Youth Coding Academy Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Youth Coding Academy Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Youth Coding Academy Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

YOUTH CODING ACADEMY FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year youth coding academy financial planning model offers detailed revenue projections, expense forecasts, and cash flow projection models designed specifically for startups and entrepreneurs. It includes robust budgeting, profitability analysis, and break-even analysis financial models to impress investors and secure funding. The template features key financial statements such as the income statement, cost structure, and operational expenses, enabling thorough financial viability assessments and investment financial modeling. With built-in financial growth models and tuition pricing strategies, this editable youth coding academy financial statement forecast is an essential tool for evaluating business performance and planning sustainable financial success.

The youth coding academy financial model template in Excel expertly addresses key pain points such as revenue projections, expense forecast, and budgeting by providing detailed cash flow projections and comprehensive income statement financial models, enabling users to streamline financial planning and optimize operational expenses. With integrated break-even analysis and profitability analysis features, the model allows entrepreneurs to evaluate financial viability and cost structure accurately, while its startup financial model functionality supports funding requirements and investment assessments. Additionally, this ready-made solution enhances financial growth modeling and tuition pricing strategies, ensuring a holistic view of the academy’s financial performance and empowering stakeholders to make informed decisions without the complexity of building models from scratch.

Description

The youth coding academy financial model is a comprehensive startup financial planning tool that integrates detailed revenue projections, expense forecasts, budgeting, and cash flow projection models to enable thorough profitability analysis and break-even assessment. Designed to generate a 5-year monthly and yearly financial statement forecast including profit and loss, balance sheet, and cash flow statements, this dynamic model supports financial viability evaluations and investment planning. Featuring automated updates upon input changes, it encompasses tuition pricing financial model components, cost structure analysis, operational expenses tracking, and funding requirements to assist in precise financial performance modeling and effective decision-making for both new and existing youth coding academies.

YOUTH CODING ACADEMY FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our Youth Coding Academy financial model offers a comprehensive startup and business plan framework, integrating revenue projections, expense forecasts, and cash flow projections. By combining the income statement, pro forma balance sheet, and monthly cash flow statement, this financial planning model provides an accurate profitability analysis and break-even evaluation. Unlike simplified templates, our model enables dynamic scenario planning to assess how changes impact your academy’s financial performance, cost structure, and funding requirements—empowering confident decision-making and sustainable financial growth.

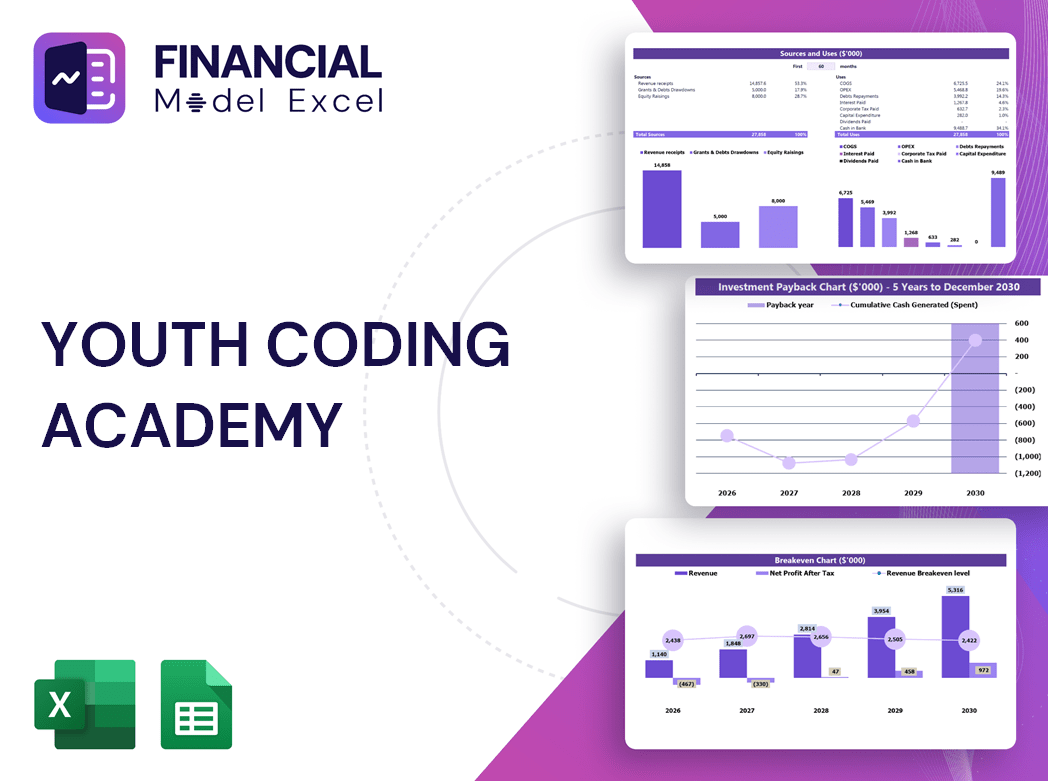

Dashboard

The Youth Coding Academy financial planning model features a dynamic dashboard showcasing critical financial indicators, including income statement forecasts, cash flow projections, and expense forecasts. This comprehensive tool enables detailed break-even analysis, profitability assessment, and revenue projections over a 5-year horizon. By inputting data for specific periods, users gain valuable insights into cost structure, operational expenses, and funding requirements, empowering informed decision-making to drive sustainable financial growth and ensure the academy’s long-term financial viability.

