Wind Farm Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Wind Farm Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Wind Farm Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

WIND FARM FINANCIAL MODEL FOR STARTUP INFO

Highlights

This sophisticated 5-year wind farm financial modeling template offers a comprehensive renewable energy project financial model tailored for businesses of any size and development stage. Designed with simplicity in mind, it requires minimal financial planning experience and basic Excel knowledge, yet delivers reliable financial projections for wind farms. The model integrates wind farm capital budgeting, operational expense forecasting, and revenue forecasting models to facilitate wind farm investment analysis and financial feasibility assessments. Fully editable and unlocked, it supports wind energy project valuation, cost-benefit analysis, and development financial planning, making it an ideal tool for evaluating startup ideas, planning pre-launch expenses, and securing funding from banks, angels, grants, and VC funds.

This ready-made renewable energy project financial model in Excel significantly alleviates the complexity and time-consuming nature of wind farm investment analysis by integrating wind turbine cost estimation models, wind farm operational expense models, and wind farm revenue forecasting models into one streamlined tool. By offering comprehensive wind energy project cash flow models alongside wind farm capital budgeting and cost-benefit analysis features, it enables users to efficiently conduct financial feasibility of wind farms and wind power economic evaluation with accuracy and confidence. The model’s built-in wind energy financial risk assessment and wind energy investment return models address uncertainties and improve projection reliability, while expense forecasting tools and a project finance model for wind farms simplify the detailed breakdown of costs and funding sources. Ultimately, this template empowers users to perform thorough wind project profitability modeling and wind energy project valuation, reducing manual calculations and enhancing decision-making for wind farm development financial plans.

Description

Our advanced wind farm financial modeling techniques incorporate a comprehensive renewable energy project financial model that enables detailed wind farm investment analysis and wind turbine cost estimation modeling, ensuring precise wind farm revenue forecasting and operational expense tracking. This wind energy project cash flow model facilitates a robust financial feasibility assessment of wind farms, integrating a project finance model for wind farms with capital budgeting tools and economic evaluation metrics. Designed to support wind power economic evaluation and wind energy financial risk assessment, the model delivers accurate financial projections for wind farms, including cost-benefit analysis, expense forecasting tools, and investment return calculations. It generates essential financial statements such as monthly profit and loss, 5-year cash flow projections, and pro forma balance sheets, allowing stakeholders to conduct wind energy project valuation, profitability modeling, and overall wind farm development financial planning with confidence, while also providing diagnostic tools to identify key risks and financing options including equity investments.

