Youth Financial Literacy Program Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Youth Financial Literacy Program Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Youth Financial Literacy Program Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

YOUTH FINANCIAL LITERACY PROGRAM FINANCIAL MODEL FOR STARTUP INFO

Highlights

Develop a comprehensive 5-year youth financial literacy program budget model and financial forecasting template in Excel, including projected profit and loss statements, cash flow forecasts, and break-even analysis tailored for education initiatives. This financial model template for literacy programs offers detailed expense tracking, revenue projection, and investment modeling to ensure financial sustainability and maximize economic impact. Designed to align with GAAP or IFRS standards, it provides a robust financial planning tool ideal for securing funding from banks, angel investors, grants, and venture capital by delivering transparent youth financial literacy program financial reports and grant financials—fully unlocked and customizable for strategic scenario analysis and cost-benefit evaluation.

This youth financial literacy program budget model significantly alleviates common pain points by providing a comprehensive financial planning tool that integrates cash flow forecast for financial literacy initiatives and expense tracking model for education initiatives, enabling users to accurately project program revenue and conduct thorough youth financial education cost analysis. The template’s built-in financial sustainability model for literacy programs and break-even analysis for youth financial education empower users to evaluate investment viability and long-term financial health with ease, while the profit and loss model for youth financial literacy and financial forecasting for literacy programs ensure detailed financial scenario analysis is at their fingertips. Tailored for versatility, this financial model template for literacy programs allows straightforward customization to fit unique program structures, streamlining budget planning for youth financial literacy projects and simplifying the creation of youth financial literacy program grant financials, ultimately reducing the complexity and time typically required for cost-benefit analysis for financial education initiatives.

Description

Our comprehensive financial model template for youth financial literacy programs integrates budget planning, expense tracking, and cash flow forecasting to deliver a robust financial sustainability model tailored for literacy initiatives. This dynamic model facilitates detailed youth financial education cost analysis and enables users to create accurate financial forecasting for literacy programs, including profit and loss models, break-even analysis, and investment modeling for financial education projects. By leveraging this youth financial literacy program budget model, organizations can conduct thorough financial scenario analysis and cost-benefit analysis, while generating professional youth financial literacy program financial reports and revenue projections, supporting effective financial planning and securing grant funding through transparent youth financial literacy program grant financials.

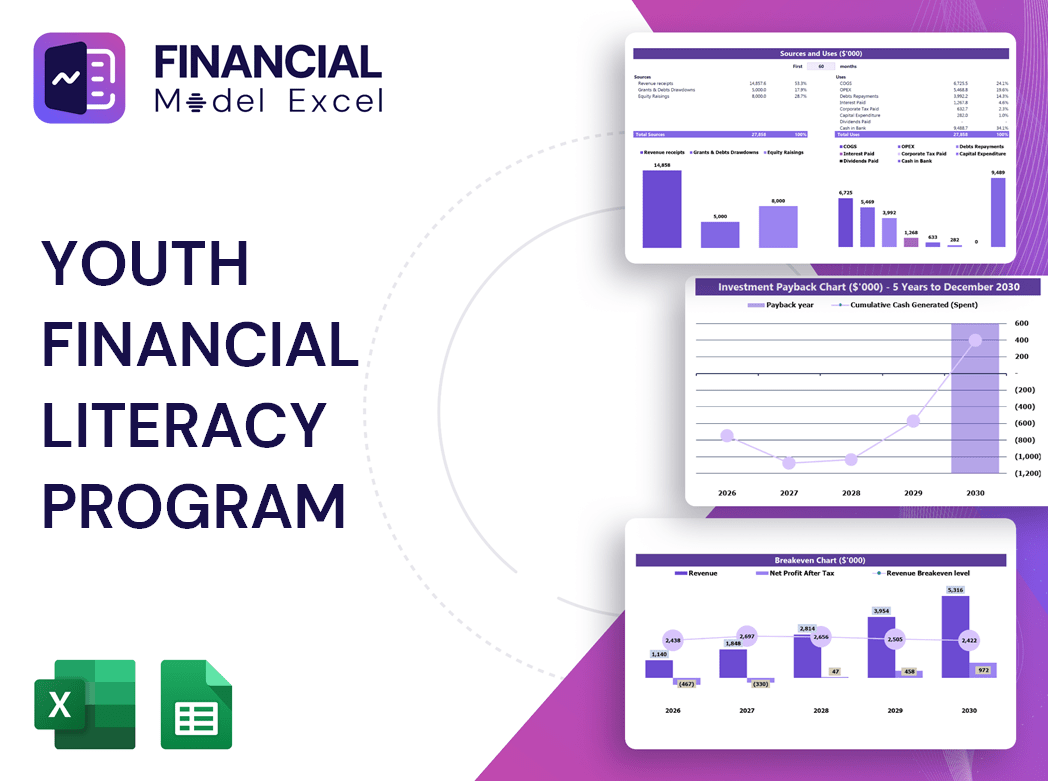

YOUTH FINANCIAL LITERACY PROGRAM FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Develop a comprehensive financial model template for youth financial literacy programs to visualize the future impact of strategic decisions. This all-in-one Excel tool includes profit and loss models, cash flow forecasts, and projected balance sheets—all automatically calculated. Benefit from integrated budget planning, expense tracking, and break-even analysis modules, complemented by a dynamic dashboard summarizing key performance indicators. Ideal for financial sustainability modeling, revenue projection, and grant financial reporting, this tool empowers organizations to conduct cost-benefit and financial scenario analyses, ensuring effective financial planning and forecasting for education initiatives.

