping industry.

VIRTUAL BOOKKEEPING SERVICE FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Net Present Value (NPV) represents the present value of all future cash flows—both positive and negative—within a virtual bookkeeping service business plan. This comprehensive financial model for bookkeeping services integrates key metrics such as investment required, equity raised, EBITDA, net income, total investment, WACC, and growth rate. Utilizing this scalable financial model bookkeeping template enables accurate virtual bookkeeping revenue forecasts, expense forecasts, and profitability models, empowering strategic financial planning and robust virtual bookkeeping cash flow models to drive sustainable growth and maximize profit margins.

Cap Table

The equity cap table is an essential strategic tool for businesses, providing precise calculations of shareholder ownership dilution. Integrated within a comprehensive bookkeeping service financial model, this cap table—often managed via Excel—captures key data across four distinct funding rounds. Each round can be analyzed individually or collectively, empowering accurate virtual bookkeeping revenue forecasts and scalable financial planning. By leveraging this framework, businesses enhance their bookkeeping financial projections and optimize their virtual bookkeeping profit margin with confidence and clarity.

VIRTUAL BOOKKEEPING SERVICE PROFORMA BUSINESS PLAN TEMPLATE ADVANTAGES

Gain full control and optimize profits with our virtual bookkeeping service financial model in an Excel spreadsheet.

Reduce risk and boost accuracy using the virtual bookkeeping financial model, your expert financial planning template in Excel.

A scalable financial model boosts virtual bookkeeping profitability by enabling precise forecasting and strategic growth planning.

Maximize cash flow accuracy with our scalable virtual bookkeeping financial model for precise 5-year projections.

Unlock accurate growth insights with a scalable virtual bookkeeping financial model forecasting revenues and expenses effectively.

VIRTUAL BOOKKEEPING SERVICE STARTUP FINANCIAL MODEL ADVANTAGES

Our scalable financial model empowers virtual bookkeeping services to optimize profits and forecast growth confidently—update anytime.

The scalable financial model for bookkeeping services enables precise, adaptable forecasting to optimize growth and profitability efficiently.

Leverage a scalable financial model for virtual bookkeeping to confidently plan and accelerate your business’s future growth.

The virtual bookkeeping financial model offers clear, accurate forecasts to drive scalable growth and maximize profitability effortlessly.

Our scalable financial model ensures precise virtual bookkeeping revenue forecasts, driving profitable growth and investor confidence.

This scalable financial model streamlines assumptions and outputs, delivering clear, investor-ready insights for virtual bookkeeping success.

Our scalable financial model for bookkeeping ensures accurate forecasting and boosts virtual bookkeeping service profitability efficiently.

Clear, color-coded virtual bookkeeping financial model ensures precise projections, streamlined planning, and insightful profitability analysis.

The financial model empowers accurate revenue forecasting and scalable profitability for virtual bookkeeping service growth.

Streamline growth with a scalable 5-year virtual bookkeeping financial model delivering real-time GAAP and IFRS insights.