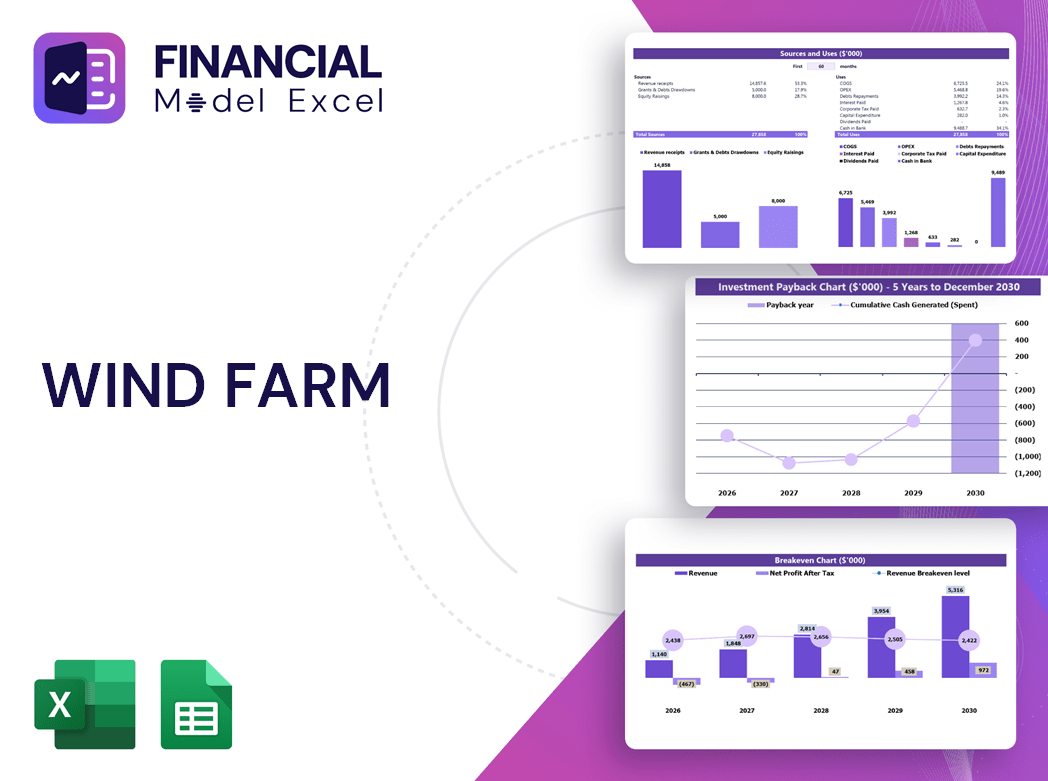

WIND FARM FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Seeking a sophisticated yet intuitive 5-year renewable energy project financial model? Our wind farm financial modeling techniques deliver a versatile, user-friendly tool designed for comprehensive wind farm investment analysis. With customizable sheets for wind turbine cost estimation, revenue forecasting, and operational expense modeling, this template empowers you to perform robust financial feasibility studies. Easily tailor and expand the wind farm capital budgeting model to suit your project’s unique demands, ensuring accurate financial projections and a thorough wind energy investment return model. Elevate your wind farm development financial plan with our powerful, adaptable solution.

Dashboard

Having a comprehensive wind farm financial modeling dashboard is essential for engaging stakeholders, investors, and lenders. This all-in-one tool integrates your renewable energy project financial model with dynamic charts, offering clear financial projections for wind farms. It streamlines wind farm investment analysis, wind energy project cash flow, and expense forecasting, enhancing your wind farm development financial plan. Empower your presentations with actionable insights using this intuitive Excel dashboard, designed to support financial feasibility assessments and optimize capital budgeting for wind power projects.

Business Financial Statements

Our advanced wind farm financial modeling template features an integrated Excel structure with pre-built pro forma statements, including a 5-year projected balance sheet, profit and loss, and cash flow models. Designed for renewable energy projects, it streamlines wind farm investment analysis, capital budgeting, and revenue forecasting. This comprehensive tool supports financial feasibility studies, expense forecasting, and financial risk assessment, offering customizable reports in GAAP or IFRS formats. Perfect for optimizing wind energy project valuation and enhancing financial projections, it empowers users to confidently evaluate wind project profitability and plan sustainable investments with precision.

Sources And Uses Statement

This wind farm financial modeling template features a comprehensive sources and uses of funds statement, providing clear insights into the project's capital structure. It enables precise tracking of funding origins and allocations, essential for accurate wind energy project cash flow modeling and financial feasibility analysis. Ideal for wind farm investment analysis and capital budgeting, this tool supports robust financial projections for wind farms, enhancing the wind energy project valuation model and optimizing wind energy investment return assessments.

Break Even Point In Sales Dollars

This wind farm financial modeling template features a dynamic break-even analysis graph that accurately forecasts when the renewable energy project transitions to profitability. By integrating forecasted revenues and operational expenses, the model pinpoints the period where revenues surpass costs, supporting informed wind farm investment analysis and capital budgeting decisions. This robust financial feasibility tool enables stakeholders to confidently assess project viability and optimize wind energy investment returns.