Dashboard

To perform a comprehensive financial analysis and accurate forecasts, leveraging a financial model template for literacy programs is essential. This model integrates key components such as pro forma balance sheets, income statements, and detailed revenue projections. Offering data visualizations like graphs and charts, it streamlines expense tracking and cash flow forecasting for youth financial literacy initiatives. This approach enhances budget planning, supports grant financials, and drives informed decision-making for sustained financial sustainability in youth financial education programs.

Business Financial Statements

Our financial model for youth financial literacy programs seamlessly generates comprehensive annual Excel reports, integrating core financial statements directly linked to your key assumptions. Simply update inputs within the youth financial education cost analysis or budget model, and the entire financial forecast—including cash flow, profit and loss, and break-even analysis—automatically adjusts to reflect your organization’s latest financials. This dynamic tool ensures accurate financial planning, expense tracking, and revenue projections, empowering sustainable decision-making and maximizing the impact of your education initiatives.

Sources And Uses Statement

The Source and Use of Funds tab within the financial model template for literacy programs clearly outlines the inflows and outflows of funds. It highlights the youth financial literacy program funding model by detailing revenue projections alongside expense tracking for educational initiatives. This essential component supports comprehensive budget planning and cash flow forecasting, ensuring financial sustainability for youth financial education projects. For start-ups and established programs alike, a transparent sources and uses statement is vital for effective financial planning and securing investment in financial literacy initiatives.

Break Even Point In Sales Dollars

The break-even analysis is crucial in youth financial literacy program funding models, pinpointing when revenue fully covers all costs without profit or loss. Utilizing a break-even formula in Excel aids in understanding the relationship between fixed costs, variable costs, and program revenue. For education initiatives with lower fixed expenses, the break-even point requires fewer unit sales, enhancing financial sustainability. Incorporating this into budget planning and financial forecasting ensures efficient cash flow management and supports long-term success in youth financial education projects.

Top Revenue

In developing a youth financial literacy program budget model, revenue projections are pivotal to accurate financial forecasting. Revenue drives key metrics and influences the overall valuation of education initiatives. Effective financial planning for youth education programs requires robust revenue forecasting grounded in historical data and realistic growth assumptions. Our financial model template for literacy programs incorporates best-practice components, including cash flow forecasts, expense tracking models, and break-even analysis. This comprehensive approach ensures sustainable funding, economic impact assessment, and reliable financial reporting, empowering stakeholders to make informed decisions for youth financial education projects.

Business Top Expenses Spreadsheet

Optimizing major expenditures is essential for any youth financial literacy program’s success. Our financial model template for literacy programs includes a top expense report that highlights the four largest cost categories, grouping all others as "other." This tool enables users to efficiently track expenses, identify trends, and make informed budget planning decisions. Effective expense tracking and financial forecasting are critical for maintaining profitability and ensuring the financial sustainability model for literacy programs supports long-term growth and impact.

YOUTH FINANCIAL LITERACY PROGRAM FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Accurately tracking start-up costs is vital in our 5-year financial model for education programs, as expenses typically precede operations. Incorporating a detailed youth financial literacy program budget model ensures early identification of funding needs, minimizing risks of underfunding or overspending. Our start-up cost pro-forma integrates both funding sources and expenditures, serving as an essential tool for expense tracking and budget planning. Utilize this financial model template for literacy programs to strengthen your cash flow forecast for financial literacy initiatives and support sustainable financial planning for youth education projects.

CAPEX Spending

The CAPEX schedule is a critical element of any financial model template, especially for youth financial literacy programs. Financial experts use it to establish startup budgets and monitor investments, ensuring accurate expense tracking for education initiatives. A clear understanding of initial costs enhances cash flow forecasts and supports effective financial planning for youth education programs. Responsible budget planning and capital expenditure analysis not only strengthen financial sustainability models but also drive informed revenue projections and break-even analysis, ultimately securing the long-term success of financial literacy projects.

Loan Financing Calculator

Our financial model template for literacy programs features a comprehensive loan amortization schedule, detailing precise repayment amounts, principal, and interest over monthly, quarterly, or annual periods. This integrated approach supports robust financial planning for youth education programs by streamlining expense tracking and cash flow forecasting. Leveraging pre-built algorithms, it enhances accuracy in financial forecasting and break-even analysis, empowering organizations to optimize their youth financial literacy program budget model and ensure sustainable funding strategies.

YOUTH FINANCIAL LITERACY PROGRAM FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) serve as a key indicator of operational performance within a financial model for education programs. In youth financial literacy program budget models, EBITDA offers crucial insights into profitability by isolating core earnings from non-operational expenses. Utilizing EBITDA in financial forecasting for literacy programs enhances accuracy in revenue projection and expense tracking models, supporting effective financial planning for youth education initiatives. This metric underpins sound decision-making in cash flow forecasts and investment models, promoting financial sustainability and long-term success of youth financial literacy projects.