Business Financial Statements

Our comprehensive youth coding academy financial model empowers entrepreneurs to develop detailed revenue projections, expense forecasts, cash flow projections, and break-even analyses. This startup financial planning model streamlines budgeting, profitability analysis, and investment assessments, enabling clear communication of financial performance to stakeholders. Accompanied by insightful charts and graphs, the model vividly illustrates the academy’s financial viability and growth potential, making it an essential tool for attracting investors and securing funding.

Sources And Uses Statement

This youth coding academy financial model offers a comprehensive 5-year cash flow projection, expense forecast, and revenue analysis, enabling clear visibility into all income sources and cost structures. It supports strategic budgeting, startup financial planning, and break-even analysis, ensuring well-informed decision-making and streamlined reporting. This robust tool empowers stakeholders with precise profitability analysis and funding requirements, driving sustainable financial growth and operational efficiency for your academy’s success.

Break Even Point In Sales Dollars

The youth coding academy break-even analysis financial model is a vital component of the startup financial forecast. It pinpoints the exact revenue needed to cover all costs, including taxes, ensuring clarity on the academy’s financial viability. Reaching this revenue threshold signals the transition from covering expenses to generating profit, marking when initial investments begin to yield returns. This financial planning model empowers founders to make informed decisions, optimize budgeting, and confidently drive sustainable growth in the competitive educational landscape.

Top Revenue

When launching a youth coding academy, revenue projections are the cornerstone of your startup financial model. Accurate revenue forecasts drive the overall financial planning model, influencing profitability analysis and cash flow projections. It’s vital to base assumptions on historical data to ensure realistic growth rates. A comprehensive youth coding academy financial model integrates revenue streams with expense forecasts, break-even analysis, and tuition pricing strategies, empowering management to make informed decisions. Our financial model Excel template offers all essential tools for strategic financial viability and sustainable growth planning.

Business Top Expenses Spreadsheet

For any youth coding academy, meticulous financial planning is crucial to ensure sustainable growth. Our startup financial model offers a comprehensive expense forecast, categorizing costs to enhance clarity and control. By closely monitoring operational expenses and justifying major outlays, academies can prevent losses and drive profitability. Utilizing this financial model for budgeting, cash flow projections, and break-even analysis empowers strategic decision-making and fuels long-term financial viability and growth. Effective cost structure management is key to achieving impactful revenue and investment outcomes.

YOUTH CODING ACADEMY FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

The Youth Coding Academy financial model is a comprehensive 3-way tool designed to forecast revenue projections, expense forecasts, and cash flow projections. This financial planning model empowers you to analyze profitability, budget effectively, and perform break-even analysis, ensuring informed decision-making. A detailed cost structure and income statement forecast enable early identification of financial gaps, guiding strategic growth. Incorporating tuition pricing and funding requirements, this startup financial model is essential for securing investor confidence and driving sustainable financial performance within your business plan.

CAPEX Spending

The capital expenditure budget is crucial within the youth coding academy financial model, representing one of the largest, most capital-intensive investments. It serves as a key indicator of the academy’s future operational quality and financial viability. Analyzing historical capital expenditures through cash flow projections and budgeting models enables accurate forecasting in the income statement and balance sheet. This careful evaluation supports responsible financial planning, ensuring sound budgeting, effective expense forecasting, and optimized resource allocation for sustained growth and profitability.

Loan Financing Calculator

A youth coding academy’s financial model must include a detailed loan repayment schedule to effectively manage funding requirements and ensure financial viability. This schedule provides a line-by-line breakdown of loan amounts and maturity terms, crucial for accurate cash flow projections and budgeting. Principal repayments impact the academy’s cash flow financial model under financing activities, while interest expenses influence both the income statement and overall profitability analysis. Incorporating loan schedules into the financial planning model supports precise expense forecasting and strengthens the academy’s operational and investment strategies for sustainable growth.

YOUTH CODING ACADEMY FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The Youth Coding Academy financial model presents a comprehensive pro forma income statement, highlighting EBITDA to showcase true profitability. Unlike cash flow figures, EBITDA captures both monetary and non-monetary factors, offering deeper insight into operational success. This metric is vital for youth coding academy business plans, supporting revenue projections, expense forecasts, and break-even analysis. It’s especially crucial for evaluating financial viability and guiding investment decisions, ensuring a robust financial planning model that drives sustainable growth and strategic budgeting in the competitive educational tech market.