Top Revenue

The Top Revenue tab in our wind farm revenue forecasting model offers a comprehensive summary of your company’s revenue, detailed by product line. This renewable energy project financial model delivers an annual breakdown of revenue streams, highlighting total income per segment alongside insightful revenue bridges. Designed for precise wind farm investment analysis, it supports accurate financial projections for wind farms, enabling robust wind energy project valuation and enhancing your wind farm capital budgeting model. This tool empowers better decision-making in assessing the financial feasibility of wind farms and optimizing wind project profitability.

Business Top Expenses Spreadsheet

The Top Expenses tab provides a detailed cost summary essential for wind farm capital budgeting and operational expense modeling. By tracking expenses by category, you streamline tax preparation and enhance your wind farm expense forecasting tools. This data supports accurate financial projections for wind farms, enabling rational planning of your three-statement wind energy project financial model. Analyze whether costs align with expectations, assess variances, and leverage insights to refine your wind project profitability model and optimize the financial feasibility of wind farms for future development scenarios.

WIND FARM FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our comprehensive wind farm financial modeling techniques enable precise financial projections and budget planning for up to 5 years. Utilizing a robust renewable energy project financial model, it forecasts costs—including variable and fixed expenses, COGS, wages, and capital expenditures—by analyzing key parameters like income percentages and payroll. This wind farm expense forecasting tool supports wind farm investment analysis and operational expense modeling, empowering developers with accurate cash flow insights. Ideal for financial feasibility studies, capital budgeting, and wind energy investment return models, it ensures confident decision-making through reliable wind energy project valuation and profitability assessments.

CAPEX Spending

Capital expenditures (CapEx) represent investments in acquiring, maintaining, or enhancing fixed assets like property, equipment, and technology essential for wind farm projects. In wind farm financial modeling techniques, CapEx is a critical component embedded within the five-year projected balance sheet, while also impacting the projected income statement and wind energy project cash flow model. Accurately estimating CapEx through wind turbine cost estimation models ensures reliable financial projections for wind farms, enabling robust wind farm investment analysis and comprehensive wind energy financial risk assessment.

Loan Financing Calculator

Effective wind farm financial modeling techniques are crucial for monitoring loan profiles, repayment schedules, and the use of proceeds in renewable energy projects. Utilizing detailed project finance models for wind farms—with line-by-line breakdowns of interest expenses, principal repayments, and covenants—ensures accurate financial projections. Integrating these with wind energy project cash flow models allows seamless reflection of debt balances on balance sheets and clear visibility of loan impacts on operational expenses. This approach strengthens the financial feasibility and investment analysis of wind farms, enhancing decision-making and long-term profitability in wind energy project valuation and capital budgeting.

WIND FARM FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

This wind farm financial modeling template empowers you to build detailed renewable energy project financial models with KPI tracking over your chosen timeline. Key indicators include EBITDA/EBIT to assess operational performance, cash flow metrics for comprehensive wind energy project cash flow analysis, and cash balance tracking to monitor liquidity. Designed to support wind farm investment analysis and financial feasibility assessments, this tool enhances your wind farm revenue forecasting model and capital budgeting efforts, driving informed decisions for profitable wind energy projects.

Cash Flow Forecast Excel

In wind farm investment analysis, robust wind energy project cash flow models are essential to forecast financial viability. A detailed pro forma cash flow projection reveals actual cash accumulation and shortfalls, guiding capital budgeting and funding decisions. Utilizing advanced wind farm financial modeling techniques ensures accurate financial projections, supporting comprehensive wind energy financial risk assessment and investment return modeling. These models empower stakeholders to evaluate the financial feasibility of wind farms, optimize operational expense planning, and maximize project profitability through informed cost-benefit analysis and revenue forecasting.

KPI Benchmarks

This pro forma income statement template includes a dedicated tab for financial benchmarking, essential for wind farm investment analysis. By comparing your wind energy project financial model against industry standards, you can evaluate operational efficiency, profitability, and competitiveness. Utilizing this benchmarking study enhances the accuracy of your wind farm financial modeling techniques, supporting informed decisions in wind farm capital budgeting and wind energy investment return models. Empower your renewable energy project financial planning with comprehensive financial projections for wind farms, ensuring optimal performance and strategic advantage in the evolving energy market.