Cash Flow Forecast Excel

The cash flow forecast for financial literacy initiatives is a vital tool, offering a clear view of cash inflows and outflows over time. Unlike traditional profit and loss models, this projection provides enhanced transparency into liquidity, essential for budgeting and financial planning for youth education programs. Our fully integrated financial model template for literacy programs includes expected cash flow projections spanning 12 months to 5 years, empowering stakeholders with accurate financial forecasting, expense tracking, and grant financials to ensure the financial sustainability model for youth financial literacy projects.

KPI Benchmarks

A robust financial model for youth financial literacy programs evaluates key performance indicators, highlighting averages and conducting comparative analyses to determine relative values. This approach is crucial for effective financial planning, budgeting, and forecasting, ensuring sustainable revenue and expense management. By tracking these metrics, organizations can perform break-even and scenario analyses, optimize funding models, and enhance strategic management. Ultimately, comprehensive financial modeling empowers program leaders to make informed decisions, maximize impact, and secure long-term financial sustainability for their youth education initiatives.

P&L Statement Excel

Financial forecasting is essential in a youth financial literacy program budget model, offering clear insights into projected revenues and expenses. Utilizing a comprehensive financial model template for literacy programs enables precise cash flow forecasts, net profit ratios, and gross margin analysis. This approach not only supports effective financial planning for youth education projects but also enhances confidence by providing a robust profit and loss model. By leveraging these tools, organizations can ensure financial sustainability, optimize funding models, and strategically assess their program’s economic impact and future profitability.

Pro Forma Balance Sheet Template Excel

Our financial model template for youth financial literacy programs integrates cash flow forecasts, profit and loss projections, and key inputs seamlessly with monthly and yearly pro forma balance sheets. This comprehensive approach provides a detailed financial report outlining assets, liabilities, and equity, empowering stakeholders with clear insights. Whether conducting budget planning, expense tracking, or break-even analysis, this model enhances financial sustainability and supports informed decision-making for successful program implementation and growth.

YOUTH FINANCIAL LITERACY PROGRAM FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

The financial model template for literacy programs integrates key metrics such as Weighted Average Cost of Capital (WACC) and Discounted Cash Flows (DCF) to support youth financial literacy program budget models. WACC evaluates the proportional cost of equity and debt, serving as a crucial risk assessment for lenders and investors. Meanwhile, DCF offers a clear cash flow forecast for financial literacy initiatives, enabling precise revenue projections and investment analysis. Together, these tools empower effective financial planning and sustainability modeling for youth financial education projects, ensuring informed decision-making and optimized grant financials.

Cap Table

In youth financial literacy program budget models, accurately tracking securities—such as common stock, preferred stock, options, and warrants—is essential. A comprehensive cap table outlines ownership details, empowering program leaders to make informed choices about fundraising, grant applications, and potential partnerships. Utilizing a financial model template for literacy programs ensures up-to-date records that support effective financial planning, cash flow forecasting, and investment decision-making. Maintaining this clarity enhances the financial sustainability model for literacy initiatives, optimizing profit and loss management while promoting long-term economic impact and success.

YOUTH FINANCIAL LITERACY PROGRAM FINANCIAL MODEL EXCEL ADVANTAGES

The financial model template centralizes all assumptions, streamlining accurate budgeting and boosting youth literacy program success.

Identify potential shortfalls early to ensure youth financial literacy program financial model maintains optimal cash balances effectively.

Set new goals confidently with a youth financial literacy program financial model for precise planning and sustainable growth.

The financial model ensures confident budget planning and accurate revenue projections, proving loan repayment feasibility seamlessly.

Optimize youth financial literacy programs with a comprehensive financial model for precise budgeting and revenue forecasting.

YOUTH FINANCIAL LITERACY PROGRAM BUSINESS PLAN FINANCIAL PROJECTIONS TEMPLATE ADVANTAGES

Our financial model offers a convenient all-in-one dashboard for precise budgeting and forecasting in youth literacy programs.

This comprehensive financial model ensures accurate forecasting, clear KPIs, and insightful performance reviews for youth literacy programs.

Our financial model for youth literacy programs identifies cash shortfalls early, ensuring proactive budget management and sustainability.

The youth financial literacy program model empowers proactive budgeting, ensuring sustainable cash flow and early financial risk detection.

Save time and money with our financial model template for literacy programs, optimizing budgets and forecasting revenue accurately.

The youth financial literacy program financial model streamlines planning, eliminating complex formulas and costly consultants for effortless growth.

The financial model ensures precise budget planning and sustainable funding for youth financial literacy programs, optimizing resource allocation.

The financial model ensures accurate budgeting and forecasting, optimizing youth financial literacy program sustainability and impact.

Our financial model for youth literacy predicts upcoming changes, optimizing budgeting and maximizing program sustainability.

The financial model empowers precise cash flow forecasting and ‘what-if’ scenarios for smarter youth program budget planning.