Cash Flow Forecast Excel

Present a clear snapshot of your Youth Coding Academy’s annual financials and key metrics with our comprehensive financial model. This powerful tool integrates revenue projections, expense forecasts, cash flow projections, and break-even analysis to ensure robust financial planning. Ideal for business plans, investor pitches, and performance reviews, it highlights tuition pricing, operational expenses, profitability analysis, and funding requirements — all essential for demonstrating financial viability and growth potential. Elevate your strategy with a precise Youth Coding Academy financial statement forecast that instills confidence and drives informed decision-making.

KPI Benchmarks

Accurate tracking of key metrics within a youth coding academy financial planning model is essential for effective benchmarking. Utilizing a comprehensive financial model—incorporating income statements, cash flow projections, and expense forecasts—allows startups to analyze performance against industry averages. This comparative analysis guides strategic decisions on budgeting, tuition pricing, and operational expenses, driving profitability and sustainable growth. By leveraging these insights, youth coding academies can optimize their financial viability and streamline investment planning, ensuring a strong foundation for long-term success.

P&L Statement Excel

Understanding your youth coding academy’s financial future starts with analyzing past performance through a comprehensive financial model. Our youth coding academy financial planning model includes projected pro forma income statements, detailed revenue projections, and profitability analysis. It highlights key metrics like net profit margin and gross margin percentages, offering clear insights into profit drivers. This robust financial framework empowers you to forecast cash flow, optimize expense forecasts, and strategize tuition pricing, ensuring sustainable growth and long-term financial viability for your academy.

Pro Forma Balance Sheet Template Excel

The youth coding academy financial model includes a comprehensive balance sheet forecast, essential for evaluating current and long-term assets, liabilities, and equity. This pro forma balance sheet template offers critical insights to support financial planning, profitability analysis, and financial viability assessments. It serves as a foundation for robust budgeting, expense forecasting, and cash flow projections, empowering informed decision-making and strategic growth within your youth coding academy business plan.

YOUTH CODING ACADEMY FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our youth coding academy financial model delivers comprehensive profit and loss projections, providing investors with essential data for informed decisions. The weighted average cost of capital (WACC) demonstrates the minimum return required on invested funds, assuring stakeholders of financial discipline. Our discounted cash flow analysis accurately values future cash flows in today’s terms, while free cash flow valuation highlights liquidity available to both shareholders and creditors. This robust financial planning model offers clarity on revenue projections, expense forecasts, and cash flow projections to ensure your academy’s financial viability and growth potential are thoroughly assessed.

Cap Table

The cap table, integrated within a comprehensive 3-way financial model, is an essential tool for youth coding academy startups. It provides a detailed breakdown of the company’s securities, investor shares, valuation, and dilution over time. This clarity supports effective financial planning, investment modeling, and funding requirements analysis, empowering founders to make informed decisions aligned with revenue projections and profitability analysis.

YOUTH CODING ACADEMY BUSINESS PLAN FINANCIAL TEMPLATE ADVANTAGES

Empower growth with Youth Coding Academy’s financial model for accurate forecasting and strategic, data-driven decisions.

Youth coding academy financial model accurately estimates future expenses, ensuring strategic budgeting and sustained business growth.

Raise capital confidently using the youth coding academy financial model for precise business planning and investor-ready projections.

Unlock strategic insights by running two valuation methods with the Youth Coding Academy startup financial model projection.

Youth coding academy financial model empowers accurate cash flow projections for strategic growth and investor confidence.

YOUTH CODING ACADEMY 5 YEAR PROJECTION PLAN ADVANTAGES

The youth coding academy financial model ensures accurate forecasts, boosting stakeholder confidence and securing essential funding.

A comprehensive youth coding academy financial model ensures clear bank communication and supports confident loan approvals.

The youth coding academy financial model empowers smart cash management for sustainable growth and optimized surplus utilization.

The youth coding academy cash flow financial model empowers strategic reinvestment decisions by forecasting surplus cash accurately.

Get it right the first time with a youth coding academy financial model that ensures accurate budgeting and profitability analysis.

Youth coding academy financial models ensure precise funding strategies, boosting investor confidence and maximizing success potential.

Youth coding academy financial models ensure accurate projections, boosting stakeholder confidence and securing investment trust.

A youth coding academy financial model ensures clear cash flow projections, building investor confidence and accelerating funding opportunities.

Youth coding academy financial model offers a convenient all-in-one dashboard for clear, strategic revenue and expense forecasting.

Youth coding academy financial model ensures precise forecasting, clear KPIs, and comprehensive monthly cash flow and P&L insights.