P&L Statement Excel

The Monthly Income Statement in this renewable energy project financial model offers detailed, timely reporting essential for wind farm investment analysis. It integrates comprehensive revenue streams, gross and net earnings, ensuring precise wind farm revenue forecasting. The Yearly Profit and Loss Projection delivers in-depth insights into operational expenses, administrative costs, and profitability metrics. Featuring clear graphs, assumptions, margins, and wind farm cost benefit analysis, this financial projection tool supports robust wind energy project valuation and financial feasibility assessments. Ideal for accurate financial projections and informed decision-making in wind farm capital budgeting and investment return modeling.

Pro Forma Balance Sheet Template Excel

Utilizing advanced wind farm financial modeling techniques, our integrated renewable energy project financial model seamlessly links pro forma cash flow statements, profit and loss templates, and monthly and yearly projected balance sheets. This comprehensive approach delivers an in-depth summary of your assets, liabilities, and equity accounts, empowering precise wind farm investment analysis and reliable financial projections for wind projects. Designed for rigorous wind energy project valuation and capital budgeting, this model enhances financial feasibility assessments and supports informed decision-making for sustainable wind power development.

WIND FARM FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Leverage our comprehensive wind farm financial modeling techniques to deliver precise financial projections for wind farms. Our renewable energy project financial model integrates a weighted average cost of capital (WACC) analysis, demonstrating the minimum expected return for investors. Utilize the wind energy project cash flow model to assess free cash flow available to both shareholders and creditors. Additionally, our discounted cash flow approach provides an accurate valuation of future cash flows at present value. This robust wind farm investment analysis empowers stakeholders with clear insights into financial feasibility and long-term profitability.

Cap Table

The Cap Table Excel within the wind farm financial modeling techniques provides a clear snapshot of financial flows, detailing all instruments involved in project finance models for wind farms. This tool enables comprehensive wind farm investment analysis by illustrating how strategic decisions impact profitability and cash flow. By integrating a wind energy project cash flow model with the Cap Table, stakeholders gain valuable insights into financial projections for wind farms, supporting robust wind power economic evaluation and enhancing the financial feasibility of wind farms through precise capital budgeting and investment return assessments.

WIND FARM FINANCIAL MODEL IN EXCEL ADVANTAGES

The wind energy project cash flow model ensures precise financial projections, optimizing investment decisions and maximizing returns.

The wind farm financial modeling techniques deliver precise cost and revenue forecasts, accelerating confident investment decisions.

Our wind farm financial modeling techniques ensure accurate, dynamic projections for optimal investment and profitability decisions.

The wind farm financial model accurately forecasts cash flow, empowering strategic investment and optimizing renewable energy project profitability.

Effortlessly forecast profits and balance sheets with advanced wind farm financial modeling techniques for smarter investment decisions.

WIND FARM FINANCIAL MODEL ADVANTAGES

Our wind farm financial model ensures accurate revenue forecasting and robust investment analysis, empowering investors ready for success.

Optimize wind farm profitability with comprehensive financial models, including income statements, cash flow, balance sheets, and ratios.

Optimize spending and stay within budget using advanced wind farm financial modeling techniques for precise cost control.

A wind energy project cash flow model enables precise future cash forecasting, improving budget planning and financial decision-making.

Get a robust wind farm financial model that ensures accurate investment analysis and maximizes renewable energy project profitability.

This robust wind farm financial model empowers precise planning, customization, and detailed analysis for superior renewable energy investments.

Optimize returns confidently with our wind farm financial modeling techniques for accurate, comprehensive project viability insights.

Maximize funding success with advanced wind farm financial modeling techniques ensuring precise investment and risk assessment.

Our wind farm financial modeling techniques optimize investment returns by accurately forecasting costs, revenues, and project profitability.

Our wind farm financial modeling techniques streamline planning by eliminating complex formulas, programming, and costly consultants.